Energy

ONHYM and IN-VR to host the 3rd Morocco Oil & Gas Summit

Over 350 C-level executives from West African Governments, Oil and Gas companies, investors and top service companies will meet with ONHYM in Marrakech to discuss the Nigeria-Morocco pipeline, E&P opportunities in Morocco, and how to get involved in one of the world’s top future energy hubs. The Energy Circle by IN-VR is pleased to announce the 3rd Morocco Oil & Gas Summit and Exhibition 2023 hosted in Savoy Le Grand Hotel, Marrakech, on the 24th-26th of October, 2023, fully endorsed by ONHYM. The event’s programme will focus on the country’s and the region’s holistic hydrocarbons sector, from onshore discoveries to its vast offshore E&P potential, midstream and infrastructure plans. After two Sold-out editions, Morocco’s official Oil & Gas Summit returns for its 3rd edition to focus on opportunities, developments and projects in Morocco and West Africa, with access to 1:1 meetings with ONHYM, African Ministries and Moroccan decision-makers involved in one of the most powerful and promising energy hubs in the region. With the Nigeria-Morocco pipeline being among Africa’s most-anticipated projects, ONHYM will be welcoming an important number of African Ministries and NOCs for the Africa Regional Cooperation Roundtable, while hosting a series of networking events throughout two full days with the presence of the country’s Project Owners, such as Chariot Energy Group. Participants will be available to meet during dedicated 1:1 meetings with ONHYM and the country’s biggest Project owners, as the event has been tailored to host two full days of non-stop networking for E&P leaders to meet with Moroccan and African players in Marrakech. The 3rd Morocco Summit is expected to be the most networking-intensive event of the year, bringing under one roof ONHYM and African Energy leaders for the African Regional Cooperation Roundtable and the stage to meet operators and service companies. The Summit is open for registrations offering a full range of networking activities and exclusive content, in addition to the myriad of networking opportunities – including drinks receptions, networking breakfasts, coffee breaks and roundtable dialogues, high-level drinks receptions, and VIP private cocktails.

Read more »

Congo-Brazzaville: Afreximbank to provide $300m for MKB II oilfields development

On September 27th, Afreximbank signed an agreement to provide a $300m facility to Trident OGX Congo for the development of the onshore Mengo-Kundji-Bindi II (MKB II) oil fields in the Republic of Congo. The reserve-based lending (RBL) facility will support the company’s capex programme to increase the country’s oil production by 30%, according to Afreximbank. Between 2018 and 2021, state-owned SNPC carried out studies to reassess the potential of its MKB II permit, where it also drilled five appraisal wells and constructed a road and platforms. “These positive results make it possible to envisage a production of over 40,000 barrels per day (bpd) at the end of the development drilling campaign in 2024,” SNPC Director General Maixent Raoul Ominga said in an interview shared with Hawilti earlier this year. In December 2021, the MKB II permit was transferred to Trident OGX Congo for 20 years to unlock additional capital and technology for its development.

Read more »

Côte d’Ivoire to sign new PSC over Block CI-705 with local upstream entity

This story was first published on the Hawilti+ Terminal on 13 September 2023. Côte d’Ivoire’s Cabinet has adopted a resolution on September 13th on the signing of a new production sharing contract (PSC) for block CI-705 with Ivory Coast Exploration (ICE) Oil & Gas. The block is located offshore Fresco and was relinquished by TotalEnergies in June 2022 after the unsuccessful drilling of the Barracuda-1X well. The block contains Albian structural closures, with structural prospects like Barracuda South yet to be tested. The award of the block to ICE is a win for Côte d’Ivoire’s local content as the company is majority-owned by Ivorian nationals. 2023 has marked a turning point for Côte d’Ivoire’s upstream sector after the commissioning of Eni’s offshore Baleine Field (phase 1) and the award of new PSCs in shallow- and deep-water to Murphy Oil and state-owned PETROCI. The government has embarked on several initiatives to boost upstream production and investment, positioning the country as a renewed hot frontier for oil & gas activity in West Africa.

Read more »

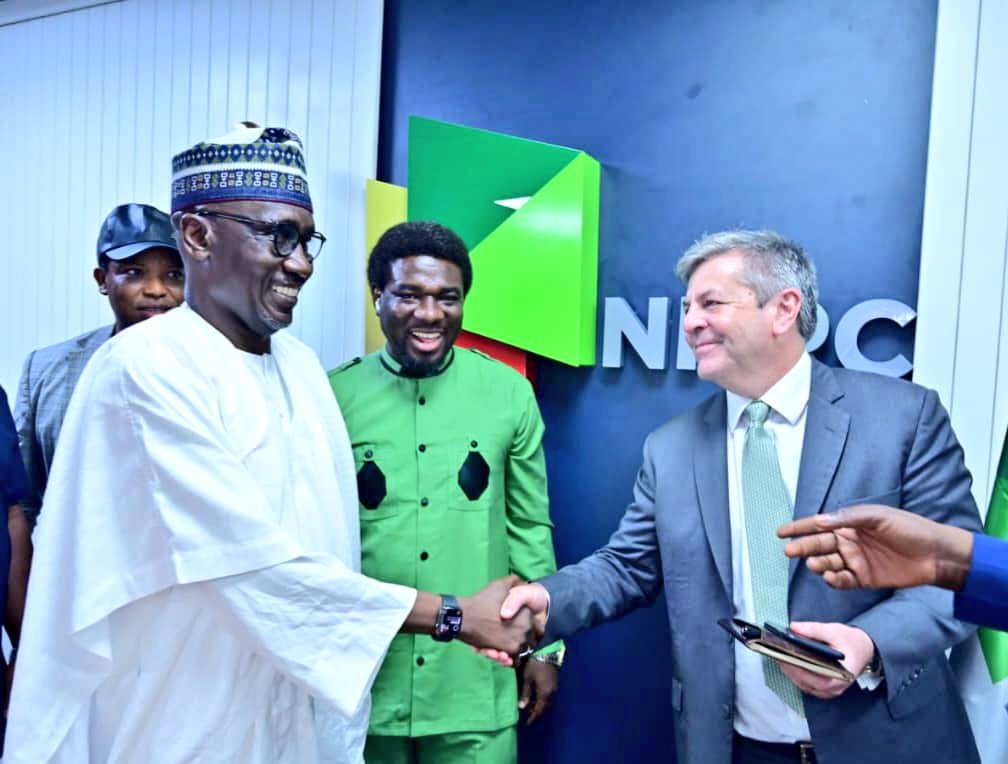

NNPC signs MoU with Indorama to boost Nigeria’s domestic gas industry

This story was first published on the Hawilti+ Terminal on 18 September 2023. Nigeria National Oil Petroleum Company (NNPC), the country’s state energy firm, and Indorama Eleme Petrochemicals Ltd., an entity of the Singapore-based Indorama Group, have signed an MoU that will allow both parties to explore opportunities across Nigeria’s hydrocarbon value chain, as Africa’s biggest oil producer seeks to boost domestic use of natural gas and associated liquids for economic growth. “This is a strategic collaboration to unlock Nigeria’s upstream sector, but more importantly, to partner downstream, in order to share the value chain,” CEO at Africa Indorama Energy Manish Mundra said in an official statement, adding that Nigeria’s gas reserves should position the country as one of the largest producers of urea in the western hemisphere. Privatized in 2006, the petrochemicals and fertilizer complex of Indorama Eleme has become one of Africa’s largest downstream facilities, proving a significant asset to monetize Nigerian gas. The fertilizer plant is well supported by port terminal at the nearby Onne port, and a gas pipeline of 83.5km for gas supply. Located in Port Harcourt, the complex started exclusively with the production of petrochemicals, including 440,000 tpy of olefins and 120,000 tpy of polypropylene. In 2013, a new polyethylene unit was added, which is able to produce 360,000 tpy. Beyond petrochemicals, Indorama Eleme has since made an aggressive venture into the urea and fertilizers business. By 2013, the company secured $1bn to develop a urea train with a capacity of 1.4 million tons per year (tpy), which it completed in 2015 and commissioned in 2016 (Line 1). A second urea train and fertilizer plant was eventually commissioned to enable Indorama Eleme to double its fertilizer production from 1.4 mmtpa to 2.8 mmtpa (Line 2). The company currently plans to expand within the next 6 years in the gas-based heavy manufacturing industries, including fertilizer, methanol, and petrochemicals. According to disclosures by the International Finance Corporation (IFC), Indorama is notably seeking to develop a third urea fertilizer line (Line 3) at the same site to grow urea production capacity to 4.2 mmtpa, To support such expansion, it will need a steady supply of gas feedstock. The agreement reached with NNPC could help monetize over 1.7 Tcf of gas and 100 million barrels of oil reserves. That monetization plan, according to the NNPC, includes downstream production of about 4.8 mmpta of associated products, including methanol, urea, and fertilizer for food security. “NNPC Limited is on the threshold of making value out of gas beyond any imagination,” GCEO, Mele Kyari said, adding as part of Nigeria’s Nigasification strategy to promote domestic utilization of natural gas “we are seeing an annual contribution of $3bn to the nation’s GDP and a lifetime contribution of $18bn to government revenue.” Nigeria holds some of the world’s biggest gas reserves estimated at over 200 trillion cubic feet, but they remain largely underdeveloped, benefiting industrialization and power generation overseas through LNG exports. Boosting local consumption is now at the centre of the government’s agenda as it promotes gas as a transition and cleaner fuel.

Read more »

N-Sea begins survey operations for Nigeria-Morocco Gas Pipeline

This story was first published on the Hawilti+ terminal on 2 September 2023. N-Sea, Netherlands-headquartered subsea services company, says it has expanded its area of operations to West Africa as it commences survey operations to support the development of the Nigeria-Morocco Gas Pipeline project. The project is led by Morocco and Nigeria’s national oil companies, the Office National des Hydrocarbures et des Mines (ONHYM) and the Nigerian National Petroleum Company (NNPC). The pipeline, which has been on the table for some time, is seen as an extension of the existing West Africa Gas Pipeline (WAGP) that was commissioned in 2011. From offshore Morocco, it will run onshore to northern Morocco, ultimately connecting to the Maghreb-Europe pipeline. “To realise this project, N-Sea have worked closely with vessel owner Rederij Groen and converted the seismic support vessel, 7-WAVES, into a survey vessel with state-of-the-art equipment,” the company said in its post on LinkedIn. “The project is being run with a “skeleton” crew on board the vessel, and all data is being transferred to shore, to the N-Sea Data Centre. Daily meetings with the Client Representative, FEED Engineer, Client and our N-Sea data processors are carried out to assess data quality and route alignment.” The 5,700 to 7,000 km pipeline, linking Nigeria’s Brass Island to Morocco, is gaining traction following the tightening of global gas markets and Europe’s search for alternative sources of gas imports. If completed, it would be the longest offshore pipeline in the world, with its total capacity expected to hold 30 billion cubic meters a year.

Read more »

Nigeria’s Tetracore Energy Group steps up local content development with new training programme

The Tetracore Energy Group, a fast-growing gas and power solutions provider based out of Nigeria, has launched a unique graduate management training program in Lagos last week. The initiative is part of the company’s commitment to grow domestic capacity and local content, as a time when African markets are rapidly expanding their domestic gas value-chains. The inaugural program includes 12 young professionals who will receive intensive training around gas, power and new energy, behavioral and soft skills, and business management skills. Tetracore aims at developing their talents and equipping them with the competences they need to solve some of Nigeria’s most pressing energy challenges around gas distribution, clean energy, and power systems. “Growing Nigeria’s energy sector requires the training of capable, competent, driven, and ambitious Nigerian young professionals. As we expand Tetracore’s footprint and welcome new investors, it is of strategic importance that we develop the skills and the manpower the company needs to deliver its sustainable energy solutions,” CEO Olakunle Williams said during the launch ceremony. Nigeria is recognized globally for having one of the most successful local content development frameworks. Under the oversight of the Nigerian Content Development & Monitoring Board (NCDMB), the country has successfully built capacity across the oil & gas sector and saw the establishment of several local businesses from upstream to downstream. However, rapidly evolving technologies and the rapid expansion of Nigeria’s midstream and downstream gas industry requires a new set of skills and competences. Private sector companies must continue to invest in workforce development and talent management as a matter of competitiveness and sustainability. Over the past three years, Tetracore has proven its commitment of building a true pan-African energy company and building local capacity along the way. In December 2020, it was amongst the first local businesses to commission its own locally assembled 15 MMscf/d gas Pressure Regulating and Metering Stations (PRMS) and has continued to grow domestic capacity ever since.

Read more »

EGYPES 2024 Set to Elevate Emerging Start-ups and Revolutionary Low Carbon Tech Through CLIMATECH Challenge

The following is submitted by dmg Events and published by Hawilti Ltd In line with Egypt’s ambition to be a global energy trading hub and its target to reduce 10% greenhouse gas emissions by 2030, the seventh edition of the Egypt Energy Show (EGYPES) is set to introduce the CLIMATECH Challenge, an initiative that is a collective response to climate change, featuring start-ups that are creating value and offering innovative solutions to accelerate net-zero greenhouse gas emissions. Taking place on Wednesday 14th February 2024, as part of the EGYPES Future Energy Zone, the CLIMATECH Challenge will serve as a platform for start-ups to showcase their groundbreaking climate technology and business models in front of a panel of influential judging committee members comprising investors, c-level executives, top government officials, thought leaders and an audience of senior energy executives. The Challenge will bring together energy industry visionaries, investors, and disruptive start-ups, with the aim of highlighting the emerging climate technology that will enable the transition towards a low-carbon energy system. In addition to start-up pitches, attendees can expect a well-curated lineup of keynote speeches, motivational talks, and interactive panel discussions, all tailored to nurture the rise of climate-tech ventures in a collective response to combat climate change. Commenting on the launch of the event, Salman Abou Hamzeh, Senior Vice President of DMG Events, stated, “We stand at a critical juncture in the current energy landscape where innovation and climate-centric technologies hold the key to a decarbonised future, and start-ups have a pivotal role in guiding us through this transformation.” He added, “The EGYPES 2024 CLIMATECH Challenge provides the opportunity for start-ups to present their innovative technological solutions before an influential judging committee, propelling their business growth and positioning them as catalysts in the journey towards net-zero.” The CLIMATECH Challenge is open to start-ups worldwide that are serving the energy transition with clean energy technologies. Five businesses will be chosen from the initial pool of applicants and invited to pitch to a jury of industry leaders. Start-ups will be evaluated on the innovation of their climate tech, the potential market size and growth prospects, their scalability and revenue generating avenues, the composition of their team, as well as their investment potential. The judges will determine the first-place winner of the CLIMATECH Challenge, while the audience will decide the second-place winner, known as the ‘people’s choice’ award. The winning startup will receive a prize to support the growth of their business. Furthermore, the Challenge offers an unparalleled opportunity to provide the shortlisted start-ups with post-event mentorship, unrivalled networking opportunities, and extensive media coverage. The EGYPES 2024 CLIMATECH Challenge welcomes disruptive startups to propose their inventions and climate technologies for a greener tomorrow. Submit your application to enter the competition here: www.egypes.com/climatechallenge For sponsorship opportunities related to the EGYPES 2024 CLIMATECH Challenge, contact Sangeeta Dhanak, Event Manager, EGYPES 2024 at sangeetadhanak@dmgevents.com

Read more »

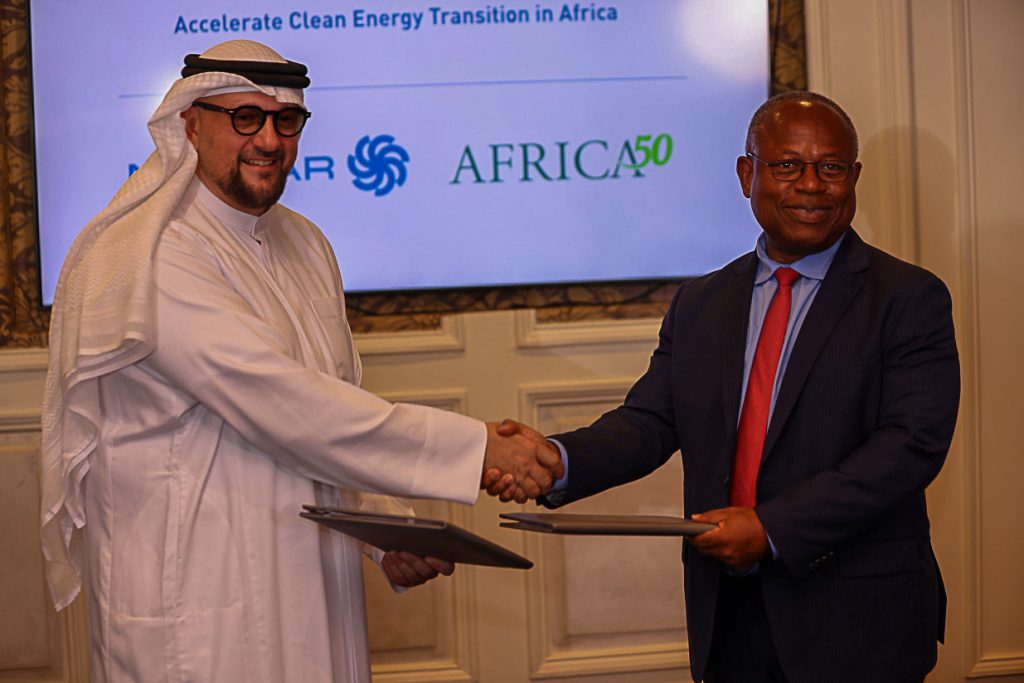

UAE finance initiative aims to unlock Africa’s clean energy potential

A landmark initiative that brings together public, private, and development capital from UAE institutions, is providing $4.5 billion in funding to boost Africa’s energy transition efforts as the continent looks to close an energy deficit that has left 600 million people without access to electricity. The UAE finance initiative is drawing its support from the Abu Dhabi Fund for Development (ADFD), Etihad Credit Insurance (ECI), Masdar, and AMEA Power – all UAE based institutions with experience funding and developing renewable energy projects in emerging markets. Africa50, an investment platform formed by African governments and the Africa Development Bank (AfDB), is also part of the UAE finance initiative. The COP28 President-Designate, H.E. Dr. Sultan Al Jaber, announced the launch of the initiative during a keynote address at the inaugural African Climate Summit last week in the Kenyan capital, Nairobi. “This initiative builds on the UAE’s track record of commercially driven, innovative blended finance solutions that can be deployed to promote the adoption of clean energy in emerging and developing nations,” President-Designate Dr. Sultan Al Jaber said in an official statement, adding the multi-stakeholder partnership approach will accelerate sustainable economic progress, address the challenge of climate change and stimulate low carbon growth. The initiative comes amid calls for the global tripling of renewable energy by 2030, while pushing to make finance more available, accessible and affordable, especially in Africa where an abundance of renewable energy potential remains largely untapped. Unlocking Africa’s clean energy potential with reforms According to findings from the International Energy Agency (IEA), Africa is home to 60% of the world’s best solar resources, yet has only 1% of installed solar generation capacity. For the continent to unlock its clean energy potential, African countries will need to improve policy and regulatory frameworks to attract the long-term investments needed to speed up the deployment of clean and renewable energy. “The initiative will prioritize investments in countries across Africa with clear transition strategies, enhanced regulatory frameworks and a master plan for developing grid infrastructure that integrates supply and demand,” Al Jaber said, noting the initiative is designed to work with Africa and for Africa. “It aims to clearly demonstrate the commercial case for clean investment across this continent. And it will act as a scalable model that can be replicated to help put Africa on a superhighway to low carbon growth.” While delivering greater access to clean energy has been known to drive social and economic development, the COP 28 President-Designate adds that current investment in African renewables represents only 2 percent of the global total, and less than a quarter of the US$60 billion a year the continent needs by 2030. The initiative seeks to correct this imbalance by bringing key stakeholders together to speed up the delivery of relevant measures, including that of infrastructure, to close the gap in universal clean energy access. Unlocking capital for clean power The initiative will form part of Etihad 7, a development platform launched by the UAE to raise 20GW in renewable energy capacity and provide 100 million people across the African continent with clean electricity by 2035. To catalyze private sector action, ADFD is funding the initial investment with US$1 billion of financial assistance to address basic infrastructure needs, offer innovative finance solutions and increase mobilization of private investments. The ECI is providing US$ 500 million of credit insurance to de-risk and unlock private capital. Masdar, one of the world’s largest clean energy companies, active in 22 countries in Africa, is committing an additional US$2 billion of equity as part of the new initiative. Masdar has been moving into the renewable energy sector in Africa as part of the Etihad 7 programme. In January, the company announced it signed an agreement with Angola, Uganda and Zambia to develop renewable energy projects with a combined capacity of up to 5 gigawatts (GW) as part of the programme. With the UAE finance initiative, the company aims to mobilize an additional US$8 billion in project finance through its Infinity Power platform, targeting the delivery of 10 gigawatts (GW) of clean energy capacity in Africa by 2030. AMEA Power looks to install 5GW of renewable energy capacity in the continent by 2030, mobilizing US$5 billion, of which US$1 billion will come from equity commitment, and US$4 billion from project finance. The company has been active in Africa for several years already. Earlier this year, it notably executed a 25-year Power Purchase Agreement (PPA) with GreenCo Power Services (GreenCo) for an 85MW solar PV power plant in South Africa as an energy crisis pushes more demand for alternative sources of power in one of Africa’s biggest economies. The initiative is also pursuing pathways for other multilateral development banks, governments, and philanthropies to catalyze additional private sector investment. At the inaugural African Climate Summit in Nairobi, the COP28 Presidency called for others including international financial institutions (IFIs) and foundations to join the effort to convert words into actions.

Read more »

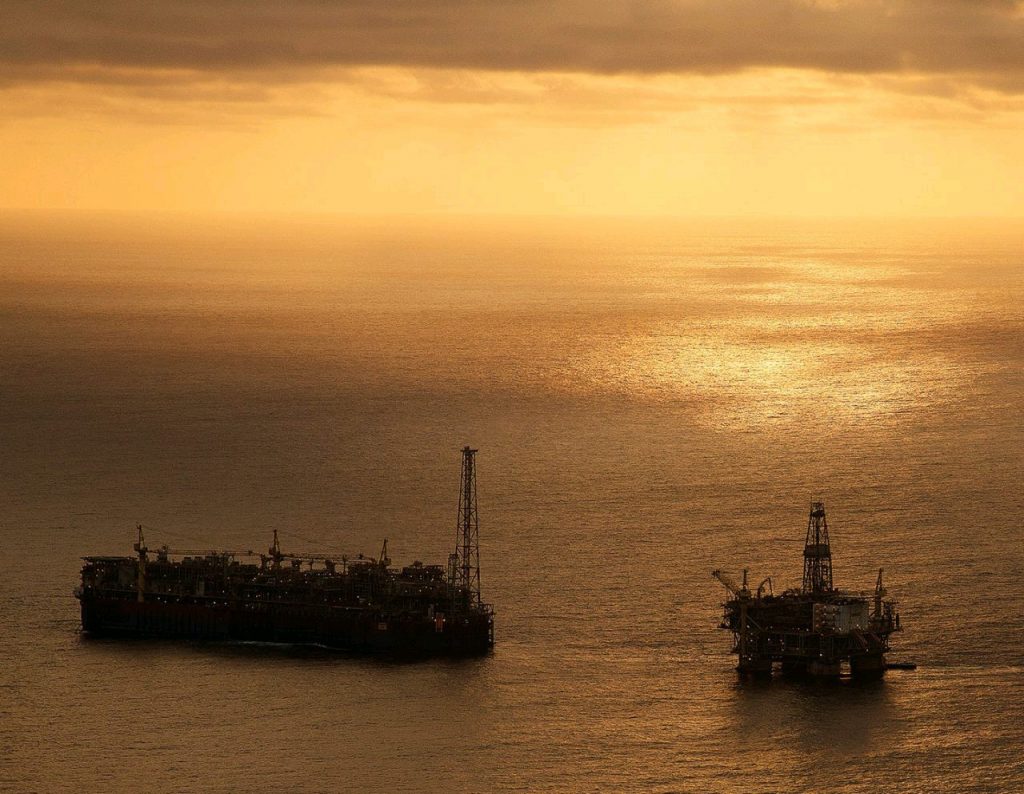

Nigeria: ExxonMobil on the hunt for two deep-water drilling rigs

ExxonMobil’s subsidiaries in Nigeria are seeking to mobilise two deep-water drilling rigs for a period of three years, with options of a further two years. Under a tender opportunity issued this week, the companies are seeking to conduct drilling, completion, testing, temporary abandonment, and workover activities in water depth ranging from 600m to 1,800m. The American major is currently divesting its shallow water portfolio in the country to focus on the development of its deep-water assets, including OML 133 (Erha FPSO), OML 138 (Usan FPSO), OML 139 and OML 154 (Owowo discovery). In recent public appearances, ExxonMobil executives in Nigeria have hinted at the progress made on several deep-water opportunities in the country, without giving any specifics. Over the past few weeks, the company’s subsidiaries have issued a total of 23 tenders to support drilling operations for three years at least, including for the provision of subsea wellhead systems and of oil country tubular goods (OCTG). The Owowo (OML 139/154) and Bosi (OML 133) developments feature amongst NNPC’s key projects this decade. The development of Owowo could include the drilling and completion of 53 producers/injectors with a subsea tie-back to the Usan FPSO. Its FEED and contracting could commence in 2024, according to NNPC. The scope for the Bosi development is yet to be announced and could rely on the existing infrastructure of Erha, located on the same block. Liam Mallon, President of ExxonMobil Upstream Company, was amongst the first executives to meet President Tinubu after he took office in May. The meeting sent encouraging sign on the major’s commitment to Nigeria and the possibility of fresh investments being announced soon. In June, the company appointed Shane Harris as its new chairman and managing director in Nigeria.

Read more »

Golar LNG in discussion for four floating LNG projects in Nigeria

This article first appeared on the Hawilti+ terminal on 12 August 2023. Golar LNG has signed a Heads of Terms with Nigeria’s state-owned NNPC Ltd in August 2023 and is currently discussing and developing four floating LNG and gas projects in the country, the company said. It targets to use its 2.4 mtpa Hilli FLNG unit, currently contracted offshore Cameroon until 2026, or its 3.5 mtpa MKII FLNG unit for deployment offshore Nigeria for a minimum of ten years. The MKII wil rely on an LNG carrier recently acquired and set for conversion. Nigeria has been increasing its outreach to global stakeholders and investors across the gas value-chain as it seeks to monetise its 206 Tcf of gas for the domestic and export market. Several gas export projects are currently planned, including pipeline and LNG export infrastructure. The most advanced of them is the UTM Offshore floating LNG unit, in which NNPC has taken a 20% stake and currently progressing toward a final investment decision (FID).

Read more »

Saipem’s Scarabeo 5 drilling rig to be converted into new floating unit for Congo LNG

This article first appeared on the Hawilti+ terminal on 10 August 2023. Saipem has been awarded a contract by Eni Congo to convert its Scarabeo 5 semisubmersible drilling unit into a separation and boosting plant. The converted rig will serve a floating production unit (FPU) for Congo LNG, Eni’s LNG export project currently under-development offshore Pointe Noire. Saipem is already a contractor on the project, for which it is executing preliminary engineering and procurement activities. The FPU will be receiving the production fluids from wellheads riser platforms, separate the gas from liquids and boosts the gas to feed the nearby 2.4 mtpa floating LNG unit (FLNG) currently being built by Wison Heavy Industry in China. While start-up is expected in Q4 2025, Eni Congo is expected to start delivering LNG as early as the end of the year from an initial development that relies on a small 0.6 mtpa FLNG unit.

Read more »

Nigeria’s pioneer CNG player taps debt capital markets for expansion

This article first appeared on the Hawilti+ terminal on 19 July 2023. Nigerian natural gas supply company Green Liquified Natural Gas Limited (GLNG) has secured its first debt funding as it looks to boost its operations in Africa’s biggest economy. The company sold NGN5 billion ($6.5m) of 10-year series bonds due 2033 under its NGN50 billion ($65m) Debt Issuance Programme. Nigerian financial guarantor InfraCredit provided guarantee for the facility. The bond proceeds will enable GLNG to develop its Liquified Natural Gas plant and expand its CNG distribution and power-as-a-service capabilities, according to an official statement, noting the bond issue was oversubscribed by 108% by ten institutional investors. “This maiden bond transaction is an important milestone for GLNG, as it provides the leverage to finance our ambitious plan to establish a state-of-the-art LNG plant in Nigeria,” Chairman of GLNG, Olajide Rosiji, said in the statement. “More importantly, the success of this transaction reinforces our steadfast commitment to contribute to Nigeria’s clean energy and transportation landscape and foster sustainable economic growth in the region. GLNG already operates two gas compression and distribution facilities in Ogun State with combined capacity of approximately 10.5 MMscf/d, making it the largest in Nigeria. The company currently delivers an average of 4.2 MMscm of CNG per month to industrial and Autogas customers in southwest Nigeria where access to piped gas infrastructure has been lacking. Nigeria, Africa’s biggest oil producer, holds some of the world’s biggest gas reserves. But while the country’s gas has benefited industrialization and power generation overseas through LNG exports, its domestic utilization remains limited. Boosting local consumption is now at the centre of the government’s agenda as it promotes gas as a transition and cleaner fuel.

Read more »

Côte d’Ivoire steps up efforts to secure more gas supplies

Côte d’Ivoire has become home to one of Africa’s most resilient energy sector thanks to its gas and hydropower potential, whose development has provided baseload and reliable power for decades. The west African country currently relies on gas supplied by domestic fields for almost 70% of its electricity production. A little over a decade ago, access to electricity in Côte d’Ivoire stood at only 34%. Today, that rate has grown to close to 70%. But with offshore fields maturing and new gas turbines nearing commissioning, the country needs to find more gas to keep power stations working for the foreseeable future and secure electricity supply for end users. “Securing gas supply to keep the lights on in the future has become a serious concern for local authorities,” one executive told Hawilti during a working visit to Abidjan earlier this year. Gas-to-Power Capacity on the Rise Last year, the country added 180MW of gas-fired power generation capacity to its electricity grid after it expanded the Azito plant. At an official ceremony announcing the expansion of the plant, Côte d’Ivoire’s Minister of Mines, Petroleum and Energy Mamadou Sangafowa Coulibaly said the country aims to increase power generation capacity from its current 2,369MW to 4,000MW by 2025. To bring the country closer to that target, a new gas powered thermal-plant is under construction, with a capacity of 390MW. The Atinkou plant ties into government’s efforts to meet increasing local demand as well as exports to neighbouring countries. The Atinkou Gas Power Project is also designed to displace inefficient and old thermal plants. According to the Africa Development Bank, a development partner on the project, the new power plant, when completed, will be the most efficient gas power plant in Côte d’Ivoire and the West Africa region. Short-term options to boost domestic gas demand To secure more gas, Côte d’Ivoire is focused on maximizing production from existing fields, developing discovered marginal gas fields, and monetizing associated gas from large and upcoming offshore oil projects. Most of Côte d’Ivoire’s gas supplies come from CI-27, a license operated by Foxtrot International where production started in 1999. To increase output, the independent completed a 5-well drilling campaign in 2022. The country’s national oil company (NOC) PETROCI is also being put to the task. Earlier this month, it signed the production sharing contracts (PSC) for blocks CI-523 and CI-525, two licenses that hold the Ibex, Gnou, Kudu and Eland gas fields. When developed, these reserves could provide a steady domestic supply of 60 MMscf/d of natural gas over 16 years. First gas is expected in 2026. Eni’s newly discovered reserves at Baleine on Blocks CI-101 and CI-802 have also brought about some respite. The Italian major has found some 2.5 billion barrels of oil and 3.3 Tcf of gas, providing an opportunity for more domestic supplies. On August 2nd, it signed a gas supply agreement with Côte d’Ivoire to ensure that, as it develops oil reserves for the export market, gas is also reserved to meet local demand. “The signing of this gas sale and purchase contract is a breath of fresh air,” declared Côte d’Ivoire Energies (CI-ENERGIES) Noumory Sidibe during the signing ceremony. What’s next? To grow its gas sector, Côte d’Ivoire is hoping that exploration will yield additional discoveries. In early 2024, Foxtrot International will notably be conducting exploratory drilling on Block CI-12 with the Topaz Driller rig contracted from Vantage Drilling, in hopes to find more gas. But given growing gas demand, Côte d’Ivoire is also considering several import options, including pipeline and LNG. Discussions have been held with Ghana regarding a possible pipeline from its Western region, which houses most of Ghana’s gas receiving and processing infrastructure. Another option could come from the Nigeria-Morocco Gas Pipeline, whose route will cross Côte d’Ivoire. In June 2023, PETROCI was one of the companies that signed a memorandum of understanding (MoU) with Nigeria’s NNPC and Morocco’s ONHYM to reaffirm its commitment to the project.

Read more »

Africa’s refining industry on the path of recovery, shows new Hawilti report

The reopening of some refineries in Africa and the gradual commissioning of new facilities will mark the recovery of the continent’s downstream industry in 2023, according to Hawilti’s African Refineries Watch published today. While sub-Saharan Africa’s refining capacity is still under-utilised at some 40%, recovery is on the horizon with the re-opening of South Africa’s Astron Energy Refinery (100,000 barrels per day – bpd) and Ghana’s Tema Oil Refinery (45,000 bpd). Once both facilities are back in operations, the sub-continent will be able to utlise about half of its installed refining capacity. Refining capacity to get a boost in West Africa Ghana is also expecting to commission soon the Sentuo Oil Refinery, a 3 train multi-product crude oil refinery built within the Tema Industrial Zone with a targeted production capacity of 120 000 bpd. Its initial phase will have a capacity to produce 2 million tonnes per year (tpy) of petroleum products, almost doubling the country’s refining capacity. This is welcome news for Ghana who has seen its imports bill soar in recent months, reaching almost $4 billion in 2022 in premium and gasoil imports, according to the Bank of Ghana. But much larger change is currently happening in Nigeria, with the upcoming commissioning of the 650,000 bpd Dangote Refinery. The facility is scheduled to be inaugurated on May 22nd just before President Buhari leaves office and will cement Nigeria’s position as Africa’s leading refiner. Hawilti expresses cautious optimism on the commissioning of the Dangote Refinery, pointing to the complex and lengthy process required to reach full production. In its most recent report on Nigeria, the IMF for instance did not expect the refinery to reach full capacity right away, assuming a production of only 100,000 bpd in 2024 and 200,000 bpd in 2025. Meanwhile, Nigerian modular refineries have managed to navigate the country’s challenging business environments and found ways to secure new feedstock options to run small-scale facilities. Both the 1,000 bpd Edo Refinery and the 2,500 bpd Duport Midstream Refinery for instance are currently receiving crude oil by trucks from a marginal field in the Niger Delta to support their operations. The Edo Refinery is also undergoing significant expansion, with owner AIPCC Energy expecting to reach a capacity of 30,000 bpd at the end of this year and up to 100,000 bpd in 2024. “The drive to develop downstream assets with emphasis on refineries in emerging economies coupled with global energy volatility and evacuation challenges in some African countries is fueling the interest in the development of modular refineries,” declared Souheil Abboud, Managing Director at VFuels LLC. “The benefits of decentralizing refining infrastructure are one of the main reasons for the growth of modular refineries in Africa, and especially Nigeria. We are surely witnessing a growing demand for more sustainable infrastructure assets and an interest from Nigerian developers to integrated low-carbon electrification options within their future refining infrastructure. VFuels is proud to have completed an engineering FEED package that integrates renewable power solution for a refinery project in Nigeria.”

Read more »

BREAKING: British junior enters onshore Angolan blocks with Apex Atlas acquisition

Corcel Plc, an AIM-listed company with interest across battery metals and oil & gas, has acquired a 90% interest in Atlas Petroleum Exploration Worldwide Limited (Apex Atlas), which was recently awarded operated and non-operated interests in onshore oil & gas blocks in Angola. The company is not to be confused with Atlas Petroleum International, the Nigerian exploration & production company. In May 2021, Apex Atlas was awarded a 20% working interest in the KON 11 and a 25% interest in the KON 12 blocks, two licenses that have produced between 1970 and 1990. They hold strong redevelopment potential focused on the Tobias and Galinda fields. The company was also awarded a 35% interest as operator of the KON 16 exploration block. A license signature and award ceremony is scheduled to take place later this week in Angola to formalize the deal. The transaction would complete only upon the formal execution of three risk service contracts (RSC) with the Angolan government covering the KON 11, 12 and 16 Blocks. The minimum spend on KON 11 and KON 12 is of $6m, while that of KON 16 is of $3m, with a commitment to drill one well on all three blocks, according to Corcel. “The Kwanza basin has been producing for 35 years, is a well understood petroleum system and has both significant scale and upside. Corcel sees significant opportunities to increase the legacy operator estimated resources given the structural configuration of the basin and recent new structural mapping. We also see large stratigraphic and structural pre salt structures on blocks, analogous to the offshore Cameia discovery. Our initial focus will however be on quickly securing first oil and revenues through our redevelopment opportunities,” said James Parsons, Executive Chairman at Corcel.

Read more »

Opinion: Nigeria’s industry is rising to the twin challenge of decarbonisation and energy security

by Wale Yusuff, Managing Director of Wärtsilä in Nigeria Wale Yusuff, the Managing Director of Wärtsilä in Nigeria, explains how businesses operating in energy-intensive industries like cement or steel are investing in flexible engine technologies to secure reliable and efficient power while also setting the perfect stage to make good on their decarbonisation objectives. Nigeria is a major industrial hub. It is home to energy-intensive manufacturing businesses whose operations, and growth potential, are constrained by the weakness of the country’s electricity supply. To mitigate this, industrial companies have been building their own power generation capabilities, but the result has often been the reliance on expensive and polluting diesel generators. As such, the industrial sector represents one of the country’s largest sources of greenhouse gas emissions. In most places in Africa, the development of renewable energy capacity is a very competitive solution that industrials can adopt to lower their environmental impact and energy costs. But things aren’t as clear-cut in Nigeria. Most of its industrial activity is in the south, a region where wind and solar resources are often not available in the right quantity to make renewables competitive at today’s equipment prices. It leaves industrials with a twin challenge to meet. First and foremost, they need to secure their own reliable and affordable power capacity either by buying electricity from an independent power producer or by building their own “captive” plant. Second, they need to integrate decarbonisation in their overall energy strategy. Both objectives are not contradictory. By making smart technology choices, forward looking businesses like BUA Cement, African Foundries, Lafarge, Wempco, Nestle and Flour Mills have found a way to hit these two birds with one stone. Here is how. Securing a reliable supply of electricity Mitigating power generation risk is critical to Nigeria’s industrial growth. As one of the world’s largest producers of liquified natural gas (LNG), Nigeria has a strong interest to develop its utilization to power local industries. That’s why flexible engine power plants have emerged as the technology of choice for Nigeria’s industries. Fuel-flexible engine technology provides a great hedge against fuel supply risk as it can operate on multiple types of fuels, from gas to heavy or light fuel oil, and switch between fuels while operating. This fuel-flexibility is also a key enabler to the decarbonisation strategy of industrials, as engine power plants can be converted to run on sustainable fuels like biofuels and green hydrogen, ammonia, or methanol, when these become available. Thanks to their modular design, Wärtsilä engine power plants are easy to construct, fully scalable and can be deployed in phases. They have the flexibility to be ramped-up or down quickly to adjust to demand, they have a high operating efficiency even at partial load and are designed to cope with regular stops and starts. This very high operating flexibility is also what is needed for the future integration of intermittent renewable energy capacity to the power mix. What is more, they require much less water to function than competing power technologies, which is an important water conservation consideration in view of Nigeria’s long dry seasons. With all these attributes, flexible engine power plants offer a cost-effective solution to meet energy demand in the short term, and environmental objectives in the longer term. BUA Cement PLC, one of Nigeria’s largest cement producers, is one example of an energy intensive industrial company which has invested to secure its own flexible and reliable power supply and decrease its carbon footprint. As the demand for cement is increasing every year, BUA has taken advantage of the modularity of engine technology to increase its power capacity in stages. The company is currently installing a 70 MW power plant for the line 4 in its Sokoto cement plant, NW Nigeria. This is in addition to a 50 MW power plant commissioned two years earlier for the line 3 of the same cement plant. Future expansion plans include another 70MW for its OBU line 3 cement plant in Edo State SW by the end of 2023. The plants feature Wärtsilä 34 DF dual-fuel engines operating primarily with LNG and PNG, but with the flexibility to switch to an alternative fuel should there be interruptions to the gas supply, quality, or pressure. What is more, the operational flexibility of the Wärtsilä engines provides future-proofing advantages by enabling the potential integration of renewable energy further down the line. Paving the way for renewables Nigeria’s long term energy strategy has defined the rapid deployment of renewables and strengthening the power transmission network as key objectives. But it must also overcome the specific challenges of the tropical monsoon climate in the industrialized south of the country where the solar and wind potential is respectively 30% and 40% lower than in the hot and semi-arid conditions in the north. By investing in gas engine power plants, energy-intensive industries will not only decrease their carbon footprint, but they will also free up resources for the government to expand the transmission network enabling the entire country to benefit from the natural gas reserves located in the south and renewable resources in the north. Paras Energy sets an example of how this can work. Since installing a 132 MW Wärtsilä gas engine power plant in Ikorodu in Lagos State and Ogijo in Ogun State, Paras Energy is supplying the company’s steel production needs as well as providing power to the Nigerian grid to support over 20,000 homes annually. The company is now commissioning a 10 MW solar power plant in Suleja and a 5 MW solar rooftop system for commercial and industrial customers is under development. Flexible engine power plants represent a smart and future-proof investment for Nigeria’s energy intensive industries. They offer the efficient power capabilities needed to offset the shortcomings of the national power grid, strengthen their global competitiveness, and reduce their GHG emissions today and tomorrow. By working towards the country’s decarbonization targets, the smart energy investments made by industry will benefit the whole country.

Read more »

Nigeria: continued crude theft and workers’ strike bring production to new low

Nigeria produced 37.35 million barrels of crude oil and condensate in April this year, loosing 10 million barrels from its March production levels, according to data from NUPRC. This brought the country’s average daily oil production below the 1 million barrels of oil per day (bopd) threshold, in a country where production capacity stands at over 2 million bopd. Africa’s largest oil producer continues to be hit hard by severe crude theft from onshore assets. These used to represent almost 40% of production before COVID-19, but their share of output fell to only a fourth of the country’s daily oil and condensates volumes last year. Despite intense efforts from authorities to curb crude theft, results have been limited. “From March 2022 to March 2023, we removed 460 illegal connections on the Trans-Niger Pipeline so we could lift force majeure from our Bonny Terminal,” said Osagie Okunbor, Chairman of the Shell Companies in Nigeria, at the recently concluded Nigeria Energy Summit in Abuja. “However, we are now struggling to catch up our repair programs vis-à-vis new attempts to steal crude oil,” he confessed. So far, Shell’s Bonny Terminal has been able to export only between 2 and 3 million barrels per month in 2023, against traditional monthly volumes of 6 to 8 millions three years ago. But the biggest blow to the country’s production came from a wide strike organized by ExxonMobil workers in April 2023, forcing the American major to declare a Force Majeur at its four terminals in Nigeria. Data from NUPRC shows a loss of 4.6 million barrels at the ExxonMobil terminals between March and April 2023, including at Qua Iboe (-2.3 million barrels), Erha FPSO (-1.3 million barrels), Usan FPSO (-480,000 barrels) and Yoho FSO (-473,000 barrels). ExxonMobil was only able to resume normal operations at the end of April after successful negotiations with the workers. In its most recent report on Nigeria’s upstream industry, Hawilti forecasted a total production of some 1.57 million barrels per day in 2023. The forecast remains heavily dependent on a recovery of onshore volumes by implementing crude theft mitigation measures.

Read more »

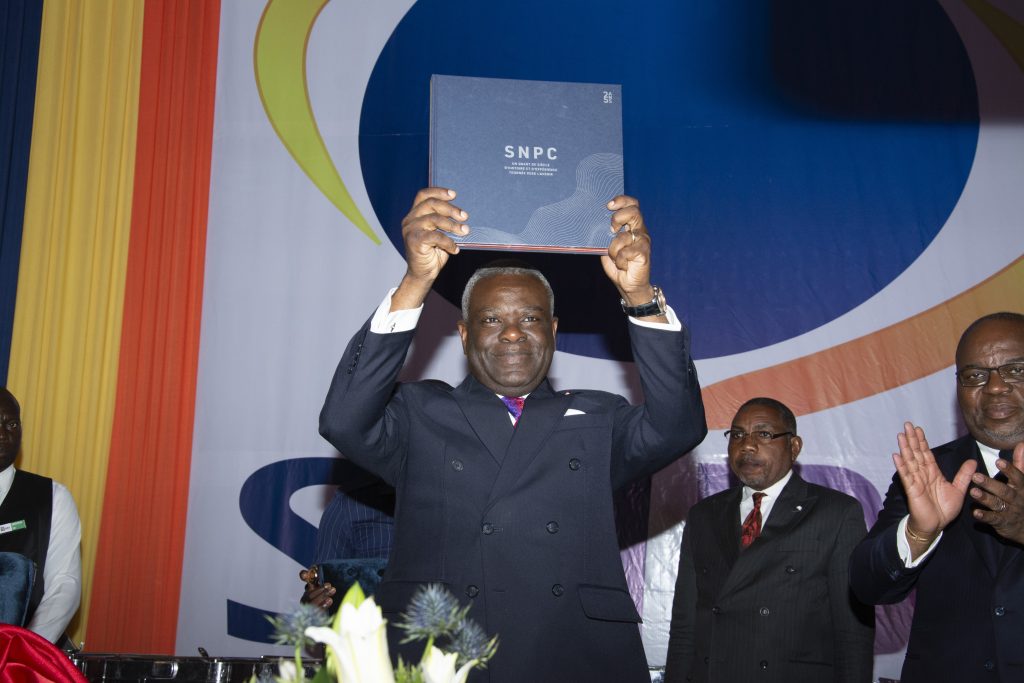

Congo’s national oil company officially launches ‘Performance 2025’

Congo’s national oil company SNPC organized a gala dinner to celebrate its 25th anniversary and launch its ambitious “Performance 2025” program. The event took place at the Grand Hotel of Kintélé in early May and brought together more than 1,000 people, including SNPC agents, partners, friends and members of the government and Congolese institutions. The highlight of the evening was the launch of the “Performance 2025” program of the SNPC. Presented by the Director General of the company, Mr. Maixent Raoul Ominga, this project is based on four pillars: increasing income, controlling and optimizing costs, supporting and contributing to the government agenda, and ensuring better governance of the company’s activities. More generally, Performance 2025 aims at positioning the SNPC as a undisputed leader of the Congolese and African oil industry in the years to come. The Director General clarified that the project seeks to improve the competitiveness of SNPC, emphasizing productivity, quality and operational efficiency. A highlight of the evening was the delivery of the SNPC book to the Director General by a tribe who presented a choreography and traditional songs. The SNPC book presents the history of hydrocarbons in the Republic of Congo since 1957 and that of the company 25 years ago. It was presented by the Director General to Mr. Bruno Jean Richard Itoua, Minister of Hydrocarbons. “For the SNPC, this historic moment is an opportunity to take a retrospective look on the road traveled and to have a prospective look at its future,” Maixent Raoul Ominga said during his speech. “It is by associating all the intelligences, energies, know-how and by getting out of our comfort zones that our company will certainly be at the rendez-vous of its ambitions, through its ‘Performance 2025’ program.”

Read more »

Gabon: Perenco takes step towards gas-to-power production at Mayumba

On April 6th, Perenco has signed a memorandum of understanding (MoU) with several public parties in Gabon towards the development of a 21 MW power plant at Mayumba in the country’s southern region. The agreement was signed by the Ministry of Petroleum and Gas, the Ministry of Energy and Hydraulic Resources, the Ministry of Economy and Recovery, the Ministry of Budget and Public Accounts, Perenco Oil & Gas Gabon (POGG) and the Gabon Power Company (GPC), entity of the Sovereign Fund of the Gabonese Republic (FSRG). The gas-to-power project includes a gas pipeline linking Perenco’s offshore gas fields to shore, a 21 MW power plant that can be expanded to 50 MW, a substation, a transmission line to Tchibanga, and a 20 kV distribution line to Mayumba and its surroundings. In its “Gas for Africa” report released in February 2023 with the International Gas Union, Hawilti reported that Mayumba was one of the pillars of Perenco’s future gas flare reduction strategy in Gabon. The independent operator is currently rolling out several gas monetisation projects in the country, including a 15,000 tonnes LPG plant at Batanga already under-construction, and an LNG export terminal planned at Cap Lopez. The company already supplies gas to Gabon’s power plants in the capital Libreville and in the oil city of Port Gentil, both located in the north of the country. Gas supplies rely on a 400-km offshore gas network developed in 2006 to monetise flare gas and make feedstock available to power stations.

Read more »

JUWI South Africa reaches financial close of major wind project amid increasing push for renewables

South African subsidiary of leading renewable energy project developer JUWI has begun construction of the 84MW Wolf Wind project after reaching financial close, as an energy crisis pushes more demand for alternative sources of power in one of Africa’s biggest economies. The facility is projected to begin generating electricity for the South African grid by Q1 2024. “The Wolf Wind Project will be generating more than 360 GWh of clean electricity for the South African grid per year,” Red Rocket Chief Executive Officer, Matteo Brambilla, said in a statement. The renewable energy company won the bid for the project in Round 5 of the South African government’s Renewable Energy Independent Power Producers Procurement Programme (REI4P). The initiative aims to bring more megawatts into the country’s electricity system through private investments in renewable energy sources. “We’re proud to have partnered with JUWI on this project and pleased to have started construction on this and other large wind projects.” The Wolf Wind Project, located two hours from the city of Gqeberha, is the second wind project developed by JUWI under REI4P. The first — the 138 MW Garob Wind Project — began commercial operation in 2021. Tackling an energy crisis with renewable energy “JUWI is committed to developing projects that help South Africa address the energy crisis and achieve the clean energy transition, and so the progress in rolling out REI4P projects is very encouraging,” said Richard Doyle, Managing Director, JUWI South Africa. South Africa is facing an energy crisis caused partly by aging coal plants in need of constant maintenance. This has led to load-shedding implemented through a series of rolling blackouts, which has become part of the country’s power grid since 2007. Last year, the country experienced 3,773 hours of loadshedding according to the Council for Scientific and Industrial Research (CSIR) – or over 157 days. According to the Ministry of Mineral Resources and Energy, South Africa’s total domestic electricity generation capacity stands at 58,095 megawatts. But most of it—around 80%—comes from coal-fired power plants. President Ramaphosa wants South Africa to begin phasing out some coal-fired generation by 2050. Under its Integrated Resource Plan (IRP2019), the country wants to install over 25GW of renewable energy capacity and 3GW of energy storage by 2030 via its REI4P auctions. JUWI South Africa (JUWI Renewable Energies Pty. Ltd) says it is supporting a mix of clean energy projects, including over 1.5 GW of wind, 2 GW of solar and 5OO MW of hybrid projects for various clients. To support growing demand from private and public energy users, Richard Doyle says JUWI plans to develop a further combined 1 GW of wind, solar and hybrid projects in 2023.

Read more »

Cameroon and Equatorial Guinea agree on offshore cross-border gas cooperation

President Teodoro Obiang Nguema Mbasogo of Equatorial Guinea and President Paul Biya of Cameroon have signed a cooperation agreement on the development of oil & gas reserves at their maritime border in the Gulf of Guinea. The agreement was signed in Yaoundé on the sideline of the 15th Ordinary Session of the Conference of Heads of State of the Central African Economic and Monetary Community (CEMAC) on March 17th. While details on the agreement have not been revealed, it is expected to facilitate the development of gas discoveries on both side of the maritime border between Equatorial Guinea and Cameroon. An Offshore Gas Megahub in the Making Equatorial Guinea already produces oil and gas from Alen on Block O and Aseng on Block I, both operated by Chevron Energy since its acquisition of Noble Energy in 2020. The blocks contain the undeveloped Felicita and Yolanda gas discoveries. Last year, Chevron produced some 56,000 bpd of oil equivalent (net) from Equatorial Guinea, including 12,000 bopd of oil, 7,000 bpd of natural gas liquids and 223 MMscf/d of natural gas. Just across the maritime border, Chevron also operates the YoYo Block in Cameroon’s Douala Basin which contains the undeveloped YoYo gas discovery. The development of the Yolanda and YoYo gas discoveries could be easily executed by utilizing Equatorial Guinea’s existing infrastructure and processing gas on Punta Europa, where Equatorial Guinea has gas processing infrastructure, including an LNG terminal, a methanol plant, and an LPG plant. The country has long ambitioned to position its gas infrastructure as a processing hub for stranded gas fields and discoveries in the Gulf of Guinea. In 2021, it completed the Alen Gas Monetisation project that enabled the production of gas from the Alen unit and its transportation by pipeline to Punta Europa where it serves as feedstock for EG LNG and the Alba LPG plant. Future monetization plans include the processing of stranded gas both from Cameroon and Nigeria’s offshore fields. A Regional Gas Future? Unlocking the potential of regional gas cooperation in the Gulf of Guinea requires several multi-party, multi-governmental commercial and legal agreements that have so far delayed projects. While the deal signed in Yaounde this week sends positive signals, its nature remains unknown. In addition, the joint-development of Yolanda and YoYo would require additional agreements with the operator Chevron. The long-term presence of the major in the region remains uncertain. In December 2021, Chevron signed a Production Sharing Contract (PSC) for exploration block EG-09, just south of its Blocks O and I. But a few months later, Reuters reported that the major had hired investment bank Jefferies to sell its assets in the country. Meanwhile, other operators in Cameroon could seek to use Equatorial Guinea’s processing infrastructure for their own ventures. This is the case of partners on the Etinde Gas Project offshore Cameroon, who are exploring the option of sending wet gas from the undeveloped Etinde field to Punta Europa before reimporting dry gas into Cameroon via a new 50km pipeline linking both countries.

Read more »

Angola: ExxonMobil to invest $200m in Namibe Basin exploration

Some $200m is being invested into exploring Blocks 30, 44 and 45 in the frontier Namibe Basin offshore Angola, according to the country’s Ministry of Mineral Resources, Petroleum and Gas (MIREMPET). The blocks are operated by ExxonMobil (60%) under Risk Service Contracts signed at the end of 2020 with Sonangol E&P (40%) and the Agency for Petroleum, Gas and Biofuel (ANPG) for the three blocks. On Tuesday this week, the three parties signed a Memorandum of Understanding to pave the way for exploration on the blocks, during a ceremony witnessed by Minister Diamantino Pedro Azevedo. Angola expects some $200m to be invested into seismic studies and the drilling of an exploratory well on the blocks by 2024, according to MIREMPET. In case of a successful commercial discovery, some $15bn could be invested into the development of reserves in the Namibe Basin to start production by 2030. “Estimated revenue for the State from the development of a single major commercial discovery can range from $20bn to $40bn, given a conservative oil price forecast of $50-60,” MIREMPET said. ExxonMobil has mobilised the Valaris DS-9 drillship offshore Angola until July 2024, the Hawilti/Caverton Offshore Rigs Tracker shows. So far, drilling has focused on the company’s producing Block 15 where a new discovery was made at the Bavuca Sul-1 well last year.

Read more »

Chevron starts production from Lifua-A project offshore Angola

Angola’s Agency for Petroleum, Gas and Biofuel (ANPG) and Chevron’s local subsidiary CABGOC have announced the start of production from the Lifua-A project within Block 0. Chevron intends to develop the Lifua reserves via three different phases, Lifua-A, -B, and -C. Phase A relies on a stacked template structure (STS) platform with ten wells, including six production wells and four injectors. All fabrication was carried out locally in Cabinda by Algoa Cabinda Fabrication Services. “The Lifua-A platform is interconnected with the existing facilities in the Takula Area and is expected to produce a total of 6,500 barrels of oil per day from the Vermelha and Likouala reservoirs,” the ANPG said. The development of Lifua benefits from fiscal incentives granted under Angola’s marginal fields legislation. In November 2019, Executive Decree 328/18 granted marginal field status to the Lifua, 83-N, Kambala and N’Dola Sul fields in Block 0, data from Hawilti+ shows. In Angola, one of the conditions for a field to be considered marginal is that its proven oil reserves do not exceed 300 million barrels. Block 0 is located in shallow waters and is one of Angola’s most prolific assets with over 20 fields currently producing. Chevron is engaged in several brownfield development projects there, including the Sanha Lean Gas Connection (SLGC) project whose final investment decision (FID) was taken two years ago to supply gas feedstock to Angola LNG and the Soyo power plant. Out of the remaining discoveries that were granted marginal field status in 2019, N’Dola Sul is expected to be developed under a similar scheme as Lifua-A, according to Sonangol records.

Read more »

NNPC and Eroton E&P clash over operatorship of one of Nigeria’s most prolific oil and gas blocks

Nigeria’s NNPC announced on March 6th the appointment of NNPC Eighteen Operating Ltd as operator of Oil Mining Lease 18 (OML 18) onshore Nigeria by the block’s non-operating joint-venture partners. OML 18 is operated by Eroton Exploration and Production Co. (27%) while non-operating partners include NNPC (55%), OML 18 Energy Resource (Sahara Group, 16.2%) and Bilton (1.8%). Eroton was removed as operator of the joint-venture to protect the partners’ investment in OML 18, NNPC said. OML 18 has been unable to produce oil for several months due to the unavailability of the Aiteo-operated Nembe Creek Trunk Line (NCTL) that provides a connection to Shell’s Bonny oil export terminal. As a result, production has fallen from some 30,000 barrels of oil per day (bopd) a few years ago to zero for most of last year, data from NNPC shows. In comparison, Eroton E&P’s initial intention after taking operatorship of the asset in 2014 had been to increase production to 115,000 bopd of oil and 485 MMscf/d of gas. Such performance is deemed unsatisfying for an asset that covers 1,035 km2 and contains 11 discovered oil and gas fields with 714 million stock tank barrels of oil and condensate and 4.7 trillion cubic feet (Tcf) of gas reserves, according to NNPC. However, Eroton E&P is not the only to suffer from reliance on the NCTL. Data from NNPC shows that all neighboring blocks and joint-ventures who rely on that pipeline have been unable to get oil to market since April 2022. To mitigate the impact of crude theft and pipeline losses, an Alternative Crude Oil Evacuation System (ACOES) had been approved by the partners to barge oil to a floating, offloading and storage (FSO) vessel offshore Bonny. While limited barging reportedly started in June 2022, COVID-19 and delays in mooring the FSO have postponed the commissioning of the ACOES and prevented resumption of production. San Leon Energy’s Transactions The replacement of Eroton E&P as operator comes at a time when LSE-listed San Leon Energy is working to secure a controlling interest over Eroton E&P, OML 18, and the ACOES project. The company already owns 40% of Midwestern Leon Petroleum Ltd (MLPL), the entity that owns Martwestern, which itself owns 98% of Eroton E&P. In July 2021, San Leon signed Heads of Terms to reorganize MLPL and acquire the remaining 60% of the company from Midwestern Oil & Gas. Such a transaction would increase San Leon’s indirect economic interest in Eroton E&P from 39.2% to 98%. In parallel, Eroton E&P is planning to acquire Sahara Group’s 16.2% and Bilton’s 1.8% interests in OML 18, with funding from the Afreximbank. The consolidation of Eroton E&P’s interest in OML 18 is one of the conditions that must be completed for San Leon to proceed with its reorganisation of MLPL. If Eroton was to consolidate its interest in OML 18, and if San Leon was to secure a controlling interest of Eroton, its indirect economic interest in OML 18 would increase from 10.58% to 44.1%. In parallel, San Leon has also invested in the ACOES being developed for OML 18 and owns 10% equity plus a conditional further 3.323% equity in ELI Malta, the owner and operator of the ACOES project. In July 2022, a Reorganisation Agreement was signed, whose completion would increase San Leon’s interest in ELI to 50.64%. The appointment and replacement of Eroton E&P as operator of OML 18 throws uncertainty both over San Leon’s transactions but also over redevelopment plans for one of Nigeria’s biggest assets in reserves size and infrastructure capacity. Since this article was first written, Eroton E&P has categorically contested NNPC’s move. “We hereby re-iterate that Eroton remains the Operator of OML-18 in line with the provisions of the JOA and any dispute whatsoever between the parties are reserved exclusively for resolution under the Dispute Resolution clause of the JOA. The actions of the other JV partners (NNPC and Sahara) remain illegal and run contrary to the rule of law and in total breach of the terms and conditions stipulated in JOA,” the company said in a statement. This article was updated on March 14th to reflect Eroton E&P’s position and statement.

Read more »