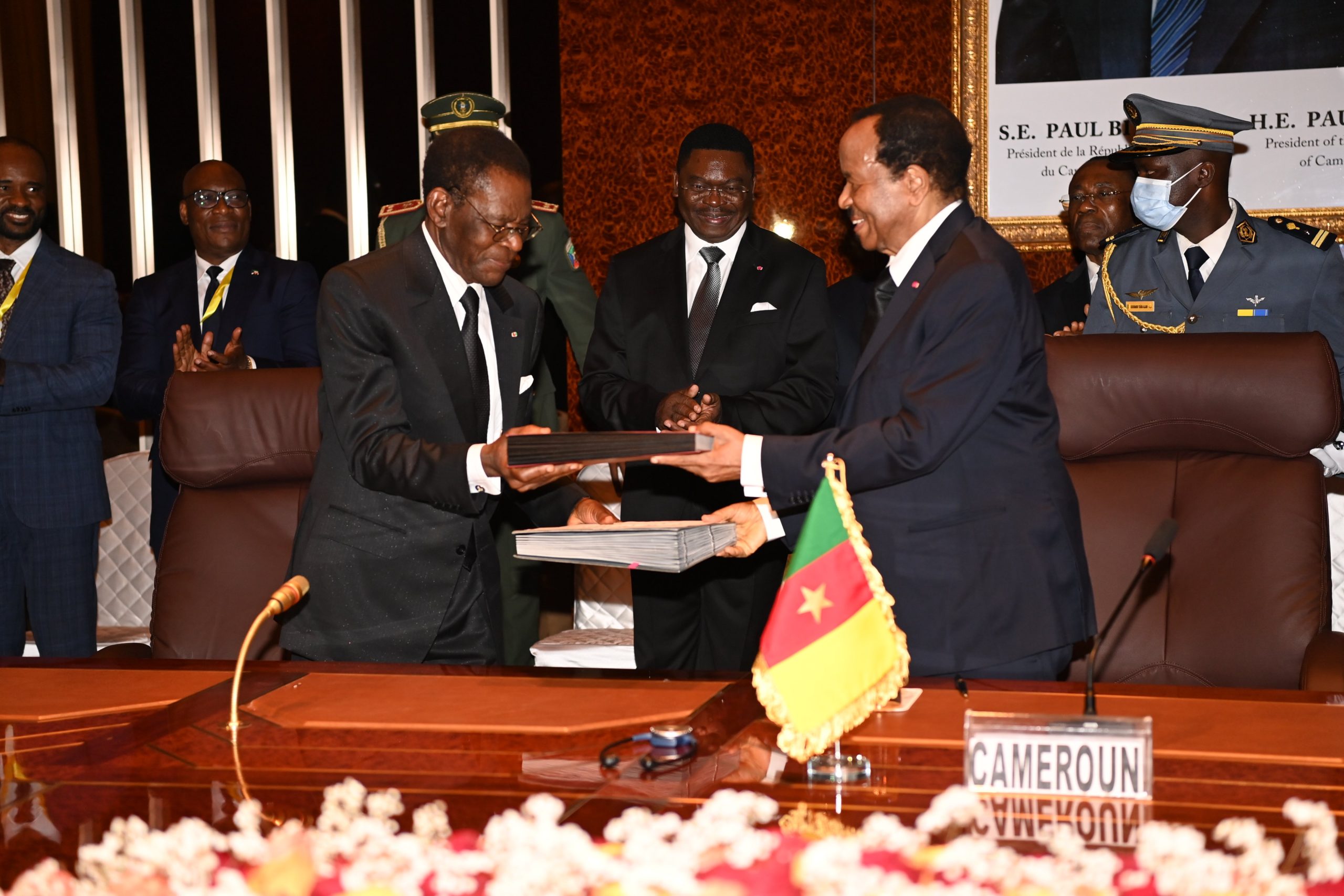

President Teodoro Obiang Nguema Mbasogo of Equatorial Guinea and President Paul Biya of Cameroon have signed a cooperation agreement on the development of oil & gas reserves at their maritime border in the Gulf of Guinea.

The agreement was signed in Yaoundé on the sideline of the 15th Ordinary Session of the Conference of Heads of State of the Central African Economic and Monetary Community (CEMAC) on March 17th.

While details on the agreement have not been revealed, it is expected to facilitate the development of gas discoveries on both side of the maritime border between Equatorial Guinea and Cameroon.

An Offshore Gas Megahub in the Making

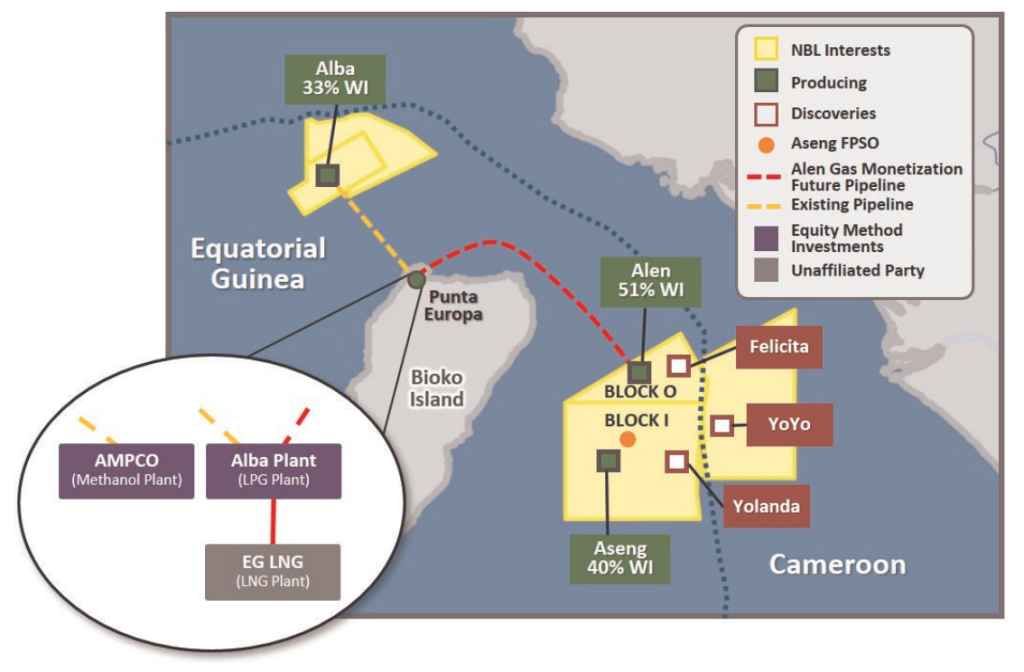

Equatorial Guinea already produces oil and gas from Alen on Block O and Aseng on Block I, both operated by Chevron Energy since its acquisition of Noble Energy in 2020. The blocks contain the undeveloped Felicita and Yolanda gas discoveries.

Last year, Chevron produced some 56,000 bpd of oil equivalent (net) from Equatorial Guinea, including 12,000 bopd of oil, 7,000 bpd of natural gas liquids and 223 MMscf/d of natural gas.

Just across the maritime border, Chevron also operates the YoYo Block in Cameroon’s Douala Basin which contains the undeveloped YoYo gas discovery.

The development of the Yolanda and YoYo gas discoveries could be easily executed by utilizing Equatorial Guinea’s existing infrastructure and processing gas on Punta Europa, where Equatorial Guinea has gas processing infrastructure, including an LNG terminal, a methanol plant, and an LPG plant.

The country has long ambitioned to position its gas infrastructure as a processing hub for stranded gas fields and discoveries in the Gulf of Guinea. In 2021, it completed the Alen Gas Monetisation project that enabled the production of gas from the Alen unit and its transportation by pipeline to Punta Europa where it serves as feedstock for EG LNG and the Alba LPG plant. Future monetization plans include the processing of stranded gas both from Cameroon and Nigeria’s offshore fields.

A Regional Gas Future?

Unlocking the potential of regional gas cooperation in the Gulf of Guinea requires several multi-party, multi-governmental commercial and legal agreements that have so far delayed projects. While the deal signed in Yaounde this week sends positive signals, its nature remains unknown.

In addition, the joint-development of Yolanda and YoYo would require additional agreements with the operator Chevron. The long-term presence of the major in the region remains uncertain. In December 2021, Chevron signed a Production Sharing Contract (PSC) for exploration block EG-09, just south of its Blocks O and I. But a few months later, Reuters reported that the major had hired investment bank Jefferies to sell its assets in the country.

Meanwhile, other operators in Cameroon could seek to use Equatorial Guinea’s processing infrastructure for their own ventures. This is the case of partners on the Etinde Gas Project offshore Cameroon, who are exploring the option of sending wet gas from the undeveloped Etinde field to Punta Europa before reimporting dry gas into Cameroon via a new 50km pipeline linking both countries.