Wind Power

UAE finance initiative aims to unlock Africa’s clean energy potential

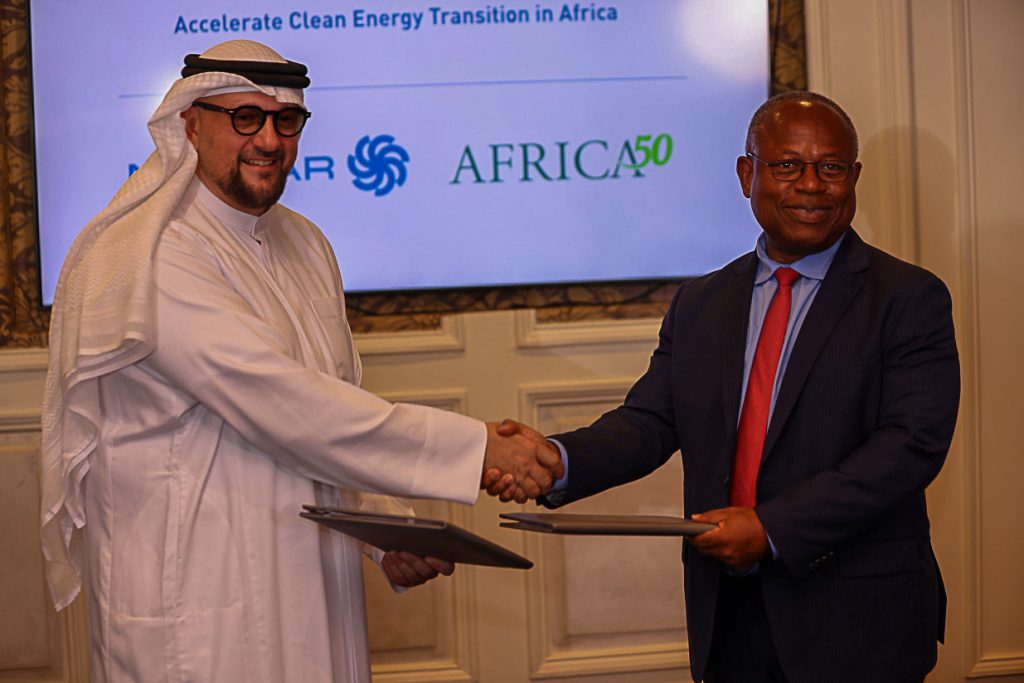

A landmark initiative that brings together public, private, and development capital from UAE institutions, is providing $4.5 billion in funding to boost Africa’s energy transition efforts as the continent looks to close an energy deficit that has left 600 million people without access to electricity. The UAE finance initiative is drawing its support from the Abu Dhabi Fund for Development (ADFD), Etihad Credit Insurance (ECI), Masdar, and AMEA Power – all UAE based institutions with experience funding and developing renewable energy projects in emerging markets. Africa50, an investment platform formed by African governments and the Africa Development Bank (AfDB), is also part of the UAE finance initiative. The COP28 President-Designate, H.E. Dr. Sultan Al Jaber, announced the launch of the initiative during a keynote address at the inaugural African Climate Summit last week in the Kenyan capital, Nairobi. “This initiative builds on the UAE’s track record of commercially driven, innovative blended finance solutions that can be deployed to promote the adoption of clean energy in emerging and developing nations,” President-Designate Dr. Sultan Al Jaber said in an official statement, adding the multi-stakeholder partnership approach will accelerate sustainable economic progress, address the challenge of climate change and stimulate low carbon growth. The initiative comes amid calls for the global tripling of renewable energy by 2030, while pushing to make finance more available, accessible and affordable, especially in Africa where an abundance of renewable energy potential remains largely untapped. Unlocking Africa’s clean energy potential with reforms According to findings from the International Energy Agency (IEA), Africa is home to 60% of the world’s best solar resources, yet has only 1% of installed solar generation capacity. For the continent to unlock its clean energy potential, African countries will need to improve policy and regulatory frameworks to attract the long-term investments needed to speed up the deployment of clean and renewable energy. “The initiative will prioritize investments in countries across Africa with clear transition strategies, enhanced regulatory frameworks and a master plan for developing grid infrastructure that integrates supply and demand,” Al Jaber said, noting the initiative is designed to work with Africa and for Africa. “It aims to clearly demonstrate the commercial case for clean investment across this continent. And it will act as a scalable model that can be replicated to help put Africa on a superhighway to low carbon growth.” While delivering greater access to clean energy has been known to drive social and economic development, the COP 28 President-Designate adds that current investment in African renewables represents only 2 percent of the global total, and less than a quarter of the US$60 billion a year the continent needs by 2030. The initiative seeks to correct this imbalance by bringing key stakeholders together to speed up the delivery of relevant measures, including that of infrastructure, to close the gap in universal clean energy access. Unlocking capital for clean power The initiative will form part of Etihad 7, a development platform launched by the UAE to raise 20GW in renewable energy capacity and provide 100 million people across the African continent with clean electricity by 2035. To catalyze private sector action, ADFD is funding the initial investment with US$1 billion of financial assistance to address basic infrastructure needs, offer innovative finance solutions and increase mobilization of private investments. The ECI is providing US$ 500 million of credit insurance to de-risk and unlock private capital. Masdar, one of the world’s largest clean energy companies, active in 22 countries in Africa, is committing an additional US$2 billion of equity as part of the new initiative. Masdar has been moving into the renewable energy sector in Africa as part of the Etihad 7 programme. In January, the company announced it signed an agreement with Angola, Uganda and Zambia to develop renewable energy projects with a combined capacity of up to 5 gigawatts (GW) as part of the programme. With the UAE finance initiative, the company aims to mobilize an additional US$8 billion in project finance through its Infinity Power platform, targeting the delivery of 10 gigawatts (GW) of clean energy capacity in Africa by 2030. AMEA Power looks to install 5GW of renewable energy capacity in the continent by 2030, mobilizing US$5 billion, of which US$1 billion will come from equity commitment, and US$4 billion from project finance. The company has been active in Africa for several years already. Earlier this year, it notably executed a 25-year Power Purchase Agreement (PPA) with GreenCo Power Services (GreenCo) for an 85MW solar PV power plant in South Africa as an energy crisis pushes more demand for alternative sources of power in one of Africa’s biggest economies. The initiative is also pursuing pathways for other multilateral development banks, governments, and philanthropies to catalyze additional private sector investment. At the inaugural African Climate Summit in Nairobi, the COP28 Presidency called for others including international financial institutions (IFIs) and foundations to join the effort to convert words into actions.

Read more »

JUWI South Africa reaches financial close of major wind project amid increasing push for renewables

South African subsidiary of leading renewable energy project developer JUWI has begun construction of the 84MW Wolf Wind project after reaching financial close, as an energy crisis pushes more demand for alternative sources of power in one of Africa’s biggest economies. The facility is projected to begin generating electricity for the South African grid by Q1 2024. “The Wolf Wind Project will be generating more than 360 GWh of clean electricity for the South African grid per year,” Red Rocket Chief Executive Officer, Matteo Brambilla, said in a statement. The renewable energy company won the bid for the project in Round 5 of the South African government’s Renewable Energy Independent Power Producers Procurement Programme (REI4P). The initiative aims to bring more megawatts into the country’s electricity system through private investments in renewable energy sources. “We’re proud to have partnered with JUWI on this project and pleased to have started construction on this and other large wind projects.” The Wolf Wind Project, located two hours from the city of Gqeberha, is the second wind project developed by JUWI under REI4P. The first — the 138 MW Garob Wind Project — began commercial operation in 2021. Tackling an energy crisis with renewable energy “JUWI is committed to developing projects that help South Africa address the energy crisis and achieve the clean energy transition, and so the progress in rolling out REI4P projects is very encouraging,” said Richard Doyle, Managing Director, JUWI South Africa. South Africa is facing an energy crisis caused partly by aging coal plants in need of constant maintenance. This has led to load-shedding implemented through a series of rolling blackouts, which has become part of the country’s power grid since 2007. Last year, the country experienced 3,773 hours of loadshedding according to the Council for Scientific and Industrial Research (CSIR) – or over 157 days. According to the Ministry of Mineral Resources and Energy, South Africa’s total domestic electricity generation capacity stands at 58,095 megawatts. But most of it—around 80%—comes from coal-fired power plants. President Ramaphosa wants South Africa to begin phasing out some coal-fired generation by 2050. Under its Integrated Resource Plan (IRP2019), the country wants to install over 25GW of renewable energy capacity and 3GW of energy storage by 2030 via its REI4P auctions. JUWI South Africa (JUWI Renewable Energies Pty. Ltd) says it is supporting a mix of clean energy projects, including over 1.5 GW of wind, 2 GW of solar and 5OO MW of hybrid projects for various clients. To support growing demand from private and public energy users, Richard Doyle says JUWI plans to develop a further combined 1 GW of wind, solar and hybrid projects in 2023.

Read more »

AMEA Power on an exponential growth trajectory in Africa

AMEA Power, a Dubai-based developer, owner and operator of green energy projects, has developed a strong appetite for Africa over recent years. The company already built West Africa’s biggest solar plant, a 50 MW PV facility in Blitta, Togo. Its commissioned and under-construction solar projects total some 130 MW, spread between Morocco, Burkina Faso, Togo, and Uganda. The company has now embarked on a significant scaling up of its renewable energy capacity on the continent via new solar, wind, and hydrogen projects. Its has a pipeline of over 1 GW of solar PV projects in various stages of development in Morocco, Tunisia, Egypt, Mali, Chad, Gabon, Angola, and Djibouti. In November 2022, it also signed an MoU for a new 50 MW facility in Malawi, and announced in January 2023 the signing of a concession agreement and 25-year power purchase agreement (PPA) for a new 50 MW solar PV project in Côte d’Ivoire. Its African portfolio is also on the verge of diversification, with wind projects of some 950 MW in total being developed in Morocco, Egypt, Ethiopia, and Kenya. Last but not least, AMEA Power intends to leverage on Africa’s significant renewable energy potential to produce green hydrogen. It has currently selected Morocco, Egypt, Ethiopia, and Angola for up to 3.5 GW of green hydrogen projects that could be approved over the coming years.

Read more »

Cape Verde planning expansion of Cabeolica wind farms

Cabeólica S.A., owner of the four wind farms on the islands of Santiago, São Vicente, Sal and Boa Vista in Cape Verde, has signed an MoU for the expansion of its facilities. The MoU targets an expansion of the Santiago facility at Monte São Filipe by 13 MW, along with the installation of 2 x 5 MW energy storage batteries on the islands of Santiago and Sal. Cabeolica was sub-Saharan Africa’s first commercial-scale wind power project upon its commissioning in 2011. It was led by the Africa Finance Corporation and co-developed with InfraCo Africa and the Finnish Fund for Industrial Cooperation. In 2021, A.P. Moller Capital acquired a 44% stake in Cabeólica S.A. from the Africa Finance Corporation through the Africa Infrastructure Fund. Cabeolica now provides 20% of the power generated in Cape Verde, displacing 15 million liters of imported diesel every year. It was recognised by the United Nations Framework Convention on Climate Change (UNFCCC) as a Clean Development Mechanism (CDM) project in 2013. “The Cabeolica Wind Farm is Cape Verde’s single highest contributor to the reduction of greenhouse gas emissions ( an average of 47,000 tons of CO2 per annum ) and this expansion will play a significant part in further reducing the country’s dependence on fossil fuels in line with its renewable energy penetration target of 30% by 2025,” the Africa Finance Corporation said.

Read more »

Lekela Power sold in “Africa’s biggest renewable energy deal”

Actis and Mainstream Renewable Power have sold Lekela Power to the Infinity Group of Egypt and the Africa Finance Corporation (AFC). With an installed wind power capacity of 1 GW, Lekela Power is Africa’s largest pure-play renewable energy independent power producer (IPP). The platform was until now owned at 60% by Actis and 40% by Mainstream Renewable Power Africa Holdings. It currently owns five operational wind farms in South Africa (624 MW), one in Egypt (252 MW), and one in Senegal (159 MW). “This acquisition marks an important milestone in our journey to build a 3GW renewable energy platform. Working together with our partner, Infinity, we aim to more than double the capacity of our joint operating assets over the next 4 years, which stands at 1.4 GW after the Lekela acquisition,” said Samaila Zubairu, CEO of the AFC. Several projects are already in Lekela Power’s pipeline including the expansion of Senegal’s 159 MW Taiba Ndiaye Wind Farm by 100 MW and the addition of 175 MWh of battery storage. In Ghana, the platform is also planning the Ayitepa Wind Farm in two phases of 150 MW and 75 MW.

Read more »

Savannah Energy plans 250 MW wind farm in Niger

Savannah Energy, operator of some of the most prolific oil blocks in Niger, is currently planning to construct and operate the country’s first wind farm in its Tahoua Region. The project was subject to the execution of an agreement yesterday between Savannah Energy and the Ministry of Petroleum, Energy and Renewable Energies of the Republic of Niger. The wind farm will be structured as an independent power producer (IPP) and is currently in feasibility study. It is expected to be sanctioned in 2023 for a potential commissioning in 2025. Initial plans include the installation of 60 wind turbines with a total power generation capacity of up to 250 MW. The project’s timeline notably seeks to align it with the development of the West African Power Pool (WAPP) that would facilitate the exchange of electricity between West African markets via a high voltage interconnection network. Niger is scheduled to be connected to the WAPP in 2023 via a 330 kV line financed by the World Bank, the African Development Bank (AfDB), the European Union and the Agence française de Développement (AfD). Subject to the planned feasibility study confirming the ultimate scale of the project, the Tarka wind farm could produce some 600 GWh a year. Its construction could also support 500 jobs, displace carbon emissions by 400,000 tonnes of CO2/year and help reduce the cost of electricity for Nigerien households and industries.

Read more »

Africa’s largest copper-gold mine to run on renewable energy

First Quantum Minerals (FQM), the company that notably operates Africa’s biggest copper mine by production in Zambia, has entered into a new partnership with Chariot and Total Eren to develop 430 MW of solar and wind power for its mining operations in Zambia. Both Chariot and Total Eren had signed last year binding key terms of a long-term joint-development partnership to jointly originate and develop wind and solar projects for mining clients in Africa. Their project in Zambia with FQM would be unique in scale for Africa and help the global mining company to decarbonize its operations as it seeks to reduce its carbon footprint by 30% by 2025. Additional renewable energy capacity would notably support operations at FQM’s flagship Kansanshi copper-gold mine new Solwezi in Northern Zambia. Since 2005, FQM has expanded its operations there and is now capable of producing 340,000 tonnes of copper and more than 120,000 ounces of gold per year.

Read more »

Lekela is studying the expansion of West Africa’s biggest wind farm

Lekela has announced the signature of a grant agreement with the United States International Development Finance Corporation (DFC) to fund a feasibility study for an extension of its Parc Eolien Taiba N’Diaye (PETN). The 158.8 MW wind farm started commercial operations in December 2019 and is West Africa’s biggest wind energy facility. “The feasibility study, which is expected to be completed within 15 months, will be jointly financed by Lekela and DFC. The study covers an area west of the existing wind farm and will consist of a wind measurement campaign, a network study, an environmental impact study and other on-site surveys,” Lekela said in a statement. In September 2020, Lekela had also been awarded a grant from the U.S. Trade and Development Agency (USTDA) to fund a feasibility study in partnership with state-utility Senelec for Senegal’s first grid-scale battery electric storage system at PETN wind farm. The initial Taiba Ndiaye wind power project already benefited from strong government support and financial backing, especially from the U.S. Government, Denmark’s Export Credit Agency and the World Bank. This allowed its quick development, and commissioning in late 2019. More importantly, the facility has a base tariff equivalent to $0.11/kWh, hence contributing to the reduction of electricity generation costs in Senegal, where prices can go as high as $0.30/kWh. Details on the Taiba Ndiaye Wind Farm are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Chariot partners with Total Eren to offer clean energy solutions to mining companies in Africa

Chariot has signed binding key terms of a long-term joint-development partnership with Total Eren, the company said this morning. By working with Total Eren, Chariot intends to jointly originate and develop wind and solar projects for mining clients in Africa. The partnership will have an initial duration of three years and start on January 1st, 2022. It can then be extended for a further two years. Under the agreement, Chariot will have a right to invest between 15 to 49% into the co-development of projects. Earlier this year, Chariot has acquired the business of Africa Energy Management Platform (AEMP) for $2m. The renewable and hybrid energy project developer had an ongoing strategic partnership with Total Eren and both entities were already looking at a pipeline of 500 W of power to African mine operators. Under that partnership, AEMP had a right to invest in up to 15% project equity at cost in projects developed by both partners.

Read more »

Mainstream Renewable Power big winner in South Africa’s 2.5 GW renewable energy bid round

South Africa’s Minister of Mineral Resources and Energy (DMRE), Mr. Gwede Mantashe, has announced yesterday the preferred bidders for the Renewable Energy Independent Power Producers Procurement Programme (REIPPPP) Bid Window 5. The round resulted in the selection of five consortium as preferred bidders for 25 projects totalling 2,583 MW of renewable energy. The bidders will jointly invest R50 billion in those projects, expected to reach financial close early next year and to start generating by April 2024. Out of the 2.5GW of awarded capacity, 1,608 MW will be based on onshore wind and 975 MW on solar PV. Mainstream Renewable Power alone secured 12 projects totaling 1,274 MW (824 MW of onshore wind and 450 MW of solar PV). To date, the company has been awarded over 2.1 GW of renewable energy projects under the REIPPPP and has become the largest renewable energy developer of the country by capacity. The company currently owns 100% of the projects awarded but ownership will transfer to the equity consortium upon financial close including Mainstream (25%), Globeleq (26%), Africa Rainbow Energy & Power (23.25%), H1 Holdings (23.25%) and Community Trusts (2.5%). Other preferred bidders notably include Scatec with 273 MW, a Norwegian company that entered the South African energy market back in 2010 and already commissioned several solar PV projects under previous REIPPPP windows. Scatec had also secured three solar projects totaling 150 MW during the 2 GW Risk Mitigation IPP procurement programme (RMIPPPP) earlier this year. Scatec will own 51% of the equity in the projects while its local Black Economic Empowerment partner H1 Holdings will own 46.5% and a Community Trust holding will hold the remaining 2.5%. Scatec will also be the Engineering, Procurement and Construction (EPC) provider and provide Operation & Maintenance as well as Asset Management services to the power plants. EDF Renewables secured three projects, as did Engie and Red Rocket. Finally, the joint-venture of Mulilo and Total secured one project. Mulilo Total is already progressing two projects it has been awarded under the RMIPPPP last June, with a combined capacity of almost 275 MW. Window 5 resulted in some of the cheapest bid price on record, making South Africa’s wind and solar energy very competitive against coal. From 2012 to 2015, South Africa already awarded 6.3 GW of renewable energy capacity via windows 1, 2, 3, 3.5 and 4. Thousands of jobs were created, while attracting billions on foreign direct investment. While the projects from Window 4 are just reaching commissioning stage, South Africa just closed its Risk Mitigation IPP Procurement Programme (RMIPPPP), awarding another 2 GW of projects earlier this year. Following Window 5, Window 6 is expected to be launched this year to announce the winners in May 2022, while Window 7 would be launched in 2022 to that winners are awarded in Q3 of the same year. Finally, South Africa is also planning a storage and gas-specific windows, with the former launched in November this year while the latter would see its request for proposal issued in Q1 2022.

Read more »

Kenya’s Kipeto wind farm has secured a $10m loan agreement to fund biodiversity

Earlier this month, the shareholders of Kipeto Energy Plc arranged a $10m pioneering loan agreement with The Nature Conservancy (TNC) to finance human-wildlife initiatives around Kenya’s second biggest wind farm. The 100 MW Kipeto wind energy facility started commercial operations earlier this year and is developed by BTE Renewables, an Actis company, along with its local partner Craftskills Wind Energy International. The arrangement of this new loan is a first for Africa’s wind power industry and will see the implementation of several conservation initiatives, further demonstrating new models of funding for the sector. The funding will notably support the project’s biodiversity action plan (BAP) that seeks to improve the livelihoods of the Kajiado communities by creating jobs and building improved predator-proof animal enclosures for local farmers. “BTE and TNC designed the investment via a $10 million fixed-rate mezzanine loan to the project, alongside a commitment by the project to provide annual funding for critical conservation initiatives throughout the life of the wind power project,” BTE Renewables said in a statement. Full details on the Kipeto Wind Farm are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Namibia is poised to become the renewable energy hub of Africa

by Hage G. Geingob, President of Namibia, Office of the President of Namibia for the World Economic Forum Namibia launched its Second Harambee Prosperity Plan (HPPII) in March 2021. The country is on course to develop a green and blue economy as articulated under the economic advancement pillar of the plan. By electrifying key parts of its economy, the Namibian government will spur unprecedented economic activity and growth for citizens. In March 2021, as I launched Namibia’s Second Harambee Prosperity Plan (HPPII), I reflected on the need to emphasize the importance of multilateralism in our efforts to foster an enduring economic recovery. Namibia’s policy on international relations and cooperation is anchored in multilateralism because our very independence was a product of international solidarity. We are a nation that was midwifed by the United Nations. It is for this reason that as we crafted our green economic recovery plan; we knew that it had to build a more sustainable future for our children and their children. Namibia is a small, open economy that is impacted by independent intervening variables, including climate change and its disruptive consequences. Our economy is heavily reliant on the agricultural sector, which employs more than 20% of our labor force. Namibia experiences recurrent droughts, the most recent of which have been recorded as the worst in history. These droughts can be linked to climate change, which according to the 2021 Intergovernmental Panel on Climate Change (IPCC) report, is unequivocally a man-made phenomenon. Therefore, Namibians must play a role in crafting climate-change solutions, not just for the sake of our citizens, but indeed for the global community at large. Accordingly, Namibia is poised to tackle climate change, by establishing a green economy that will drive our economic recovery as envisioned for African countries by African Heads of State during the launch of the African Union Continental Green Recovery Action Plan. In this context, we have ambitious plans to develop green and blue economies as articulated under the economic advancement pillar of our HPPII. The feasibility of these plans is underscored by the abundant availability of sunlight throughout the year and proximity to billions of cubic meters of seawater and vast marine resources in the Atlantic Ocean. We have the potential to capture around 10 hours of strong sunlight per day for 300 days per year. As a result, Namibia has some of the highest solar irradiance potential of any country in Africa, which is sufficient to provide power for our people and our neighbours. It is with this potential in mind that we have entered into a partnership with the Government of Botswana and the United States – under the auspices of USAID’s Power Africa – which culminated in the signing of a Memorandum of Intent in April 2021. With support from the global community, we intend to utilize the abundance of sunlight to produce solar power for our own benefit and for our neighbours. The generation of solar power will complement Namibia’s available green energy portfolio, such as hydro-electricity, which already constitutes more than two-thirds of our installed power capacity. Electrifying key parts of our economy and of our neighbours will spur unprecedented economic activity and growth for Namibia and Southern Africa. A Green Hydrogen Economy It is well known that clean electricity is not available in sufficient quantities to adequately supply global demand. This challenge was underlined in the Net Zero by 2050 report published by the International Energy Association (IEA), which noted that hard-to-abate sectors – like cement, steel and chemicals, road trucking, container shipping, and aviation – will need green hydrogen if the world is to remain on course to achieve climate neutrality by 2050. Namibia is better-positioned resource-wise, as well as having the political will to answer that clarion call. To produce green hydrogen competitively a country would need world-class transmission infrastructure, international port facilities, world-class wind and solar resources, access to sustainable sources of clean water (without displacing existing consumers), lots of land and a conducive legislative environment. These are all ingredients that Namibia has. Already, our country is home to the largest desalination plant in Southern Africa, meaning that the conditions for producing abundant clean water in a desert country are conducive. Once Namibia has successfully incubated the green hydrogen economy, it will enable the country to become a supplier of energy, rather than an importer. Judging from the scale of the initial proposals submitted to Namibia by interested investors, these renewable projects, relative to the size of Namibia’s economy, will be greatly transformative to the Namibian economy. Currently, at its peak, the economy consumes about 640 megawatts of power per annum whereas the proposals presented to government entail investments that could produce 10 times that amount of peak generation capacity in the next 10 years. But Namibians will not have to wait until 2030 to start enjoying the benefits of our green revolution because construction of the pilot plants will begin within the next 12 months. A New Frontier The required infrastructure for power trading already exists. About 40% of Namibia’s power currently comes from South Africa and is primarily driven by coal-fired power plants. We imagine a reality where Namibia exports clean energy to South Africa thereby assisting the Southern African region to decarbonize. Namibia also boasts world-class port infrastructure in the cities of Luderitz to the south, and Walvis Bay to the east. Renewable electricity, and green hydrogen and its derivatives, provide Namibia with a real opportunity to attract meaningful foreign direct investment, create well-paying jobs, further diversify its export basket, and improve its terms of trade. Therefore, the development of a green and blue economy, as well as a green hydrogen industry, are some of the cornerstones of the HPPII. As Namibia embarks on this new frontier, it is imperative that its vision of shared prosperity on the national, regional and global levels is realized. Meaning that we do not neglect those without access to political and economic power today nor exclude those who currently rely on carbon fuels. COVID-19 has already widened the existing chasm of inequality, a scourge Namibia is all too familiar with.

Read more »

A.P. Moller Capital has acquired 44% of Cabeólica from the Africa Finance Corporation

Through the Africa Infrastructure Fund, A.P. Moller Capital has just acquired a 44% stake in Cabeólica S.A., which runs four wind farms on the islands of Santiago (9.35MW), São Vicente (5.95MW), Sal (7.65 MW) and Boa Vista (2.55 MW) in Cabo Verde. The stake was acquired from the Africa Finance Corporation (AFC), who has been part of the project since 2020. The AFC will continue to hold a 50% stake in Cabeólica, alongside the Government of Cape Verde and its national utility Electra, who together own the remaining 6% stake. The Cabeólica wind farms were sub-Saharan Africa’s first wind power public-private partnership (PPP) project upon their commissioning in 2011. Back then, Cabo Verde’s electricity generation relied heavily on imported diesel, which came at significant financial and environmental costs. Consequently, the development of 25.5 MW of wind power generation capacity not only helped the archipelago reach its renewable energy targets, but also decrease its national electricity bill. The PPP took shape in the late 2000s with an agreement between InfraCo Africa, Cabo Verde’s Ministry of Tourism, Industry and Energy, and Electra SARL, the local electricity concessionary company. The partnership welcomed the Africa Finance Corporation (AFC) and the Finnish Fund for Industrial Cooperation as strategic partners and majority investors in Cabeólica S.A. in 2010, and reached financial close the same year. It resulted in the development of four different windfarms for a total installed capacity of 25.5MW. 30 Vestas model V52-850kW wind turbines were installed, along with four substations and 33.5km of power cables. The onshore wind farms represent Cabo Verde’s first independent power producer (IPP) project and have all been successfully operating since 2012. Cabeólica was recognised by the United Nations Framework Convention on Climate Change (UNFCCC) as a Clean Development Mechanism (CDM) project in 2013. A.P. Moller Capital has been increasing its investment across sub-Saharan Africa’s power industry this year. In April, it notably acquired Iberafrica Power from Naturgy and took control of its 52.5 MW thermal power plant in Kenya. A month later, it established a new joint-venture with Reunert called Lumika Renewables to develop of portfolio of cost efficient renewable energy solutions across the continent. Details on the Cabeólica Wind Farms are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Globeleq completes ZAR 5.2bn refinancing for 238 MW in South Africa

Globeleq has announced the completion of a ZAR 5.2 billion debt financing package for three of its renewable energy facilities in South Africa: the 138 MW Jeffreys Bay Wind Farm, and the 50 MW De Aar Solar and 50 MW Droogfontein Solar plants. The transaction falls under the Department of Mineral Resources and Energy’s (DMRE) Independent Power Producer Office (IPPO) Refinancing Protocol initiated in June 2020. The initiative works on a voluntary basis and targets IPPs from Bid Windows 1 to 3.5 of South Africa’s Renewable Energy Independent Power Procurement Programme (REIPPP). The initiative can include a wide range of options such as maintaining existing debt levels and structure but reducing margins; increasing existing debt levels; increasing debt tenor; converting Johannesburg Interbank Average Rate debt to Consumer Price Index debt; replacing reserve accounts with contingent facilities; replacing junior debt with senior debt introducing preference shares; and restructuring existing risk management strategy and hedging policies. Its end goal is to contribute to the lowering of the wholesale price of electricity. It had already resulting in South Africa’s largest infrastructure deal when the 50 MW Bokpoort CSP plant completed its refinancing in late 2020. The transaction had then created more favourable debt terms and effectively reduced the project’s cost of capital. Globeleq’s projects refinancing is the second transaction to be executed under the protocol. New financing structures effectively unlock reduced tariff to Eskom, which in turn directly impacts the cost of electricity for South African consumers. Globeleq’s refinancing operation, for which Absa acted as the mandated lead arranger and sole underwriter, will save ESKOM ZAR 1 billion in tariff reductions across the three assets over the remaining 12-year term of the power purchase agreements (PPAs). Details on REIPPP projects from Window 1 to 4 are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Kenya’s second biggest wind farm starts commercial operations

The 100 MW Kipeto wind farm has officially achieved commercial operations date as of Monday, July 5th. Majority-owned by Actis (88%) via BTE Renewables, Kipeto Energy is Kenya’s second largest wind energy facility after the Lake Turkana one. Kipeto Energy was originally conceived by Kenyan company Craftskills Wind Energy International (CWEIL) with support from General Electric. The $320m project received a boost with the entry of African Infrastructure Investment Managers (AIIM) and IFC InfraVentures in the 2010s. Both entities co-developed the project with Craftskills from 2014 until early 2018, executing a 20-year power purchase agreement (PPA) with Kenya Power and Lighting in 2016. Financial close was successfully achieved with the exit of AIIM and IFC InfraVentures in 2018, whose interests in Kipeto Energy were acquired by Actis. The project is now owned and operated by BTE Renewables (88%), majority-owned by Actis with the rest of the equity in Kipeto Energy Plc still held by CWEIL (12%). Details on the Kipeto Wind Farm are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

The U.S. commits $550m to boost Senegal’s electricity sector

On September 9, the U.S. Government’s Millennium Challenge Corporation (MCC) officially launched the $550 million MCC–Senegal Power Compact in Dakar. The five-year partnership had been signed since 2018 and will be completed by an additional $50 million commitment from the Government of Senegal. Investments will be made specifically in the strengthening of electricity networks in Dakar along with the boosting of electricity access in peri-urban and rural areas of the south and central regions. “The compact investment is designed to strengthen the power sector, by increasing reliability and access to electricity and aims to help the Government of Senegal establish a modern and efficient foundation upon which the nation’s power system can grow,” the MCC explains. The compact includes in fact three distinct projects: a $376.8m project to modernize and strengthen Senelec’s transmission network, a $57.3m project to increase access to electricity in rural and peri-urban areas, and a $43.5m reform and capacity building project to strengthen the country’s laws, policies and regulations governing the electricity sector. The strengthening of the state-utility’s transmission network will mobilise most of the company’s financing and target high-voltage transmission network in around around greater Dakar. It is notably expecting to pave the way for additional private sector investment in power generation in the future, including gas-to-power and renewable energy sources. Beyond official support from the American government, Senegal has attracted several private American investors into its power sector. The 86.6 MW Cap des Biches power plant for instance was the result of an agreement between ContourGlobal and Senelec executed during the Africa Leaders’ Summit convened by President Barack Obama in 2014. Both companies worked to rehabilitate the former GTI Dakar power station and construct a new thermal facility that remains until today one of Senegal’s top performing power plants.

Read more »

First wind turbine installed at Djibouti’s Goubet wind energy facility

In early August, Siemens Gamesa completed the installation of Djibouti’s first wind turbine at the Goubet wind farm in Djibouti. The 59 MW facility has been under construction since October 2020 and will be Djibouti’s first utility-scale wind project and the country’s first independent power producer (IPP). It is the result of a strong involvement into the project by the Africa Finance Corporation, which leads a consortium of Dutch investors, the Climate Fund Managers and Great Horn Investment Holdings (GHIH) within the project’s company, Red Sea Power. The AFC has been leading the project’s development since 2017 and developed it from concept to bankability before securing the 25-year take-or-pay power purchase agreement (PPA) with state-utility Électicité de Djibouti (EDD). Ghoubet notably aligns with Djibouti’s Vision Djibouti 2035, under which the authorities want to transition from the country’s complete reliance on domestic thermal energy in 2010 to 100% of renewable electricity sources by 2030. Details of the Goubet Wind Energy Facility are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Why Africa’s energy transition is only happening in South Africa

In more ways than one, the concept of energy transition makes no sense for African countries. The energy transition model by which fossil fuels were going to be replaced with renewable energy emerged out of developed countries, where low population growth and few incremental energy needs have paved the way for new planning strategies to reorganise the energy mix towards cleaner sources of electricity generation. For the same reason, the energy transition is mostly happening in countries where total energy supply and energy consumption has stabilised for over a decade. However, African countries are still under development and the continent counts over 600m people without access to electricity. Because of Africa’s continued demographic growth, the number of people without access to power is likely to rise. Lack of industrialisation along with uneven economic development means that Africa is also one of the world’s smallest carbon emitter. From a policy and development perspective, the priority will very much remain on adding as much power generation capacity as possible along with expanding electricity transmission and distribution infrastructure to lift people out of poverty. Before Africa can transition its energy mix, it needs to significantly expand and transform it. In doing so, renewable energy capacity will be growing, but not to the extent where it can replace existing electricity generation facilities. South Africa is the exception to the story. First, because its energy supply has remained more or less the same for a decade; its electricity consumption, for instance, has averaged 230 TWh a year for about ten years now, according to IEA data. South Africa is part of the G20, has started its demographic transition and has a relatively easy access to finance. Second, because well over 80% of the country’s electricity still comes from coal facilities, many of which are aging. A relatively stable electricity supply along with a heavy carbon-emitting electricity mix naturally paved the way for South Africa to transition its energy mix. South Africa’s energy transition strategy The country’s strategy is very much targeted at relying less on coal and more on solar, wind and gas. In fact, its 2019 Integrated Resource Plan (IRP) provides for the decommissioning of over 24 GW of coal power sources within the next 10-30 years. Natural gas will become an energy fuel for the country, especially when it comes to converting some of its diesel and coal facilities. The country notably commissioned several power plants expected to run on gas but currently running on diesel: Ankerling (1,327 MW), Gourikwa (740 MW), Avon (670 MW), and Dedisa (335 MW). In the IRP of 2019, South Africa reiterated a long-standing commitment to natural gas, by reaffirming its ambition to convert the four stations to LNG or natural gas, and commission an additional 3,000 MW of greenfield gas-to-power capacity by 2030. Several such projects are already well advanced, including the conversion of the Ankerling and Gourikwa stations. But the real story of the past few years has been that of wind and solar. South Africa has become an undisputed renewable energy leader on the continent, attracting local and global investors from Europe, China, the Middle East and the Americas into its now famous Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). From 2012 to 2015, South Africa awarded 6.3 GW of renewable energy capacity via windows 1, 2, 3, 3.5 and 4. Thousands of jobs were created, while attracting billions on foreign direct investment. While the projects from Window 4 are just reaching commissioning stage, South Africa just closed its Risk Mitigation IPP Procurement Programme (RMIPPPP), awarding another 2 GW of projects in March 2021. And this is only the beginning for the country’s clean energy sector. The need to ensure reliable and affordable energy supply post Covid-19 has accelerated the timeline of the future REIPPPP windows. Window 5 is currently underway with winners expected to be announced by the end of the year. Meanwhile, Window 6 is expected to be launched this year to announce the winners in May 2022, while Window 7 would be launched in 2022 to that winners are awarded in Q3 of the same year. Finally, South Africa is also planning a storage and gas-specific windows, with the former launched in November this year while the latter would see its request for proposal issued in Q1 2022.

Read more »