Green Bonds

UAE finance initiative aims to unlock Africa’s clean energy potential

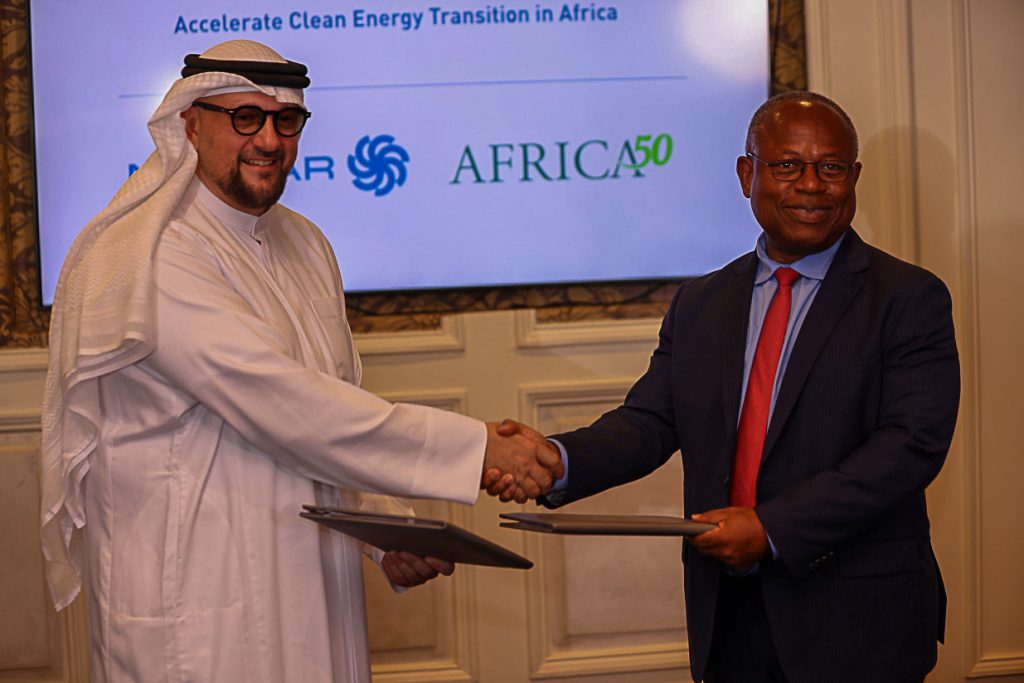

A landmark initiative that brings together public, private, and development capital from UAE institutions, is providing $4.5 billion in funding to boost Africa’s energy transition efforts as the continent looks to close an energy deficit that has left 600 million people without access to electricity. The UAE finance initiative is drawing its support from the Abu Dhabi Fund for Development (ADFD), Etihad Credit Insurance (ECI), Masdar, and AMEA Power – all UAE based institutions with experience funding and developing renewable energy projects in emerging markets. Africa50, an investment platform formed by African governments and the Africa Development Bank (AfDB), is also part of the UAE finance initiative. The COP28 President-Designate, H.E. Dr. Sultan Al Jaber, announced the launch of the initiative during a keynote address at the inaugural African Climate Summit last week in the Kenyan capital, Nairobi. “This initiative builds on the UAE’s track record of commercially driven, innovative blended finance solutions that can be deployed to promote the adoption of clean energy in emerging and developing nations,” President-Designate Dr. Sultan Al Jaber said in an official statement, adding the multi-stakeholder partnership approach will accelerate sustainable economic progress, address the challenge of climate change and stimulate low carbon growth. The initiative comes amid calls for the global tripling of renewable energy by 2030, while pushing to make finance more available, accessible and affordable, especially in Africa where an abundance of renewable energy potential remains largely untapped. Unlocking Africa’s clean energy potential with reforms According to findings from the International Energy Agency (IEA), Africa is home to 60% of the world’s best solar resources, yet has only 1% of installed solar generation capacity. For the continent to unlock its clean energy potential, African countries will need to improve policy and regulatory frameworks to attract the long-term investments needed to speed up the deployment of clean and renewable energy. “The initiative will prioritize investments in countries across Africa with clear transition strategies, enhanced regulatory frameworks and a master plan for developing grid infrastructure that integrates supply and demand,” Al Jaber said, noting the initiative is designed to work with Africa and for Africa. “It aims to clearly demonstrate the commercial case for clean investment across this continent. And it will act as a scalable model that can be replicated to help put Africa on a superhighway to low carbon growth.” While delivering greater access to clean energy has been known to drive social and economic development, the COP 28 President-Designate adds that current investment in African renewables represents only 2 percent of the global total, and less than a quarter of the US$60 billion a year the continent needs by 2030. The initiative seeks to correct this imbalance by bringing key stakeholders together to speed up the delivery of relevant measures, including that of infrastructure, to close the gap in universal clean energy access. Unlocking capital for clean power The initiative will form part of Etihad 7, a development platform launched by the UAE to raise 20GW in renewable energy capacity and provide 100 million people across the African continent with clean electricity by 2035. To catalyze private sector action, ADFD is funding the initial investment with US$1 billion of financial assistance to address basic infrastructure needs, offer innovative finance solutions and increase mobilization of private investments. The ECI is providing US$ 500 million of credit insurance to de-risk and unlock private capital. Masdar, one of the world’s largest clean energy companies, active in 22 countries in Africa, is committing an additional US$2 billion of equity as part of the new initiative. Masdar has been moving into the renewable energy sector in Africa as part of the Etihad 7 programme. In January, the company announced it signed an agreement with Angola, Uganda and Zambia to develop renewable energy projects with a combined capacity of up to 5 gigawatts (GW) as part of the programme. With the UAE finance initiative, the company aims to mobilize an additional US$8 billion in project finance through its Infinity Power platform, targeting the delivery of 10 gigawatts (GW) of clean energy capacity in Africa by 2030. AMEA Power looks to install 5GW of renewable energy capacity in the continent by 2030, mobilizing US$5 billion, of which US$1 billion will come from equity commitment, and US$4 billion from project finance. The company has been active in Africa for several years already. Earlier this year, it notably executed a 25-year Power Purchase Agreement (PPA) with GreenCo Power Services (GreenCo) for an 85MW solar PV power plant in South Africa as an energy crisis pushes more demand for alternative sources of power in one of Africa’s biggest economies. The initiative is also pursuing pathways for other multilateral development banks, governments, and philanthropies to catalyze additional private sector investment. At the inaugural African Climate Summit in Nairobi, the COP28 Presidency called for others including international financial institutions (IFIs) and foundations to join the effort to convert words into actions.

Read more »

Lagos State prepares for historic green bond issuance

The Lagos State Government is preparing for the issuance of an NGN 25bn ($60m) green bond under the Nigerian Green Bond Market Development Programme (NGBMDP). State Governor Babajide Sanwo-Olu signed an MoU towards the issuance with the NGBMDP’s implementing partners, FMDQ Holdings and Financial Sector Deepening (FSD) Africa this week. The NGBMDP was launched in 2018 by FMDQ, FSD Africa and the Climate Bonds Initiative to support the growth of Nigeria’s non-sovereign debt capital market. It notably supported the development and issuance of Nigeria’s Green Bond Issuance Rules by the country’s Securities and Exchange Commission (SEC) in November 2018 and provided technical support to several issuers. Nigeria was the first nation to issue a sovereign certified climate bond back in 2017, followed by several of its companies. In 2019, Access Bank issued the first Climate Bonds Initiative (CBI)-certified corporate green bond in Africa, raising N15.0 billion. The 5-year, 15.50% fixed rate bond was fully subscribed. The same year, North South Power Company, through the NSP-SPV PowerCorp PLC, issued its Series 1 N8.5 billion Green Bond, which was the first certified corporate green bond and the longest tenured (15 years) corporate bond issued in the Nigerian debt capital markets approved by the SEC. Lagos State is about to become the first issuer of a subnational green bond in Nigeria as it seeks to diversify its financing sources and support sustainable development across the state. On September 10th, its national long-term rating was upgraded to AAA by Fitch Ratings, while its LTR, STR and local currency long-term issuer default ratings were affirmed B.

Read more »