Finance

Axxela’s new gas plant to expand Nigeria’s gas infrastructure following bond success

Axxela Limited, a leading African gas and power company owned by Helios Investment Partners and Sojitz of Japan, has announced a Final Investment Decision to develop a 50 million standard cubic feet per day (MMscf/d) gas processing plant in Delta State, as it pushes towards sustainable energy solutions in Nigeria. This decision is bolstered by Axxela’s successful ₦16.4 billion bond issuance earlier this month, which was oversubscribed by 109 percent. The announcement comes as Axxela continues to expand its footprint in the energy sector, following last year’s agreement with BUA Group, one of Africa’s largest conglomerates, and CIMC ENRIC, a global leader in the energy equipment industry, to build a 700-ton-per-day mini liquefied natural gas (LNG) project. The new gas processing plant, expected to begin operations by the end of 2024, will start with a 12 MMscf/d modular unit and is designed for rapid expansion, with the potential to increase the plant’s output to 50 MMscf/d within 18 months. It is a key part of Axxela’s strategy to support the Nigerian government’s Decade of Gas initiative and to enhance domestic gas utilization. Strategically located in OML 152, the gas processing plant is expected to serve as a central processing hub for surrounding oil & gas operators, with the potential to transform gas flaring into a valuable economic resource, and significantly reduce CO2 emissions. “We are positioning to develop requisite infrastructure for natural gas processing and last mile distribution that creates market access for at least 20% of Nigeria’s gas demand,” Axxela’s Director of Business Development, Franklin Umole, said in a company statement. “Over the past two decades, we have been at the forefront of natural gas advocacy, and this project is a further reaffirmation of our dedication to gas infrastructure development and our vision to deliver innovative energy solutions across Nigeria and Africa.’’ In preparation for the project, Axxela has secured a long-term feedstock supply agreement with a leading local upstream company and established equipment supply arrangements with top-tier Original Equipment Manufacturers (OEMs). Upon completion, the processed gas will support various market segments, including Compressed Natural Gas (CNG) for vehicles, industrial feedstock, and decentralized power solutions, marking a significant step towards energy security and economic growth in Nigeria. Boost from successful bond issuance In a related financial achievement, Axxela recently raised ₦16.4 billion in an oversubscribed bond issuance, despite challenging economic conditions marked by rising interest rates and limited market liquidity. The funds will be instrumental in realizing the gas plant project. “This is a significant indicator of increasing investor confidence in our company’s reputation, brand, and performance,” CEO at Axxela Bolaji Osunsanya said. “The bond proceeds will support the development of our growth projects, signifying the importance of local and international capital markets in the development of critical infrastructure.” With the FID and successful bond issuance, Axxela looks to advance Nigeria’s gas infrastructure, support the energy transition, and meet the increasing demand for cleaner energy solutions.

Read more »

UAE finance initiative aims to unlock Africa’s clean energy potential

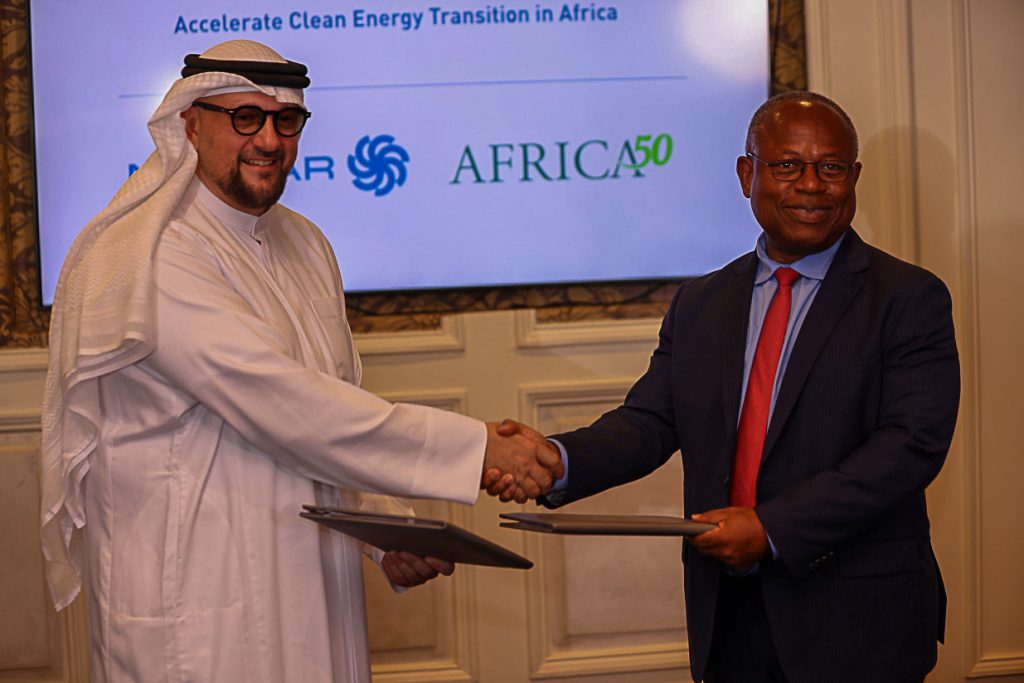

A landmark initiative that brings together public, private, and development capital from UAE institutions, is providing $4.5 billion in funding to boost Africa’s energy transition efforts as the continent looks to close an energy deficit that has left 600 million people without access to electricity. The UAE finance initiative is drawing its support from the Abu Dhabi Fund for Development (ADFD), Etihad Credit Insurance (ECI), Masdar, and AMEA Power – all UAE based institutions with experience funding and developing renewable energy projects in emerging markets. Africa50, an investment platform formed by African governments and the Africa Development Bank (AfDB), is also part of the UAE finance initiative. The COP28 President-Designate, H.E. Dr. Sultan Al Jaber, announced the launch of the initiative during a keynote address at the inaugural African Climate Summit last week in the Kenyan capital, Nairobi. “This initiative builds on the UAE’s track record of commercially driven, innovative blended finance solutions that can be deployed to promote the adoption of clean energy in emerging and developing nations,” President-Designate Dr. Sultan Al Jaber said in an official statement, adding the multi-stakeholder partnership approach will accelerate sustainable economic progress, address the challenge of climate change and stimulate low carbon growth. The initiative comes amid calls for the global tripling of renewable energy by 2030, while pushing to make finance more available, accessible and affordable, especially in Africa where an abundance of renewable energy potential remains largely untapped. Unlocking Africa’s clean energy potential with reforms According to findings from the International Energy Agency (IEA), Africa is home to 60% of the world’s best solar resources, yet has only 1% of installed solar generation capacity. For the continent to unlock its clean energy potential, African countries will need to improve policy and regulatory frameworks to attract the long-term investments needed to speed up the deployment of clean and renewable energy. “The initiative will prioritize investments in countries across Africa with clear transition strategies, enhanced regulatory frameworks and a master plan for developing grid infrastructure that integrates supply and demand,” Al Jaber said, noting the initiative is designed to work with Africa and for Africa. “It aims to clearly demonstrate the commercial case for clean investment across this continent. And it will act as a scalable model that can be replicated to help put Africa on a superhighway to low carbon growth.” While delivering greater access to clean energy has been known to drive social and economic development, the COP 28 President-Designate adds that current investment in African renewables represents only 2 percent of the global total, and less than a quarter of the US$60 billion a year the continent needs by 2030. The initiative seeks to correct this imbalance by bringing key stakeholders together to speed up the delivery of relevant measures, including that of infrastructure, to close the gap in universal clean energy access. Unlocking capital for clean power The initiative will form part of Etihad 7, a development platform launched by the UAE to raise 20GW in renewable energy capacity and provide 100 million people across the African continent with clean electricity by 2035. To catalyze private sector action, ADFD is funding the initial investment with US$1 billion of financial assistance to address basic infrastructure needs, offer innovative finance solutions and increase mobilization of private investments. The ECI is providing US$ 500 million of credit insurance to de-risk and unlock private capital. Masdar, one of the world’s largest clean energy companies, active in 22 countries in Africa, is committing an additional US$2 billion of equity as part of the new initiative. Masdar has been moving into the renewable energy sector in Africa as part of the Etihad 7 programme. In January, the company announced it signed an agreement with Angola, Uganda and Zambia to develop renewable energy projects with a combined capacity of up to 5 gigawatts (GW) as part of the programme. With the UAE finance initiative, the company aims to mobilize an additional US$8 billion in project finance through its Infinity Power platform, targeting the delivery of 10 gigawatts (GW) of clean energy capacity in Africa by 2030. AMEA Power looks to install 5GW of renewable energy capacity in the continent by 2030, mobilizing US$5 billion, of which US$1 billion will come from equity commitment, and US$4 billion from project finance. The company has been active in Africa for several years already. Earlier this year, it notably executed a 25-year Power Purchase Agreement (PPA) with GreenCo Power Services (GreenCo) for an 85MW solar PV power plant in South Africa as an energy crisis pushes more demand for alternative sources of power in one of Africa’s biggest economies. The initiative is also pursuing pathways for other multilateral development banks, governments, and philanthropies to catalyze additional private sector investment. At the inaugural African Climate Summit in Nairobi, the COP28 Presidency called for others including international financial institutions (IFIs) and foundations to join the effort to convert words into actions.

Read more »

Starsight Energy and SolarAfrica to become one

Earlier this month, Starsight Energy and SolarAfrica have announced their merger to transform into one of the largest commercial and industrial (C&I) solar developers in Africa. The former has a regional footprint in East and West Africa, while the latter is mostly present in South Africa. The merger will notably result in the establishment of a pan-African renewable energy services provider, focused on rooftop to large-scale solar projects and backed by Helios Investment Partners (Helios) and African Infrastructure Investment Managers (AIIM). The merged entity will comprise a portfolio of over 220MW of operated and contracted generation capacity, and 40MWh of operational battery storage, with an additional generation pipeline exceeding 1GW. Substantial funding is expected to be allocated to South Africa, where new regulations have recently permitted wheeling and self-generation of up to 100 MW by private generators.

Read more »

Norway’s DNO enters Côte d’Ivoire’s as it looks for more African oil & gas deals

DNO has announced yesterday the acquisition of Mondoil Enterprises from Oslo-listed RAK Petroleum for a consideration of $117.25m. By acquiring Mondoil Enterprises in an all-share transaction, DNO gains a 33.33% indirect interest in Foxtrot International, operator of the producing block CI-27 and exploration block CI-12 in Côte d’Ivoire. “As DNO targets expansion beyond the Kurdistan region of Iraq and the North Sea, the move into Côte d’Ivoire is an important first step into a highly prospective region offering a broad set of growth opportunities through acquisition of producing fields, development assets and exploration licenses,” said Bjørn Dale, DNO’s Managing Director. The company also added that is it already evaluating other opportunities in Africa. A Significant Gas Asset Côte d’Ivoire’s offshore CI-27 Block represents one of West Africa’s most strategic gas assets as it produces and supplies natural gas to the country’s biggest power producers: CIPREL and Azito Energie. As a result, CI-27 continues until today to produce about 70% of the gas consumed on the Ivorian market, and ultimately providing power to millions of households and industries. The development of the block primarily focuses on the Foxtrot field, but also the Manta field discovered in 1981 by Phillips Petroleum, and the Mahi and Marlin fields discovered in 2005 and 2007 respectively by current operator, Foxtrot International. During the first half of 2022, gross sales averaged 200 MMscf/d of gas and 1,500 bpd of oil and condensate, DNO said. Over the 2020-2022 period, Foxtrot and its partners on CI-27 invested $350m into developing additional reserves and building new onshore facilities to increase gas production and processing capacity to 230 MMscf/d. The Sapura Berani rig was mobilized on the block this year, Hawilti’s Offshore Rigs Tracker shows. Three new wells and two side-track were drilled in total as part of the campaign. Côte d’Ivoire is emerging as a new oil & gas hub in West Africa Next to Nigeria and Ghana, Côte d’Ivoire has traditionally appeared as a less attractive market for oil & gas investments. While the country ambitioned to reach a production of 100,000 bopd this decade, output remains at below 25,000 bopd. However, fresh investments into power generation have justified the expansion of the country’s gas infrastructure while new offshore discoveries have repositioned it as an exploration frontier on the continent. The country’s two biggest thermal power producers, CIPREL and Azito Energie, are indeed both involved in expansion of their gas-to-power facilities around Abidjan. The ongoing Azito 4 expansion is adding 250 MW to Globeleq’s power complex in Yopougon, while Eranove is building a 390 MW plant in Jacqueville, known as Atinkou (CIPREL V). To supply feedstock to the new turbines, investments had to be made in gas production, processing, and distribution. To that purpose, Côte d’Ivoire’s Council of Ministers adopted in March 2020 four decrees that renewed the Exclusive Exploitation Authorizations of the Foxtrot (F Zone), Mahi, Manta and Marlin fields on block CI-27. Each decree extended the fields’ EEA by another ten years to ensure continued and reliable supplies of gas to the CIPREL V and Azito 4 power plants. Meanwhile, fresh exploration has yielded tremendous results offshore with the discovery of the Baleine field by Eni on blocks CI-101 and CI-802 in 2021. Baleine is one of sub-Saharan Africa’s biggest recent finds with 2.5 billion barrels of oil and 3.3 Tcf of gas discovered at the Baleine-1X well in 2021 and Baleine East-1X well in 2022. The development of the discovery was quickly approved by Côte d’Ivoire’s authorities and benefit from strong political support to fast-track the project and achieve first oil in 2023 (Phase 1). Such news has given hopes that this is just the beginning for Côte d’Ivoire’s oil & gas sector and more operators are expected to enter the market moving forward. In July 2022, Côte d’Ivoire’s Cabinet notably gave its greenlight for the negotiations of production sharing contracts (PSCs) for blocks CI-520, CI-521, and CI-522 with British independent Elephant Oil. Details on the development of block C-27 offshore Côte d’Ivoire are available in the “Projects” section within you Hawilti+ research terminal – plus.hawilti.com.

Read more »

BREAKING: President Buhari gives consent to acquisition of Mobil Producing Nigeria by Seplat Energy

President Buhari has announced today that, in his capacity as Minister of Petroleum Resources, he was giving his consent to the acquisition of the entire share capital of Mobil Producing Nigeria Unlimited (MPNU) by Seplat Energy. The President’s consent was seen as a surprise by many industry observers, especially after the NNPC Ltd sought to declare a dispute between itself and MPNU in relation to their interpretation of pre-emption rights under their joint-operating agreement (JOA). NNPC had notably received last month an ex-parte order of interim injunction from the State Hight Court of Abuja restraining MPNU from completing the transaction with Seplat Energy. “Considering the extensive benefits of the transaction to the Nigerian Energy sector and the larger economy, President Muhammadu Buhari has given Ministerial Consent to the deal,” said the Nigerian Presidency in a tweet. Seplat Energy has announced its cash acquisition of MPNU back in February 2022 for $1.283bn, in what remains one of the top oil & gas deals of the year globally. By acquiring MPNU, the LSE and NSE-listed independent will take over Exxon Mobil’s entire offshore shallow water business in Nigeria which includes assets that are very rich in natural gas and gas liquids. The acquisition would increase Seplat Energy’s production by a whooping +186% while increasing its total 2P reserves by +89%. The total portfolio includes a 40% operating ownership of OMLs 67, 68, 70 and 104 and their associated infrastructure. Combined, the assets produced an average of 177,000 boepd gross in 2021 according to NUPRC data. OMLs 67, 68 and 70 form what is known in Nigeria as the “East Area”, where ExxonMobil has executed some of the most successful flaring reduction and valorization projects in the Niger Delta. Seplat Energy’s stock is already up +15% since the announcement broke out earlier today. Details on OMLs 67, 68, 70, and 104 are available in the “Projects” section within your Hawilti+ research terminal.

Read more »Abuja’s State High Court halts Seplat Energy’s acquisition of Mobil Producing Nigeria

Last week, the State High Court of the Federal Capital Territory of Abuja made an ex-parte order of interim injunction restraining Mobil Producing Nigeria and its shareholders from completing the Share Sale and Purchase Agreement previously signed with Seplat Energy. In February 2022, and after months of negotiations, Seplat Energy had announced a $1.283bn cash proposition to acquire the shares of Mobil Producing Nigeria from ExxonMobil Corporation. This remains the biggest oil & gas transaction of the year so far, and one set to significantly expand Seplat Energy’s business in Nigeria. Mobil Producing Nigeria holds the entire operate shallow water business of ExxonMobil in Nigeria, representing some 95,000 barrels of oil equivalent per day (boepd) of working interest production. It also includes the Qua Ibo export terminal that exports oil to global markets, and the Bonny River Terminal that processes natural gas liquids into cooking gas notably. The NNPC had very early on expressed its disagreement over the deal. The state-owned giant, set to be officially unveiled as new commercial entity later this month, has sought to expand its upstream portfolio in recent years. Last year, it notably pre-empted a deal by Nigerian independent ConOil from acquiring Chevron Nigeria’s interest in OMLs 86 & 88. However, because Seplat Energy’s acquisition of Mobil Producing Nigeria is a corporate transaction and not an asset-based one, the pre-emption matter has remained subject of debate. In May, Seplat Energy had notably confirmed that it had received a letter from the NUPRC declining its consent on the transaction. The ex-parte order of interim injunction made by the State High Court last week is a response to NNPC seeking to declare a dispute between itself and Mobil Producing Nigeria in relation to their interpretation of pre-emption rights under their Joint-Operating Agreement (JOA).

Read more »

Tullow Oil and Capricorn Energy agree on all-stock merger deal

Tullow Oil and Capricorn Energy (formerly Cairn Energy) have agreed earlier this week on an all-stock merger deal worth over $800m. The combination of both companies will create one of Africa’s leading independent energy companies, and confirms the strong rise of M&A deals in Africa this year. The deal is likely to be implemented as a Court-sanctioned scheme of arrangement under which Tullow Oil would acquire all of the issued and to be issued shares of Capricorn Energy. Upon completion, Capricorn Energy shareholders would hold some 47% of the new combined group, and Tullow Oil’s shareholders the remaining 53%. While the name of the new combined company is yet to be revealed, it would sit on some 343m barrels of oil equivalent (boe) of reserves (2P) and 696m boe of resources with a production of some 96,000 boepd. The company would still be listed in London and be one of the largest Africa-focused energy independents. A Portfolio of Incremental, High-Return Investment Opportunities The new group will be present across lucrative assets in Ghana, Egypt, Gabon, and Côte d’Ivoire. Capricorn Energy notably entered Egypt in 2021 when it acquired Shell’s onshore assets in the Western Desert along with its consortium partner Cheiron. The gas-rich fields represent some 36,500 boepd of output for Capricorn Energy, with significant opportunity to deliver self-funded growth production via infill drilling and low-cost exploration. In Ghana, Tullow Oil’s success stories continues deliver returns while generating local value via the producing Jubilee and TEN fields where a drilling campaign is ongoing until 2025. New development wells are notably planned, especially at Jubilee South-East. Tullow Oil also has non-operated interests in key producing fields such as Espoir in Côte d’Ivoire or Tchatamba and Ezanga in Gabon. In 2021, the company’s working interest production averaged 59,200 boepd. Infrastructure-led exploration will be executed across these assets over the coming years, with opportunities to unlock additional reserves and maintain production decline. The wells will be reported within Hawilti’s Exploration Watch, available within the Hawilti+ Terminal. New Plays in Frontier Basins The new group could also be a key pioneer in the development of reserves in Kenya, Mauritania and Latin America notably. Tullow Oil is a partner in Project Oil Kenya, where a final investment decision (FID) is expected in 2023. The onshore project would deliver 120,000 bopd at peak and be Kenya’s first oil venture. Meanwhile, Capricorn Energy is hopeful that its C7 Block offshore Mauritania could yield success soon. The Dauphin-1 exploratory well could notably be drilled there in a couple of years.

Read more »

Seplat Energy to triple in size as it proposes to acquire Mobil Producing Nigeria for $1.283 bn

Officialising a transaction that has been in the making for some time, Seplat Energy has announced this morning its proposed cash acquisition of Mobil Producing Nigeria (MPNU) for $1.283bn. Seplat Energy Offshore Ltd, a subsidiary of Seplat Energy, has now entered into the Sale and Purchase Agreement to acquire the entire share capital of MPNU from Exxon Mobil Corporation. The purchase price is set at $1.283bn plus up to $300m contingent consideration, subject to lockbox, working capital and other adjustments. While Seplat expects the transaction to close in the second half of this year, it is still subject to Ministerial Consent and regulatory approvals from the NUPRC and the Nigerian Federal Competition and Consumer Protection Commission. Acquired assets By acquiring MPNU, Seplat Energy takes over Exxon Mobil’s entire offshore shallow water business in Nigeria which includes assets that are very rich in natural gas and gas liquids. The acquisition would increase Seplat Energy’s production by a whooping +186% while increasing its total 2P reserves by +89%. The total portfolio includes a 40% operating ownership of OMLs 67, 68, 70 and 104 and their associated infrastructure. Combined, the assets produced an average of 177,000 boepd gross in 2021 according to NUPRC data. OMLs 67, 68 and 70 form what is known in Nigeria as the “East Area”, where ExxonMobil has executed some of the most successful flaring reduction and valorization projects in the Niger Delta. Such developments notably included the Oso natural gas liquids (NGL) plant commissioned in 1998, and its expansion with the NGL II project in 2008. Both projects also provide gas to the Bonny River Terminal, enabling production of key commodities such as LPG for the domestic and export markets. Last year, the Bonny River Terminal provided some 70,000 metric tonnes of LPG to the local market for instance, making it Nigeria’s second biggest source of domestic LPG supply. On the other side, OML 104 contains the producing Yoho field. The shallow water Yoho development project came on stream in early 2003 and oil is exported via the Yoho FSO terminal. OML 104 has significant undeveloped gas reserves and could potentially see the deployment of a floating LNG (FLNG) unit in the near future. The license for the project was awarded to local company UTM Offshore in 2021. As part of the transaction, Seplat Energy is also acquiring all the aforementioned infrastructure, including the Qua Iboe Terminal, a 51% interest in the Bonny River Terminal and the EAP and Oso natural gas liquids recovery plant. Financing component Seplat Energy will fund its cash acquisition through a combination of existing cash resources and credit facilities. In addition, it is securing a new $550m senior term loan facility and a $275m junior off-take facility. The financing syndicate comprises of both Nigerian and international banks, along with commodity trading companies.

Read more »

Africa Finance Corp. attracts fresh capital from Asia and the Middle East

The Africa Finance Corporation (AFC) has raised $400m in a new syndicated loan to support the development of infrastructure on the continent and aid in the post-pandemic recovery. Strong interest from investors led to the offering being 2.5 times oversubscribed, leading to a total facility of $100m above the initial target. This is the AFC’s first three-year facility since 2018. “The proceeds will facilitate upcoming infrastructure projects that address the continent’s developmental challenges,” the AFC said in a statement. Moody’s recently improved its outlook for AFC’s investment grade credit ratings to ‘stable.’ Its senior unsecured ratings at A3 and short-term issuer ratings at P-2 are the second highest of any institution in Africa. Key participating lenders as bookrunners and mandated lead arrangers include Absa Bank, Bank of China (London branch), First Abu Dhabi Bank PJSC, ICBC (London), Mashreq Bank PSC of Dubai, MUFG Bank of Japan, Nedbank (London branch), Rand Merchant Bank (a division of FirstRand Bank, London branch), Standard Chartered Bank and SMBC Bank International, acted as Bookrunners and Mandated Lead Arrangers. On their side, the Korea Development Bank and Standard Bank of South Africa acted as Mandated Lead Arrangers, while MUFG Bank Ltd and ICBC (London) also acted as Facility Agent and Documentation Agent, respectively. Last year, the AFC revealed plans to step up its infrastructure financing in Africa with a new asset management division, AFC Capital Partners. Its debut offering, the Infrastructure Climate Resilient Fund (ICRF) is planning to raise $500m this year and $2bn over the next three years.

Read more »

Eco Atlantic to consolidate Southern African portfolio with acquisition of Azinam

The South Atlantic continental margins of Africa continue to fuel investors’ appetite as their promising prospects open up to oil & gas exploration. Eco (Atlantic) Oil & Gas, the Canadian independent with assets in Guyana and Namibia, has just announced its acquisition of 100% of Azinam to consolidate its portfolio in the region, including in Namibia and South Africa. The company announced this morning the signing of a Memorandum of Understanding (MoU) to acquire Azinam Group Ltd, in return for a 16.65% equity stake in the enlarged group n completion of the transaction. Under this new deal, Eco Atlantic is expected to close the acquisition of Azinam’s entire offshore asset portfolio in Namibia and South Africa by the end of January 2022. The agreement provides for a consideration in the form of new common shares to Azinam Holdings Limited who will own 16.65% of the enlarged Group. The licenses in which AziNam has working interests represent some of the most promising exploration assets in South Western Africa, with several drill-ready prospects that could yield future world-class discoveries. Gaining exposure to South African exploration opportunities These notably include a 50% operated interest in the Block 2B where the Gazania-1 exploratory well is expected to be spudded in the second half of this year. “Discussions are already underway with Eco’s key existing stakeholders in relation to underwriting the funds required to participate directly in the 2022 Block 2B South Africa drilling programme.” Eco (Atlantic) Oil & Gas, 10 January 2022 The drilling location for Gazania-1 will test both the Namaqualand (1,840m) and Gazania (2,040m) Prospects. Gazania is an up-dip of the proven A-J1 oil discovery and has Best Estimate Prospective Resources of 300mbarrels. Also in South Africa, Eco Atlantic will gain Azinam’s 20% working interest in the deep-water 3B/4B Block operated by Africa Oil Corp. (AOC). AOC is notably an equity investor into Eco Atlantic and owns 18.7% of the company’s shares. Recent data acquisition and interpretation from Block 3B/4B has allowed current partners to identify an inventory of leads and prospects out of which Wolf, previously known as Aardwolf, could be subject to exploratory drilling in the near future. Finally, Eco Atlantic will also enter the Nearshore Block 3B/4B where Azinam is operator with a 51% interest. Consolidating Namibia’s exploration portfolio In Namibia, Eco Atlantic is de facto consolidating its interest in licenses it already operates and is familiar with. Azinam is Eco Atlantic’s partner on petroleum exploration licenses (PEL) 97, 98 and 99 that were re-issued in 2020 with the establishment of a new 10-year life cycle (4 + 2 + 2) for each. During the first exploration period of four years, Eco Atlantic notably plans to shoot 3,000km of 2D seismic and 7,750 km2 of 3D seismic in different surveys across the blocks. Upon completion of the Azinam acquisition, Eco Atlantic will have increased its operated working interest in those blocks to 85%. It notably estimates that 2.362 billion barrels of oil equivalent of prospective P50 resources could be held within these four areas, which cover a total of over 28,500 km2. The acquisition announced today is one of many deals that have marked exploration activity in Namibia and South Africa in recent years. Several prospects are currently being drilled in the Orange Basin, including Venus-1 (TotalEnergies) and Graff-1 (Shell) in Namibia. “The deal is expected to complete by 31 January 2022 subject, inter alia, to the signing of a Share Purchase Agreement and satisfactory completion of due diligence by Eco and any requisite approvals.” Eco (Atlantic) Oil & Gas, 10 January 2022 More details on Eco (Atlantic) Oil & Gas and Azinam along with the exploration activity on PEL 97 and Blocks 2B and 3B/4B are available in the “Companies” and “Projects” section within your Hawilti+ research terminal.

Read more »

What are the shallow water assets Seplat Energy is trying to acquire from ExxonMobil in Nigeria?

Following press speculation, Seplat Energy has finally confirmed today that it is indeed in competitive discussions to acquire ExxonMobil’s Nigerian shallow water business along with an undisclosed partner. While deliberations are still ongoing and have no certainty to conclude, such an acquisition would be transformational for Seplat. The assets that Seplat is eyeing cover those of Mobil Producing Nigeria (MPN), the entity that operates a joint-venture with the state-owned Nigerian National Petroleum Corp. (NNPC). Via the NNPC, the Nigerian government has a 60% share while ExxonMobil holds the remaining 40%. The blocks can be broadly divided into the East Area that covers OMLs 67, 68 and 70 and the Yoho development on OML 104. All those shallow water assets hold significant amount of gas that would support Seplat Energy’s gas strategy. Nigeria’s East Area (OMLs 67, 68 & 70) The East Area relies on ExxonMobil’s Qua Iboe terminal for exports and produced an average of 177,000 barrels of oil per day (bopd) between January and July 2021, NNPC data shows. The area also remains one of the most successful flaring reduction and valorization projects in the Niger Delta. Source: NNPC Such developments notably included the Oso natural gas liquids (NGL) plant commissioned in 1998, and its expansion with the NGL II project in 2008. Between 2007 and 2011, both projects had notably contributed to a 70% reduction in flaring on the acreage. They also provide gas to the Bonny River Terminal, enabling production of key commodities such as LPG for the domestic and export markets. The Yoho Field Development (OML 104) The other key asset is OML 104, which contains the producing Yoho field. The $1.3bn shallow water Yoho development project came on stream in early 2003 via the Falcon FPSO which acted as an Early Production Sytem. The FPSO produced its last oil in February 2006 when full-field facilities came on stream. The development is targeting the development of 440 million barrels of recoverable oil resources from the Yoho and Awawa reservoirs. Oil is exported via the Yoho FSO terminal and OML 104’s production does not rely on ExxonMobil’s Qua Iboe Terminal like the rest of the MPN/NNPC JV fields do. In the first nine months of 2021, Yoho produced a maximum of 30,000 bopd according to DPR data. Source: DPR OML 104 has significant undeveloped gas reserves and could potentially see the deployment of a floating LNG (FLNG) unit in the near future. The license for the project was awarded to local company UTM Offshore in 2021.

Read more »

Afreximbank signs $2 billion in deals with Nigerian oil & gas companies

The African Export-Import Bank (Afreximbank) showed up for Nigeria’s oil sector this week in Durban, during the Intra-African Trade Fair 2021. The bank has signed three separate deals totaling almost $2bn with the state-owned Nigerian National Petroleum Corporation (NNPC), indigenous operator Eroton Exploration & Production and new Nigerian independent Mars Exploration & Production. A $1.04 bn exploration deal with NNPC The first agreement is a $1.04 billion facility with the NNPC to finance oil exploration in Nigeria. It notably notably comprises a pre-export/shipment finance facility underpinned by a forward sale agreement (FSA) and offtake contracts from the NNPC acting as the borrower and seller. Under the terms of the contract, NNPC will enter into an FSA within which it shall deliver 35,000 barrels of crude oil per day (bopd). The NNPC was represented by Umar I. Ajiya, Group Executive Director, Finance & Accounts while the Afreximbank was represented by Amr Kamel, Executive Vice President, Business Development & Corporate Banking. A Second Lending Facility to Eroton E&P The second agreement is a term-sheet that lays the basis for the approval of a $750m senior secured reserve-based lending facility with Eroton Exploration & Production, the Nigerian company that operates OML 18 with a 27% interest in the Niger Delta. IIt was signed by Chairman Onajite Okoloko. Other parties in the deal are Shell Western Supply & Trading and Midwestern Oil & Gas Company Limited. Midwestern is an indirect owner of Eroton E&P through its 60% ownership of Midwestern Leon Petroleum, which in turns owns Eroton E&P’s mother company Martwestern. Out of the full facility, $196m is expected to refinance Eroton’s current senior bank debt. The remaining is expected to help Eroton finance the acquisition of an additional 18% economic interest in OML 18 from Sahara Field Production Ltd (SFPL, 16.2%) and Bilton (1.85%). Afreximbank and Eroton have been working together since the Nigerian company acquired Shell’s interest in OML 18 back in 2015. The bank had then provided a $663m syndicated reserve base lending facility to Eroton. Financing AA&R’s Acquisition Spree The third and last deal is a $274m senior secured reserve-based lending facility to Mars Exploration & Production, a subsidiary of Nigeria’s AA&R Group. AA&R is in the process of acquiring several offshore licenses in Nigeria and details on the transaction are available within the Hawilti+ research terminal.

Read more »

Ardova Plc completes acquisition of Enyo Retail & Supply Ltd in Nigeria

Nigerian energy and oil marketing company Ardova Plc has announced the completion of its 100% acquisition of Nigerian fuels retailing company Enyo Retail & Supply. Through this transaction, Ardova has grown its fuel retail stations by 95, bringing its total network in Nigeria to 545. The acquisition is part of ongoing consolidation in the Nigerian downstream market as oil marketers seek to achieve economies of scale to boost profitability. Earlier this month, RainOil also completed its acquisition of 63.6% of the shares of Eterna Plc though its investment arms, Preline Ltd (60.9%) and Norsworthy Investments (2.6%).

Read more »

African Development Bank Group and French Development Agency sign €2 billion co-financing partnership

On the sideline of the Paris Peace Forum this week, the African Development Bank Group (AdFB) and French Development Agency (AFD) have signed a €2 billion co-financing partnership agreement for Africa. The agreement covers the 2021-2026 period and targets €2 billion in the first three years only to complement the current partnership between both institutions. The existing partnership already covers such key sectors as infrastructure, water and sanitation, agriculture, and the private sector. The new agreement supersedes an earlier framework agreement signed in November 2015.

Read more »

Tullow Oil exercises pre-emption rights in Ghana and consolidates stake in key producing fields

Tullow Oil has announced today that it has exercised its right of pre-emption related to the sale of Occidental Petroleum’s interests in Ghana’s Deep Water Tano (DWT) Block to Kosmos Energy. As per the DWT Joint Operating Agreement (JOA), Tullow has pre-emption rights in respect of the 11.05% participating interest acquired by Kosmos Energy from Anadarko WCTP Company in the block last month. Tullow’s pre-emption rights are now expected to increase its share in the license by 7.7% (to a total of 54.8%). This would in turn increase Tullow’s equity interests in the Jubilee and TEN fields to 38.9% and 54.8%, respectively. Both fields are operated by Tullow Oil’s and are its most strategic assets. The company is currently executing a drilling campaign on both projects to increase output and has planned significant investment in their continued development until 2030. “The additional equity is expected to increase Group daily production by c.10% and generate over $250 million incremental free cash flow at $65/bbl for Tullow between 2022 and 2026, which will help to accelerate debt reduction,” Tullow Oil said in a statement today.

Read more »

Western nations announce multi-billion dollar partnership to phase out South African coal

During the COP26 Climate Summit in Glasgow this week, the United States, Britain, France, Germany and the European Union have committed $8.5bn (£6.2bn) to help end South Africa’s reliance on coal. South Africa has become an undisputed renewable energy leader in Africa, but continues to heavily depend on burning coal to generate electricity. Coal still represents about 90% of the country’s energy mix, the highest share amongst G20 nations. Dubbed the “Just Energy Transition Partnership”, the initiative is expected to prevent up to 1.5 gigatonnes of emissions over the next 20 years. In a joint statement, the parties declared that the partnership would initially mobilise several financing mechanisms over a five-year period. These would include grants, concessional loans and investments and risk sharing instruments, including private sector funding. France has notably set its contribution at $1 bn. On its side, Germany mentioned a support for green hydrogen with a contribution of $700m from its development aid funds.

Read more »

InfraCo Africa and Helios are establishing a new $350m climate-focused investment vehicle for Africa

InfraCo Africa, part of the Private Infrastructure Development Group (PIDG) and Helios Investment Partners (Helios) have announced that they are working together to establish a pan-African investment vehicle: Climate, Energy Access and Resilience (CLEAR). The initiative was announced as part of a UK government event hosted in Glasgow on Finance Day of the UN’s COP26 Summit. CLEAR will work towards the achievement of the UN Sustainable Development Goals (SDGs) by funding climate-aligned infrastructure and growth businesses on the continent. In doing so, it will also address the growing demand from domestic and international investors for sustainable investment opportunities that can help to close the infrastructure and productivity gap in Africa. The new pan-African investment vehicle will notably leverage a robust pipeline of projects and growth businesses from both InfraCo Africa and Helios across three core themes: clean energy and the energy transition, green transportation and mobility, and sustainable growth and consumption. CLEAR expects to ultimately raise more than $350m for investment into sustainable infrastructure and businesses which will provide at least 100,000 new jobs, connect more than 1 million people to power for the first time and avoid 100m tonnes of carbon emissions. InfraCo and Helios anticipate that CLEAR will initially be established as a private vehicle but designed and capitalised with a view to listing the vehicle within 3 years of final close.

Read more »

The UK’s CDC Group commits over £3 bn to combat the climate emergency in Africa and Asia

During the COP26 this week in Glasgow, the UK’s development finance institution and impact investor CDC Group has made an investment commitment of over £3 billion to support emerging economies in Africa and Asia to combat the climate emergency. The funds will mostly be channeled into Africa and select South Asian markets and are part of the UK’s Clean Green Initiative announced earlier this week by Prime Minister Boris Johnson. CDC’s investment is targeting key sectors such as renewable power, infrastructure and agriculture, including forestry. As a result, the group notably expects to double the size of its funded renewable energy capacity and grow its share of renewables within its energy portfolio from 32% to 70% within the next five years. CDC’s commitment is notably supported by the £200 million Climate Innovation Facility announcement by the UK Government at COP26. The first beneficiary is Kenya-based agritech business Pula, a company that is piloting a new “Pay-at-Harvest” insurance product. Additional investments in Africa announced by the CDC at COP26 this week include a $37m investment in Africa Renewable Energy Fund II, and a $10 million of follow up investment in M-Kopa, the Kenyan off-grid solar company that provides vital power for homes and communities in rural locations,

Read more »

Nigeria: RainOil completes acquisition of majority stake in Eterna Plc

RainOil has completed its acquisition of 63.6% of the shares of Eterna Plc though its investment arms, Preline Ltd (60.9%) and Norsworthy Investments (2.6%). The Sale and Purchase Agreement (SPA) was executed on August 25th, 2021. The transaction had been reported in Hawilti’s Q3 M&A Watch, available within the Hawilti+ research terminal. The acquisition of Eterna will further consolidate RainOil’s market presence in Nigeria. Over the past two years, the Nigerian company has been investing heavily into its asset base which currently include three ultra-modern petroleum product storage deports in Delta, Cross River and Lagos, a 8,000 metric tonnes LPG storage facility in Lagos, over 100 retail outlets and a fleet of over 140 petroleum product tank trucks. The Nigerian downstream sector is going through significant consolidation as players seek to expand their reach and network to benefit from economies of scale in a market where PMS remains heavily subsidised and regulated. In January this year, Ardova Plc announced it was acquiring Enyo Retail & Supply, a private oil marketer with 95 retail stations in Nigeria.

Read more »

Kosmos Energy consolidates interests in Ghana’s producing Jubilee and TEN fields

Kosmos Energy has just announced the close of a transaction by which it has acquired an additional 18% in the Jubilee Field and an additional 11% in the TEN Fields in Ghana from Occidental Petroleum (OXY) for a price of $550m. Both assets were previously chased by TotalEnergies as part of its broader acquisition of Anadarko Petroleum’s assets in Africa. However, the French major and OXY had mutually agreed in May 2020 to execute a waiver of the obligation to purchase and sell them, so that OXY could begin marketing their sale to other third parties. Both fields are served by a different floating, production, storage and offloading (FPSO) vessel and are operated by Tullow Oil. Jubilee achieved first oil in 2020 and produced an average of 71,000 barrels of oil per day (bopd) in Q2 2021 with production currently increasing as a result of an ongoing drilling campaign. TEN achieved first oil in 2016 and produced an average of 37,000 bopd in H1 2021. Source: PIAC Kosmos Energy is familiar with both assets and has been present in the licences since the exploratory phase several years ago. Subject to pre-empty rights, the transaction could increase the company’s interests in Jubilee to 42.1% and in TEN to 28.1%. Both projects have significant remaining potential and form the core of Tullow Oil’s growth and cash generation strategy this decade. “The acquired assets are expected to generate about $1bn of free cash flow by the end of 2026 at $65/bbl Brent,” Kosmos Energy said in a statement. The American independent also expects payback in less than three years if oil prices remain at an average of $65/bbl or above. By simplifying the partnerships that run both fields, maintaining the pace of investments to develop additional reserves is also expected to be easier. A key focus will notably be on additional gas monetization from both fields in order to support Ghana’s gas-to-power industry. Full details on both the Jubilee and TEN Fields Development are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Nigeria to increase spending with new “Budget of Economic Growth and Sustainability”

At a Joint-Session of the National Assembly in Abuja this week, President Buhari delivered his 2022 Budget Speech, presenting what will be his administration’s last full year budget before the 2023 presidential election. To boost economic recovery, the country will be increasing government spending by over 20% to reach $40bn next year, or NGN 16.39 trillion. This will in turn fuel the fiscal deficit, expected to reach 3.39% of GDP in 2022. In response, Nigeria is expected to borrow an additional NGN 5.01 trillion while raising funds from privatization proceeds (NGN 90.73 bn) and drawdowns on loans secured for specific development projects. Expectations are that the 2022 budget will help Nigeria achieved a growth of 4.2% this against, again an IMF forecast of 2.3%. A Bet on Infrastructure To maintain the pace of infrastructure development, especially in critical projects such as roads, ports, airports and power, the budget provides for the strengthening of concessions and PPP frameworks. Nigeria is also expected to explore green finance options as part of its Sovereign Green Bond Programme and to leverage debt-for-climate swap mechanisms. Nigeria was already the first nation to issue a sovereign certified climate bond back in 2017. Expectations from Oil The oil sector will be once again expected to significantly contribute to government revenues with oil production set at 1.88m barrels per day (including condensate) and the price benchmark at $57 per barrel. However, the country has repeatedly missed its oil production target. By July of this year, actual oil revenues were 34% below target while the federal government’s share of oil revenue was 51% below target. It remains to be seen if Nigeria can turn things around and ramp production back up, especially given the lack of investment into its oil infrastructure and ongoing divestments from IOCs. Nigeria produced an average of 1.567m barrels per day (including condensates) in Q3 2021 according to data released by the Department of Petroleum Resources. The country notably had to face a Force Majeure at Shell’s Forcados Terminal from mid-August to mid-September. A Lingering Subsidy Problem Overall, Nigeria’s budget will continue to be affected by a heavy subsidy burden. The collapse of oil prices in 2020 led to the removal of subsidy on petrol (PMS), before it was quickly reinstated this year once prices rose again and pushed the landing price above the regulated threshold of NGN 145/litre. Because of subsidies, Nigeria continues to have the cheapest petrol in West Africa, which in turns significantly erodes revenues that could otherwise allocated for social infrastructure projects. Low petrol prices are also creating serious barriers to promote the adoption and consumption of natural gas across the country.

Read more »

TCX and FMO issue first ever offshore Congolese franc note

Yesterday, the Dutch entrepreneurial development bank (FMO) issued on the Luxembourg Stock Exchange the first ever offshore Congolese franc note, with a countervalue of $20m (or about FCFA 40bn) and 14-month tenor. The issuance of the AAA-rated note was supported by TCX, a fund specialised in shielding international lenders and their local borrowers in emerging and frontier markets from exchange rate volatility. By providing FMO with a Congolese franc currency hedging solution at the time of bond issuance, TCX took the currency risk ensured that its Congolese franc bond was converted into US dollars. The bond is a synthetic one, meaning it was issued as an asset in Congolese franc, but the reconciliation of all cash flows is done in US dollars. The investors who acquired this asset bought a bond with the triple-A credit rating of FMO, but with a coupon reflecting the risk exposure of the Congolese market.

Read more »

After Oza and Asaramatoru, Decklar considers entry into Emohua Marginal Field

Decklar Resources has announced it has entered into a non-binding letter of intent to purchase all of the issued and outstanding shares of Wesfield Exploration and Production. Westfield E&P is the Nigerian entity that holds a Risk Finance and Technical Services Agreement (RFTSA) with Erebiina Energy Resources, the recent winner of the Emohua Marginal Field (OML 22) during Nigeria’s 2020/2021 Marginal Fields Bid Round. Erebiina is operating the Emohua field with a 60% interest. “Emohua has a considerable infrastructure advantage with existing oil and gas export pipelines in close proximity. This will allow Decklar to use an Early Production Facility (EPF) after the Emohua-1 re-entry well as part of a fast-track development plan to realize near-term cash flow,” the company said in a statement. Decklar has been increasing its footprint across Nigerian marginal fields over the past two years. In 2019, its Nigerian subsidiary Decklar Petroleum entered into a Risk Service Agreement (RSA) with Millenium Oil and Gas Co. to provide technical, financial and operational support needed to develop the Oza Marginal Field on OML 11. Drilling is ongoing there, with the Oza-1 well expected to be put back on production before the end of the year. In July 2021, Decklar continued its acquisition spree by completing a Share Purchase Agreement (SPA) to acquire Purion Energy, the Nigerian entity that holds a RFTSA with Prime Exploration & Production in respect of the Asaramatoru Marginal Field (OML 11). Decklar has so far focused on drill-ready assets located in close proximity to existing and operational oil and gas evacuation infrastructure. “The M&A deals space in Nigeria is very hot at the moment especially onshore and in shallow waters,” said Mickael Vogel, Head of Research at Hawilti. “Investors are especially looking at the market’s brownfield opportunities which offer tremendous upside potential and the ability to cash in very quickly. While everyone is focusing on transactions involving IOCs’ divestments, other juniors and independents are quickly moving to get a foothold over smaller assets that can be put on production within 12 months or less.” Details on the development of the Oza and Asaramatoru Marginal Fields are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

A.P. Moller Capital has acquired 44% of Cabeólica from the Africa Finance Corporation

Through the Africa Infrastructure Fund, A.P. Moller Capital has just acquired a 44% stake in Cabeólica S.A., which runs four wind farms on the islands of Santiago (9.35MW), São Vicente (5.95MW), Sal (7.65 MW) and Boa Vista (2.55 MW) in Cabo Verde. The stake was acquired from the Africa Finance Corporation (AFC), who has been part of the project since 2020. The AFC will continue to hold a 50% stake in Cabeólica, alongside the Government of Cape Verde and its national utility Electra, who together own the remaining 6% stake. The Cabeólica wind farms were sub-Saharan Africa’s first wind power public-private partnership (PPP) project upon their commissioning in 2011. Back then, Cabo Verde’s electricity generation relied heavily on imported diesel, which came at significant financial and environmental costs. Consequently, the development of 25.5 MW of wind power generation capacity not only helped the archipelago reach its renewable energy targets, but also decrease its national electricity bill. The PPP took shape in the late 2000s with an agreement between InfraCo Africa, Cabo Verde’s Ministry of Tourism, Industry and Energy, and Electra SARL, the local electricity concessionary company. The partnership welcomed the Africa Finance Corporation (AFC) and the Finnish Fund for Industrial Cooperation as strategic partners and majority investors in Cabeólica S.A. in 2010, and reached financial close the same year. It resulted in the development of four different windfarms for a total installed capacity of 25.5MW. 30 Vestas model V52-850kW wind turbines were installed, along with four substations and 33.5km of power cables. The onshore wind farms represent Cabo Verde’s first independent power producer (IPP) project and have all been successfully operating since 2012. Cabeólica was recognised by the United Nations Framework Convention on Climate Change (UNFCCC) as a Clean Development Mechanism (CDM) project in 2013. A.P. Moller Capital has been increasing its investment across sub-Saharan Africa’s power industry this year. In April, it notably acquired Iberafrica Power from Naturgy and took control of its 52.5 MW thermal power plant in Kenya. A month later, it established a new joint-venture with Reunert called Lumika Renewables to develop of portfolio of cost efficient renewable energy solutions across the continent. Details on the Cabeólica Wind Farms are available in the “Projects” section within your Hawilti+ research terminal.

Read more »