Liquefied Natural Gas (LNG)

NNPC and TotalEnergies announce $550m investment in Nigeria’s Ubeta Gas Field

The Nigerian National Petroleum Corporation and TotalEnergies have announced a $550 million investment decision for the development of the Ubeta Field, a key onshore gas project expected to provide feedstock to Nigeria LNG – Africa’s biggest LNG export terminal. The project is located within OML 58, a TotalEnergies-operated onshore license that frequently suffers production disruptions due to pipeline vandalism and crude theft. The Ubeta field, discovered in 1964 and located northwest of Port Harcourt in the Niger Delta, is projected to produce about 350 million standard cubic feet (MMscf/d) of gas and 10,000 barrels of associated liquids daily. This development is expected to contribute significantly to the supply for NLNG’s Train 7. “Ubeta is the latest in a series of projects developed by TotalEnergies in Nigeria, most recently Ikike and Akpo West. I am pleased that we can launch this new gas project which has been made possible by the Government’s recent incentives for non-associated gas developments,” TotalEnergies’ Senior Vice President for Africa, Exploration & Production, Mike Sangster, said in a company statement. “Ubeta fits perfectly with our strategy of developing low-cost and low-emission projects, and will contribute to the Nigerian economy through higher NLNG exports.” At the official signing event at NNPC Towers, Group CEO Mele Kyari expressed appreciation for the Tinubu administration’s support in fostering a conducive fiscal environment that has been instrumental in reaching this significant FID. “The Presidential Executive Order is instrumental to us getting to this significant milestone, and we are now seeing the impact of the policy,” Kyari said. Slated for a 2027 start-up, the Ubeta gas condensate field in OML58 will be developed with a six-well cluster connected by pipeline to the existing Obite treatment plant. The development plan includes a 5 MW solar plant and electrification of the drilling rig to reduce carbon intensity. TotalEnergies and NNPC are also focusing on local content, with more than 90% of manhours expected to be worked locally. The Ubeta Field’s FID marks a significant step in NNPC’s ongoing efforts, supported by the executive branch, to address the challenges that have historically hindered foreign investment in Nigeria’s oil and gas industry. The project is expected to stimulate economic growth, create job opportunities, and generate substantial value for various stakeholders.

Read more »

Nigeria’s NNPC Ltd and Golar LNG announce new FLNG project

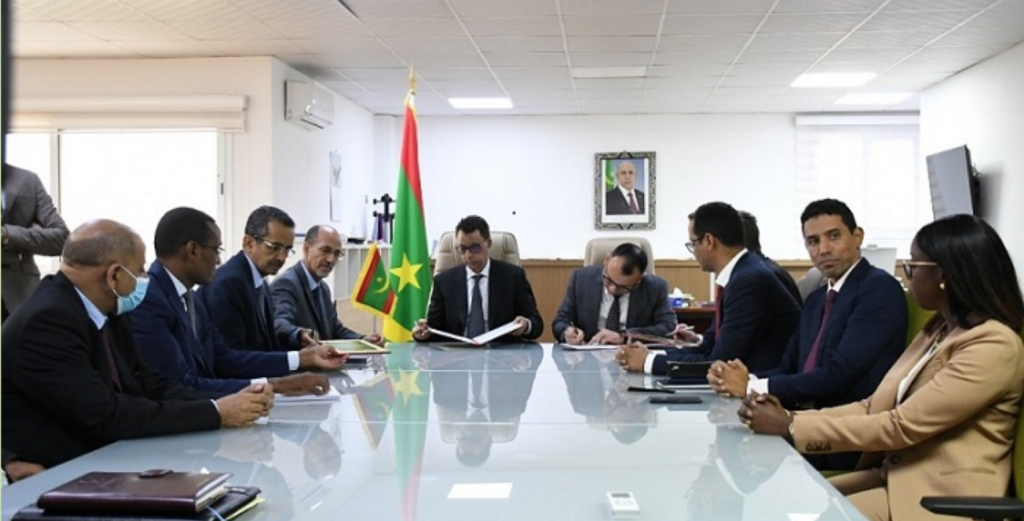

In a significant move towards harnessing Nigeria’s abundant natural gas reserves, state-owned NNPC Limited has forged a Project Development Agreement (PDA) with Golar LNG for the establishment of a Floating Liquefied Natural Gas (LNG) facility off the shores of the Niger Delta. Both companies have been in discussions around the launch of FLNG ventures for several months, having already signed a Memorandum of Understand and Heads of Terms for that purpose. The PDA was signed on June10th, 2024 in the presence of NNPC Limited’s key executives including Chief Financial Officer Umar Ajiya, Executive Vice President for Gas Power & New Energy Olalekan Ogunleye, and Executive Vice President for Upstream Mrs. Oritsemeyiwa Eyesan, alongside Golar LNG’s CEO Karl Fredrik Staubo. This collaboration represents a significant stride towards commercializing Nigeria’s gas resources, aligning with President Bola Ahmed Tinubu’s vision to expedite the economic exploitation of Nigeria’s gas assets. The agreement is poised to tap into the extensive proven gas reserves from shallow water resources off the Nigerian coast. The PDA delineates a comprehensive plan for monetization, leveraging approximately 400-500 million standard cubic feet per day (MMscf/d) to produce LNG, LPG, and Condensate. Both NNPC Limited and Golar LNG have underscored their dedication to achieving a Final Investment Decision (FID) by the close of Q4, 2024, with the aim of commencing gas production by 2027. Golar LNG Limited, recognized as a leading independent owner and operator of LNG infrastructure, brings its expertise in managing LNG carriers, floating storage and regasification units (FSRUs), and floating liquefaction (FLNG) vessels to this ambitious venture. The project would be the first FLNG carried by NNPC in Nigeria and follows several such ventures currently under development by the private sector, the most advanced of which is the UTM FLNG.

Read more »

Axxela’s new gas plant to expand Nigeria’s gas infrastructure following bond success

Axxela Limited, a leading African gas and power company owned by Helios Investment Partners and Sojitz of Japan, has announced a Final Investment Decision to develop a 50 million standard cubic feet per day (MMscf/d) gas processing plant in Delta State, as it pushes towards sustainable energy solutions in Nigeria. This decision is bolstered by Axxela’s successful ₦16.4 billion bond issuance earlier this month, which was oversubscribed by 109 percent. The announcement comes as Axxela continues to expand its footprint in the energy sector, following last year’s agreement with BUA Group, one of Africa’s largest conglomerates, and CIMC ENRIC, a global leader in the energy equipment industry, to build a 700-ton-per-day mini liquefied natural gas (LNG) project. The new gas processing plant, expected to begin operations by the end of 2024, will start with a 12 MMscf/d modular unit and is designed for rapid expansion, with the potential to increase the plant’s output to 50 MMscf/d within 18 months. It is a key part of Axxela’s strategy to support the Nigerian government’s Decade of Gas initiative and to enhance domestic gas utilization. Strategically located in OML 152, the gas processing plant is expected to serve as a central processing hub for surrounding oil & gas operators, with the potential to transform gas flaring into a valuable economic resource, and significantly reduce CO2 emissions. “We are positioning to develop requisite infrastructure for natural gas processing and last mile distribution that creates market access for at least 20% of Nigeria’s gas demand,” Axxela’s Director of Business Development, Franklin Umole, said in a company statement. “Over the past two decades, we have been at the forefront of natural gas advocacy, and this project is a further reaffirmation of our dedication to gas infrastructure development and our vision to deliver innovative energy solutions across Nigeria and Africa.’’ In preparation for the project, Axxela has secured a long-term feedstock supply agreement with a leading local upstream company and established equipment supply arrangements with top-tier Original Equipment Manufacturers (OEMs). Upon completion, the processed gas will support various market segments, including Compressed Natural Gas (CNG) for vehicles, industrial feedstock, and decentralized power solutions, marking a significant step towards energy security and economic growth in Nigeria. Boost from successful bond issuance In a related financial achievement, Axxela recently raised ₦16.4 billion in an oversubscribed bond issuance, despite challenging economic conditions marked by rising interest rates and limited market liquidity. The funds will be instrumental in realizing the gas plant project. “This is a significant indicator of increasing investor confidence in our company’s reputation, brand, and performance,” CEO at Axxela Bolaji Osunsanya said. “The bond proceeds will support the development of our growth projects, signifying the importance of local and international capital markets in the development of critical infrastructure.” With the FID and successful bond issuance, Axxela looks to advance Nigeria’s gas infrastructure, support the energy transition, and meet the increasing demand for cleaner energy solutions.

Read more »

Nigeria: Transoceanic Gas & Power lines up consortium for new offshore gas hub

Transoceanic Gas & Power has announced the start of pre-FEED work for a new 3 million tons per annum (mtpa) floating LNG (FLNG) project offshore Nigeria, in cooperation with Wison New Energies and NMDPRA. The company seeks to develop an offshore gas hub around OPL 289, an offshore license located next to the Pennington terminal. It wants to monetise some 500 MMscf/d of stranded offshore and swamp gas resources to produce 3 mtpa of LNG for the export market, 150,000 metric tonnes per annum (tpa) of LPG for the domestic market, 25,000 barrels of per day (bpd) of condensates, and 75,000 metric tpa of propane. The project’s plans also include a phased gas-to-power project of up to 1GW, starting with a floating power barge of 250 MW. Feedstock would come from gas resources on OPL 289 along with OMLs 86 and 88, two shallow water blocks that include the Pennington Terminal and were recently divested by Chevron and acquired by NNPC Ltd. “The model will help derisk upstream gas resourcing, and we guarantee at least 7 TCF of gas supply,” the company says on its website. The project is backed by private equity with the upstream gas development supported by financing from Quantum Suisse, Transoceanic Gas & Power said yesterday. It has revealed an impressive lineup of international contractors and partners it intends to work with to support various components of its future gas hub, including Wison New Energies for the design and EPC of the floating LNG unit and floating power barge, Samsum Heavy Industry (SHI) for the upstream facilities, Siemens Energy for the power and compression components, and Karpowership, Vitol and Socar of Azerbaijan as LNG off-takers. Transoceanic Gas & Power is not the first company to propose a floating LNG project in Nigeria, where several such ventures are currently being planned. However, the company’s vision is unique in its scale and diversity by integrating several revenue streams that ensure a maximal usage of the gas molecules including for LNG, LPG, condensate, and power with a mix of domestic and export allocations.

Read more »

Nigeria LNG Train 7 hits 52% but concerns remain over future feedstock

The Nigeria Liquefied Natural Gas (NLNG) Train-7 project has reached 52% completion, as Africa’s leading oil producer pushes to boost its gas sector and increase its revenue from gas exports. The multi-billion dollar NLNG Train-7 project is an expansion under construction at the 22.5 mtpa NLNG Terminal in Bonny Island, Rivers State. The project aims to increase capacity by an additional 7.6 mpta of LNG by building a seventh train of 4.2 mtpa capacity and debottlenecking the existing trains. But despite the substantial progress made in constructing Train-7, concerns remain over the future feedstock. These were notably voiced during an engagement session between the Executive Secretary of the Nigerian Content Development and Monitoring Board (NCDMB), Engr. Simbi Kesiye Wabote and Dr. Philip Mshelbila, the Managing Director of NLNG, at the gas company’s operational base at Bonny Island. NLNG management expressed concerns over the delay in initiating deep-water gas projects that are intended to supply feed gas for Train-7 and future expansions. This delay means the facility could be completed without a gas source for liquefaction. Mshelbila said NLNG is already facing difficulties in getting adequate gas supply, resulting in its six plants –Trains 1 to 6 – producing below 50% of their total installed capacity. Data collected by Hawilti shows that the facility was already operating at only 65% last year. While feed gas to the NLNG plants comes mainly from some of its joint ventures (JV) partners, including Shell Petroleum Development Company (SPDC) Limited, Total Energies and Nigerian Agip Oil Company (NAOC), Mshelbila said supplies have suffered disruptions due to recurrent vandalism of pipelines, facility failures and low production from aging wells. According to Mshelbila, NLNG is exploring several options to mitigate the challenge, including partnering with critical security agencies to curtail vandalism on the pipelines and working with their JV partners to increase their gas production. To boost performance of Trains 1 to 6, Mshelbila said the Board of Directors at the NLNG has approved for the company to procure gas from other international and indigenous gas producers.

Read more »

Greenville launches historic L-CNG station in Nigeria

Greenville LNG, a company producing liquefied and compressed natural gas for the Nigerian market, has officially inaugurated the first-ever Liquefied Compressed Natural Gas (L-CNG) station in the country today amidst efforts to boost domestic use of gas as a cleaner and cheaper fuel in Africa’s most populous country. Launched in Nigeria’s Kaduna state, the outlet seeks to transform the transportation landscape through enhanced gas distribution, which in turn curbs fuel shortages. The facility is expected to cater for a wide range of vehicles, including tricycles, buses, and other small vehicles, offering a cleaner and cost-effective alternative to traditional fossil fuels. “Both LNG and L-CNG offer compelling alternatives to traditional fuels, delivering 15-20% fuel cost savings and promoting eco-friendly choice,” Greenville notes in its online channels confirming the launch. “Notably, L-CNG will boost the economy by promoting local business and the transport sector in Kaduna.” As part of efforts to advance clean and cost-effective energy in Nigeria, Greenville says it is establishing 25 L-CNG distribution hubs to provide reliable energy to fuel stations across the country. The company already supplies gas to more than 25 major companies across Nigeria using over 300 LNG powered trucks as part of its innovative virtual pipeline system. Greenville has a network of LNG re-fueling stations strategically located in several parts of the country for LNG fueled trucks, tankers and buses. Founded in 2015, it installed 3 gas liquefaction trains at its Rumuji plant in Rivers state, which it commissioned in 2018. Although Nigeria holds some of the world’s biggest gas reserves estimated at over 200 trillion cubic feet (Tcf), they remain largely underdeveloped, benefiting industrialization and power generation overseas through LNG exports instead. But, boosting local consumption is now at the centre of the government’s agenda as it promotes gas as a transition and cleaner fuel. Boosting local gas consumption with reforms Nigeria’s downstream gas sector has particularly witnessed a raft of reforms since President Bola Tinubu assumed office on May 29 this year, amid push to boost confidence among domestic and international investors looking to do business in Africa’s biggest economy. The subsidy removal on gasoline is notably one of those changes. Cheap petrol prices, which Nigeria spent a fortune subsidising, had made it difficult for motorists to consider an alternative source of fuel such as Compressed Natural Gas (CNG). This also meant a poor investment case for potential investors. But with the subsidy removal levelling out the playing field for all fuels, Nigeria’s transport sector presents tremendous growth opportunities for the CNG and LNG industry. However, while subsidy removal incentivises motorists to go for a cheaper and cleaner fuel in gas, limited investments over the years also mean limited gas infrastructure, which could stifle growth opportunities for Nigeria’s domestic gas market. To bolster the shortfall in critical gas infrastructure, the Nigerian National Petroleum Company (NNPC) partnered earlier this year with NIPCO Gas Limited to deploy CNG stations across the country. The NNPC-NIPCO partnership, signed in August, aims at expanding Nigeria’s CNG infrastructure as it pushes for improved access to CNG, while speeding up the adoption of cheaper and cleaner alternative fuel for private cars and vehicles used for public transport. NIPCO Gas Limited already operates 14 CNG stations across Nigeria, and has converted over 7,000 vehicles to run on CNG, mostly in Benin City. NNPC is betting on NIPCO’s technical expertise and field experience to drive and expand the initiative. The project will be rolled out in phases. The first phase, supporting intra-city transportation, targets 21 CNG stations by Q1 2024. The second phase, to be ready in Q4 2024, will cover 35 CNG stations, servicing inter-city transportation. NNPC plans to bolster the programme with an additional 56 stations through its retail outlets across the country. Once fully operational, the stations can service over 200,000 vehicles daily, the state oil firm said, adding it expects more oil marketing companies from the private sector to participate in expanding CNG penetration and availability in Nigeria.

Read more »

Golar LNG in discussion for four floating LNG projects in Nigeria

This article first appeared on the Hawilti+ terminal on 12 August 2023. Golar LNG has signed a Heads of Terms with Nigeria’s state-owned NNPC Ltd in August 2023 and is currently discussing and developing four floating LNG and gas projects in the country, the company said. It targets to use its 2.4 mtpa Hilli FLNG unit, currently contracted offshore Cameroon until 2026, or its 3.5 mtpa MKII FLNG unit for deployment offshore Nigeria for a minimum of ten years. The MKII wil rely on an LNG carrier recently acquired and set for conversion. Nigeria has been increasing its outreach to global stakeholders and investors across the gas value-chain as it seeks to monetise its 206 Tcf of gas for the domestic and export market. Several gas export projects are currently planned, including pipeline and LNG export infrastructure. The most advanced of them is the UTM Offshore floating LNG unit, in which NNPC has taken a 20% stake and currently progressing toward a final investment decision (FID).

Read more »

Saipem’s Scarabeo 5 drilling rig to be converted into new floating unit for Congo LNG

This article first appeared on the Hawilti+ terminal on 10 August 2023. Saipem has been awarded a contract by Eni Congo to convert its Scarabeo 5 semisubmersible drilling unit into a separation and boosting plant. The converted rig will serve a floating production unit (FPU) for Congo LNG, Eni’s LNG export project currently under-development offshore Pointe Noire. Saipem is already a contractor on the project, for which it is executing preliminary engineering and procurement activities. The FPU will be receiving the production fluids from wellheads riser platforms, separate the gas from liquids and boosts the gas to feed the nearby 2.4 mtpa floating LNG unit (FLNG) currently being built by Wison Heavy Industry in China. While start-up is expected in Q4 2025, Eni Congo is expected to start delivering LNG as early as the end of the year from an initial development that relies on a small 0.6 mtpa FLNG unit.

Read more »

Government of Tanzania completes negotiations with Equinor and Shell on Tanzania LNG

The Government of Tanzania has completed negotiations with Shell and Equinor, Minister of Energy January Makamba said yesterday. The completion of the negotiations enables the writing and signing of key contracts towards the $30bn Tanzania LNG project, including the Host Government Agreement (HGA). The project is expected to monetise 16 Tcf of gas discovered by Shell on Block 1 and Block 4, and 20 Tcf of gas discovered by Equinor on Block 2. Partners on the licenses include ExxonMobil, Ophir Energy, and Pavilion Energy. In June 2022, a Framework Agreement was signed between the Government of Tanzania signed, Equinor, and Shell to support negotiations. The HGA was then expected to be signed by the end of 2022 for a taking of the final investment decision (FID) in 2025. Equinor has scheduled a 3-year planning and engineering programme for the pre-FEED and FEED and expects construction to take at least 4 years after that. An independent macroeconomic study prepared last year by Stanbic Bank Tanzania and endorsed by the Ministry of Energy found that the $32.7bn, 15 million tonnes per annum (MTPA) terminal could generate fiscal proceeds of up to $6bn a year for Tanzania. Tanzania LNG is also expected to be a pathfinder in the development of sustainable LNG infrastructure in Africa with the partners reportedly exploring several low-carbon electrification options such as hydropower and solar, along with carbon capture utilization and storage (CCUS) technologies.

Read more »

Eni Congo selects Expro for onshore LNG pre-treatment facility

Expro has announced this week the signing of a 10-year Production Solutions contract with Eni Congo for an 80 MMscf/d LNG pre-treatment facility in Congo-Brazzaville. Under the agreement, Expro will design, construct, operate and maintain a fast-track the facility as part of Eni Congo’s Marine XII gas development plans that include the deployment of two floating LNG units in 2023 and 2025. Expro’s facility will be built near the Litchendjili gas plant to enable LNG production, under a 10-year contract that should generate some $300m for Expro. “The facility will link to Eni Congo’s offshore floating LNG (FLNG) operations, supporting both the local energy market and increased global demands for LNG to support secure energy supplies,” Expro said in a statement.

Read more »

Wison starts construction of new FLNG project for Eni in Congo

Wison Offshore & Marine held yesterday its 1st Cutting Ceremony for a new floating LNG unit it is constructing for Eni in the Republic of Congo. The ceremony took place at the Nantong yard, where Wison (Nantong) Heavy Industry Co., Ltd. will be constructing the 2.4 mtpa unit. The project is expected to be commissioned in 2025 on Eni’s shallow water Marine XII Block offshore Congo-Brazzaville. It is part of Eni’s phased gas valorisation plan to develop and monetise the gas reserves on the license. Phase 1 relies on the 0.6 mtpa Tango FLNG which Eni acquired from Exmar in 2022 and where first production is expected in H2 2023 to monetise available gas from the Litchendjili et Néné-Banga fields. Once both projects are commissioned, the block will have an LNG export capacity of 3 mtpa, or 4.5 Bcm/year.

Read more »

Mozambique’s Coral Sul FLNG project has delivered its first cargo

Eni has announced the departure of the first LNG cargo from its Coral Sul floating LNG facility offshore Mozambique on November 13th. The Italian major is operator of the project with partners ExxonMobil, CNPC, Galp Energia, KOGAS, and national oil company ENH. The project has come on stream in line with its initial budget and schedule, despite several constraints generated by the Covid-19 pandemic. The Coral Sul FLNG unit has a capacity of 3.4 million tons per annum and is Mozambique’s first gas export project. Under an agreement signed with bp in October 2016, the British major will be the sole off-taker for the entire volumes of LNG produced by the Coral South project for a period of over twenty years. Eni revealed earlier this year that it was considering a second floating unit in the country in response of Europe’s needs to replace gas imports from Russia.

Read more »Bridport Energy makes new Board appointments ahead of inaugural LNG cargo in Nigeria

Nigerian LNG distribution company Bridport Energy has made new appointments to its Board of Directors, the company has said today. Engr. Ahmadu-Kida Musa and Mr. Auwalu A. Ilu, two experienced energy executives, have joined the company as Non-Executive Directors effective 1st October 2022. Both directors are well-known within the Nigerian oil & gas sector, where they have successfully held leadership position within international and local companies. Engr. Ahmadu-Kida Musa has over three decades of experience working in the oil & gas industry and worked on several of TotalEnergies’ onshore and offshore gas projects in Nigeria. He was until 2020 the Deputy Managing Director of TotalEnergies’ deep-water district in the country. On the other side, Mr. Ilu founded and runs one of Nigeria’s most successful LPG businesses, Ultimate Gas. He brings over 20 years of experience in the energy, maritime, and logistics industry. Bridport Energy is one of the Nigerian companies who signed a Sales & Purchase Agreement (SPA) with Nigeria LNG in 2021 to start delivering liquefied natural gas (LNG) to the domestic market. The expansion of its Board comes as the company is currently developing an LNG import, storage, and distribution terminal in Lagos where first cargo is expected within a few months.

Read more »

“We are still in operations!”, says Nigeria LNG

Nigeria LNG, Africa’s biggest LNG exporter, has clarified that its terminal on Bonny Island in the Niger Delta is still operating despite a force majeure issued by the company earlier this week. “The company’s plant is in operation though at limited capacity due to reduced gas supply from some of its upstream suppliers,” Nigeria LNG has declared today. The declaration of force majeure by NLNG had raised several concerns on gas supplies in and out of Nigeria. The company is Africa’s largest LNG exporter and the gas it exports represents on average 10% of Nigeria’s export revenues. It is also the biggest domestic supplier of cooking gas, a commodity that already suffers from soaring inflation. The company had earlier revealed that all its upstream gas suppliers had declared force majeure following their inability to produce gas due to ravaging floods that have already displaced millions in the Niger Delta. The shut-in of gas production has caused significant disruption of gas supply to Nigeria LNG, forcing the LNG exporter to operated at limited capacity. Nigeria LNG operates six LNG trains on Bonny Island with a capacity of 22.5 million tonnes per annum (mtpa). Most of Nigeria’s LNG is exported to Europe and Asia, with key European markets such as France, Spain, and Portugal amongst its largest buyers.

Read more »

Africa’s biggest LNG exporter declares Force Majeure

A series of force majeure events have been declared by oil & gas operators in the Niger Delta, leading Nigeria LNG to declare its own force majeure on product supplies from the Bonny Island LNG terminal, the company has said today. Nigeria LNG is owned by NNPC (49%), Shell Gas B.V. (25.6%), Total Gaz Electricite Holdings France (15%), and Eni International (10.4%). The company has revealed that all its upstream gas suppliers have declared force majeure following their inability to produce gas due to ravaging floods that have already displaced millions in the Niger Delta. The shut-in of gas production has caused significant disruption of gas supply to Nigeria LNG, forcing the LNG exporter to operate at limited capacity. Nigeria LNG operates six LNG trains on Bonny Island with a capacity of 22.5 million tonnes per annum (mtpa). LNG represents on average almost 10% of Nigeria’s export earnings, data from the National Bureau of Statistics shows. In addition to supplying LNG to global markets, the company is also the biggest domestic supplier of cooking gas to the Nigerian market. Most of Nigeria’s LNG is exported to Europe and Asia, with key European markets such as France, Spain, and Portugal amongst its largest buyers.

Read more »

Mauritania: FID expected in 2025 on bp’s new BirAllah gas hub

bp and Kosmos Energy have signed a new Exploration & Production Sharing Contract over the BirAllah gas discovery offshore Mauritania on October 11th. A new agreement was required after the exploration period over Block C8 expired last June. The BirAllah gas field was discovered 60km north of the Greater Tortue-Ahmeyim (GTA) gas field that straddles the Mauritanian-Senegalese maritime border. Negotiations over future activity on the acreage have been ongoing for several months and were previously announced by Kosmos Energy, bp’s partner on Block C8. The new EPSC signed this week provides for 30 months of studies and planning before submitting a development plan for the field, where a final investment decision (FID) is now expected in the first half of 2025. 50 Tcf of gas have been discovered on Block C8 across the BirAllah discovery in 2015 (Marsouin-1 well) and the Orca-1 discovery of 2019. The reserves are bigger than at the GTA field, where bp and Kosmos Energy expects to start producing gas and exporting LNG next year and are already preparing the expansion of their FLNG hub to 5 mtpa. The BirAllah’s development plan is expected to further maximize local content and build on the domestic capacities developed during the development phase of GTA. The project includes an increased participation from the State of Mauritania – 29% – and will rely on the logistics capacities of the Ndiago Port, the Ministry of Petroleum, Mines, and Energy said. The project is expected to include a domestic and an export component to maximise value from the gas. Mauritania is notably trying to push for domestic gas monetization to expand its power supply, and develop gas-based industries such as petrochemicals and steel.

Read more »Increasing LNG availability in Nigeria will support new sustainable development models for Nigerian industries

by Ken Etete, Group CEO, Century Group. Nigeria is one of the world’s biggest LNG exporters. Since the first train at Nigeria LNG was commissioned in 1999, the country has built a massive LNG export complex with a capacity of 22.5 million tonnes per annum (mtpa). Last year, it held a 6% market share of the global LNG export market and was the world’s 6th largest exporter of the commodity. But while Nigeria’s gas has benefited industrialization and power generation overseas, LNG has remained relatively absent of its domestic market. This is now changing along with the government promotion of gas as a transition fuel and increasing private sector investment into virtual gas pipelines. At the Century Group, we have always believed that gas was meant to play a bigger role in supporting Nigeria’s industrialisation and energy access. As early as 2011, we set up Gas Plus Synergy (GPS) to support the monetization of associated gas and reduce carbon emissions across the country’s oil & gas sector. In 2021, our efforts paid off with the signing of a Sales & Purchase Agreement with Nigeria LNG for the delivery of LNG to the domestic market. Moving forward, we will continue to expand Nigeria’s domestic gas value-chain, and are committed to incentivize the switching from diesel to gas across sectors such as manufacturing and transport. This will support new sustainable development models for Nigerian industries, and ultimately make the economy more resilient. As Nigeria recovers from a recession caused by the Covid-19 pandemic and crash in oil prices, there are several reasons to be bullish on the future of its domestic gas market. To begin with, the country has increasingly become aware of the potential to develop its 206 Tcf of gas reserves both for the domestic and for the export markets. The 2020-2030 period has been declared “Decade of Gas” and is seeing several incentives to boost gas monetization. Nigeria has also taken a clear stance in favor of gas even as it thrives to reach net 0 emissions by 2060. Market dynamics are also evolving in a favorable way and will be providing positive grounds to support gas adoption moving forward. Throughout the end of 2021 and first quarter of 2022, fluctuating commodity prices have sent diesel prices soaring, generating significant operational expenses for Nigerian industries that heavily rely on diesel for power generators and logistics. As a result, demand for cheaper and cleaner fuels such as CNG and LNG is growing. It is now up to Nigerian companies and financiers to step up and meet the needs of the hour.

Read more »

Afreximbank steps up support to first Africa-owned FLNG project

Last week in Cairo, the Afreximbank signed a Heads of Terms to support the establishment by UTM Offshore of the first Africa-owned floating LNG unit in Nigeria. Both companies had already signed a memorandum of understanding (MoU) at the end of last year. UTM Offshore has been working for a couple of years on deploying a floating unit that would process flared gas into LNG for the export market. In 2021, it received a License to Establish (LTE) and teamed up with LNG Investment Management Services (LIMS), a subsidiary of NNPC Ltd, to advance the project. It has now been joined by several international financial and technical partners, including KBR as owner’s engineer, and a consortium of JGC Corp. and Samsung Heavy Industries to execute the FEED. A final investment decision (FID) is expected in 2023 for a commissioning in 2026.

Read more »

Tanzania LNG: HGA expected in December 2022, FID in 2025

Over the weekend, the Government of Tanzania signed a Framework Agreement with Equinor and Shell to support negotiations on the Tanzania Gas and LNG Project (TGP). The agreement marks another step towards the signing of the Host Government Agreement (HGA) expected before the end of 2022. Both international oil companies resumed negotiations mega-gas project in November 2021, aided by the renewed interest from the new Tanzanian leadership. Equinor operates Block 2 where it has discovered 20 Tcf of recoverable gas reserves in the early 2010s, while Shell operates Blocks 1 and 4, which it inherited from its combination with the BG Group in 2016. BG had previously discovered 16 Tcf of recoverable gas reserves on both blocks. While negotiations on the project continue to make progress, the final investment decision (FID) is not expected before 2025. Equinor has notably scheduled a 3-year planning and engineering programme for the pre-FEED and FEED and expects construction to take at least 4 years after that. On the Tanzanian side, hopes are that commissioning could be reached as early as June 2028. While it is too early to know what the project will look like, Equinor expects a liquefaction capacity of 7.5 million tonnes per annum (mtpa) from its Block 2 with an investment of $20bn. Part of the gas arriving at the facility in Lindi in southern Tanzania would also be reserved for the domestic market and the production of cooking fuels (LPG). If Shell replicates the same scheme, the project could see an investment of up to $40bn, making it by far the largest foreign investment in Tanzania’s history.

Read more »

The US is contemplating increasing debt provided to South Africa’s leading gas, LNG, and helium project

The United States’ International Development Finance Corporation (DFC) is evaluating an increase of its loan to Renergen’s Virginia Gas Project in South Africa by up to $500m. The development finance institution (DFI), previously known as Overseas Private Investment Corporation (OPIC), had already provided $40m in debt to finance Phase 1 of the project. Its growing appetite is welcomed news as most gas infrastructure developers in Africa have criticized the withdrawal of Western DFIs from financing oil and natural gas projects on the continent. South Africa’s first LNG and helium project The Virginia Gas Project is developed by Tetra4, a wholly owned subsidiary of ASX-listed Renergen. It is developing South Africa’s first and only onshore petroleum production right to produce liquefied natural gas (LNG) and helium, a first in the country. Its Phase 1 includes a scalable gas plant and 52km of pipeline, and a maximum production target of 74.6 million cubic feet per day (MMcf/d) (about 350kg) of liquid helium and 2,700 GJ (50 tons) of LNG. Upon start of production, Renergen will notably become South Africa’s first distributor of LNG at filling stations through its partnership with French major TotalEnergies. Phase 2 is expected to follow by 2024, further increasing LNG production to meet an anticipated increase in demand and provide LNG supplies across all major highways in South Africa. Key contracts for phase 2 were awarded in early 2021, including the FEED studies, and the final investment decision (FID) is expected to be taken once these are completed. Phase 2 is designed to allow Renergen to produce significantly larger quantities of LNG and liquid helium: it should notably require a CAPEX of $800m and involve a drilling campaign of 297 wells, anticipated to build up to 44 MMscfd at full production. 65% of Phase 2’s anticipated production is already pre-sold to clients including Linde, Meser, Helium 24 and iSi. Details on the Virginia Gas Project, including contractors, financiers, and offtakers, are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

AG&P delivers world’s first modular FSRU in Senegal

GAS Entec, a subsidiary of Singapore-based Atlantic Gulf & Pacific International (AG&P) has completed the conversion of a 125,000 m3 LNG carrier for KARMOL, the joint-venture of Turkey’s Karpowership and Japan’s Mitsui OSK Lines. The converted 84 MMscf/d modular floating storage and regasification unit (M-FSRU) is a first in the world and will be delivering LNG to the 236 MW Karadeniz Powership Aysegul Sultan in the Port of Dakar. “Gas Entec’s proprietary, patented RegasTainer® technology offers flexibility to scale the capacity of the FSRU up and down from 15 to 300 mmscfd with minimized downtime, allowing the vessel to be repurposed as power requirements grow in a market,” AG&P said in a statement today. Karpowership’s Ayşegül Sultan power barge was relocated offshore Dakar from Ghana in 2019. It has run on heavy fuel oil (HFO) until the arrival of the KARMOL LNGT Powership Africa FSRU in 2021, and currently represents 15% of Senegal’s electricity supply. In 2021, the Mauritius Commercial Bank (MCB) announced a $140m syndicated project finance facility to convert the facility to natural gas.

Read more »

Eni selects New Fortress Energy’s Fast LNG liquefaction technology for Congo FLNG

New Fortress Energy has executed a a Heads of Agreement (HoA) with Eni Congo for the deployment of its Fast LNG liquefaction technology off the coast of the Republic of the Congo for a period of 20 years. Under the agreement, NFE will deploy its innovative “Fast LNG” facility to produce up to 1.4 million metric tons per year of LNG from the associated gas fields of Nene Marine on Block Marine XII. The development of a floating LNG project has been on the table for several years in Congo and is finally gaining traction. A few weeks ago, Eni announced it was seeking to develop the project in two phases with two modular and flexible liquefaction plants. Phase 1 is expected to rely on a near-shore concept while Phase 2 would rely on an offshore concept. The production from Phase 1 is expected to start in Q2 of 2023. The project would both target zero gas flaring but also seek to valorise gas for the domestic power and industrial sectors and for the export market. Last December, NFE had also executed a non-binding Memorandum of Understanding (MoU) with the Islamic Republic of Mauritania for the development of the offshore Banda gas reserves into a new energy hub. Under the MoU signed with the Ministry of Petroleum, Mines and Energy, New Fortress Energy would also deploy its Fast LNG liquefaction technology to produce LNG for Mauritania’s domestic gas and power markets and for exports.

Read more »

NFE Signs MoU With Mauritania for Fast LNG and Gas-to-Power Project

Earlier this week, New Fortress Energy executed a non-binding Memorandum of Understanding (MoU) with the Islamic Republic of Mauritania for the development of the offshore Banda gas reserves into a new energy hub. The project could be commissioned as early as 2024 and would entail the production of natural gas, power, liquefied natural gas (LNG) and blue ammonia for the domestic and export markets. The Banda gas field was discovered by Woodside Energy back in 2002 but was never developed. Reserves are located 60km offshore Nouakchott and are estimated at 1.2 Tcf. Until recently, Tullow Oil was the operating partner of the Banda and Tiof fields, and an equity partner in the Chinguetti oil field were production ceased at the end of 2017. Tullow Oil is currently decommissioning the Chinguetti field and is fully abandoning the Banda and Tiof fields, where five wells and two side-tracks were drilled. Under the MoU signed with the Ministry of Petroleum, Mines and Energy this week, New Fortress Energy will deploy its Fast LNG liquefaction technology to produce LNG for Mauritania’s domestic gas and power markets and for exports. Natural gas will notably be supplied to the existing 180 MW Nouakchott Nord thermal power plant owned by state-utility Somelec, along with a new 120 MW gas-to-power plant. Nouakchott Nord was commissioned in 2015 and relies on 12 turbines with a capacity of 15 MW each, able to run on heavy fuel oil or natural gas. By developing the Banda gas reserves, Mauritania expects to switch its biggest power plant to cleaner fuels while expanding its power generation infrastructure. “The memorandum paves the way for the launch of the necessary technical and commercial feasibility studies for the development of the field and the construction of the new power plant, as well as commercial negotiations to reach the project’s contractual framework, including the power purchase agreement,” said the Ministry of Petroleum, Mines and Energy on its website.

Read more »

UTM Offshore signs $2bn MoU with Afreximbank for Nigeria’s first FLNG project

Nigerian marine and services group UTM Offshore and the African Export-Import Bank (Afreximbank) have signed a Memorandum of Understanding (MoU) to raise $2 billion for the development of Nigeria’s first floating liquefied natural gas (FLNG) project. The MoU was signed yesterday in Abuja by Julius Rone, Group Managing Director/CEO of UTM Offshore and Dr. Benedict Okey Oramah, President and Chairman of Afreximbank. “This is a landmark project that Afreximbank takes very seriously,” Afreximbank’s president said. The agreement paves the way for additional collaboration between UTM Offshore and the Afreximbank to support a future final investment decision (FID) on UTM’s FLNG project. The company has been studying and conceptualising the development of an FLNG in Nigeria since 2020. In February 2021, it received a License to Establish (LTE) from Nigeria’s former Department of Petroleum Resources (DPR) for the installation of an FLNG unit on oil mining lease (OML) 104. The block is operated by the joint-venture of Mobil Producing Nigeria (operator, 40%) and the state-owned Nigerian National Petroleum Corp. (NNPC, 60%) and contains the producing Yoho field. Preparations for the project are now in full swing and benefit from robust global and technical expertise. The pre-Front End Engineering Design (Pre-FEED) contract was awarded to JGC Corporation of Japan in May and completed in October. KBR was appointed Owners Engineer while global energy and commodities trader Vitol has also joined the consortium as off-taker for the LNG. “The UTM Offshore FLNG will be the first such project developed by an African company on the continent. It will also significantly contribute to the Nigerian government’s agenda of reducing the flaring of associated gas across our industry. As Africa’s FLNG industry grows, we are well positioned to offer attractive project economics by developing shallow water gas reserves, while bringing significant environmental benefits to our industry as a whole.” Julius Rone, Group Managing Director/CEO, UTM Offshore The project notably involves the development and financing of a 1.2m tonnes per annum FLNG facility with a capacity to process 176 MMscfd of natural gas and condensate. The unit would target the processing of associated gas currently flared in order to cut carbon emissions and monetise additional reserves for the domestic and global markets. UTM Offshore is pioneering the development of the FLNG facility in collaboration with LNG Investment Management Services (LIMS), a subsidiary of the state-owned Nigeria National Petroleum Corporation (NNPC). Details on the UTM FLNG can be found in the “Projects” section within your Hawilti+ research terminal.

Read more »