Gas to Power

Côte d’Ivoire steps up efforts to secure more gas supplies

Côte d’Ivoire has become home to one of Africa’s most resilient energy sector thanks to its gas and hydropower potential, whose development has provided baseload and reliable power for decades. The west African country currently relies on gas supplied by domestic fields for almost 70% of its electricity production. A little over a decade ago, access to electricity in Côte d’Ivoire stood at only 34%. Today, that rate has grown to close to 70%. But with offshore fields maturing and new gas turbines nearing commissioning, the country needs to find more gas to keep power stations working for the foreseeable future and secure electricity supply for end users. “Securing gas supply to keep the lights on in the future has become a serious concern for local authorities,” one executive told Hawilti during a working visit to Abidjan earlier this year. Gas-to-Power Capacity on the Rise Last year, the country added 180MW of gas-fired power generation capacity to its electricity grid after it expanded the Azito plant. At an official ceremony announcing the expansion of the plant, Côte d’Ivoire’s Minister of Mines, Petroleum and Energy Mamadou Sangafowa Coulibaly said the country aims to increase power generation capacity from its current 2,369MW to 4,000MW by 2025. To bring the country closer to that target, a new gas powered thermal-plant is under construction, with a capacity of 390MW. The Atinkou plant ties into government’s efforts to meet increasing local demand as well as exports to neighbouring countries. The Atinkou Gas Power Project is also designed to displace inefficient and old thermal plants. According to the Africa Development Bank, a development partner on the project, the new power plant, when completed, will be the most efficient gas power plant in Côte d’Ivoire and the West Africa region. Short-term options to boost domestic gas demand To secure more gas, Côte d’Ivoire is focused on maximizing production from existing fields, developing discovered marginal gas fields, and monetizing associated gas from large and upcoming offshore oil projects. Most of Côte d’Ivoire’s gas supplies come from CI-27, a license operated by Foxtrot International where production started in 1999. To increase output, the independent completed a 5-well drilling campaign in 2022. The country’s national oil company (NOC) PETROCI is also being put to the task. Earlier this month, it signed the production sharing contracts (PSC) for blocks CI-523 and CI-525, two licenses that hold the Ibex, Gnou, Kudu and Eland gas fields. When developed, these reserves could provide a steady domestic supply of 60 MMscf/d of natural gas over 16 years. First gas is expected in 2026. Eni’s newly discovered reserves at Baleine on Blocks CI-101 and CI-802 have also brought about some respite. The Italian major has found some 2.5 billion barrels of oil and 3.3 Tcf of gas, providing an opportunity for more domestic supplies. On August 2nd, it signed a gas supply agreement with Côte d’Ivoire to ensure that, as it develops oil reserves for the export market, gas is also reserved to meet local demand. “The signing of this gas sale and purchase contract is a breath of fresh air,” declared Côte d’Ivoire Energies (CI-ENERGIES) Noumory Sidibe during the signing ceremony. What’s next? To grow its gas sector, Côte d’Ivoire is hoping that exploration will yield additional discoveries. In early 2024, Foxtrot International will notably be conducting exploratory drilling on Block CI-12 with the Topaz Driller rig contracted from Vantage Drilling, in hopes to find more gas. But given growing gas demand, Côte d’Ivoire is also considering several import options, including pipeline and LNG. Discussions have been held with Ghana regarding a possible pipeline from its Western region, which houses most of Ghana’s gas receiving and processing infrastructure. Another option could come from the Nigeria-Morocco Gas Pipeline, whose route will cross Côte d’Ivoire. In June 2023, PETROCI was one of the companies that signed a memorandum of understanding (MoU) with Nigeria’s NNPC and Morocco’s ONHYM to reaffirm its commitment to the project.

Read more »

Opinion: Nigeria’s industry is rising to the twin challenge of decarbonisation and energy security

by Wale Yusuff, Managing Director of Wärtsilä in Nigeria Wale Yusuff, the Managing Director of Wärtsilä in Nigeria, explains how businesses operating in energy-intensive industries like cement or steel are investing in flexible engine technologies to secure reliable and efficient power while also setting the perfect stage to make good on their decarbonisation objectives. Nigeria is a major industrial hub. It is home to energy-intensive manufacturing businesses whose operations, and growth potential, are constrained by the weakness of the country’s electricity supply. To mitigate this, industrial companies have been building their own power generation capabilities, but the result has often been the reliance on expensive and polluting diesel generators. As such, the industrial sector represents one of the country’s largest sources of greenhouse gas emissions. In most places in Africa, the development of renewable energy capacity is a very competitive solution that industrials can adopt to lower their environmental impact and energy costs. But things aren’t as clear-cut in Nigeria. Most of its industrial activity is in the south, a region where wind and solar resources are often not available in the right quantity to make renewables competitive at today’s equipment prices. It leaves industrials with a twin challenge to meet. First and foremost, they need to secure their own reliable and affordable power capacity either by buying electricity from an independent power producer or by building their own “captive” plant. Second, they need to integrate decarbonisation in their overall energy strategy. Both objectives are not contradictory. By making smart technology choices, forward looking businesses like BUA Cement, African Foundries, Lafarge, Wempco, Nestle and Flour Mills have found a way to hit these two birds with one stone. Here is how. Securing a reliable supply of electricity Mitigating power generation risk is critical to Nigeria’s industrial growth. As one of the world’s largest producers of liquified natural gas (LNG), Nigeria has a strong interest to develop its utilization to power local industries. That’s why flexible engine power plants have emerged as the technology of choice for Nigeria’s industries. Fuel-flexible engine technology provides a great hedge against fuel supply risk as it can operate on multiple types of fuels, from gas to heavy or light fuel oil, and switch between fuels while operating. This fuel-flexibility is also a key enabler to the decarbonisation strategy of industrials, as engine power plants can be converted to run on sustainable fuels like biofuels and green hydrogen, ammonia, or methanol, when these become available. Thanks to their modular design, Wärtsilä engine power plants are easy to construct, fully scalable and can be deployed in phases. They have the flexibility to be ramped-up or down quickly to adjust to demand, they have a high operating efficiency even at partial load and are designed to cope with regular stops and starts. This very high operating flexibility is also what is needed for the future integration of intermittent renewable energy capacity to the power mix. What is more, they require much less water to function than competing power technologies, which is an important water conservation consideration in view of Nigeria’s long dry seasons. With all these attributes, flexible engine power plants offer a cost-effective solution to meet energy demand in the short term, and environmental objectives in the longer term. BUA Cement PLC, one of Nigeria’s largest cement producers, is one example of an energy intensive industrial company which has invested to secure its own flexible and reliable power supply and decrease its carbon footprint. As the demand for cement is increasing every year, BUA has taken advantage of the modularity of engine technology to increase its power capacity in stages. The company is currently installing a 70 MW power plant for the line 4 in its Sokoto cement plant, NW Nigeria. This is in addition to a 50 MW power plant commissioned two years earlier for the line 3 of the same cement plant. Future expansion plans include another 70MW for its OBU line 3 cement plant in Edo State SW by the end of 2023. The plants feature Wärtsilä 34 DF dual-fuel engines operating primarily with LNG and PNG, but with the flexibility to switch to an alternative fuel should there be interruptions to the gas supply, quality, or pressure. What is more, the operational flexibility of the Wärtsilä engines provides future-proofing advantages by enabling the potential integration of renewable energy further down the line. Paving the way for renewables Nigeria’s long term energy strategy has defined the rapid deployment of renewables and strengthening the power transmission network as key objectives. But it must also overcome the specific challenges of the tropical monsoon climate in the industrialized south of the country where the solar and wind potential is respectively 30% and 40% lower than in the hot and semi-arid conditions in the north. By investing in gas engine power plants, energy-intensive industries will not only decrease their carbon footprint, but they will also free up resources for the government to expand the transmission network enabling the entire country to benefit from the natural gas reserves located in the south and renewable resources in the north. Paras Energy sets an example of how this can work. Since installing a 132 MW Wärtsilä gas engine power plant in Ikorodu in Lagos State and Ogijo in Ogun State, Paras Energy is supplying the company’s steel production needs as well as providing power to the Nigerian grid to support over 20,000 homes annually. The company is now commissioning a 10 MW solar power plant in Suleja and a 5 MW solar rooftop system for commercial and industrial customers is under development. Flexible engine power plants represent a smart and future-proof investment for Nigeria’s energy intensive industries. They offer the efficient power capabilities needed to offset the shortcomings of the national power grid, strengthen their global competitiveness, and reduce their GHG emissions today and tomorrow. By working towards the country’s decarbonization targets, the smart energy investments made by industry will benefit the whole country.

Read more »

Gabon: Perenco takes step towards gas-to-power production at Mayumba

On April 6th, Perenco has signed a memorandum of understanding (MoU) with several public parties in Gabon towards the development of a 21 MW power plant at Mayumba in the country’s southern region. The agreement was signed by the Ministry of Petroleum and Gas, the Ministry of Energy and Hydraulic Resources, the Ministry of Economy and Recovery, the Ministry of Budget and Public Accounts, Perenco Oil & Gas Gabon (POGG) and the Gabon Power Company (GPC), entity of the Sovereign Fund of the Gabonese Republic (FSRG). The gas-to-power project includes a gas pipeline linking Perenco’s offshore gas fields to shore, a 21 MW power plant that can be expanded to 50 MW, a substation, a transmission line to Tchibanga, and a 20 kV distribution line to Mayumba and its surroundings. In its “Gas for Africa” report released in February 2023 with the International Gas Union, Hawilti reported that Mayumba was one of the pillars of Perenco’s future gas flare reduction strategy in Gabon. The independent operator is currently rolling out several gas monetisation projects in the country, including a 15,000 tonnes LPG plant at Batanga already under-construction, and an LNG export terminal planned at Cap Lopez. The company already supplies gas to Gabon’s power plants in the capital Libreville and in the oil city of Port Gentil, both located in the north of the country. Gas supplies rely on a 400-km offshore gas network developed in 2006 to monetise flare gas and make feedstock available to power stations.

Read more »

Senegal: Ndar Energies to build a 250 MW gas-to-power plant in Saint Louis

On Wednesday, the African Export-Import Bank (Afreximbank) and Senegalese power company Ndar Energies S.A. signed a Framework Agreement for the development of a 250 MW combined cycle gas-to-power plant in Senegal. The agreement covers the financing, design, construction, and operation of the €430m facility that will be built in Saint Louis in northern Senegal, next to the border with Mauritania. Afreximbank will act as the Lead Project Developer and Mandated Lead Arranger. “The project, which possesses strong climate finance credentials, is in line with Afreximbank’s strategy to support the deployment of just energy transition solutions across Africa,” the bank said in a statement. Senegal is significantly expanding its gas-to-power capacity as domestic gas expects to become available in the coming years from offshore fields operated by bp. Earlier this month, President Macky Sall inaugurated the new 120 MW Malicounda power station which will ultimately run on gas and was co-developed by Africa50. Another 300 MW power plant has also been under construction in Cap des Biches in Dakar by West African Energy since March 2021.

Read more »

Senegal: inauguration of the new 120 MW Malicounda power plant

President Macky Sall has inaugurated the new 120 MW Malicounda power plant on February 11th. The project is the result of a development agreement signed in 2017 between Africa50 and state utility Senelec to select a strategic sponsor to develop the facility under a Build, Own, Operate and Transfer model (BOOT). Independent power producer (IPP) Melec Power Gen, part of the Lebanese Matelec Group, was eventually selected, making Malicounda its third power station in the country following the 67.5 MW Kounoune station commissioned in 2008 and the 115 MW Tobene station commissioned in 2016. Malicounda was developed a cost of €154m and has increased Senegal’s generation capacity by 8%. Its construction started a few years ago after the setting up of a €75m (FCFA 50bn) bridge loan with the Orabank Group and a few regional partners. The senior debt was ultimately provided by the African Development Bank (AfDB), acting as the mandated lead arranger, the Arab Bank for Economic Development in Africa (BADEA), the West African Development Bank (BOAD) and the OPEC Fund for International Development (OFID). The power plant will initially consume diesel and HFO but has been designed to switch to natural gas as soon as gas becomes available from Senegal’s domestic offshore fields

Read more »

Côte d’Ivoire adds 180 MW to flagship gas-to-power plant in Abidjan

On Monday this week, Côte d’Ivoire added another 180 MW to its Azito gas-to-power complex in Yopougon, Abidjan. The facility has been under expansion since 2019 under the Azito 4 project, which includes the new 180 MW gas turbine inaugurated this week, and a 74 MW steam turbine. Azito 4 represents an investment of some €330m and is expected to produce about 2 000 GWh every year upon completion. It follows several phases of expansion since the project was initially conceived in the late 1990s under a 24-year concession agreement. The facility is equipped by GE turbines, including the new GT13E2 2012 MXL2 turbine commissioned this week, which is now the biggest one installed in the country. Azito successfully monetizes domestic gas produced offshore Côte d’Ivoire by Foxtrot and national oil company PETRO-CI. Its conversion to a combined-cycle facility in 2015 notably helped in reducing carbon emissions by almost 450,000 tCO2e/year. Details on Azito’s history, operational and sustainability performances are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

AG&P delivers world’s first modular FSRU in Senegal

GAS Entec, a subsidiary of Singapore-based Atlantic Gulf & Pacific International (AG&P) has completed the conversion of a 125,000 m3 LNG carrier for KARMOL, the joint-venture of Turkey’s Karpowership and Japan’s Mitsui OSK Lines. The converted 84 MMscf/d modular floating storage and regasification unit (M-FSRU) is a first in the world and will be delivering LNG to the 236 MW Karadeniz Powership Aysegul Sultan in the Port of Dakar. “Gas Entec’s proprietary, patented RegasTainer® technology offers flexibility to scale the capacity of the FSRU up and down from 15 to 300 mmscfd with minimized downtime, allowing the vessel to be repurposed as power requirements grow in a market,” AG&P said in a statement today. Karpowership’s Ayşegül Sultan power barge was relocated offshore Dakar from Ghana in 2019. It has run on heavy fuel oil (HFO) until the arrival of the KARMOL LNGT Powership Africa FSRU in 2021, and currently represents 15% of Senegal’s electricity supply. In 2021, the Mauritius Commercial Bank (MCB) announced a $140m syndicated project finance facility to convert the facility to natural gas.

Read more »

NFE Signs MoU With Mauritania for Fast LNG and Gas-to-Power Project

Earlier this week, New Fortress Energy executed a non-binding Memorandum of Understanding (MoU) with the Islamic Republic of Mauritania for the development of the offshore Banda gas reserves into a new energy hub. The project could be commissioned as early as 2024 and would entail the production of natural gas, power, liquefied natural gas (LNG) and blue ammonia for the domestic and export markets. The Banda gas field was discovered by Woodside Energy back in 2002 but was never developed. Reserves are located 60km offshore Nouakchott and are estimated at 1.2 Tcf. Until recently, Tullow Oil was the operating partner of the Banda and Tiof fields, and an equity partner in the Chinguetti oil field were production ceased at the end of 2017. Tullow Oil is currently decommissioning the Chinguetti field and is fully abandoning the Banda and Tiof fields, where five wells and two side-tracks were drilled. Under the MoU signed with the Ministry of Petroleum, Mines and Energy this week, New Fortress Energy will deploy its Fast LNG liquefaction technology to produce LNG for Mauritania’s domestic gas and power markets and for exports. Natural gas will notably be supplied to the existing 180 MW Nouakchott Nord thermal power plant owned by state-utility Somelec, along with a new 120 MW gas-to-power plant. Nouakchott Nord was commissioned in 2015 and relies on 12 turbines with a capacity of 15 MW each, able to run on heavy fuel oil or natural gas. By developing the Banda gas reserves, Mauritania expects to switch its biggest power plant to cleaner fuels while expanding its power generation infrastructure. “The memorandum paves the way for the launch of the necessary technical and commercial feasibility studies for the development of the field and the construction of the new power plant, as well as commercial negotiations to reach the project’s contractual framework, including the power purchase agreement,” said the Ministry of Petroleum, Mines and Energy on its website.

Read more »

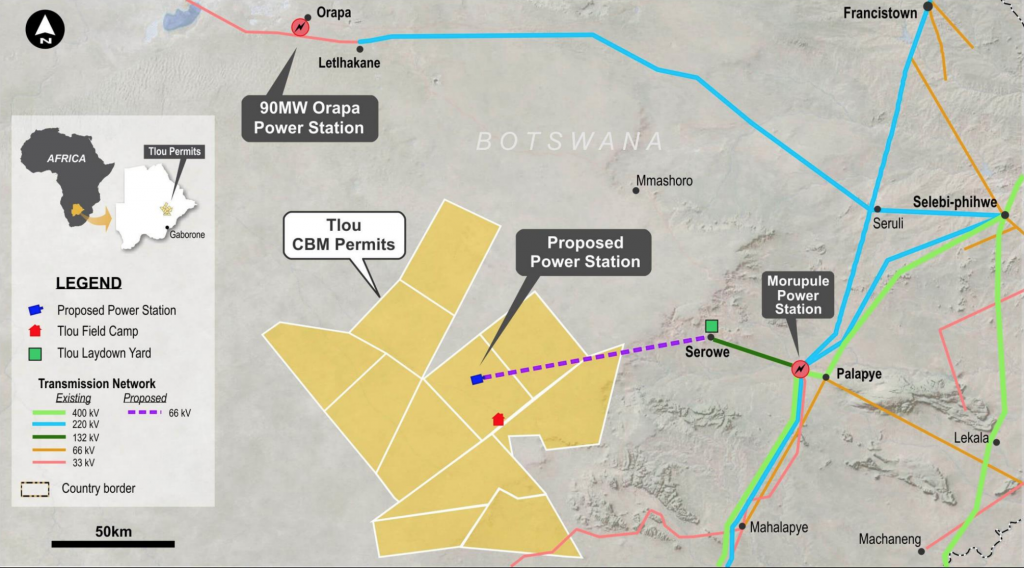

Tlou Energy secures institutional money for Lesedi CBM-to-power project in Botswana

Tlou Energy has announced today the signing of a BWP 50m ($5m) convertible loan agreement with the Botswana Public Officers Pension Fund (BPOPF). The note has a maturity of five years and interest rate of 7.75% per annum. The agreement also includes an equity investment by BPOPF. Preliminary terms include a further BWP 50m ($5m) equity investment post 1 July 2022. “The funds are planned to be used to finance construction of transmission line infrastructure to connect the Lesedi Project to the Botswana Power Corporation power grid and to fund installation of generation assets and ancillary costs to facilitate power generation and sale of electricity,” Tlou Energy said in a statement.

Read more »

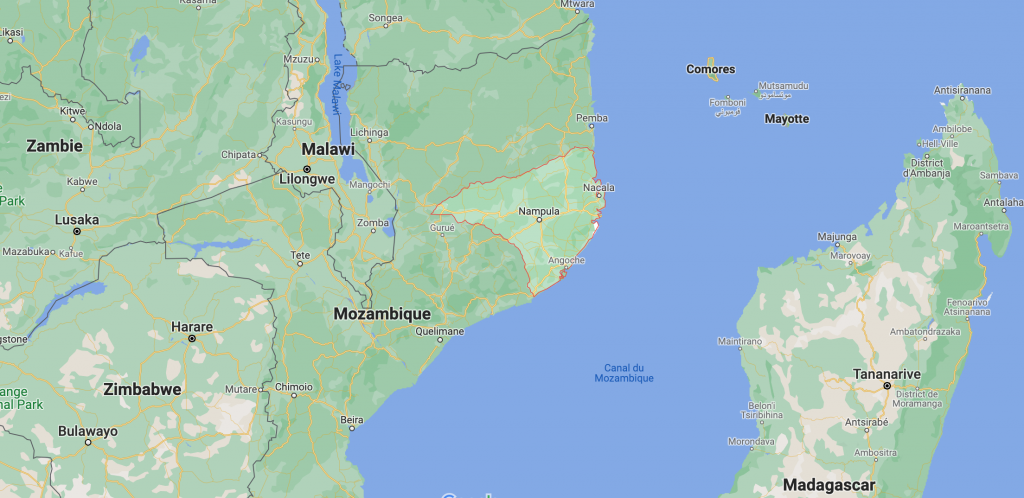

GL Africa Energy signs agreement for a new 250 MW LNG-to-power plant in Mozambique

Janus Continental Group’s subsidiary Great Lakes Africa Energy (GL Africa Energy) has signed yesterday a Concession Agreement with Mozambique’s Energy Minister to finance, build and operate a 250 MW LNG-to-power plant in the country’s Nampula province. “The deal signals the start of a three-part phased investment. Initial phase will create 50MW capacity within 16 months. The second and third phases will add 200MW in total and will be completed within 24 months,” GL Africa Energy said in a statement shared with Hawilti. This will be GL Africa Energy’s biggest investment to date, developed under a 30-year public-private partnership with state-utility Electricidade de Moçambique (EDM) as the off-taker. Electricity generated will then supply the entire Nacala corridor in Northern Mozambique. The $400m project has been in preparations for a while and was already subject to the signing of a Memorandum of Understanding (Mou) between both parties in May 2018. This had notably followed the result of Mozambique’s Rovuma Basin domestic gas tender, the results of which were announced in January 2017. The facility will be supplied from gas coming from Mozambique’s Rovuma Basin, where Eni’s 3.4 million tonnes per annum (mtpa) Coral South FLNG is expecting to achieve first gas next year. This is also where TotalEnergies is developing a 12.88 mtpa onshore LNG export terminal, where it expects to resume works in 2022 following the declaration of Force Majeure earlier this year. While the Coral South FLNG does not have a domestic gas allocation, Mozambique LNG has 100 MMscfd allocated to the domestic market. A Growing Gas-to-Power Market Gas-to-power in Mozambique is a relatively new industry but growing rapidly. The country’s first facilities emerged from the monetizing of royalty gas from the Mozambique-Secunda Gas Pipeline that has been exporting onshore gas to South Africa since 2004. In 2015, three facilities were commissioned including the 175 MW Central Térmica de Ressano Garcia, or CTRG, currently owned by Azura Power and EDM, Gigawatt’s 100 MW Ressano García facility and Kuvaninga’s 40.29 MW gas-to-power plant. EDM’s 110 MW Maputo facility followed in 2018. More recently, Globeleq has embarked on the development of the 420 MW Central Térmica de Temane (CTT) to monetise additional gas from Temane and Pande onshore Mozambique. The project is expected to be commissioned by 2025 and has already secured funding and approvals. Meanwhile, a consortium of TotalEnergies, the Gigajoule Group and Matola Gas has embarked on a very ambitious and integrated gas-to-power project in Maputo. It notably includes the deployment of a floating, storage and regasification unit (FSRU) in the city’s harbour to import gas and support the development of the new 2,000 MW Central Térmica de Beluluane (CTB). FID is expected in 2022, with Phase 1 targeting 500 MW. Details on Mozambique’s gas-to-power projects are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Gabon exposes clear vision on what to do with its natural gas

Gabon is thought to hold anywhere between 3 to 5 trillion cubic feet (Tcf) of gas, although the country remains a small gas producer. To date, most of its gas has remained on the ground or flared – with only small quantities monetised domestically for power generation in Libreville and Port Gentil. But as Gabon implements an ambitious “Green Gabon” environmental policy and seeks to diversify its economy, the country wants to cut routine flaring altogether and monetise it for the benefits of its industries, households, and economy. The recent Gabon Oil, Gas & Energy Summit organized by IN-VR in Libreville last October notably exposed the alignment of most parties on the need to monetise gas instead of flaring it. A New Gas Strategy in the Making To achieve its gas ambitions, Gabon is currently working on a new Gas Master Plan with Wood Mackenzie and the World Bank’s Global Gas Flaring Reduction Partnership (GGFR). The plan will have four major ambitions: reduce gas flaring, increase energy security, expand access to affordable energy and attract investments into gas projects. Gabon’s flared gas currently emits about 2,244,500 tonnes of CO2 per year, enough to generate 500 MW of power. Natural gas also features prominently within the country’s 2021-2023 Plan to Accelerate Transformation (PAT), which includes a dedicated Gas Task Force headed by former Gabon Oil executive Yann Pierre A. Livulibutt Yangari. “Our gas strategy is targeting actions across the whole value-chain. In upstream, we want to get operators to explore for gas and stop considering it as a risk. In midstream, we want to see flared gas being monetised for the benefits of the Gabonese economy. Finally in downstream, we want to improve gas supplies especially of liquefied petroleum gas (LPG), compressed natural gas (CNG) and liquefied natural gas (LNG),” Yangari said during IN-VR’s summit. As it stands, Gabon intends to primarily monetise flared gas to generate power, manufacture urea and produce methanol. These are the major industries identified based on existing gas reserves and technology available from existing investors and operators in the country. Once these are developed, hopes are that by-products would follow, especially when it comes to LPG, CNG (Autogas) and micro-LNG. Source: DGEPF “We are working on supporting the development of a gas-based economic network to support local content development, promote technology adoption and support industrialisation,” Yangari added. While Gabon has not discovered enough gas reserves to justify the development of more significant industries like LNG for export or gas-to-liquids, the country remains hopeful. Its 12th Licensing Bid Round has resulted in the award of new exploration blocks, and upcoming drilling campaigns could result in new gas discoveries supporting further gas developments in the medium-term. To justify the investment, Gabon is putting forward its growing industrial base driving demand for both power and gas. Last September, the Gabon Power Company (GPC) notably signed a landmark Concession Agreement with Wärtsilä for the development, supply, construction, operation, and maintenance of a new 120 MW gas-to-power project in Owendo, next to the capital city of Libreville. But beyond just the power sector, Gabon wants to provide gas to its mining, forestry, agro-industry, and steel industries. In parallel, its logistics network is expanding with railways and maritime industries both positioned to be potential off-takers sooner than later. An Opportunity for Small-Scale Gas Projects Gabon’s vision relies on the monetization of gas into CNG for transport and micro-LNG for industries. A key strategy is to expand the country’s CNG network but use micro-LNG for any remote industries located over 400km from producing fields, especially mining industries. To support such expansion, the country is seeking investors across several projects such as LPG plants, LNG and CNG plants, LNG and CNG storage, onsite regasification and bi-fuel conversion. Chief amongst them is the need to secure 30,000 cubic metres of additional butane storage capacity, up from only 4 to 5,000 cubic metres now. Source: DGEPF Port Gentil features prominently within that vision as a pilot city to grow the CNG industry. It is there that Perenco already runs a private gas retail station for 40 of its own vehicles. Now, Gabon wants to grow the market by constructing public CNG stations in partnership with oil marketers and develop a new pricing structure for CNG. The aim is clear: reduce petroleum products imports while generating additional revenues from domestic gas. Perenco Takes the Lead Perenco will be a key actor of that transition to gas. The operator is the country’s sole commercial gas producer and currently supplies gas feedstock to the power stations of Port Gentil and Libreville. In fact, 100% of Port Gentil’s power relies on Perenco’s gas while 70% of Libreville’s power is generated from the operator’s gas supply. “We have invested $500m into the development of a 400km onshore and offshore gas gathering system in Gabon that supplies gas to power plants but also key industries such as Sobraga. In the process, we created 150 jobs,” Director General Adrien Broche said during the IN-VR Summit. Perenco is now increasing its investments and leveraging on its existing infrastructure to commission a 10 to 15,000 tonnes per annum (tpa) LPG plant in Batanga by 2023. Batanga is currently the cornerstone of its gas business and is equipped with enough compressors to compress gas to over 100 bars so it can be transported across the country. “The Libreville and Port Gentil power stations currently represent an off-take of about 40 MMscfd,” Broche explained. “While only half of that capacity was coming from flared gas, we are installing additional compression capacity so all feedstock supplied to power plants comes from previously flared gas. We have installed two onshore compressors this year and are now expecting additional ones for offshore operations. By mid-2022 or early 2023, all gas we send onshore for power generation will come from previously burned resources,” he added. The Need for an Industry and Policy Consensus But to furter monetise gas and create jobs, Gabon must first find a way to aggregate

Read more »

BW Energy moves to develop giant Namibian gas field first discovered in 1974

BW Energy has just signed an agreement with Aquadrill LLC to acquire the semisubmersible drilling rig “Leo” for a total consideration of $14m. Surprisingly, the rig is not to be used for the company’s flagship Gabonese nor Brazilian assets, but for the development of the Kudu gas field offshore Namibia. The acquisition of the “Leo” drilling rig follows indeed a new revised development plan for Kudu under which BW Energy plans to use a repurposed semisubmersible drilling rig as a Floating Production Unit (FPU). 1.3 Tcf of Gas Within Namibia’s Sole Production License Despite about 1.3 trillion cubic feet (Tcf) of gas discovered and its ability to transform Namibia’s energy sector and resolve the country’s energy crisis, the Kudu gas field has remained undeveloped since its first discovery by ChevronTexaco in 1974. Located 170 km off the coast of Namibia, Kudu has been subject to substantial drilling with seven appraisal wells drilled since its discovery: two by Swakor in 1987 and 1988, four by Shell in the 1990s, and one by Tullow Oil in 2007. The field has had several operators as well since it was discovered: ChevronTexaco was followed by Swakor in the 1980s then Shell in the 1990s, then Energy Africa in the 2000s before the company was acquired by Tullow Oil in 2004 which led to the issuance of Production License 001 in 2005. In the more recent past, Gazprom and national oil company NAMCOR took over the field for a short while in 2010 and 2011 (Production License 002) before operatorship was given back to Tullow Oil in 2011 (Production License 003). The British multinational finally withdrew with its Japanese partners in 2014, and BW Energy has been operator since 2017 with a firm intention to bring the project to final investment decision (FID). From the inability of parties to agree on a gas price to delays in obtaining governmental support packages and finalising costs, several factors have contributed over the years to constantly reschedule the project’s FID. BW Energy Take Over and Revives Namibia’s Gas Ambitions When BW Energy acquired the field in 2017, Kudu was estimated to contain 1C contingent resource of 755 billion standard cubic feet (Bscf), with 2C contingent resources estimated at 1.33 Tcf and 3C ones at 2.3 Tcf. The development of the field still calls for the establishment of an integrated upstream-midstream-downstream venture to produce gas via a floating production unit (FPU) before exporting it to shore to generate electricity. While initial plans envisioned a gas-to-power plant of up to 885 MW, the facility is expected to finally have half that capacity if commissioned. The latest Contingent Resources Report prepared by ERC Equipoise Ltd for BW Energy in January 2020 notably estimates gross contingent gas resources at 587 Bscf, enough to justify a 440 MW gas-to-power plant. Full details on the Kudu Gas Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Gabon on the move: what you need to know ahead of the Gabon Oil, Gas & Energy Summit in Libreville this week

Nested in the Gulf of Guinea, Gabon has built itself a reputation of environmental stewardship and sustainable development of its natural resources. The country of less than 2.5m notably hosts Africa’s largest forest elephant population and is covered at 88% by rainforest. Despite being an established offshore hydrocarbons province, Gabon is steadily diversifying away from oil. A public-private partnership with ARISE IIP resulted in the establishment of one of Africa’s most modern and efficient free zones now serving a growing industrial and mining base. The country is in fact one of the world’s top producers of manganese, of which it exported almost 4m tonnes in the first half of the year. Gabon has also successfully industrialised its wood industry to become a recognised exporter of timber: between January and June 2021, the country produced over 1 million m3 of logs. Gabon’s economy remains fairly diversified compared to that of its African neighbours. Its oil & gas sector’s contribution to the GDP stood at 37.7% in 2020 and represented 33% of government revenues last year. Oil exports also accounted for 70% of total export revenues. Maintaining the pace of investment in the country’s hydrocarbons value-chain remains a priority for the government, especially as it seeks to develop gas-based economies and use oil revenues to invest in sustainable infrastructure and the conservation of its environment. A Focus on Reversing Production Decline Gabon is member of the Organisation of Petroleum Exporting Countries (OPEC) and produced an average of 183,000 barrels of oil per day (bopd) between January and September 2021. This makes it sub-Saharan Africa’s fourth largest producer, behind Nigeria, Angola and Congo-Brazzaville and more or less at par with Ghana. Production has been in decline for several years and has stagnated in the recent past. Gabon launched its 12th Licensing Bid Round before Covid19, which it is just concluding now. The round generated relatively strong interest given market dynamics, and award letters started being issued this month with BW Energy provisionally securing two blocks along with partners Panoro Energy and VAALCO Energy. Source: DGEPF The award of new exploration acreage is much needed in order to encourage seismic acquisition and exploratory drilling and ultimately maintain production in the medium-term. Exploration has so far been a miss this year, with BW Energy’s Hibiscus Extension appraisal well (DHIBM-2) encountering water in the first half of the year, and its Hibiscus North exploration well (DHBNM-1) failing to deliver on pre-drill resource estimate in July. An Independents’ Market Gabon is an independents and national oil companies (NOCs)’ game. Shell Gabon sold all its assets in the country to Assala Energy in November 2017, and Total Gabon sold seven of its non-operated mature fields and operatorship of the Cap Lopez Oil Terminal to Perenco in July 2020. Beyond Assala Energy and Perenco, Gabon’s upstream sector is dominated by Maurel & Prom, VAALCO Energy and BW Energy along with a few NOCs such as Petronas. TotalEnergies remains the only IOC still operating upstream assets in the country. Gabon continues to offer significant opportunities for independents, both onshore and offshore. In February 2021, Panoro Energy acquired Tullow Oil’s 10% working interest in BW Energy’s Dussafu Marin Permit. A New Strategy to Monetise Domestic Gas Gabon has been working for a few years on a new strategy to monetise gas to generate additional electricity and develop new gas-based industries. The move benefits from significant political will and support and is one of the key pillars of the country’s new three-year plan over the 2021-2023 period, dubbed Plan to Accelerate the Transformation (PAT). Because Perenco represents most of the country’s operated gas production, it will play a major role in the development of Gabon’s domestic gas market. The company completed this year studies and plans for the new 10,000 metric tonnes Batanga LPG plant, where construction is expected to start before the end of the year. In July 2019, Gabon’s Ministry of Petroleum, Gas and Mines had also signed an agreement giving the Olowi Field to Perenco as its new operator. The field was developed between 2005 and 2018 by Canadian Natural Resources and is now to be redeveloped under an integrated gas project. Source: DGEPF Finally, an expanding gas industry will benefit the power sector. Gabon already runs several gas-to-power facilities and in September 2021, the Gabon Power Company (GPC) signed a landmark Concession Agreement with Wärtsilä for the development, supply, construction, operation, and maintenance of a new 120 MW gas-to-power project in Owendo, next to the capital city of Libreville. A Diversifying Energy Basket Beyond gas, Gabon is also expanding its energy sector with the development of its solar and water resources. Several hydropower plants are currently being developed, When it comes to hydroelectricity, Meridiam and the Gabon Power Company successfully reached financial close on the 35 MW Kinguélé Aval in July this year. Additional facilities include the 15 MW Dibwangui hydropower plant and the 73 MW Ngoulmendjim hydropower plants, whose power purchase agreements (PPA) were signed with Eranove in 2018. Solar energy is also making its entry into the country’s grid with the signing last August of a contract with the Turkish group Desiba Energy for the construction of a 20 MW solar power plant in Doubou, in the province of Ngounié. To find out about investment and business opportunities in Gabon, register for IN-VR’s Gabon Oil, Gas & Energy Summit hybrid conference taking place in Libreville and online between October 20th-22nd. More information at https://www.in-vr.co/gabon. All details on ongoing and future projects across Gabon’s energy sector are available within your Hawilti+ research terminal.

Read more »

Tlou Energy signs PPA with Botswana Power Corporation – takes one more step towards Lesedi gas-to-power project

Tlou Energy has signed this morning a 10 MW Power Purchase Agreement (PPA) with the Botswana Power Corporation (BPC) under which BPC will purchase up to 10 MW of power generated at the company’s Lesedi power project. The PPA is for an initial five-year term and will help Tlou Energy in reaching financial close for Phase 1 of the project, expected to cost $10m. A Pioneering Project for Botswana’s CBM Industry Tlou Energy has been working on developing Botswana’s coal-bed methane (CBM) reserves to generate electricity since its incorporation in 2009. Now listed on the AIM, ASX and BSE, the company is focusing on the development of three major project areas in Botswana: Lesedi, Mamba and Boomslang. Lesedi is a lot more advanced and is being developed as a scalable and hybrid solar and CBM gas-to-power project. It has in fact been producing gas for several years now from the Selemo project, though in small quantities. That gas has been used since 2017 to replace diesel within the generators on site. Lesedi remains an extremely attractive venture because of continued power deficit in Botswana, and continued reliance on coal-based electricity generation and imports. By burning coal and diesel, and importing significant amount of electricity from South Africa, Botswana spends on average $100m every year on securing energy for its industries and households. In contrast, Lesedi is one such project with the ability to offer a cheaper and cleaner solution from a fully local resource base. Two Phases Requiring $30m The Lesedi project is now being developed in two phases. Phase one involves the construction of the 100km transmission line from Lesedi to Serowe, which will act as the backbone for any monetisation of electricity produced from CBM at Lesedi. At a cost of $10m, it also involves the installation of transformers and generators, and the establishment of a grid connection. Initial electricity generation in phase one is proposed to be up to 2 MW. It will then be followed by phase two, at a cost of about $20m, targeting expansion from 2 MW to 10 MW and involving drilling of additional gas wells and the purchase of additional electricity generators. Any further expansion beyond 10 MW will then rely on project revenues and debt from the first two phases. Botswana’s First Carbon Neutral Baseload Power Project? In February 2021, Tlou Energy announced it was working towards the goal of being the first carbon neutral baseload power project in Botswana by further advancing land acquisition for carbon sequestration. The company’s plans to combine gas, solar and carbon sequestration at Lesedi make the project a truly unique one for Africa and could result in the supply of carbon neutral power to significant regional power consumers such as the Orapa diamond mine operated by Debswana and located north of Tlou’s gas fields. Full details on the Lesedi Hybrid CBM and Solar Power Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Nigeria’s NNPC has broken ground on 50 MW emergency power project in Borno State

A groundbreaking ceremony was held over the weekend for the 50 MW Maiduguri & Environs Emergency Power Project (MEPP), in presence of Borno State Governor, Prof. Babagana Umara Zulum and the NNPC Group Managing Director Mallam Mele Kyari. The contract for the project had been signed last month with the China Machinery and Engineering Corporation (CMEC) and GE, acting respectively as EPC contractor and supplier of the plant’s gas turbines.

Read more »

Gabon signs Concession Agreement for new 120 MW gas-to-power plant

Yesterday, the Gabon Power Company (GPC) signed a landmark Concession Agreement with Wärtsilä for the development, supply, construction, operation and maintenance of a new 120 MW gas-to-power project in Owendo, next to the capital city of Libreville. Wärtsilä will jointly lead the project with the GPC, a subsidiary of Gabon’s sovereign wealth fund FGIS via a new joint-venture called Orinko S.A. Under the agreement signed yesterday, Wärtsilä will build the plant under a full Engineering, Procurement, and Construction (EPC) contract and will then operate and maintain it under a long-term 15-year Operation and Maintenance (O&M) agreement. The EPC contract and the O&M agreement will be signed in 2022 with Orinko S.A. When commissioned, the plant will supply electricity to Société d’Energie et d’Eau du Gabon (SEEG), the Gabonese utility, under a 15-year Power Purchase Agreement. Gabon is currently looking at monetizing its gas across several industries, including power generation. The country already runs several gas-to-power facilities, including the 128 MW Owendo plant, the 105 Port Gentil plant and the 75 MW Alenakiri plant. Most plants are supplied in domestic gas by Perenco. The independent delivers gas on land and at sea through a 450km network of high-pressure pipelines and currently ensure the transport and delivery of 50 MMscfd of gas to the power plants of Port-Gentil and Libreville. The new gas-to-power plant with Wärtsilä also falls within Gabon’s ambition to increase power generation capacity across the country. In July this year, the GPC and Meridiam had already successfully reached financial close for the 35 MW Kinguélé Aval hydropower plant.

Read more »