Natural Gas

NNPC and TotalEnergies announce $550m investment in Nigeria’s Ubeta Gas Field

The Nigerian National Petroleum Corporation and TotalEnergies have announced a $550 million investment decision for the development of the Ubeta Field, a key onshore gas project expected to provide feedstock to Nigeria LNG – Africa’s biggest LNG export terminal. The project is located within OML 58, a TotalEnergies-operated onshore license that frequently suffers production disruptions due to pipeline vandalism and crude theft. The Ubeta field, discovered in 1964 and located northwest of Port Harcourt in the Niger Delta, is projected to produce about 350 million standard cubic feet (MMscf/d) of gas and 10,000 barrels of associated liquids daily. This development is expected to contribute significantly to the supply for NLNG’s Train 7. “Ubeta is the latest in a series of projects developed by TotalEnergies in Nigeria, most recently Ikike and Akpo West. I am pleased that we can launch this new gas project which has been made possible by the Government’s recent incentives for non-associated gas developments,” TotalEnergies’ Senior Vice President for Africa, Exploration & Production, Mike Sangster, said in a company statement. “Ubeta fits perfectly with our strategy of developing low-cost and low-emission projects, and will contribute to the Nigerian economy through higher NLNG exports.” At the official signing event at NNPC Towers, Group CEO Mele Kyari expressed appreciation for the Tinubu administration’s support in fostering a conducive fiscal environment that has been instrumental in reaching this significant FID. “The Presidential Executive Order is instrumental to us getting to this significant milestone, and we are now seeing the impact of the policy,” Kyari said. Slated for a 2027 start-up, the Ubeta gas condensate field in OML58 will be developed with a six-well cluster connected by pipeline to the existing Obite treatment plant. The development plan includes a 5 MW solar plant and electrification of the drilling rig to reduce carbon intensity. TotalEnergies and NNPC are also focusing on local content, with more than 90% of manhours expected to be worked locally. The Ubeta Field’s FID marks a significant step in NNPC’s ongoing efforts, supported by the executive branch, to address the challenges that have historically hindered foreign investment in Nigeria’s oil and gas industry. The project is expected to stimulate economic growth, create job opportunities, and generate substantial value for various stakeholders.

Read more »

Private sector steps up efforts to expand Nigeria’s downstream gas infrastructure

Nigeria’s private sector is driving the expansion of the country’s downstream gas infrastructure in partnership with state-owned NNPC Ltd, with companies like Tetracore Energy Group and Axxela recently launching new compressed natural gas (CNG) and liquefied natural gas (LNG) facilities. Tetracore Energy Group has commissioned a new CNG facility in Ogun State, with a capacity of 3.1 million standard cubic feet per day (mmscf/d). The facility will support gas availability along Nigeria’s Western-Southern corridor, where some of the country’s biggest industrial clusters are located. The facility is expandable to 6.2 mmscf/d, providing room for expansion as demand for gas grows. In addition, Tetracore broke ground on a small-scale LNG plant, which will supply gas to industrial and power customers in Nigeria’s Southwest, South-South, Southeast, and Northern markets. “Tetracore is investing approximately $40 million into the future LNG plant where we are breaking ground today, with commissioning expected at the same time next year,” CEO of Tetracore Energy Group, Kunle Williams, said during a grand ceremony in Ogun State on June 7th. Last week, NNPC and Axela commissioned a CNG plant in Lagos, with a capacity to deliver 5.2 mmscf/d of gas per day, serving around 3,700 cars daily and supplying gas to industries and other companies. The partners also announced plans to build six additional CNG service plants to expand access to alternative fuel for cars and industries. Tetracore and Axxela are representative of increased private sector participation within Nigeria’s midstream and downstream gas space. Seplat Energy, one of the country’s leading independent operators, is currently commissioning the 300 MMscf/d ANOH gas plant, while NIPCO Gas and NNPC have agreed last year to invest in the development of several CNG stations across the country,. The private sector’s investment in gas infrastructure is crucial for Nigeria’s energy and industrialization landscape, as it enables the efficient utilization of natural gas for various sectors, including transportation, power generation, and industrial applications. Nigeria is pivoting toward natural gas as an alternative fuel after eliminating a widely used but expensive petrol subsidy, resulting in a sharp increase in pump prices. The government aims to reduce costs and promote clean energy adoption in Africa’s leading oil-exporting nation by transitioning to gas.

Read more »

Axxela’s new gas plant to expand Nigeria’s gas infrastructure following bond success

Axxela Limited, a leading African gas and power company owned by Helios Investment Partners and Sojitz of Japan, has announced a Final Investment Decision to develop a 50 million standard cubic feet per day (MMscf/d) gas processing plant in Delta State, as it pushes towards sustainable energy solutions in Nigeria. This decision is bolstered by Axxela’s successful ₦16.4 billion bond issuance earlier this month, which was oversubscribed by 109 percent. The announcement comes as Axxela continues to expand its footprint in the energy sector, following last year’s agreement with BUA Group, one of Africa’s largest conglomerates, and CIMC ENRIC, a global leader in the energy equipment industry, to build a 700-ton-per-day mini liquefied natural gas (LNG) project. The new gas processing plant, expected to begin operations by the end of 2024, will start with a 12 MMscf/d modular unit and is designed for rapid expansion, with the potential to increase the plant’s output to 50 MMscf/d within 18 months. It is a key part of Axxela’s strategy to support the Nigerian government’s Decade of Gas initiative and to enhance domestic gas utilization. Strategically located in OML 152, the gas processing plant is expected to serve as a central processing hub for surrounding oil & gas operators, with the potential to transform gas flaring into a valuable economic resource, and significantly reduce CO2 emissions. “We are positioning to develop requisite infrastructure for natural gas processing and last mile distribution that creates market access for at least 20% of Nigeria’s gas demand,” Axxela’s Director of Business Development, Franklin Umole, said in a company statement. “Over the past two decades, we have been at the forefront of natural gas advocacy, and this project is a further reaffirmation of our dedication to gas infrastructure development and our vision to deliver innovative energy solutions across Nigeria and Africa.’’ In preparation for the project, Axxela has secured a long-term feedstock supply agreement with a leading local upstream company and established equipment supply arrangements with top-tier Original Equipment Manufacturers (OEMs). Upon completion, the processed gas will support various market segments, including Compressed Natural Gas (CNG) for vehicles, industrial feedstock, and decentralized power solutions, marking a significant step towards energy security and economic growth in Nigeria. Boost from successful bond issuance In a related financial achievement, Axxela recently raised ₦16.4 billion in an oversubscribed bond issuance, despite challenging economic conditions marked by rising interest rates and limited market liquidity. The funds will be instrumental in realizing the gas plant project. “This is a significant indicator of increasing investor confidence in our company’s reputation, brand, and performance,” CEO at Axxela Bolaji Osunsanya said. “The bond proceeds will support the development of our growth projects, signifying the importance of local and international capital markets in the development of critical infrastructure.” With the FID and successful bond issuance, Axxela looks to advance Nigeria’s gas infrastructure, support the energy transition, and meet the increasing demand for cleaner energy solutions.

Read more »

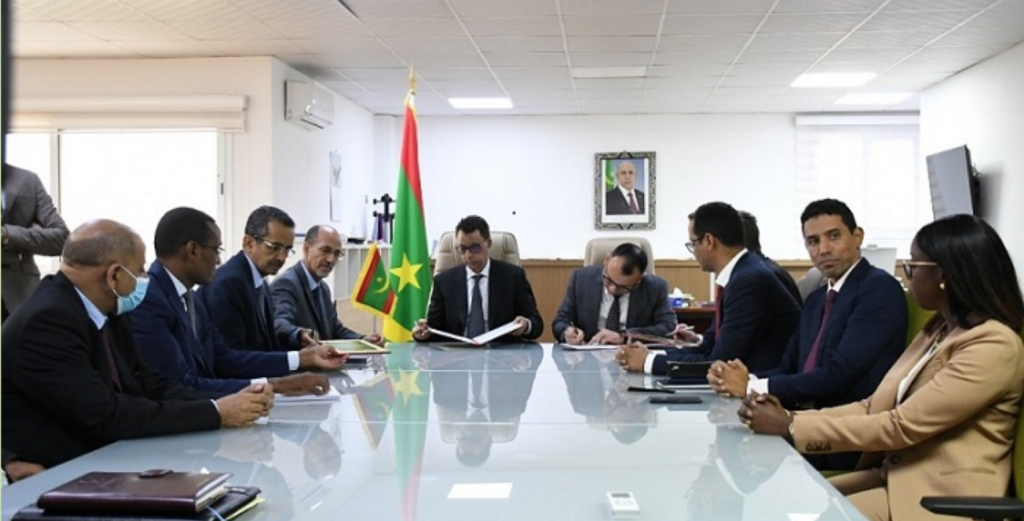

Mauritania signs domestic gas deal for Banda and Tevet fields

Mauritania has signed an exploration and gas production contract with energy firms Go gas and Taqa Arabia to tap into the discovered Banda and Tevet fields, which boast an estimated 2.2 trillion cubic feet (Tcf) of natural gas reserves. The deal represents an investment of some $1bn and is a key part of the West African nation’s plan to improve its energy infrastructure and boost electricity production. The contract, a cornerstone of Mauritania’s energy strategy, aims at supplying domestic gas to fuel the 180-megawatt Nouakchott dual power plant located north of the capital. The development is expected to stabilize the electricity supply, proving crucial for the country’s key industrial and mining sectors. “The signing of this agreement represents an important step in the framework of the new dynamic of valorization of Mauritania’s national gas resources,” Minister of Petroleum, Mines and Energy Nani Ould Chrougha said in an official statement, emphasizing the deal’s alignment with efforts to stimulate investments in the upstream segment of the oil and gas industry. Last week on Wednesday, the Mauritanian government gave approval to the gas exploration and production contract with the Taqa-Go consortium following a competitive bidding process. The consortium’s commitment includes the development of a new 120-megawatt gas-fired power plant and the enhancement of the existing 180-megawatt facility, reflecting Mauritania’s shift towards more efficient energy production. The exploitation of the Banda and Tevet fields is crucial to Mauritania’s goal of achieving universal electricity access by 2030. Banda was discovered in 2002 by Woodside Energy and was quickly earmarked as a domestic gas project, whose economics have been deemed too unattractive by most of its operators ever since. The project also aims to foster a synergistic relationship between the gas and power sectors, offering competitively priced, reliable electricity to support the nation’s industrial backbone. Both state utility SOMELEC and state-mining company SNIM are expected to benefit from more reliable gas-to-power supply. This agreement marks a significant step in Mauritania’s journey towards energy self-sufficiency as it pushes to leverage its natural resources for economic growth and energy autonomy.

Read more »

Tetracore to regionalise gas expertise as it plans Ghana’s first virtual gas pipeline solution

Tetracore Energy Group, a prominent player in Africa’s energy sector, is partnering with the Africa Prosperity Dialogues 2024 (APD 2024) in Ghana ahead of its opening of the country’s first compressed natural gas (CNG) mother station in the West African country later this year. The Nigerian company will be gold sponsor of the 3-day annual summit organised by the Africa Prosperity Network (APN), under the auspices of the President of the Republic of Ghana, H.E. Nana Addo Dankwa Akufo-Addo. It will shape a critical dialogue on the type of inclusive strategies that can deliver prosperity in Africa by promoting regional and continental integration, prioritizing marginalized populations, women, and youth, and providing a platform for sharing best practices and innovative solutions that can be scaled up across the continent. The APD 2024 will be held at the Peduase Presidential Lodge, Aburi Hills, Ghana, from January 25 to January 27, 2024. The event themed ‘Delivering Prosperity in Africa – Produce, Add Value, Trade,’ is designed to facilitate a comprehensive dialogue among key stakeholders from government, business, civil society, and academia and unlock additional regional cooperation. Expressing the significance of Tetracore’s strategic collaboration with Africa Prosperity Network, the Program Executive, Tetracore Energy Group, Oladayo Williams stated “our sponsorship of the Africa Prosperity Dialogues 2024 underscores our commitment to fostering sustainable development and energy security across the continent. We believe in the transformative power of collaborative dialogues, and the APD provides a unique opportunity to engage with thought leaders and shape the trajectory of Africa’s prosperity with the overarching goal of contributing to economic growth and prosperity in Africa, aligning with the AU Agenda 2063.” Later this year, Tetracore Energy Group ambitions to commission Ghana’s first virtual gas pipeline network and first CNG mother station. In doing so, it will bring its expertise of developing gas-to-industry and gas distribution networks in Nigeria to the rest of the region, with a focus on supporting African industries with cheap, affordable and sustainable energy solutions. Aligned with Tetracore in this strategic partnership, the Chairman and Founder, Africa Prosperity Network (APN), Gabby Asare Otchere-Darko, emphasized “Africa needs a paradigm shift and this transformation hinges on dedicated leadership, strategic investments in vital sectors, one single African Market, innovations, and a steadfast commitment to fostering trade and investment to unlocking the continent’s immense potential on the global stage. This is the second edition of the Africa Prosperity Dialogue, so when we have these meetings where political and business leaders meet, we think, plan and work together on how we can accelerate, deepen and expand the implementation of the single market project and present this to the assembly of heads of states and governments for the African Union to adopt.” Tetracore’s sponsorship reflects the company’s dedication to corporate responsibility, and sustainability, and its role as a catalyst for positive change, alongside other strategic partners for ADP 2024 including the African Continental Free Trade Area (AfCFTA) Secretariat, United Nations Development Programme (UNDP) Africa, African Development Bank (AfDB), African Export-Import Bank (Afreximbank), United Nations Economic Forum for Africa (UNECA), Africa Business Council (AfBC), Africa America Institute (AAI), Arab Bank for Economic Development in Africa (BADEA), Africa Soft Power, and Ghana Investment Promotion Centre (GIPC). To register for the Africa Prosperity Dialogues 2024 (APD 2024), visit www.africaprosperitynetwork.com for more information.

Read more »

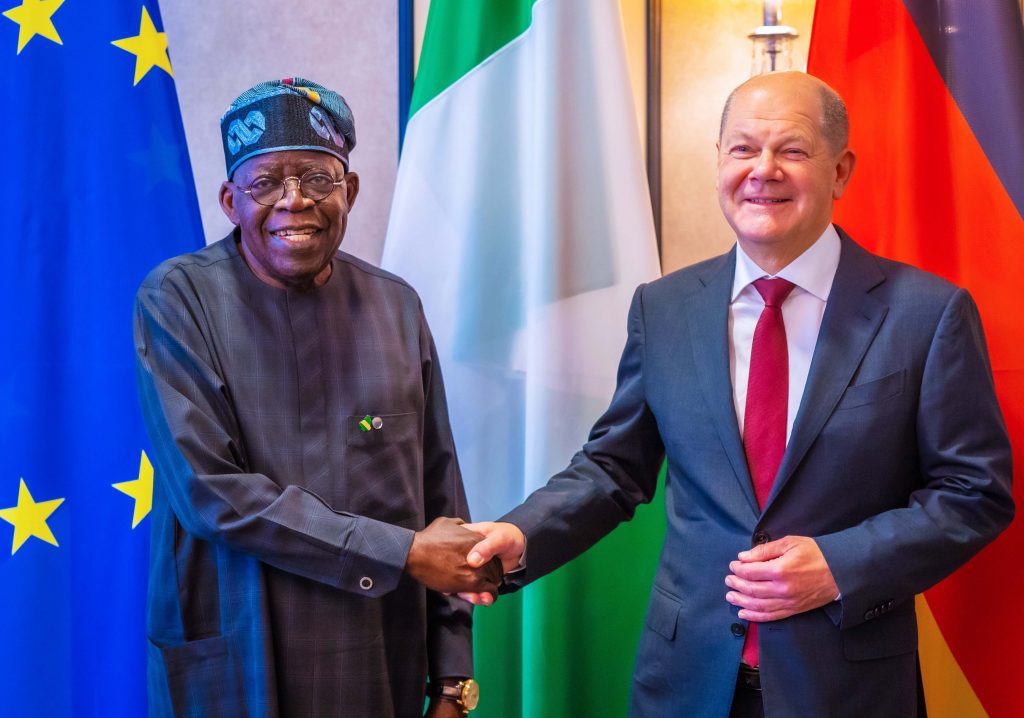

Nigeria and Germany sign gas deal and clean energy investment agreement

Nigeria and Germany have signed a historic agreement that will see Africa’s largest oil producer supply more gas to Europe’s biggest gas consumer. In an MOU signed by Nigeria’s Riverside LNG project, which works in the country’s Niger Delta, and Germany’s Johannes Schuetze Energy Import, Nigeria will export 850,000 tons of liquefied natural gas per year to Germany. The agreement also includes a provision for export volume to increase to 1.2 million tonnes in future. Under the deal, Nigeria is expected to export its first deliveries of liquified natural gas (LNG) to Germany in 2026, which will account for 2% of Germany’s total LNG imports. The deal was signed at the G20 Compact with Africa conference in Berlin on November 21, 2023, according to an official statement from the Nigerian presidency. In addition to the gas deal, Germany has pledged to invest $500 million in renewable energy projects in Nigeria, with a primary focus on rural communities. The investment is expected to create jobs and power sustainable economic growth in the country. “This agreement marks a new era of cooperation between our two countries,” Nigerian President Bola Ahmed Tinubu said. “It is a testament to the strong relationship between Nigeria and Germany and our shared commitment to sustainable development.” Nigeria’s economy, which has been grappling with the impact of falling oil prices in recent years, is expected to benefit positively form the gas deal and renewable energy investment. The deal will also help Germany meet its energy needs while reducing its reliance on fossil fuels.

Read more »

TAQA Arabia commissions Tanzania’s first integrated CNG filling station and conversion center

TAQA Arabia, Egypt’s full-service energy and utility provider, has commissioned Tanzania’s first integrated Compressed Natural Gas (CNG) Filling Station and Conversion Center branded “Master Gas.” The project was carried out by TAQA Dalbit, a Joint Venture (JV) between TAQA Arabia and JCG Oil & Gas, a unit of the Janus Continental Group (JCG). The CNG station, expected to serve 800 vehicles a day, is the first of 12 stations that TAQA Dalbit plans to open in Tanzania in the coming years. TAQA Dalbit plans to invest $12 million in establishing the natural gas fuelling stations. TAQA Dalbit focuses on investing, developing, building and operating filling stations and conversion centers to convert and fill cars with compressed natural gas. A CNG-powered passenger vehicle emits about 25% less CO2 and is, on avearge, 50% cheaper than petrol cars. “We are on the cusp of a transformative shift in Tanzania’s energy landscape,” Tanzania’s Deputy Prime Minister and Minister of Energy, Dr. Doto Mashaka Biteko, said during the commissioning ceremony in the country’s city and financial hub of Dar re Salaam. “The new CNG Filling Station and Conversion Center is a monumental achievement that demonstrates the Tanzanian government’s keenness to provide state-of-the-art solutions and technological prowess as part of our commitment to form a sustainable, greener and economically efficient future.” Tanzania is betting on TAQA Arabia’s know-how and experience in energy projects to help the east African country to unlock its energy potential and benefit from its gas reserves. Beyond serving vehicles, the company also aims to deliver natural gas to households, catering to varied needs of customers in Tanzania with CNG and LNG. “TAQA Arabia is committed to expanding its presence in the Tanzanian market across various areas,” Chairman of TAQA Arabia, Eng Khaled Abu Bakr said. “TAQA Arabia is looking also in adding greater value to clients either with natural gas distribution, conventional and renewable power generation and distribution and other utility services that the company provides.” TAQA Arabia, a subsidiary of Qalaa Holdings based in Cairo, provides energy and utility services to over 1.7 million customers across 50 cities in Egypt. The services include natural gas, electricity, renewable energy, petroleum products, and water.

Read more »

Senegal: 33% up for grab into new Yakaar-Teranga gas project says PETROSEN

The development of the world-class Yakaar-Teranga gas fields offshore Senegal will welcome a new partner alongside Kosmos Energy and PETROSEN, the national oil company said today. Earlier this week, Kosmos Energy announced it was increasing its working interest in the Cayar Profond Block from 30% to 90% and assuming operatorship after the exit of bp. Both fields were discovered in 2016 and 2017 and hold some 25 Tcf of low carbon, high quality gas, making their development attractive for transportation and liquefaction. Kosmos Energy said it was working on a 550 MMscf/d development concept that would provide gas to the domestic market to replace heavy fuel oil in power plant, and export the rest via a new floating LNG (FLNG) unit. PETROSEN clarified that it would increase its interest to 35% once the fields start producing. Long-term, the view is for Kosmos Energy and PETROSEN to both farm down their interests to a new partner so that the partnership includes PETROSEN (34%), Kosmos Energy (33%) and a new partner that would hold the remaining 33%. “This structure marks a turning point in the growing influence of the national company who will play a growing role in the ventures in charge of developing the country’s hydrocarbon resources,” PETROSEN said in a statement.

Read more »

N-Sea begins survey operations for Nigeria-Morocco Gas Pipeline

This story was first published on the Hawilti+ terminal on 2 September 2023. N-Sea, Netherlands-headquartered subsea services company, says it has expanded its area of operations to West Africa as it commences survey operations to support the development of the Nigeria-Morocco Gas Pipeline project. The project is led by Morocco and Nigeria’s national oil companies, the Office National des Hydrocarbures et des Mines (ONHYM) and the Nigerian National Petroleum Company (NNPC). The pipeline, which has been on the table for some time, is seen as an extension of the existing West Africa Gas Pipeline (WAGP) that was commissioned in 2011. From offshore Morocco, it will run onshore to northern Morocco, ultimately connecting to the Maghreb-Europe pipeline. “To realise this project, N-Sea have worked closely with vessel owner Rederij Groen and converted the seismic support vessel, 7-WAVES, into a survey vessel with state-of-the-art equipment,” the company said in its post on LinkedIn. “The project is being run with a “skeleton” crew on board the vessel, and all data is being transferred to shore, to the N-Sea Data Centre. Daily meetings with the Client Representative, FEED Engineer, Client and our N-Sea data processors are carried out to assess data quality and route alignment.” The 5,700 to 7,000 km pipeline, linking Nigeria’s Brass Island to Morocco, is gaining traction following the tightening of global gas markets and Europe’s search for alternative sources of gas imports. If completed, it would be the longest offshore pipeline in the world, with its total capacity expected to hold 30 billion cubic meters a year.

Read more »

Nigeria’s Tetracore Energy Group steps up local content development with new training programme

The Tetracore Energy Group, a fast-growing gas and power solutions provider based out of Nigeria, has launched a unique graduate management training program in Lagos last week. The initiative is part of the company’s commitment to grow domestic capacity and local content, as a time when African markets are rapidly expanding their domestic gas value-chains. The inaugural program includes 12 young professionals who will receive intensive training around gas, power and new energy, behavioral and soft skills, and business management skills. Tetracore aims at developing their talents and equipping them with the competences they need to solve some of Nigeria’s most pressing energy challenges around gas distribution, clean energy, and power systems. “Growing Nigeria’s energy sector requires the training of capable, competent, driven, and ambitious Nigerian young professionals. As we expand Tetracore’s footprint and welcome new investors, it is of strategic importance that we develop the skills and the manpower the company needs to deliver its sustainable energy solutions,” CEO Olakunle Williams said during the launch ceremony. Nigeria is recognized globally for having one of the most successful local content development frameworks. Under the oversight of the Nigerian Content Development & Monitoring Board (NCDMB), the country has successfully built capacity across the oil & gas sector and saw the establishment of several local businesses from upstream to downstream. However, rapidly evolving technologies and the rapid expansion of Nigeria’s midstream and downstream gas industry requires a new set of skills and competences. Private sector companies must continue to invest in workforce development and talent management as a matter of competitiveness and sustainability. Over the past three years, Tetracore has proven its commitment of building a true pan-African energy company and building local capacity along the way. In December 2020, it was amongst the first local businesses to commission its own locally assembled 15 MMscf/d gas Pressure Regulating and Metering Stations (PRMS) and has continued to grow domestic capacity ever since.

Read more »

Nigeria’s pioneer CNG player taps debt capital markets for expansion

This article first appeared on the Hawilti+ terminal on 19 July 2023. Nigerian natural gas supply company Green Liquified Natural Gas Limited (GLNG) has secured its first debt funding as it looks to boost its operations in Africa’s biggest economy. The company sold NGN5 billion ($6.5m) of 10-year series bonds due 2033 under its NGN50 billion ($65m) Debt Issuance Programme. Nigerian financial guarantor InfraCredit provided guarantee for the facility. The bond proceeds will enable GLNG to develop its Liquified Natural Gas plant and expand its CNG distribution and power-as-a-service capabilities, according to an official statement, noting the bond issue was oversubscribed by 108% by ten institutional investors. “This maiden bond transaction is an important milestone for GLNG, as it provides the leverage to finance our ambitious plan to establish a state-of-the-art LNG plant in Nigeria,” Chairman of GLNG, Olajide Rosiji, said in the statement. “More importantly, the success of this transaction reinforces our steadfast commitment to contribute to Nigeria’s clean energy and transportation landscape and foster sustainable economic growth in the region. GLNG already operates two gas compression and distribution facilities in Ogun State with combined capacity of approximately 10.5 MMscf/d, making it the largest in Nigeria. The company currently delivers an average of 4.2 MMscm of CNG per month to industrial and Autogas customers in southwest Nigeria where access to piped gas infrastructure has been lacking. Nigeria, Africa’s biggest oil producer, holds some of the world’s biggest gas reserves. But while the country’s gas has benefited industrialization and power generation overseas through LNG exports, its domestic utilization remains limited. Boosting local consumption is now at the centre of the government’s agenda as it promotes gas as a transition and cleaner fuel.

Read more »

Cameroon and Equatorial Guinea agree on offshore cross-border gas cooperation

President Teodoro Obiang Nguema Mbasogo of Equatorial Guinea and President Paul Biya of Cameroon have signed a cooperation agreement on the development of oil & gas reserves at their maritime border in the Gulf of Guinea. The agreement was signed in Yaoundé on the sideline of the 15th Ordinary Session of the Conference of Heads of State of the Central African Economic and Monetary Community (CEMAC) on March 17th. While details on the agreement have not been revealed, it is expected to facilitate the development of gas discoveries on both side of the maritime border between Equatorial Guinea and Cameroon. An Offshore Gas Megahub in the Making Equatorial Guinea already produces oil and gas from Alen on Block O and Aseng on Block I, both operated by Chevron Energy since its acquisition of Noble Energy in 2020. The blocks contain the undeveloped Felicita and Yolanda gas discoveries. Last year, Chevron produced some 56,000 bpd of oil equivalent (net) from Equatorial Guinea, including 12,000 bopd of oil, 7,000 bpd of natural gas liquids and 223 MMscf/d of natural gas. Just across the maritime border, Chevron also operates the YoYo Block in Cameroon’s Douala Basin which contains the undeveloped YoYo gas discovery. The development of the Yolanda and YoYo gas discoveries could be easily executed by utilizing Equatorial Guinea’s existing infrastructure and processing gas on Punta Europa, where Equatorial Guinea has gas processing infrastructure, including an LNG terminal, a methanol plant, and an LPG plant. The country has long ambitioned to position its gas infrastructure as a processing hub for stranded gas fields and discoveries in the Gulf of Guinea. In 2021, it completed the Alen Gas Monetisation project that enabled the production of gas from the Alen unit and its transportation by pipeline to Punta Europa where it serves as feedstock for EG LNG and the Alba LPG plant. Future monetization plans include the processing of stranded gas both from Cameroon and Nigeria’s offshore fields. A Regional Gas Future? Unlocking the potential of regional gas cooperation in the Gulf of Guinea requires several multi-party, multi-governmental commercial and legal agreements that have so far delayed projects. While the deal signed in Yaounde this week sends positive signals, its nature remains unknown. In addition, the joint-development of Yolanda and YoYo would require additional agreements with the operator Chevron. The long-term presence of the major in the region remains uncertain. In December 2021, Chevron signed a Production Sharing Contract (PSC) for exploration block EG-09, just south of its Blocks O and I. But a few months later, Reuters reported that the major had hired investment bank Jefferies to sell its assets in the country. Meanwhile, other operators in Cameroon could seek to use Equatorial Guinea’s processing infrastructure for their own ventures. This is the case of partners on the Etinde Gas Project offshore Cameroon, who are exploring the option of sending wet gas from the undeveloped Etinde field to Punta Europa before reimporting dry gas into Cameroon via a new 50km pipeline linking both countries.

Read more »

Hawilti launches “Gas for Africa” report with the International Gas Union (IGU), AU-AFREC, and AFC

Hawilti released an important new study on Gas for Africa in partnership with the International Gas Union (IGU), assessing the potential for domestic gas resources to energise Africa in line with the global energy transition. The African Energy Commission (AU-AFREC) and the Africa Finance Corporation endorse the report and its findings. The study starts by analysing current energy poverty trends in Africa, a continent with the lowest electricity per capita consumption in the world and the lowest CO2 per capita emissions. It argues for a pragmatic use of natural gas reserves to support a broad industrial and economic development of Africa in a way that is sustainable and enables a just energy transition. Mickael Vogel, Director & Head of Research, Hawilti “Energy poverty in Africa often boils down to the number of people without access to electricity – 600 million, or without access to clean cooking – 970 million. Unfortunately, this assessment misses the point and can lead to responses and solutions that are ill-adapted to Africa’s development needs. As it argues for a better use of gas, the report calls for more ambitious targets around energy access so that we can both bridge Africa’s energy deficit but also support economic growth and industrialisation.” The ”Gas for Africa” report highlights several ways in which gas can have a positive impact on Africa’s socio-economic development including by switching away from coal and diesel, developing energy-intensive industries and gas-based industrialisation, displacing fuelwood and biomass in households, generating baseload electricity to integrate intermittent energies, and building gas systems that can be decarbonisable in the future with hydrogen, renewable gas, and CCUS. However, a pragmatic utilisation of Africa’s 18 Tcm of proven gas reserves – or 9% of the world’s reserves – calls for a reorientation towards domestic monetisation. Most of the gas produced in sub-Saharan Africa remains exported, with local consumption still limited because of limited infrastructure availability. Additional barriers include limited access to capital, security risks, and policy uncertaint.y To overcome these key barriers to development, a total of eight guiding principles are given as recommendations to help stakeholders and policy makers navigate the complexity of the gas industry: The full report is available for download here.

Read more »

Ghana embarks on the expansion of its gas processing infrastructure

The Ghana National Gas Company (GNGC) has signed last week a project agreement for the construction of a second gas processing plant of 150 MMscf/d at Atuabo in Western Ghana. Train 2 will double gas processing capacity at Atuabo, where a first train of 150 MMscf/d was commissioned in 2015. Expansion plans have been on the table for a few years, with FEED studies completed for the second train in 2021. The initial capacity has been set at 150 MMscf/d, expandable to 350 MMscf/d in the future. The development of gas processing plants at Atuabo is part of Ghana’s Western Corridor Gas Infrastructure that transports gas produced offshore, processes it and sells it on the domestic market. The initial phase of the project cost some $1bn and was funded by China. It comprised a 58km offshore gas export pipeline from the Jubilee FPSO to the Atuabo gas plant, the construction of the first train at Atuabo, a 110km onshore pipeline transporting sales gas to the Volta River Authority’s power plant at Aboadze in Takoradi, and an LPG truck-loading gantry. The commissioning of the network in 2015 enabled TullowOil to monetise its associated gas from its Jubilee and TEN fields, thereby reducing flaring. The operator has committed to eliminate routine flaring in Ghana by 2025 while monetizing some 2 Tcf of gas reserves to meet the country’s growing gas demand. As a result, additional gas processing capacity is needed to process incremental raw gas volumes that will come from both the Jubilee and TEN fields. Details on Ghana’s gas infrastructure and the contractors involved in the expansion of the Atuabo GPP are available within your Hawilti+ research terminal – plus.hawilti.com

Read more »

Industry Catch-up: What You Might Have Missed

The oil & gas sector knows no break and has had its fair share of developments over the past two weeks. Here is what you need to know as you get back to the office. Mozambique has announced the results of its 6th Licensing Round On December 21st, Mozambique revealed the results of its 6th Licensing Round, which resulted in the award of only six blocks out of the 16 license areas that were proposed. The China National Offshore Oil Corporation (CNOOC) secured five blocks over the Save and Angoche Basins and Eni Mozambique securing one license in the Angoche Basin. None of the areas within the Zambeze Basin were awarded. “The Exploration programs proposed for the first sub-period of the Exploration Period have the potential to allow investments amounting to approximately $369.8m, foreseeing the acquisition of 31,200 Km2 of 3D seismic, opening of a minimum of four wells in deep water, and other geoscientific studies,” the National Institute of Petroleum (INP) said in a statement. Nigeria has launched a Mini Bid Round for deep-water blocks On December 21st, Nigeria announced its Mini Bid Round 2022 and put seven deep-water blocks on offer covering some 6,700 km2. A pre-bid conference is scheduled for January 16th while pre-qualification applications mut be submitted by January 31st. Under the new PIA regime, the blocks on offer are PPL-300-DO (former OPL 312); PPL-301-DO (former OPL 313); PPL-302-DO (former OPL 314); PPL-303-DO, PPL-304-DO, and PPL-305-DO (the three used to form IPL 318); and PPL-306-DO (former OPL 327). This Mini Bid Round will be a test for Nigeria’s attractiveness and competitiveness after a full overhaul of its oil & gas regulatory regime with the adoption of the PIA in 2021. Eni has selected a provider for its second FLNG unit in Congo-Brazzaville On December 22nd, Eni announced the signing of a contract with Wison Heavy Industry of China for the construction and installation of a 2.4 mtpa floating LNG unit in the Republic of Congo, offshore Pointe Noire. The unit will be the second FLNG facility of Eni in Congo since the company expects to commission this year the 0.6 mtpa Tango FLNG vessel it acquired from Exmar a few months ago. Both units will be monetizing associated gas from the Marine XII permit. Total Gabon expanded its upstream portfolio in Central Africa On December 26th, TotalEnergies EP Gabon extended its presence in Gabon with the signing of a new Exploitation & Production Sharing Contract (EPSC) over the Baudroie-Merou-Marine G5-143 permit. The 25-year agreement will run until 2047. “We remain fully committed as an energy producer in Gabon. We will maintain our investments to reduce greenhouse gas emissions by valorising associated gas and will continue to implement actions to maintain our production,” said Henri-Max Ndong-Nzue, President of TotalEnergies EP Gabon. Invictus Energy has finished drilling its first wildcat onshore Zimbabwe On January 3rd, Invictus Energy confirmed that technical and operational issues prevented a discovery at its Mukuyu-1 wildcat well onshore Zimbabwe. However, multiple potential gas bearing reservoir units were encountered and the well did prove the existence of a working hydrocarbons system. The Rig 202 is currently warm stacked on site for maintenance and upgrades and will recommence drilling operations later this year. Invictus Energy is considering an appraisal well (Mukuyu-2) or the drilling of Baobab-1. As a result, the contract with EXALO Drilling for the rig has been extended by another 12 months.

Read more »

Mauritania: FID expected in 2025 on bp’s new BirAllah gas hub

bp and Kosmos Energy have signed a new Exploration & Production Sharing Contract over the BirAllah gas discovery offshore Mauritania on October 11th. A new agreement was required after the exploration period over Block C8 expired last June. The BirAllah gas field was discovered 60km north of the Greater Tortue-Ahmeyim (GTA) gas field that straddles the Mauritanian-Senegalese maritime border. Negotiations over future activity on the acreage have been ongoing for several months and were previously announced by Kosmos Energy, bp’s partner on Block C8. The new EPSC signed this week provides for 30 months of studies and planning before submitting a development plan for the field, where a final investment decision (FID) is now expected in the first half of 2025. 50 Tcf of gas have been discovered on Block C8 across the BirAllah discovery in 2015 (Marsouin-1 well) and the Orca-1 discovery of 2019. The reserves are bigger than at the GTA field, where bp and Kosmos Energy expects to start producing gas and exporting LNG next year and are already preparing the expansion of their FLNG hub to 5 mtpa. The BirAllah’s development plan is expected to further maximize local content and build on the domestic capacities developed during the development phase of GTA. The project includes an increased participation from the State of Mauritania – 29% – and will rely on the logistics capacities of the Ndiago Port, the Ministry of Petroleum, Mines, and Energy said. The project is expected to include a domestic and an export component to maximise value from the gas. Mauritania is notably trying to push for domestic gas monetization to expand its power supply, and develop gas-based industries such as petrochemicals and steel.

Read more »

TotalEnergies applies for Production Right in South Africa

TotalEnergies has filed the Production Right Application for Block 11B/12B offshore South Africa, where it has made significant gas and condensate discoveries at Brulpadda (2019) and Luiperd (2020). Along with its partners Qatar Energy, CNR International and Main Street 1549 (Africa Energy Corp,), the French major has decided to relinquish the northern portion of the block while entering into a Gas Market Development Period to confirm the economic viability of the project. Development plans have so far focused on an early production system (EPS) targeting the Luiperd discovery to supply the domestic market in South Africa. Gas would be delivered to the Mossel Bay area, where South Africa already has key gas off-take infrastructure in place, including PetroSA’s gas-to-liquids (GTL) refinery and the 40 MW Gourikwa thermal power plant. Both plants represent 300 MMscfd of gas demand and were until now supplied by domestic fields that have now matured.

Read more »

Senegal is planning to use its natural gas for ammonia and urea production

Senegal’s Petrosen Trading & Services, a subsidiary of the country’s national oil company, has signed a Memorandum of Understanding (MoU) with Turkey’s Çalık Enerji and Japan’s Mitsubishi for the pre-feasibility study of an ammonia and urea manufacturing unit. The agreement was signed in the presence of Senegalese President Macky Sall during the 8th Tokyo International Conference on African Development (TICAD8) held in Tunis on August 27th and 28th. The production of fertilizers is one of the option Senegal is exploring to monetise its offshore gas reserves, currently being developed by bp and Kosmos Energy for the export market. The Greater Tortue/Ahmeyim (GTA) project that straddles the Senegal-Mauritania border will start exporting LNG next year, but has an allocation of 35 MMscf/d reserved for the domestic market. Such allocation is expected to increase once the second phase of GTA is sanctioned, leaving Senegal with plenty of gas to process domestically. While the country’s strategy relies on switching several of its thermal power plants from diesel and HFO to natural gas, additional industries could also benefit from the processing and transformation of gas reserves. The pre-feasibility study for a gas-based ammonia and urea plant will be financed by the Ministry of Economy, Trade, and Industry (METI) of Japan and conducted by Mitsubishi Corporation and Nippon Koei.

Read more »

Rwanda has broken ground on new CNG project from Lake Kivu

On August 18th, Rwanda’s Prime Minister Dr. Edouard Ngirente officiated the groundbreaking ceremony of GasMeth Energy’s new compressed natural gas (CNG) project on the shores of Lake Kivu. The project will be extracting gas from Lake Kivu before processing it and distributing it across Rwanda as CNG, an alternative to imported diesel and HFO. GasMeth Energy holds a 25-year concession with the Government of Rwanda to extract 40 MMscf/d of natural gas from Lake Kivu. The gas will be extracted offshore before being sent to an onshore gas processing and compression facility. This is the third project to be developed in Rwanda to extract gas from the Lake, which serves as a natural boundary with the Democratic Republic of Congo (DRC). In 2016, ContourGlobal commissioned its 26 MW KivuWatt project, a floating gas-to-power barge turning Lake Kivu’s deadly methane into power for Rwandan households and industries. Since 2019, Shema Power Lake Kivu, owned by Highland Group Holdings, has also been constructing a 56 MW methane gas extraction and gas-to-power plant under a public-private partnership (PPP) there. The project is structured as an independent power producer (IPP) and is currently being completed.

Read more »

Nigeria: Accugas secures third Gas Sales Agreement of the year

Savannah Energy’s subsidiary Accugas has announced earlier today the signing of a new gas sales agreement (GSA) with Nigerian fertilizer manufacturer Notore Chemical Industries. The agreement covers the supply of up to 10 MMscf/d of gas on an interruptible and reasonable endeavours basis, based on gas availability and nominations, for an initial term of one year. Gas will be coming from Accugas’ 200 MMscf/d Uquo gas plant in Esit Eket, Akwa Ibom State. In February 2022, Accugas already entered into a new GSA with the Central Horizon Gas Company (CHGC), a subsidiary of Axxela. Under the terms of the GSA, CHGC can nominate to be delivered up to a maximum daily quantity of 5 MMscf/d. In June 2022, Accugas had also entered into a new 3-month gas sales agreement (GSA) with TransAfam Power Ltd to provide up to 35 MMscf/d of gas on an interruptible basis to the power plants of Afam Power Plc and Afam Three Fast Power in Okoloma, Rivers State. Details on the Uquo gas plant and Uquo marginal field development are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Genser Energy raises $435m to expand Ghana’s midstream gas infrastructure

American energy solutions provider Genser Energy has announced the closing of a $425m funding package to support the expansion of its midstream gas business in Ghana. The company is already a provider of captive power solutions to several of Ghana’s gold mines and is currently expanding across West Africa. The 8-year, $425m funding package includes a $325m syndicated senior loan facility and a $100m mezzanine loan facility. It will be used to refinance Genser Energy’s existing debt and support three critical midstream gas projects in Ghana. Expansion of Ghana’s gas pipeline network The first one is a 100km natural gas pipeline to Kumasi, Ghana’s second largest city. In doing so, Genser Energy seeks to make piped natural gas available within Ghana’s central belt and offer an alternative to imported trucked diesel and heavy fuel oil (HFO) for industries in the region. According to Genser Energy’s records, the company is planning to build an overall gas pipeline network of 320km in Ghana to connect its power generation plants to Ghana Gas’ Prestea Regulating and Metering Station (PRMS). In November 2019, a first phase of 80km was already commissioned to provide gas to Gold Fields’ Tarkwa and Damang gold mines power stations. Additional phases notably target gas supplies to Kinross Gold Corporation’s Chirano mine, Perseus Mining’s Edikan mine, and Gold Star Resources’ Wassa mines, among others. Launch of an integrated natural gas liquids (NGLs) business The second one is a 200 MMscf/d gas conditioning plant in Prestea, southwestern Ghana, where Genser Energy intends to produce natural gas liquids (NGLs) such as propane, butane, ethane, and liquefied natural gas (LNG). All NGLs will be sold under an off-take agreement to Trafigura, who notably participated in the mezzanine loan. Trafigura is also providing additional funding to the third and last project, a NGL storage terminal at the Takoradi Port. A wide range of financiers The ability of Genser Energy to secure such a debt package is an encouraging sign for Africa where several asset owners and operators are currently raising capital for domestic midstream and downstream gas ventures. A wide and diverse range of investors participated in Genser Energy’s senior loan facility, including regional and commercial international banks, development financial institutions, and funds. These comprised the Standard Bank of South Africa, Absa Bank, Société Générale, the Mauritius Commercial Bank, Ninety One, Barak Fund SPC Ltd, and the Development Bank of Southern Africa. On the other hand, the mezzanine loan facility is provided by Trafigura, Barak Fund SPC Limited and the US Based Fund, Trilinc Global Sustainable Income Fund Master Ltd.

Read more »

All gas: Eni takes FID on Quiluma and Maboqueiro gas project in Angola

Italian major Eni has announced the successful completions of negotiations to start up the New Gas Consortium (NGC) in Angola. The partnership was announced in late 2019 and includes Eni as operator (25.6%) along with Chevron (31%), bp (11.8%), TotalEnergies (11.8%), and Sonangol (19.8%). The consortium is developing Angola’s first non-associated gas project by focusing on the Quiluma and Maboqueiro gas fields. The development plan includes two offshore wellhead platforms and an onshore gas processing plant connected to Angola LNG’s Soyo export terminal. The project will provide feedstock to Angola LNG, who until now has relied solely on associated gas that was previously flared. Activities will start in 2022 with First Gas scheduled for 2026 and an expected production of 330 MMscf/d at plateau. Partners in the New Gas Consortium are all shareholders in Angola LNG and have a strategic interest in investing into new feedstock supply for the 5.2m tpy facility. Ultimately, the Quilume and Maboqueiro gas fields will be operated by Azule Energy, the new joint-venture of Eni Angola and bp Angola announced earlier this year.

Read more »

Eberechukwu Oji: Nigeria needs to make gas available to all its states capital cities

By the end of its Decade of Gas in 2030, Nigeria needs to have brought gas to all its state capital cities if it wants to truly spur industrialization, ND Western CEO Eberechukwu Oji said in Abuja last week. Oji was speaking at the 21st NOG Conference & Exhibition that took place from July 4-7, 2022. “A country is considered industrialized if its industrial output stands at around 20% of its gross domestic product (GDP),” he said. “Nigeria is far below that but has an opportunity to boost manufacturing and industrial production by monetizing its natural gas reserves. To reach that goal, we need to implement policies that enable capital to flow into gas infrastructure and make gas available to all of Nigeria’s state capital cities,” he added. ND Western owns 45% of OML 34 in the onshore Niger Delta where it produces oil and natural gas. It notably operates three gas processing plants there with a combined capacity of 600 MMscf/d and supplies gas to power plants and industries. However, illiquidity in the power sector value-chain has made investments into gas production uneconomically, and demand for gas-based industrialization is seen as much more attractive for operators in Nigeria. In May this year, ND Western partnered with another Nigerian independent, First Hydrocarbons Nigeria (FHN), and with gas distributor Falcon Corporation to provide gas to the Lagos Free Zone. The Gas Infrastructure Development Agreement (GIDA) was signed with their special purpose vehicle, Optimera Energy FZE, and will start delivering an initial 5 MMscf/d of gas from 2024. “We need to unlock investments into distributing gas to all of Nigeria’s industrial hubs,” Oji explained. “Even some demand centers in the East remain in need of gas for their industries. We need to look at the originally conceived eastern gas network and make gas available in Benue, Ebonyi, and Anambra states.” Oji was speaking on the day when the Parliament of the European Union backed new rules labelling investments in gas and nuclear power plants as climate-friendly. “Nigeria needs to get down to business with these new rules and think of commercializing its gas on a much larger scale for the export and domestic market,” he commented.

Read more »