Nigeria’s NNPC announced on March 6th the appointment of NNPC Eighteen Operating Ltd as operator of Oil Mining Lease 18 (OML 18) onshore Nigeria by the block’s non-operating joint-venture partners.

OML 18 is operated by Eroton Exploration and Production Co. (27%) while non-operating partners include NNPC (55%), OML 18 Energy Resource (Sahara Group, 16.2%) and Bilton (1.8%). Eroton was removed as operator of the joint-venture to protect the partners’ investment in OML 18, NNPC said.

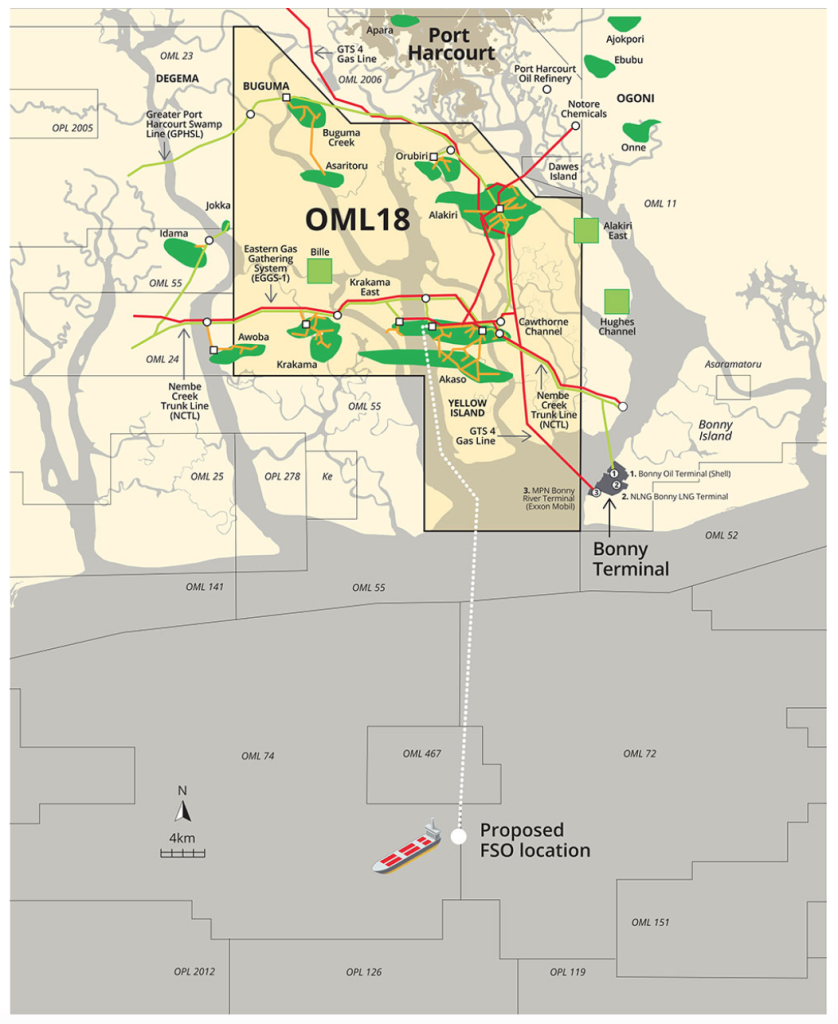

OML 18 has been unable to produce oil for several months due to the unavailability of the Aiteo-operated Nembe Creek Trunk Line (NCTL) that provides a connection to Shell’s Bonny oil export terminal. As a result, production has fallen from some 30,000 barrels of oil per day (bopd) a few years ago to zero for most of last year, data from NNPC shows. In comparison, Eroton E&P’s initial intention after taking operatorship of the asset in 2014 had been to increase production to 115,000 bopd of oil and 485 MMscf/d of gas.

Such performance is deemed unsatisfying for an asset that covers 1,035 km2 and contains 11 discovered oil and gas fields with 714 million stock tank barrels of oil and condensate and 4.7 trillion cubic feet (Tcf) of gas reserves, according to NNPC.

However, Eroton E&P is not the only to suffer from reliance on the NCTL. Data from NNPC shows that all neighboring blocks and joint-ventures who rely on that pipeline have been unable to get oil to market since April 2022.

To mitigate the impact of crude theft and pipeline losses, an Alternative Crude Oil Evacuation System (ACOES) had been approved by the partners to barge oil to a floating, offloading and storage (FSO) vessel offshore Bonny. While limited barging reportedly started in June 2022, COVID-19 and delays in mooring the FSO have postponed the commissioning of the ACOES and prevented resumption of production.

San Leon Energy’s Transactions

The replacement of Eroton E&P as operator comes at a time when LSE-listed San Leon Energy is working to secure a controlling interest over Eroton E&P, OML 18, and the ACOES project.

The company already owns 40% of Midwestern Leon Petroleum Ltd (MLPL), the entity that owns Martwestern, which itself owns 98% of Eroton E&P. In July 2021, San Leon signed Heads of Terms to reorganize MLPL and acquire the remaining 60% of the company from Midwestern Oil & Gas. Such a transaction would increase San Leon’s indirect economic interest in Eroton E&P from 39.2% to 98%.

In parallel, Eroton E&P is planning to acquire Sahara Group's 16.2% and Bilton's 1.8% interests in OML 18, with funding from the Afreximbank. The consolidation of Eroton E&P's interest in OML 18 is one of the conditions that must be completed for San Leon to proceed with its reorganisation of MLPL.

If Eroton was to consolidate its interest in OML 18, and if San Leon was to secure a controlling interest of Eroton, its indirect economic interest in OML 18 would increase from 10.58% to 44.1%.

In parallel, San Leon has also invested in the ACOES being developed for OML 18 and owns 10% equity plus a conditional further 3.323% equity in ELI Malta, the owner and operator of the ACOES project. In July 2022, a Reorganisation Agreement was signed, whose completion would increase San Leon’s interest in ELI to 50.64%.

The appointment and replacement of Eroton E&P as operator of OML 18 throws uncertainty both over San Leon’s transactions but also over redevelopment plans for one of Nigeria’s biggest assets in reserves size and infrastructure capacity.

Since this article was first written, Eroton E&P has categorically contested NNPC's move. "We hereby re-iterate that Eroton remains the Operator of OML-18 in line with the provisions of the JOA and any dispute whatsoever between the parties are reserved exclusively for resolution under the Dispute Resolution clause of the JOA. The actions of the other JV partners (NNPC and Sahara) remain illegal and run contrary to the rule of law and in total breach of the terms and conditions stipulated in JOA," the company said in a statement.

This article was updated on March 14th to reflect Eroton E&P's position and statement.