Energy

OPINION: The Cost of Orthodoxy

Pulling Nigeria’s ailing economy from the brink calls for a radical improvement in efficiency within its oil & gas industry, writes Ofserv CEO Dimeji Bassir who presents opportunities to cut down the cost of production within Africa’s biggest oil market. To quote Joel Barker in The Business of Paradigms “It’s so easy to say no to a new idea. After all, new ideas cause change; they disrupt the status quo. They take people out of their comfort zones and create uncertainty… Plus, it is less work to do things the way we have always done it……less work, maybe. Costly, definitely” New ideas are resisted from greasy rig floors in the Niger Delta swamps to cushy business offices and conference rooms in regulator’s offices in Abuja; each, with very prohibitive costs of inaction. Yet it’s business as usual in Nigeria’s oil industry despite current economic realities in the country, which provide the impetus for a radical transformation of its cost base. Pulling the ailing economy from the brink calls for a radical improvement in efficiency within its mainstay industry. Dwindling daily production and significantly reduced foreign exchange earnings, and foreign reserves, establishes the urgency to drive down unit cost per barrel of oil produced. Simply stated, Today’s ‘Good’ is tomorrow’s ‘Not good enough’ and what sets us apart today will be the baseline tomorrow. The future belongs to those who act with urgency and foresight. A huge, yet untapped opportunity Successful upstream operations is underpinned by the ability to balance the trio of cost-schedule- production and maximise NPV, i.e. produce the most barrels in the quickest manner possible at the cheapest mean cost across a portfolio of assets. Incremental improvement in well delivery (drilling & completion) efficiency in the US had characterised the shale oil boom which effectively began in 2007. Efficiency gains cut well costs by a third and reduced cost per barrel by 75% in the decade between 2007 and 2017. In effect, America became an oil and gas power house within this period, doubled US Shale production and tripled total daily oil output. In Nigeria, the oil and gas industry is the largest revenue contributor to the Nigerian economy but production has declined by 40% from 2010 to date. Declining oil production presents major revenue challenges and precipitates chronic macroeconomic crisis in the short to medium term. Dimeji Bassir Reducing unit production costs by driving down well delivery costs presents an untapped opportunity to increase government earnings & reduce its fiscal deficit. Being the most complex, costly and highly specialised upstream development activity which easily accounts for up to 60% of oilfield development CAPEX, drilling presents a unique opportunity to reduce the cost of oil production. For this reason, in the early eighties, drilling engineers and other personnel operating in the UK’s North Sea recognised the need to learn from each other and compare performances across their respective drilling operations. This led to the formation of the drilling performance review (DPR) in 1989, a drilling benchmarking club. Most international operators who are value-driven continue to subscribe to the DPR till this day for the inherent benefit to their global operations and enterprise’s financial performance. In general, up to 60% of drilling time goes to Non-productive time (NPT) and inefficiencies which is known in drilling parlance as invisible lost time (ILT). The cost of ILTs, being an invisible factor, to the Nigerian oil industry is in the order of billions of dollars overspent annually. Improving drilling performance therefore is an enabler to reducing cost of oil production. Lower drilling costs stimulates more drilling activities which in turn increases production and reduces unit production costs. You can’t improve what you don’t measure Drilling performance in Nigeria is laden with tremendous inefficiencies. An indicative benchmark of an average Nigerian, and similar North American well reveals significant underperformance in the Nigerian well as measured by days to drill a 10,000 feet well. A 10,000 feet well routinely delivered in 10 days in North America could take as long as 85 days in Nigeria. This disparity is surmised to be causative of the consistently high well delivery cost in Nigeria. Disproportionately long well durations delays time to market (deferred production), reduces project NPV – costly wells reduces the number of profitable opportunities – which in turn reduces rig activities and associated demand for services. By top down estimates, the industry spends circa $11.4 billion to produce 1.25 million barrels daily and approximately $6 billion in drilling wells. A 30% performance gap between the authorised expenditure (budget) and actual costs as gleaned from an analysis of Nigerian wells represents a $1.8 billion a year opportunity. The relentless pursuit of excellence in well delivery begins with establishing key indicators which must be tracked with rigour and provides indication of drilling performance and efficiency trends. An excellent drilling efficiency metric commonly tracked is the dollar spend per reservoir foot of hole. US-based oil services research firm Spears & Associates, Inc. looking at this metric in US land operations from 2006 to date showed the cost of a foot of exposed reservoir falling by 75% in over a decade when considering what was paid to the contract driller. Similarly, the directional driller cost per exposed reservoir foot fell from $45 to $35, a decrease of 25%. In addition to the reduced cost per barrel, other implications of drilling efficiency gains break down as follows: Where there is a will, there is a way Investments in the Nigerian oil and gas sector declined by 70% between 2017 and 2021 closely correlating with the contraction in production output. Nigeria could only attract $3 billion in investments (approximately 5% of the total investment into the sector in Africa) in the five years between 2017 and 2022 despite having 38% of the continent’s total hydrocarbon reserves. As the government pushes for more transfer of resource ownership to locals via organised acreage farm-outs and International Oil Company (IOC) divestments, Nigeria’s oil industry’s uncompetitiveness is certainly at its pinnacle. For the sake

Read more »

NNPC and TotalEnergies announce $550m investment in Nigeria’s Ubeta Gas Field

The Nigerian National Petroleum Corporation and TotalEnergies have announced a $550 million investment decision for the development of the Ubeta Field, a key onshore gas project expected to provide feedstock to Nigeria LNG – Africa’s biggest LNG export terminal. The project is located within OML 58, a TotalEnergies-operated onshore license that frequently suffers production disruptions due to pipeline vandalism and crude theft. The Ubeta field, discovered in 1964 and located northwest of Port Harcourt in the Niger Delta, is projected to produce about 350 million standard cubic feet (MMscf/d) of gas and 10,000 barrels of associated liquids daily. This development is expected to contribute significantly to the supply for NLNG’s Train 7. “Ubeta is the latest in a series of projects developed by TotalEnergies in Nigeria, most recently Ikike and Akpo West. I am pleased that we can launch this new gas project which has been made possible by the Government’s recent incentives for non-associated gas developments,” TotalEnergies’ Senior Vice President for Africa, Exploration & Production, Mike Sangster, said in a company statement. “Ubeta fits perfectly with our strategy of developing low-cost and low-emission projects, and will contribute to the Nigerian economy through higher NLNG exports.” At the official signing event at NNPC Towers, Group CEO Mele Kyari expressed appreciation for the Tinubu administration’s support in fostering a conducive fiscal environment that has been instrumental in reaching this significant FID. “The Presidential Executive Order is instrumental to us getting to this significant milestone, and we are now seeing the impact of the policy,” Kyari said. Slated for a 2027 start-up, the Ubeta gas condensate field in OML58 will be developed with a six-well cluster connected by pipeline to the existing Obite treatment plant. The development plan includes a 5 MW solar plant and electrification of the drilling rig to reduce carbon intensity. TotalEnergies and NNPC are also focusing on local content, with more than 90% of manhours expected to be worked locally. The Ubeta Field’s FID marks a significant step in NNPC’s ongoing efforts, supported by the executive branch, to address the challenges that have historically hindered foreign investment in Nigeria’s oil and gas industry. The project is expected to stimulate economic growth, create job opportunities, and generate substantial value for various stakeholders.

Read more »

Nigeria’s NNPC Ltd and Golar LNG announce new FLNG project

In a significant move towards harnessing Nigeria’s abundant natural gas reserves, state-owned NNPC Limited has forged a Project Development Agreement (PDA) with Golar LNG for the establishment of a Floating Liquefied Natural Gas (LNG) facility off the shores of the Niger Delta. Both companies have been in discussions around the launch of FLNG ventures for several months, having already signed a Memorandum of Understand and Heads of Terms for that purpose. The PDA was signed on June10th, 2024 in the presence of NNPC Limited’s key executives including Chief Financial Officer Umar Ajiya, Executive Vice President for Gas Power & New Energy Olalekan Ogunleye, and Executive Vice President for Upstream Mrs. Oritsemeyiwa Eyesan, alongside Golar LNG’s CEO Karl Fredrik Staubo. This collaboration represents a significant stride towards commercializing Nigeria’s gas resources, aligning with President Bola Ahmed Tinubu’s vision to expedite the economic exploitation of Nigeria’s gas assets. The agreement is poised to tap into the extensive proven gas reserves from shallow water resources off the Nigerian coast. The PDA delineates a comprehensive plan for monetization, leveraging approximately 400-500 million standard cubic feet per day (MMscf/d) to produce LNG, LPG, and Condensate. Both NNPC Limited and Golar LNG have underscored their dedication to achieving a Final Investment Decision (FID) by the close of Q4, 2024, with the aim of commencing gas production by 2027. Golar LNG Limited, recognized as a leading independent owner and operator of LNG infrastructure, brings its expertise in managing LNG carriers, floating storage and regasification units (FSRUs), and floating liquefaction (FLNG) vessels to this ambitious venture. The project would be the first FLNG carried by NNPC in Nigeria and follows several such ventures currently under development by the private sector, the most advanced of which is the UTM FLNG.

Read more »

Private sector steps up efforts to expand Nigeria’s downstream gas infrastructure

Nigeria’s private sector is driving the expansion of the country’s downstream gas infrastructure in partnership with state-owned NNPC Ltd, with companies like Tetracore Energy Group and Axxela recently launching new compressed natural gas (CNG) and liquefied natural gas (LNG) facilities. Tetracore Energy Group has commissioned a new CNG facility in Ogun State, with a capacity of 3.1 million standard cubic feet per day (mmscf/d). The facility will support gas availability along Nigeria’s Western-Southern corridor, where some of the country’s biggest industrial clusters are located. The facility is expandable to 6.2 mmscf/d, providing room for expansion as demand for gas grows. In addition, Tetracore broke ground on a small-scale LNG plant, which will supply gas to industrial and power customers in Nigeria’s Southwest, South-South, Southeast, and Northern markets. “Tetracore is investing approximately $40 million into the future LNG plant where we are breaking ground today, with commissioning expected at the same time next year,” CEO of Tetracore Energy Group, Kunle Williams, said during a grand ceremony in Ogun State on June 7th. Last week, NNPC and Axela commissioned a CNG plant in Lagos, with a capacity to deliver 5.2 mmscf/d of gas per day, serving around 3,700 cars daily and supplying gas to industries and other companies. The partners also announced plans to build six additional CNG service plants to expand access to alternative fuel for cars and industries. Tetracore and Axxela are representative of increased private sector participation within Nigeria’s midstream and downstream gas space. Seplat Energy, one of the country’s leading independent operators, is currently commissioning the 300 MMscf/d ANOH gas plant, while NIPCO Gas and NNPC have agreed last year to invest in the development of several CNG stations across the country,. The private sector’s investment in gas infrastructure is crucial for Nigeria’s energy and industrialization landscape, as it enables the efficient utilization of natural gas for various sectors, including transportation, power generation, and industrial applications. Nigeria is pivoting toward natural gas as an alternative fuel after eliminating a widely used but expensive petrol subsidy, resulting in a sharp increase in pump prices. The government aims to reduce costs and promote clean energy adoption in Africa’s leading oil-exporting nation by transitioning to gas.

Read more »

NOG Energy Week: West African countries harnessing gas for industrialisation to boost economic development

Many African countries are harnessing gas and other cleaner and greener energies to drive their industrialisation journey. African countries including Ghana and Nigeria are investing in gas infrastructure and promoting its utilisation, and by extension are addressing energy poverty and environmental challenges. The Honourable Minister of Energy for Ghana, H.E. Dr. Matthew Opoku Prempeh, who recently confirmed his participation in the NOG Energy Week, taking place from 30 June to 4 July at the ICC, Abuja, amplified the need for competitive financing to propel natural gas projects. Nigeria, boasting gas reserves of over 200TCF, recently announced plans to execute a gas strategy that will trigger the nations industrialisation and economic growth. NNPC Limited’s Executive Vice President for Upstream, Oritsemeyiwa Eyesan, shared the organisation’s plans to deepen domestic gas utilisation for power generation in a bid to support the manufacturing sector. To transform the energy sector in West Africa, leveraging natural gas to drive economic growth and development is key. Gas for industrialisation contributes to increasing energy transition progress across the region. From revitalising key industries to fostering innovation, the strategic focus on gas underscores a commitment to propel West Africa towards a future built on energy security and economic resilience. Through the Decade of Gas Initiative by the Nigerian government, industry leaders have continually conveyed a collaborative approach aimed at unlocking the country’s energy resources. To drive progress in Sub-Saharan Africa’s energy market, energy stakeholders, government officials, regulators, and key industry players are convening at NOG Energy Week 2024 to deliberate on policies aimed at meeting West Africa’s energy demand. The event, themed “Showcasing Opportunities. Driving Investment. Meeting Energy Demand.”, is scheduled to take place from 30 June – 4 July at the International Conference Centre (ICC), Abuja. Speaking on what stakeholders should expect at NOG Energy Week 2024, the Country Director – Nigeria & Portfolio Director – Africa for dmg events, Wemimo Oyelana, said, “Our commitment for almost 25 years has been to provide a platform where industry leaders can have frank conversations that proffer solutions to the different challenges the industry is facing. NOG Energy Week has contributed significantly to key policy development & implementation over the years. We look forward to having industry stakeholders discuss pertinent issues including; Attracting International and Regional Funding Into Nigeria’s Energy Sector, Optimising the Significance of Natural Gas as the Fuel Of Choice, and Driving Industrialisation as a Catalyst for Economic Growth. Expected government officials and industry leaders at NOG Energy Week 2024 are; H.E. Heineken Lokpobiri, Minister of State for Petroleum Resources (Oil), H.E. Ekperikpe Ekpo, Minister of State for Petroleum Resources (Gas), Dr. Matthew Opoku Prempeh, Minister of Energy, Ghana, Engr. Gbenga Komolafe, Commission Chief Executive, Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Engr. Farouk Ahmed, Authority Chief Executive, Nigerian Midstream & Downstream Petroleum Regulatory Authority (NMDPRA), Mele Kolo Kyari, Group Chief Executive Officer, NNPC Limited, Elohor Aiboni, Managing Director, Shell Nigeria’s Exploration and Production Company Limited, Dr. Philip Mshelbila, Managing Director & Chief Executive Officer, Nigeria LNG, Eberechukwu Oji, Managing Director and Chief Executive Officer, ND Western, Dr Ernest Azudialu – Obiejesi OFR, Chairman, Nestoil Limited, Adewale Tinubu, Group Chief Executive, Oando PLC, Julius Rone OFR, Group Managing Director, UTM FLNG Limited, Daere Akobo. F.IoD, F.IMC, CMC, Group Chief Executive Officer, PANA Holdings, among others.

Read more »

OPINION: Charting the Course – Who Dares, Wins!

The African continent stands at a pivotal juncture in the global energy sector with its abundant oil and gas reserves offering immense potential for economic growth, writes Constantine ‘Labi Ogunbiyi. However, while the continent holds significant promise, navigating the upstream oil and gas sector in Africa comes with a plethora of risks and potential setbacks that demand careful consideration and strategic planning. This is against a backdrop of cutbacks in international capital for carbon-intensive oil and gas developments and increasing competition for the same sources of capital. Innovative financing solutions are thus required to fill the void, but can only be truly successful if tailored to specific needs and adopted and respected by all stakeholders. Nigeria, Africa’s largest oil producer, epitomizes the complexities and opportunities within the continent’s energy sector. Over the past decade, the Nigerian oil and gas industry has grappled with insecurity, asset vandalism, and community unrest, leading to a decline in investment. This coupled with the need for the sanctity of contracts and a properly structured fiscal framework has seen investment in the sector decline to about US$5 billion per annum from highs of about US$22 billion per annum in 2012. Nigeria has an abundance of unexploited discovered natural gas (as well as significant prospective gas resources), now heralded as a “clean” transition fuel amidst global energy shifts. Nigeria should seek to attract significant investment during this transition era (which has also seen crude oil prices rebound) to take full advantage of this, thus retaining the value of crude oil and gas resources to enable it to position itself for its energy transition (towards net zero) agenda. A just energy transition, the paradigm that gained impetus at the December 2023 COP28 Conference, is intended to decelerate financing fossil fuel developments while supporting those most vulnerable to the impacts of climate change when facilitating the transition to clean energy. This is not simply a tweak to existing systems; it is a fundamental transformation towards a cleaner, more sustainable future. This shift is driven by environmental concerns, the changing balance of power on the global stage, and awareness that the energy-producing nations in the Global South (which produce only a fraction of global emissions) should be given a chance to “catch up” industrially, technological advancement as consumer demands. It is estimated that the country needs about US$25 billion of annual investment in the next 10 years to achieve crude oil output of three to four million barrels per day and 3 bcf per day of gas production for domestic consumption (an ambition). A lack of available infrastructure, whether because of existing compromised infrastructure through age or sabotage or simply a lack of new investment, and competition for capital regionally, poses challenges that will need to be overcome to achieve this. Inadequate infrastructure impedes the development and operation of oil and gas projects in Africa, increases project costs, delays timelines, and heightens operational risks. The new Government has declared that it is “open for business” and will take urgent steps towards solving the fiscal, regulatory, security, and other issues discouraging investment and operations in the nation’s petroleum sector – something that is urgently required to help to push its oil and gas production to the ambitious levels being targeted. The mechanisms are in place – the Petroleum Industry Act (PIA) has done a lot to bring an enabling framework to the industry, including by allowing the Nigerian National Petroleum Corporation (NNPC) and its subsidiaries to raise capital on their own balance sheets, whether by divestitures or development partnerships on their blocks (including risk service contracts, financial and technical service agreements and the likes), crude forward sales, debt or equity capital raisings, etc. Still, there is a need to focus more on implementing the PIA in a manner that restores investors’ confidence and boosts oil and gas production, ultimately increasing jobs, the country’s earnings, and prosperity. Whilst international commodity traders have increased their activity and funding of oil production in Nigeria, they rarely support the development of appraisal and near-production assets. Access to innovative capital structures for such capital-intensive projects, involving a more risk-reward approach will be key to developing such assets, as will the deepening of regional capital markets to bolster the capital available from institutions such as the African Export-Import Bank and planned new initiatives such as the African Energy Bank. Effectively, more “home-grown” solutions will be required. As international oil companies shift focus to deep offshore and gas-rich assets, indigenous companies and smaller operators are stepping in to fill the void. However, accessing capital remains challenging. Innovative financing models, such as the contractor risk service model, offer a promising solution. This model, which involves contractors taking financial risks and receiving payment from production, incentivizes efficient asset development while mitigating risk for owners and operators. The contractor taking such risk, is effectively a co-financier of, and investor in, the development of the oil block – ensuring a service that would otherwise require immediate payment, to benefit from payment from oil and gas production (therein lies the contractor risk). The success of such models hinges on the support of all stakeholders, including operators, joint venture partners, financiers, regulatory authorities, and local communities. By aligning incentives and sharing risks, these partnerships can drive sustainable development and enhance investor returns. The recent completion of the FSO ELI Akaso infrastructure project by the Century Group (CG) (part of an alternative crude oil evacuation system (ACOES)), facilitated by the contractor risk service model, exemplifies the potential for collaboration to unlock value and foster growth. The ACOES is being developed as a result of the need to enhance production and supply security from oil blocks in the Eastern Niger Delta due to infractions and prolonged outages of the Nembe Creek Trunkline (historically one of Nigeria’s major oil transportation arteries evacuating up to 150,000 bopd of crude from the Niger Delta to the Atlantic coast for export). The CG model is “Made-in-Nigeria-for-Nigeria” but can be rolled out regionally (and globally too), in countries where access

Read more »

Axxela’s new gas plant to expand Nigeria’s gas infrastructure following bond success

Axxela Limited, a leading African gas and power company owned by Helios Investment Partners and Sojitz of Japan, has announced a Final Investment Decision to develop a 50 million standard cubic feet per day (MMscf/d) gas processing plant in Delta State, as it pushes towards sustainable energy solutions in Nigeria. This decision is bolstered by Axxela’s successful ₦16.4 billion bond issuance earlier this month, which was oversubscribed by 109 percent. The announcement comes as Axxela continues to expand its footprint in the energy sector, following last year’s agreement with BUA Group, one of Africa’s largest conglomerates, and CIMC ENRIC, a global leader in the energy equipment industry, to build a 700-ton-per-day mini liquefied natural gas (LNG) project. The new gas processing plant, expected to begin operations by the end of 2024, will start with a 12 MMscf/d modular unit and is designed for rapid expansion, with the potential to increase the plant’s output to 50 MMscf/d within 18 months. It is a key part of Axxela’s strategy to support the Nigerian government’s Decade of Gas initiative and to enhance domestic gas utilization. Strategically located in OML 152, the gas processing plant is expected to serve as a central processing hub for surrounding oil & gas operators, with the potential to transform gas flaring into a valuable economic resource, and significantly reduce CO2 emissions. “We are positioning to develop requisite infrastructure for natural gas processing and last mile distribution that creates market access for at least 20% of Nigeria’s gas demand,” Axxela’s Director of Business Development, Franklin Umole, said in a company statement. “Over the past two decades, we have been at the forefront of natural gas advocacy, and this project is a further reaffirmation of our dedication to gas infrastructure development and our vision to deliver innovative energy solutions across Nigeria and Africa.’’ In preparation for the project, Axxela has secured a long-term feedstock supply agreement with a leading local upstream company and established equipment supply arrangements with top-tier Original Equipment Manufacturers (OEMs). Upon completion, the processed gas will support various market segments, including Compressed Natural Gas (CNG) for vehicles, industrial feedstock, and decentralized power solutions, marking a significant step towards energy security and economic growth in Nigeria. Boost from successful bond issuance In a related financial achievement, Axxela recently raised ₦16.4 billion in an oversubscribed bond issuance, despite challenging economic conditions marked by rising interest rates and limited market liquidity. The funds will be instrumental in realizing the gas plant project. “This is a significant indicator of increasing investor confidence in our company’s reputation, brand, and performance,” CEO at Axxela Bolaji Osunsanya said. “The bond proceeds will support the development of our growth projects, signifying the importance of local and international capital markets in the development of critical infrastructure.” With the FID and successful bond issuance, Axxela looks to advance Nigeria’s gas infrastructure, support the energy transition, and meet the increasing demand for cleaner energy solutions.

Read more »

Mauritania signs domestic gas deal for Banda and Tevet fields

Mauritania has signed an exploration and gas production contract with energy firms Go gas and Taqa Arabia to tap into the discovered Banda and Tevet fields, which boast an estimated 2.2 trillion cubic feet (Tcf) of natural gas reserves. The deal represents an investment of some $1bn and is a key part of the West African nation’s plan to improve its energy infrastructure and boost electricity production. The contract, a cornerstone of Mauritania’s energy strategy, aims at supplying domestic gas to fuel the 180-megawatt Nouakchott dual power plant located north of the capital. The development is expected to stabilize the electricity supply, proving crucial for the country’s key industrial and mining sectors. “The signing of this agreement represents an important step in the framework of the new dynamic of valorization of Mauritania’s national gas resources,” Minister of Petroleum, Mines and Energy Nani Ould Chrougha said in an official statement, emphasizing the deal’s alignment with efforts to stimulate investments in the upstream segment of the oil and gas industry. Last week on Wednesday, the Mauritanian government gave approval to the gas exploration and production contract with the Taqa-Go consortium following a competitive bidding process. The consortium’s commitment includes the development of a new 120-megawatt gas-fired power plant and the enhancement of the existing 180-megawatt facility, reflecting Mauritania’s shift towards more efficient energy production. The exploitation of the Banda and Tevet fields is crucial to Mauritania’s goal of achieving universal electricity access by 2030. Banda was discovered in 2002 by Woodside Energy and was quickly earmarked as a domestic gas project, whose economics have been deemed too unattractive by most of its operators ever since. The project also aims to foster a synergistic relationship between the gas and power sectors, offering competitively priced, reliable electricity to support the nation’s industrial backbone. Both state utility SOMELEC and state-mining company SNIM are expected to benefit from more reliable gas-to-power supply. This agreement marks a significant step in Mauritania’s journey towards energy self-sufficiency as it pushes to leverage its natural resources for economic growth and energy autonomy.

Read more »

NIES: seven nations vie for Africa Energy Bank headquarters as launch nears

The race to host the headquarters of the Africa Energy Bank, a new institution aimed at financing the continent’s energy sector, is heating up as seven countries compete to meet the criteria before the end of March. The bank, which is expected to launch by June 30, 2024, is an initiative of the African Petroleum Producers Organization (APPO), a group of 18 oil and gas producing nations. The bank will have an initial share capital of $5 billion, and each member country of APPO is invited to subscribe $83.3 million, according to Omar Farouk Ibrahim, the secretary general of APPO. The criteria to host the headquarters are: having an office building available, subscribing to the share capital of the bank, and signing a host government agreement, Ibrahim said at the Nigeria International Energy Summit in Abuja on Tuesday. The seven countries that are in the running are Algeria, Egypt, Nigeria, Ghana, South Africa, Benin Republic, and Côte d’Ivoire. “This is a real competion,” Ibrahim said. Ghana has been very aggressive in pursuing the bid and has met some or is working hard to meet all of the criteria, he noted. Nigeria, however, feels that it deserves to host the bank, as it had initially wanted to host the APPO headquarters, which went to Brazzaville, Congo. The bank is part of APPO’s vision to create a new model for financing and growing the African energy industry. Ibrahim invited all stakeholders who believe in the role of oil and gas in providing a global energy mix to partner with APPO in its projects, which include the bank, the regional centers of excellence, and the provision of cross-border and regional energy infrastructure. The bank is open to investors from outside APPO and Africa, but not just to anyone, Ibrahim said. He said that APPO would ensure that the bank is not influenced by any political or ideological agenda and remains committed to a sustainable development of African hydrocarbons resources. The final decision on the headquarters will be made by the APPO council of ministers, which is expected to meet before the end of March.

Read more »

Nigeria: Transoceanic Gas & Power lines up consortium for new offshore gas hub

Transoceanic Gas & Power has announced the start of pre-FEED work for a new 3 million tons per annum (mtpa) floating LNG (FLNG) project offshore Nigeria, in cooperation with Wison New Energies and NMDPRA. The company seeks to develop an offshore gas hub around OPL 289, an offshore license located next to the Pennington terminal. It wants to monetise some 500 MMscf/d of stranded offshore and swamp gas resources to produce 3 mtpa of LNG for the export market, 150,000 metric tonnes per annum (tpa) of LPG for the domestic market, 25,000 barrels of per day (bpd) of condensates, and 75,000 metric tpa of propane. The project’s plans also include a phased gas-to-power project of up to 1GW, starting with a floating power barge of 250 MW. Feedstock would come from gas resources on OPL 289 along with OMLs 86 and 88, two shallow water blocks that include the Pennington Terminal and were recently divested by Chevron and acquired by NNPC Ltd. “The model will help derisk upstream gas resourcing, and we guarantee at least 7 TCF of gas supply,” the company says on its website. The project is backed by private equity with the upstream gas development supported by financing from Quantum Suisse, Transoceanic Gas & Power said yesterday. It has revealed an impressive lineup of international contractors and partners it intends to work with to support various components of its future gas hub, including Wison New Energies for the design and EPC of the floating LNG unit and floating power barge, Samsum Heavy Industry (SHI) for the upstream facilities, Siemens Energy for the power and compression components, and Karpowership, Vitol and Socar of Azerbaijan as LNG off-takers. Transoceanic Gas & Power is not the first company to propose a floating LNG project in Nigeria, where several such ventures are currently being planned. However, the company’s vision is unique in its scale and diversity by integrating several revenue streams that ensure a maximal usage of the gas molecules including for LNG, LPG, condensate, and power with a mix of domestic and export allocations.

Read more »

Tetracore to regionalise gas expertise as it plans Ghana’s first virtual gas pipeline solution

Tetracore Energy Group, a prominent player in Africa’s energy sector, is partnering with the Africa Prosperity Dialogues 2024 (APD 2024) in Ghana ahead of its opening of the country’s first compressed natural gas (CNG) mother station in the West African country later this year. The Nigerian company will be gold sponsor of the 3-day annual summit organised by the Africa Prosperity Network (APN), under the auspices of the President of the Republic of Ghana, H.E. Nana Addo Dankwa Akufo-Addo. It will shape a critical dialogue on the type of inclusive strategies that can deliver prosperity in Africa by promoting regional and continental integration, prioritizing marginalized populations, women, and youth, and providing a platform for sharing best practices and innovative solutions that can be scaled up across the continent. The APD 2024 will be held at the Peduase Presidential Lodge, Aburi Hills, Ghana, from January 25 to January 27, 2024. The event themed ‘Delivering Prosperity in Africa – Produce, Add Value, Trade,’ is designed to facilitate a comprehensive dialogue among key stakeholders from government, business, civil society, and academia and unlock additional regional cooperation. Expressing the significance of Tetracore’s strategic collaboration with Africa Prosperity Network, the Program Executive, Tetracore Energy Group, Oladayo Williams stated “our sponsorship of the Africa Prosperity Dialogues 2024 underscores our commitment to fostering sustainable development and energy security across the continent. We believe in the transformative power of collaborative dialogues, and the APD provides a unique opportunity to engage with thought leaders and shape the trajectory of Africa’s prosperity with the overarching goal of contributing to economic growth and prosperity in Africa, aligning with the AU Agenda 2063.” Later this year, Tetracore Energy Group ambitions to commission Ghana’s first virtual gas pipeline network and first CNG mother station. In doing so, it will bring its expertise of developing gas-to-industry and gas distribution networks in Nigeria to the rest of the region, with a focus on supporting African industries with cheap, affordable and sustainable energy solutions. Aligned with Tetracore in this strategic partnership, the Chairman and Founder, Africa Prosperity Network (APN), Gabby Asare Otchere-Darko, emphasized “Africa needs a paradigm shift and this transformation hinges on dedicated leadership, strategic investments in vital sectors, one single African Market, innovations, and a steadfast commitment to fostering trade and investment to unlocking the continent’s immense potential on the global stage. This is the second edition of the Africa Prosperity Dialogue, so when we have these meetings where political and business leaders meet, we think, plan and work together on how we can accelerate, deepen and expand the implementation of the single market project and present this to the assembly of heads of states and governments for the African Union to adopt.” Tetracore’s sponsorship reflects the company’s dedication to corporate responsibility, and sustainability, and its role as a catalyst for positive change, alongside other strategic partners for ADP 2024 including the African Continental Free Trade Area (AfCFTA) Secretariat, United Nations Development Programme (UNDP) Africa, African Development Bank (AfDB), African Export-Import Bank (Afreximbank), United Nations Economic Forum for Africa (UNECA), Africa Business Council (AfBC), Africa America Institute (AAI), Arab Bank for Economic Development in Africa (BADEA), Africa Soft Power, and Ghana Investment Promotion Centre (GIPC). To register for the Africa Prosperity Dialogues 2024 (APD 2024), visit www.africaprosperitynetwork.com for more information.

Read more »

Programme Unveiled for Eighth SAIPEC 2024

The eighth edition of the Sub-Saharan Africa International Petroleum Exhibition and Conference (SAIPEC) returns to the Eko Convention Center in Lagos from 13-15 February 2024. This premier industry event, is hosted by PETAN in strategic partnership with the Nigerian Content Development Monitoring Board (NCDMB), Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and NNPC Limited. Keeping with the theme, “The Next Steps: Accelerating African Content; the conference will highlight billions of dollars of project opportunities across Africa. SAIPEC, with local content at its core, plays a vital role in charting the pathway to developing the continent’s untapped energy, oil, and gas resources and annually represents more than 30 NOCs, IOCs, governments, and regulators. With more than 6,000 attendees from 51 countries, this year’s event promises to be bigger and better than ever. Over five days, the full SAIPEC programme features numerous B2B networking and partnership opportunities. Beginning on 12 February and preceding the main conference discussions start at the 3rd African Content Series seminar, again hosted by NCDMB and PETAN, and attended by a select number of NOCs, IOCs, regulators, governments and private sector representatives. The conference programme features over 100 speakers from across Nigeria, Ghana, Senegal, Mozambique, Cote d’Ivoire, The Gambia, Republic of Congo, Kenya, Tanzania, Namibia, Niger, Guinea, Uganda, South Sudan, Islamic Republic of Mauritania and Senegal. SAIPEC will highlight the future of the energy, oil, and gas industry in Sub- Saharan Africa with special focus sessions on regional collaboration and SAIPEC’s Diversity, Equality and Inclusion and Youth Empowerment programmes. The free-to-attend SAIPEC exhibition runs from 13 – 15 February, featuring a record number of exhibitors that span various companies specialising in services across the industry. Finally, a plethora of networking opportunities underpins the main conference and exhibition proceedings including the SAIPEC Awards, drinks receptions and PETAN’S golf day as the concluding event on 15 February. An overview of the programme is now available to download via the SAIPEC website https://saipec-event.com/programme

Read more »

After its Shell acquisition, Renaissance to become pillar of Nigeria’s local content and gas monetisation strategy

Shell has announced today the sale of its onshore Nigerian subsidiary, the Shell Petroleum Development Company (SPDC), to the Renaissance Africa Energy Company comprised of ND Western, Aradel Energy (former Niger Delta E&P), First E&P, Waltersmith and Petrolin. The deal is still subject to approvals by the Nigerian government and, if completed, would represent the biggest M&A for the country’s oil & gas sector. While many will see it as yet another exit by a major IOC from the Niger Delta, the transaction is a win for Africa’s local content development. The Renaissance consortium comprises some of Nigeria’s most respected upstream companies with a demonstrated track record of redeveloping mature assets in the Niger Delta. The group already successfully came together in 2011 to incorporate ND Western and acquire SPDC’s 45% interest in OML 34. Individually, each of Renaissance’s shareholders have also demonstrated an ability to operate in Nigeria and maximise domestic value creation. Aradel Holdings has grown an integrated oil, gas and refining business around Ogbele that has continued to expand over the years. Waltersmith follows a similar pattern as operator of the producing Ibigwe marginal field and the Ibigwe modular refinery. First E&P successfully commissioned the Anyala-Madu shallow water hub in 2020 and is working with Dangote on achieving first oil at the Kalaekule Field soon. The transaction also includes continued support from Shell – operationally and financially – through the transition. This is critical to prevent past errors made during divestments in Nigeria with too little attention given to financial resources allocated to assets operations and redevelopment post completion of the deals. Last but not least, Renaissance is set to become a critical player in Nigeria’s energy transition journey as it takes over some of the country’s biggest gas upstream and midstream assets. Nigeria is currently faced with a gas supply shortage that must be addressed to meet the objectives of the Decade of Gas which seeks to grow gas penetration and develop a gas-based economy that is more sustainable and spurs industrialization. As Nigeria seeks to grow gas production, processing, and distribution, Renaissance will become a pillar of the country’s gas monetization strategy and a critical partner to the public and private sector players seeking to expand the country’s gas value-chain. In that regard, the appointment of Tony Attah, former Shell executive and Managing Director/CEO of Nigeria LNG for more than five years, to be Renaissance’s first MD/CEO is not insignificant.

Read more »

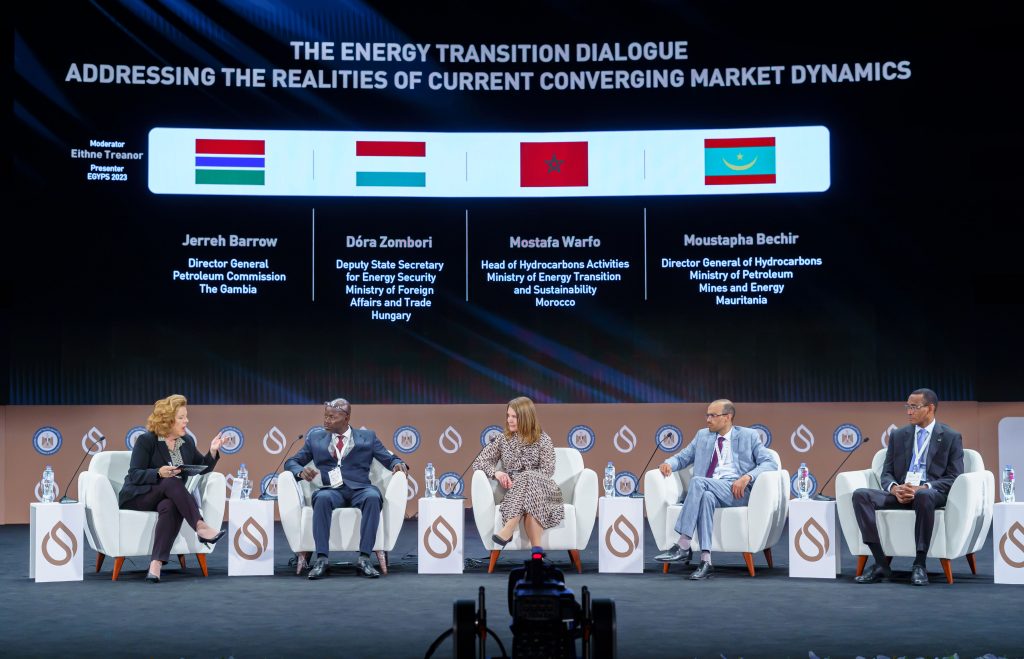

Egypt to Host Major Energy Show Focused on Decarbonisation

Egypt is gearing up to host the Egypt Energy Show (EGYPES) 2024, a three-day event that will bring together thousands of energy experts, investors, and policymakers to discuss the challenges and opportunities of the global energy transition. The show, which will run from Feb. 19 to Feb. 21 at the Egypt International Exhibition Center in Cairo, is expected to attract more than 35,000 attendees and 2,200 delegates from across the energy supply and value chains, according to a statement from the organizers. The theme of the show is “Driving Energy Transition, Security, and Decarbonisation,” reflecting the urgent need to cut greenhouse gas emissions and achieve net-zero targets in line with the Paris Agreement on climate change. The show is held under the auspices of Egyptian President Abdel Fattah El Sisi and supported by the Egyptian Ministry of Petroleum and Mineral Resources, which has been leading the country’s efforts to diversify its energy mix and become a regional energy hub. Africa Dialogue Conference A highlight this year is the Africa Dialogue Conference, a forum for influential African stakeholders, including government officials, financiers, economists and energy though leaders. They will tackle thorny issues such as policy, regulation, gas infrastructure and how to harness Africa’s abundant energy resources for a greener and richer future. Egypt’s Minister of Petroleum and Mineral Resources Tarek El Molla said the show has become a cornerstone of the energy ecosystem in Africa and the Mediterranean, spurring business and investment in the regional energy market. “Each year, we witness substantial growth, increased interest, and the formation of invaluable partnerships, thereby accelerating Egypt’s ascendancy as a regional energy hub,” he said in the statement. The show will feature a comprehensive conference programme, with more than 80 sessions and 300 speakers covering topics such as decarbonisation and methane reduction strategies, energy security and affordability, and the role of fossil fuels and renewables in the energy transition. Among the speakers are John Ardill, vice president of ExxonMobil, who said he looks forward to the show as a vital opportunity to engage in constructive discussions regarding energy security, investments in oil and gas, and the transition towards a lower carbon, lower emissions, and sustainable future. Future Energy Zone & Theatre The show will also feature a new Future Energy Zone & Theatre, an immersive platform for showcasing energy innovations. It will cover all aspects of the energy transition, from decarbonisation and hydrogen to digitalisation and alternative energy. It will also host discussions on the regional impact of emerging technologies and the role of different players in shaping the future of energy for Egypt, the region and the world. More than 500 exhibitors from local and international firms will display the latest gadgets, gizmos and solutions in the energy sector. The exhibition will include 12 country pavilions and 26 national and international oil and gas companies. CLIMATECH Challenge Another innovation is the CLIMATECH Challenge, a contest for energy start-ups to pitch their resilient business models and inventions. The aim is to speed up regional adaptations, highlight the importance of climate technology for a low-carbon future and spot undiscovered energy entrepreneurs. Other attractions The show will also host the EGYPES 2024 Sustainability in Energy Conference, where industry leaders will explore the latest developments in clean energy and the strategies required to accelerate net-zero targets by 2050. The EGYPES 2024 Finance and Investment in Energy Conference will bring together energy leaders, sustainable finance experts, and climate professionals to address the economic uncertainties facing global economies and the financial mechanisms and capital market tools to support future energy systems. The EGYPES 2024 Equality in Energy Conference will unite global industry experts, including organisational change management, inclusion, and sustainability leaders, driving discussions on how talent strategy is becoming a paramount priority in shaping a people-centred energy future. In addition to the overarching theme of EGYPES 2024, the EGYPES Energy Awards will take centre stage, honouring trailblazers and energy pioneers making headlines in energy, whose contributions have been instrumental in advancing the global energy landscape towards achieving net-zero emissions and enabling transformational change for people, organisations and economies. To facilitate exclusive networking opportunities, the EGYPES Energy Club (EEC) will continue to elevate EGYPES 2024 as a private membership club lounge, where industry veterans and C-suite leaders can connect and explore critical partnerships for the future. Serving as the destination for all energy stakeholders, the Energy Club will set the stage for signing agreements and MOUs, executive meetings, and media-free networking enabling energy negotiations and decisions of national and global significance. The show comes at a time when the energy sector faces unprecedented challenges and opportunities amid the covid-19 pandemic, geopolitical tensions and climate mandates. The show hopes to foster dialogue, collaboration and action to drive the energy transition and decarbonisation agenda in Africa and the Mediterranean. For more information, including how to plan your EGYPES 2024 experience, visit the show’s website: egypes.com.

Read more »

Perenco opens the tap on new Gabon LPG unit

Gabon’s Transition President General Brice Clotaire Oligui Nguema has inaugurated Perenco’s Batanga LPG Plant last week, marking another critical milestone in the roll out of Perenco’s gas monetisation strategy in Central Africa. Perenco is a pioneer in the monetisation of associated gas in the Gulf of Guinea where it is deploying innovative solutions to reduce flaring and process gas for the production of electricity, liquefied petroleum gas (LPG) or liquefied natural gas (LNG). In the 2000s, it commissioned a high pressure offshore pipeline network of over 400km in Gabon, including a compression station at Batanga to supply previously flared gas to the power stations of Libreville and Port Gentil. Additional compressors have been installed since to further reduce flaring, with volumes averaging 50 MMscf/d. The commissioning of the 15,000 tonnes per year (tpy) LPG unit at Batanga represents the next step in an already successful strategy of monetising local resources in Gabon. It will help the country cut imports of cooking gas by a at least a third, and will be followed by the commissioning of the 0.7 tpy Cap Lopez LNG terminal in 2026. Perenco is also progressing the development of a 21 MW gas-to-power plant at Mayumba in the south of the country, in collaboration with the Gabon Power Company.

Read more »

VFuels wins FEED contract for new refinery in Nigeria

VFuels LLC, a Houston- based oil and gas engineering firm, has signed a Front-End Engineering Design (FEED) contract with HSI Refining & Petrochemical Company Ltd for a modular refinery project in Nigeria. The contract, which was announced on 17th November, covers the design and engineering of a 5,000 barrels per day (bpd). The refinery will process crude oil produced from a marginal field located in Abia State. The project is expected to be completed in 18 months and will produce Naphtha, Kerosene, Diesel, and Heavy Fuel Oil for the domestic market. “The refinery is set to play a crucial role in meeting the growing demand for energy products in Abia state as well as fulfilling the need for decentralized refining infrastructures in Nigeria,” Vfuels said in an official statement. VFuels specializes in modular process equipment for the oil and gas industry, and has experience in designing and fabricating modular refineries, gas plants and early production facilities. Earlier this year, VFuels announced that it has been selected to carry out expansion works at the Waltersmith Ibigwe Refinery in Imo State. The contract allows VFuels to double the refinery’s capacity to 10,000 barrels per day (bpd), after it designed and installed the 5,000 bpd Phase, which was commissioned in 2020.

Read more »

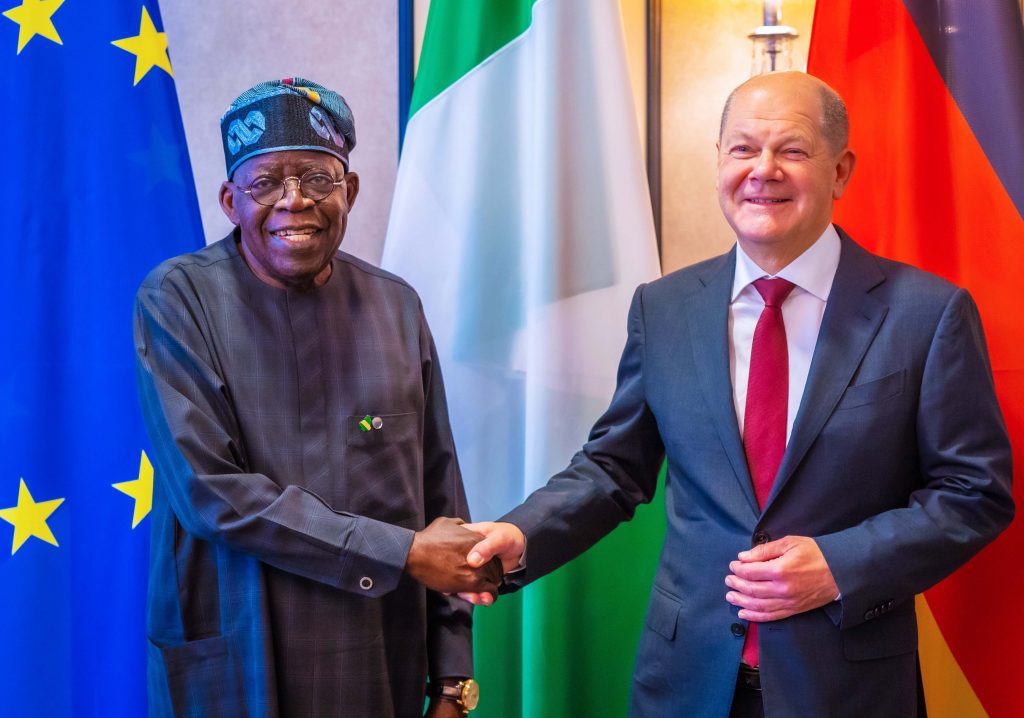

Nigeria and Germany sign gas deal and clean energy investment agreement

Nigeria and Germany have signed a historic agreement that will see Africa’s largest oil producer supply more gas to Europe’s biggest gas consumer. In an MOU signed by Nigeria’s Riverside LNG project, which works in the country’s Niger Delta, and Germany’s Johannes Schuetze Energy Import, Nigeria will export 850,000 tons of liquefied natural gas per year to Germany. The agreement also includes a provision for export volume to increase to 1.2 million tonnes in future. Under the deal, Nigeria is expected to export its first deliveries of liquified natural gas (LNG) to Germany in 2026, which will account for 2% of Germany’s total LNG imports. The deal was signed at the G20 Compact with Africa conference in Berlin on November 21, 2023, according to an official statement from the Nigerian presidency. In addition to the gas deal, Germany has pledged to invest $500 million in renewable energy projects in Nigeria, with a primary focus on rural communities. The investment is expected to create jobs and power sustainable economic growth in the country. “This agreement marks a new era of cooperation between our two countries,” Nigerian President Bola Ahmed Tinubu said. “It is a testament to the strong relationship between Nigeria and Germany and our shared commitment to sustainable development.” Nigeria’s economy, which has been grappling with the impact of falling oil prices in recent years, is expected to benefit positively form the gas deal and renewable energy investment. The deal will also help Germany meet its energy needs while reducing its reliance on fossil fuels.

Read more »

TAQA Arabia commissions Tanzania’s first integrated CNG filling station and conversion center

TAQA Arabia, Egypt’s full-service energy and utility provider, has commissioned Tanzania’s first integrated Compressed Natural Gas (CNG) Filling Station and Conversion Center branded “Master Gas.” The project was carried out by TAQA Dalbit, a Joint Venture (JV) between TAQA Arabia and JCG Oil & Gas, a unit of the Janus Continental Group (JCG). The CNG station, expected to serve 800 vehicles a day, is the first of 12 stations that TAQA Dalbit plans to open in Tanzania in the coming years. TAQA Dalbit plans to invest $12 million in establishing the natural gas fuelling stations. TAQA Dalbit focuses on investing, developing, building and operating filling stations and conversion centers to convert and fill cars with compressed natural gas. A CNG-powered passenger vehicle emits about 25% less CO2 and is, on avearge, 50% cheaper than petrol cars. “We are on the cusp of a transformative shift in Tanzania’s energy landscape,” Tanzania’s Deputy Prime Minister and Minister of Energy, Dr. Doto Mashaka Biteko, said during the commissioning ceremony in the country’s city and financial hub of Dar re Salaam. “The new CNG Filling Station and Conversion Center is a monumental achievement that demonstrates the Tanzanian government’s keenness to provide state-of-the-art solutions and technological prowess as part of our commitment to form a sustainable, greener and economically efficient future.” Tanzania is betting on TAQA Arabia’s know-how and experience in energy projects to help the east African country to unlock its energy potential and benefit from its gas reserves. Beyond serving vehicles, the company also aims to deliver natural gas to households, catering to varied needs of customers in Tanzania with CNG and LNG. “TAQA Arabia is committed to expanding its presence in the Tanzanian market across various areas,” Chairman of TAQA Arabia, Eng Khaled Abu Bakr said. “TAQA Arabia is looking also in adding greater value to clients either with natural gas distribution, conventional and renewable power generation and distribution and other utility services that the company provides.” TAQA Arabia, a subsidiary of Qalaa Holdings based in Cairo, provides energy and utility services to over 1.7 million customers across 50 cities in Egypt. The services include natural gas, electricity, renewable energy, petroleum products, and water.

Read more »

Nigeria LNG Train 7 hits 52% but concerns remain over future feedstock

The Nigeria Liquefied Natural Gas (NLNG) Train-7 project has reached 52% completion, as Africa’s leading oil producer pushes to boost its gas sector and increase its revenue from gas exports. The multi-billion dollar NLNG Train-7 project is an expansion under construction at the 22.5 mtpa NLNG Terminal in Bonny Island, Rivers State. The project aims to increase capacity by an additional 7.6 mpta of LNG by building a seventh train of 4.2 mtpa capacity and debottlenecking the existing trains. But despite the substantial progress made in constructing Train-7, concerns remain over the future feedstock. These were notably voiced during an engagement session between the Executive Secretary of the Nigerian Content Development and Monitoring Board (NCDMB), Engr. Simbi Kesiye Wabote and Dr. Philip Mshelbila, the Managing Director of NLNG, at the gas company’s operational base at Bonny Island. NLNG management expressed concerns over the delay in initiating deep-water gas projects that are intended to supply feed gas for Train-7 and future expansions. This delay means the facility could be completed without a gas source for liquefaction. Mshelbila said NLNG is already facing difficulties in getting adequate gas supply, resulting in its six plants –Trains 1 to 6 – producing below 50% of their total installed capacity. Data collected by Hawilti shows that the facility was already operating at only 65% last year. While feed gas to the NLNG plants comes mainly from some of its joint ventures (JV) partners, including Shell Petroleum Development Company (SPDC) Limited, Total Energies and Nigerian Agip Oil Company (NAOC), Mshelbila said supplies have suffered disruptions due to recurrent vandalism of pipelines, facility failures and low production from aging wells. According to Mshelbila, NLNG is exploring several options to mitigate the challenge, including partnering with critical security agencies to curtail vandalism on the pipelines and working with their JV partners to increase their gas production. To boost performance of Trains 1 to 6, Mshelbila said the Board of Directors at the NLNG has approved for the company to procure gas from other international and indigenous gas producers.

Read more »

Nigeria: start of exports from the new Nembe Creek Oil Export Terminal

Nigeria has introduced a new crude oil grade to the international oil markets with the exports of two cargoes of Nembe Crude Oil from the new Nembe Crude Oil Export Terminal (NCOET), NNPC Ltd said. The two initial cargoes of 950,000 barrels each have been exported to France and the Netherlands. Nembe crude is produced from onshore OML 29, operated by the NNPC/Aiteo Eastern E&P joint venture. Oil was previously exported via the Nembe Creek Trunk Line (NCTL) to Shell’s Bonny Oil Terminal. However, recurrent crude theft and pipeline vandalism have made the export route unavailable for months, severely curtailing production from OML 29. The unreliability of the pipeline has also affected Newcross E&P (OML 24), Eroton E&P (OML 18) and BelamOil (OML 55) who all rely on NCTL to access the Bonny Oil Terminal. Nembe crude has a low sulphur content and low carbon footprint due to flare gas elimination, NNPC said. This makes the new grade particularly attractive for European buyers. The oil also has an attractive Assay of API 29, which commands a premium to the global Brenth benchmark. The new export terminal was established following the Nembe Crude Oil Export Terminal, Nembe (Establishment) Order gazette on January 19th, 2021. It relies on the 2 million barrels Galilean 7 floating, storage and offloading (FSO) vessel able to export some 3.6 million barrels of oil every month. The FSO was converted from a crude oil tanker at the Dung Quat Shipyard in Vietnam. Several alternative crude oil evacuation systems have been put in place by operators who used to rely on the Nembe Creek Trunk Line. Newcross E&P put in place the MB Bryanston shuttle tanker with a storage capacity of some 800,000 barrels. Along with nearby producers, the company has been barging crude from OML 24 to the vessel before sending oil to the Bonny Oil Terminal for exports. Last month, Century Energy Services Ltd (CESL) also announced the completion of spread mooring installation at another 2 million barrels FSO, the ELI Akaso. The unit is owned by Energy Link Infrastructure Limited and will help debottleneck production from OML 18.

Read more »

Senegal: 33% up for grab into new Yakaar-Teranga gas project says PETROSEN

The development of the world-class Yakaar-Teranga gas fields offshore Senegal will welcome a new partner alongside Kosmos Energy and PETROSEN, the national oil company said today. Earlier this week, Kosmos Energy announced it was increasing its working interest in the Cayar Profond Block from 30% to 90% and assuming operatorship after the exit of bp. Both fields were discovered in 2016 and 2017 and hold some 25 Tcf of low carbon, high quality gas, making their development attractive for transportation and liquefaction. Kosmos Energy said it was working on a 550 MMscf/d development concept that would provide gas to the domestic market to replace heavy fuel oil in power plant, and export the rest via a new floating LNG (FLNG) unit. PETROSEN clarified that it would increase its interest to 35% once the fields start producing. Long-term, the view is for Kosmos Energy and PETROSEN to both farm down their interests to a new partner so that the partnership includes PETROSEN (34%), Kosmos Energy (33%) and a new partner that would hold the remaining 33%. “This structure marks a turning point in the growing influence of the national company who will play a growing role in the ventures in charge of developing the country’s hydrocarbon resources,” PETROSEN said in a statement.

Read more »

Greenville launches historic L-CNG station in Nigeria

Greenville LNG, a company producing liquefied and compressed natural gas for the Nigerian market, has officially inaugurated the first-ever Liquefied Compressed Natural Gas (L-CNG) station in the country today amidst efforts to boost domestic use of gas as a cleaner and cheaper fuel in Africa’s most populous country. Launched in Nigeria’s Kaduna state, the outlet seeks to transform the transportation landscape through enhanced gas distribution, which in turn curbs fuel shortages. The facility is expected to cater for a wide range of vehicles, including tricycles, buses, and other small vehicles, offering a cleaner and cost-effective alternative to traditional fossil fuels. “Both LNG and L-CNG offer compelling alternatives to traditional fuels, delivering 15-20% fuel cost savings and promoting eco-friendly choice,” Greenville notes in its online channels confirming the launch. “Notably, L-CNG will boost the economy by promoting local business and the transport sector in Kaduna.” As part of efforts to advance clean and cost-effective energy in Nigeria, Greenville says it is establishing 25 L-CNG distribution hubs to provide reliable energy to fuel stations across the country. The company already supplies gas to more than 25 major companies across Nigeria using over 300 LNG powered trucks as part of its innovative virtual pipeline system. Greenville has a network of LNG re-fueling stations strategically located in several parts of the country for LNG fueled trucks, tankers and buses. Founded in 2015, it installed 3 gas liquefaction trains at its Rumuji plant in Rivers state, which it commissioned in 2018. Although Nigeria holds some of the world’s biggest gas reserves estimated at over 200 trillion cubic feet (Tcf), they remain largely underdeveloped, benefiting industrialization and power generation overseas through LNG exports instead. But, boosting local consumption is now at the centre of the government’s agenda as it promotes gas as a transition and cleaner fuel. Boosting local gas consumption with reforms Nigeria’s downstream gas sector has particularly witnessed a raft of reforms since President Bola Tinubu assumed office on May 29 this year, amid push to boost confidence among domestic and international investors looking to do business in Africa’s biggest economy. The subsidy removal on gasoline is notably one of those changes. Cheap petrol prices, which Nigeria spent a fortune subsidising, had made it difficult for motorists to consider an alternative source of fuel such as Compressed Natural Gas (CNG). This also meant a poor investment case for potential investors. But with the subsidy removal levelling out the playing field for all fuels, Nigeria’s transport sector presents tremendous growth opportunities for the CNG and LNG industry. However, while subsidy removal incentivises motorists to go for a cheaper and cleaner fuel in gas, limited investments over the years also mean limited gas infrastructure, which could stifle growth opportunities for Nigeria’s domestic gas market. To bolster the shortfall in critical gas infrastructure, the Nigerian National Petroleum Company (NNPC) partnered earlier this year with NIPCO Gas Limited to deploy CNG stations across the country. The NNPC-NIPCO partnership, signed in August, aims at expanding Nigeria’s CNG infrastructure as it pushes for improved access to CNG, while speeding up the adoption of cheaper and cleaner alternative fuel for private cars and vehicles used for public transport. NIPCO Gas Limited already operates 14 CNG stations across Nigeria, and has converted over 7,000 vehicles to run on CNG, mostly in Benin City. NNPC is betting on NIPCO’s technical expertise and field experience to drive and expand the initiative. The project will be rolled out in phases. The first phase, supporting intra-city transportation, targets 21 CNG stations by Q1 2024. The second phase, to be ready in Q4 2024, will cover 35 CNG stations, servicing inter-city transportation. NNPC plans to bolster the programme with an additional 56 stations through its retail outlets across the country. Once fully operational, the stations can service over 200,000 vehicles daily, the state oil firm said, adding it expects more oil marketing companies from the private sector to participate in expanding CNG penetration and availability in Nigeria.

Read more »

RusselSmith to deploy Nigeria’s first industrial 3D manufacturing solution for the oil and gas industry

RusselSmith, one of Nigeria’s leading oil and gas maintenance and inspection solutions companies, has gained approval to deploy its industrial non-metallic additive manufacturing solution in the Nigerian oil and gas industry. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) gave the approval for the country’s first industrial 3D manufacturing solution for the oil and gas industry. RusselSmith’s additive manufacturing solution utilizes advanced 3D printing technology to locally produce fully functional and corrosion-resistant industrial components, saving time and cost for oil and gas companies ordering such parts through traditional supply chain methods. It also reduces companies’ carbon footprints, while improving efficiency in their operations. “This is a new milestone in the Nigerian energy sector, and we are excited to be leading the charge in industrial 3D manufacturing,” RusselSmith’s CEO, Kayode Adeleke, said in an official statement. “We are also proud that the NUPRC has once again exhibited its role in the industry as not just a regulator, but a facilitator of business in Nigeria. We are building the foundation for a digital supply chain across Africa, and this is just the beginning. With this approval, our non-metallic additive manufacturing solution is now operational and available to service the needs of the Nigerian market”. RusselSmith says its additive manufacturing solution utilizes high-performance materials such as super polymers and composites to produce finished parts that are less susceptible to material degradation and corrosion. Super polymers, ideal for diverse applications, are known to endure extreme conditions without compromising their functionality and desirable properties. Delivered in partnership with Roboze, a renowned provider of Industrial 3D Printing systems, RusselSmith is betting on its extensive technical capabilities to digitize supply chains, optimize production processes and advance manufacturing in the Nigerian oil and gas industry. In January, the Nigerian services company joined Roboze 3D Parts Network, becoming part of a network of specialized additive manufacturing centres that use Roboze ARGO Production technology and are able to deliver on complex designs and difficult engineering challenges. “We at Roboze are proud to be associated with this innovative development,” CEO of Roboze Alessio Lorusso said, referring to RusselSmith’s latest landmark approval in Nigeria. “The approval by the NUPRC for the use of this additive manufacturing technology is a significant step forward for Nigeria’s energy sector in embracing digitalization, and we are fully committed to supporting our partner, RusselSmith, with our expertise and global network to ensure the success of this solution.”

Read more »

Nigeria: new FSO ELI Akaso has started storage operations offshore Bonny

Century Energy Services Ltd (CESL), part of Nigeria’s Century Group, has announced the completion of spread mooring installation at the floating, storage and offloading (FSO) unit ELI Akaso offshore Bonny in Nigeria. The double hull terminal has a storage capacity of 2 million barrels and will provide hydrocarbons evacuation, storage, and offtake solutions for producers within the area. It has been classed by Bureau Veritas for oil storage services. The commissioning of the FSO is welcomed news for producers around Bonny who have struggled to evacuate their oil over the past few years due to the unavailability of the Nembe Creek Trunk Line (NCTL) and the Trans-Niger Pipeline (TNP). Both lines are the main options for operators to send their oil to Shell’s Bonny Oil Terminal for exports to global markets. The FSO ELI Akaso will be providing an alternative options to store and export oil and is expected to support production recovery around Bonny. “The FSO ELI Akaso, which offers hydrocarbon storage and export solutions, exemplifies our strategic approach to addressing both current and future demands of the oil and gas industry,” said EnergyLink Managing Director Adekolapo Ademola. The terminal is owned by Energy Link Infrastructure Limited (EnergyLink) and operated/managed by CESL. “With the FSO ELI Akaso Terminal, we have significantly advanced our collaboration in oil and gas infrastructure, positively impacting EnergyLink’s business approach and bottom line. The terminal is a remarkable accomplishment and a further testament to CESL’s energy infrastructure project delivery capacity and experience,” added Ken Etete, Group CEO at the Century Group. CESL has imposed itself as Africa’s foremost owner and operator of FPSOs and FSOs. Its fleet includes the FPSO Tamara Nanaye, previously deployed on OML 113, the FPSO Tamara Tokoni on OML 120, and the recently acquired FPSO Tamara Elmina (former Sendje Berge).

Read more »