Uncategorized

Petralon Energy CEO takes over as Chairman of the Nigerian Exchange Ltd (NGX)

The Nigerian Exchange Group Plc (NGX Group) has announced changes to the board of its subsidiaries, and appointed the Founder & CEO of Petralon Energy, Mr. Ahonsi Unuigbe as the new Board Chairman of the Nigerian Exchange Limited (NGX). The appointment is effective 27 September 2023, following the retirement of Mr. Abubakar Mahmoud, SAN, OON. Ahonsi has previously served on the NGX Board as an Independent Non-Executive Director since April 2021. Ahonsi’s appointment is a demonstration of his leadership and entrepreneurial ingenuity, validated by its vast expertise. Over the past twenty years, he has established himself as a business leader and seasoned professional, whose experience spans across sectors such as banking, finance, energy, telecoms, manufacturing and the public sector. He began his career as an investment banker, working with banks such as Citibank in the UK and Nigeria and later Standard bank / Stanbic IBTC, with stints in the public sector, during which time he successfully executed complex project finance transactions, thereby helping to raise over $2bn as capital for private and public sector projects in Nigeria, notable amongst which were the $150 million concessional World Bank funding for Edo state during his tenure as pioneer Commissioner for Budget, Planning, and Economic Development. Ahonsi also served as a founding executive at First Hydrocarbon Nigeria (FHN). As a Chief Finance Officer and Executive Director, he raised over $450m in debt and equity finance within 3 years and instituted best-in-class risk management frameworks and financial management processes respectively. Since founding Petralon Energy in 2014, Ahonsi managed to raise over $60m over 2021 and 2022 to consolidate the company’s oil assets portfolio. Under his leadership, Petralon Energy has sealed multilateral partnerships and investments in Europe, the Middle East and Africa managed to build a diverse portfolio of onshore and offshore producing assets. Commenting on his appointment, Ahonsi stated “I am pleasantly honoured by this appointment and fully understand the enormous responsibility that this new role places on my shoulders. Chairing this important Board at this specific time in the Exchange’s evolution is both an opportunity and call to service in building our market, economy, and nation. With the strong foundation laid by my predecessor, bringing about reforms and deepening policy frameworks that would help to strengthen the market for further growth and development are easily achievable. I therefore seek the support and cooperation of all stakeholders towards placing this very important institution on an even stronger pedestal.” A Lifetime member of the Institute of Directors (IoD), Ahonsi holds a B.A degree in Economics from the University of Sussex, UK, and an MSc in International Securities and Investment Banking from the ISMA Centre, University of Reading, UK, and is also a recipient of the prestigious Archbishop Desmond Tutu Leadership Fellowship Award.

Read more »Africa’s offshore rigs count climbs to new highs amidst drilling frenzy

Africa’s offshore rigs count has kept growing since the start of 2023, with 36 drilling rigs contracted this year so far. Recent contract extensions and new contract awards have confirmed 2023 as one of the biggest years for offshore drilling activity on the continent in a decade, shows the new Offshore Rigs Tracker released by Hawilti and the Caverton Offshore Support Group (COSG) Plc. Nigeria is playing catch up Nigeria, who has lost its position of top African oil producers several times on the back of repeated crude theft and pipeline vandalism, is showing signs of recovery. Several of the rigs mobilised offshore Nigeria have been extended, including the Valaris DS-10 for SNEPCo and Shelf Drilling’s Baltic and Mentor rigs for TotalEnergies and First E&P respectively. In addition, Shelf Drilling has also secured new contracts for the Adriatic I and the Scepterunits which are providing a boost to Nigeria’s offshore drilling activity. In total, Nigeria will see eight offshore drilling campaigns take place this year at any point in time, putting it at the same level as Angola. The southern African country had long held the position of top drilling destination on the continent as international oil companies (IOCs) have several rig mobilised on long-term contracts there to support infill, development, and exploratory drilling in deep-water. “The recovery of Nigeria’s offshore drilling activity is welcome news as the industry continues to be a main driver of the Nigerian economy. This is in turn providing unique opportunities for aviation services providers to pursue growth opportunities and provide safe and sustainable solutions to transport workers and equipment to offshore drilling rigs and platforms,” said Capt Ibrahim Bello, Managing Director at Caverton Helicopters. “Such market activity also contributes to the development of other sectors such as search and rescue, VIP transport, and executive charter services,” he added. TotalEnergies is leading the pack The French major has imposed itself as the most active operator offshore Africa this year, with a total of eight rigs mobilised throughout 2023, including three in Angola, two in Nigeria, two in Namibia, and one in West Africa whose destination is yet to be disclosed. The company’s Namibian campaign represents tome $300m of investment to appraise its Venus discovery, drill the Nara prospect, and execute drill stem tests (DSTs). In Nigeria, TotalEnergies is also drilling the Ntokon Central shallow water prospect on OML 102, but more importantly executing a multi-well deep-water campaign on its Egina and Akpo hubs within OML 130. Egina is notably experiencing a rapid production decline which the drilling campaign seeks to address. Up to nine wells are scheduled on both Egina and Akpo, including potential exploratory drilling of nearby prospects. Exploration is heating up Exploration activity is also supporting the drilling momentum, with rigs mobilised across frontier markets to spud several much-anticipated wildcats. Eni has contracted the Capella drillship to drill the Raia-1X well offshore Mozambique, with results yet to be announced. New rig contracts have also been awarded by Galp to spud two wells offshore Namibia later this year, and by Shell to drill a wildcat offshore Mauritania at the end of 2023. “Any new discovery is likely to provide further impetus to explore African basins and make the best of the current high oil prices cycle,” noted Mickael Vogel, Director & Head of Research at Hawilti. “However, the rigs market remain extremely tight and under supplied. High mobilisation rates and lack of rig availability is already slowing down the pace of activity and delaying several drilling plans by operators offshore Africa.”

Read more »Hello world!

| 1 Comment on Hello world!Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Read more »

Nigeria: Century Group consolidates position in offshore oil & gas market

The Century Group, the only Nigeria-owned company to own and operate floating, production, storage and offloading (FPSO) vessels in Africa, is consolidating its market presence on the country’s offshore oil & gas market. On March 24th, it signed an agreement with Samsung Heavy Industries Nigeria (SHIN) for the renovation of its FPSO Tamara Nanaye. The vessel, previously known as FPSO Front Puffin, previously served as the production hub for the Aje Field on OML 113. As technical partner to the OML 113 operator, Century successfully kept the Aje field operational, productive and profitable from 2014 to 2021. Century Group has now selected SHIN to carry out a de-bottlenecking upgrade to maintain and upgrade the FPSO ahead of its redeployment offshore Nigeria later this year. Hawilti previously reported that the FPSO Tamara Nanaye had been selected to support the redevelopment of the Kalaekule Field on OML 72, operated by West Africa E&P, a joint-venture of Dangote Exploration Assets Ltd and First E&P. “The FPSO Tamara Nanaye is undergoing renovations such as adding topside production facilities, altering flaring capacity, change mooring system to spread mooring and adding a riser porch structure to increase the production capacity of the FPSO,” Century Group said in a post last week. The upgrade of the FPSO locally in Nigeria will allow a shorter renovation timeline than sending the vessel for maintenance overseas, and will reduce the input cost. On April 3rd, Century Energy Group announced another deal to complete, operate and maintain the ELI Akaso floating, storage and offloading (FSO) vessel of Energy Link Infrastructure (ELI). The FSO serves as a new evacuation route to onshore OML 18 and neighbouring fields where production has been severely curtailed by the unavailability of the main evacuation pipeline, the Nembe Creek Trunk Line (NCTL). Under a Risk Service Contract (RSC), Century Group has already deployed its personnel, infrastructure and expertise to finish the spread mooring of the FSO, which is expects to complete on April 10th, 2023. With a storage capacity of 2 million barrels of oil, the FSO can offer a reliable export route for onshore fields seeking access to the export market. The evacuation system includes a 47km undersea pipeline with a targeted throughput capacity of 100,000 barrels of oil per day (bopd) once operational. With both deals, Century Group continues to build local content within segments of the value-chain that are traditionally reserved for international players.

Read more »

Industry Catch-up: What You Might Have Missed

The oil & gas sector knows no break and has had its fair share of developments over the past two weeks. Here is what you need to know as you get back to the office. Mozambique has announced the results of its 6th Licensing Round On December 21st, Mozambique revealed the results of its 6th Licensing Round, which resulted in the award of only six blocks out of the 16 license areas that were proposed. The China National Offshore Oil Corporation (CNOOC) secured five blocks over the Save and Angoche Basins and Eni Mozambique securing one license in the Angoche Basin. None of the areas within the Zambeze Basin were awarded. “The Exploration programs proposed for the first sub-period of the Exploration Period have the potential to allow investments amounting to approximately $369.8m, foreseeing the acquisition of 31,200 Km2 of 3D seismic, opening of a minimum of four wells in deep water, and other geoscientific studies,” the National Institute of Petroleum (INP) said in a statement. Nigeria has launched a Mini Bid Round for deep-water blocks On December 21st, Nigeria announced its Mini Bid Round 2022 and put seven deep-water blocks on offer covering some 6,700 km2. A pre-bid conference is scheduled for January 16th while pre-qualification applications mut be submitted by January 31st. Under the new PIA regime, the blocks on offer are PPL-300-DO (former OPL 312); PPL-301-DO (former OPL 313); PPL-302-DO (former OPL 314); PPL-303-DO, PPL-304-DO, and PPL-305-DO (the three used to form IPL 318); and PPL-306-DO (former OPL 327). This Mini Bid Round will be a test for Nigeria’s attractiveness and competitiveness after a full overhaul of its oil & gas regulatory regime with the adoption of the PIA in 2021. Eni has selected a provider for its second FLNG unit in Congo-Brazzaville On December 22nd, Eni announced the signing of a contract with Wison Heavy Industry of China for the construction and installation of a 2.4 mtpa floating LNG unit in the Republic of Congo, offshore Pointe Noire. The unit will be the second FLNG facility of Eni in Congo since the company expects to commission this year the 0.6 mtpa Tango FLNG vessel it acquired from Exmar a few months ago. Both units will be monetizing associated gas from the Marine XII permit. Total Gabon expanded its upstream portfolio in Central Africa On December 26th, TotalEnergies EP Gabon extended its presence in Gabon with the signing of a new Exploitation & Production Sharing Contract (EPSC) over the Baudroie-Merou-Marine G5-143 permit. The 25-year agreement will run until 2047. “We remain fully committed as an energy producer in Gabon. We will maintain our investments to reduce greenhouse gas emissions by valorising associated gas and will continue to implement actions to maintain our production,” said Henri-Max Ndong-Nzue, President of TotalEnergies EP Gabon. Invictus Energy has finished drilling its first wildcat onshore Zimbabwe On January 3rd, Invictus Energy confirmed that technical and operational issues prevented a discovery at its Mukuyu-1 wildcat well onshore Zimbabwe. However, multiple potential gas bearing reservoir units were encountered and the well did prove the existence of a working hydrocarbons system. The Rig 202 is currently warm stacked on site for maintenance and upgrades and will recommence drilling operations later this year. Invictus Energy is considering an appraisal well (Mukuyu-2) or the drilling of Baobab-1. As a result, the contract with EXALO Drilling for the rig has been extended by another 12 months.

Read more »

Shell acquires West Africa’s leading provider of hybrid solar power solutions

Shell has revealed its intention to acquire Daystar Power in a bid to deliver carbon emission reductions and power cost savings to commercial and industrial (C&I) businesses in Africa. The acquisition is expected to help Daystar Power further expand beyond West Africa and into East and Southern Africa, and help grow its installed capacity to 400 MW by 2025. Africa’s solar C&I segment has witnessed significant demand in recent years, supporting the growth of several African renewable energy solutions providers. Earlier this month, AIIM and Helios-backed Starsight Energy agreed on its merger with SolarAfrica to develop a pipeline of some 1 GW of C&I projects across the continent. Shell has sought to increasingly tap into Africa’s power market while divesting from some key oil assets, especially in Nigeria. At the end of 2021, it notably launched a Shell Energy Nigeria with the aim of delivering competitive and reliable energy for power generation and industrial users via gas distribution networks.

Read more »

Equatorial Guinea: deal signed for new 20,000 bpd refinery

The Vice Presidency of Equatorial Guinea has announced the signing of a new agreement between national oil company GEPetrol and Chinese companies China Railway Construction Corporation (CRCC) and CIRDL for the construction of a new 20,000 bpd refinery. The deal was signed on August 16th during a signing ceremony presided by Vice President Teodoro Nguema Obiang Mangue at the Palacio del Pueblo in Malabo. Financing is expected to be covered at 44% by Equatorial Guinea and 56% by its new Chinese partners. Equatorial Guinea has had refining ambitions for several years as it tries to expand its downstream infrastructure. From Punta Europa on Bioko Island, the country has already established one of Africa’s most successful downstream gas hubs producing liquefied natural gas (LNG), liquefied petroleum gas (LPG), and methanol. In March 2020, Equatorial Guinea had notably shortlisted Petrojet of Egypt, Rosslyn Energy of the UK, a Spanish-Russian group of Selquimica International with Engineering and Energy, and the UAE’s SDLE International for a new modular refinery in Kogo South on Bata. The same year, American company VFuels had been awarded the feasibility study for another modular refinery at Punta Europa.

Read more »

AMEA Power to build 30 MW solar plant in Djibouti

Earlier today, AMEA Power announced the signing of an Implementation Agreement (IA) and Joint Development Agreement (JDA) for a new 30 MW solar PV plant in Djibouti. The official ceremony was held in Djibouti in the presence of His Excellency President Ismail Omar Guelleh. The project will be Djibouti’s first solar independent power producer (IPP) and demonstrates the country’s commitment to ramping up renewable energy capacity. In Ghoubet, near Lake Assal, Siemens Gamesa is currently completing the construction of a 60 MW wind farm on behalf of Red Sea Power, the country’s first wind IPP. The project is majority owned by the Africa Finance Corporation (AFC).

Read more »West Africa’s energy powerhouse convenes world players to accelerate global energy partnerships at NOG 2022

From Asia to the US, via India, Turkey, Qatar, Spain and Portugal, Nigeria’s drive for international energy partnerships is limitless. NOG Conference & Exhibition taking place 4 – 7 July 2022 in Abuja, is Nigeria’s foremost energy conference and will review Nigeria’s positioning within the evolving global energy landscape, with a focus on funding and emerging opportunities to transform her energy industry. This has become imperative as the world tiptoes the fragile tightrope of the ‘new different’ reality in the global energy system, Africa, and in particular, her largest economy, Nigeria, has been hit hard but is also at a crossroads of immense potential. Since the inception of the Ukraine crisis, the global economy has been significantly disrupted, leading to surging inflation and a potential food crisis – especially in emerging economies like Nigeria. While global markets have witnessed a surge in oil prices of over $100 per barrel, Nigeria’s oil and gas sector has been unable to boost its reserves – in fact, this loss has been compounded by low oil production hovering at around 1.2 million bpd. Aligning with this position, the theme for the twenty-first edition of the NOG Conference & Exhibition is “Funding The Nigerian Energy Mix For Sustainable Economic Growth” will focus on the strategies that will be employed by the Nigerian government and private sector leaders to navigate the emerging energy business environment – helping to set the nation’s energy agenda for the next 12 months. One of the key opportunities for Nigeria within this dynamic is to expand its gas supply and energy cooperation with the world. The EU, which gets a substantial percentage of its oil and gas from Russia, is seeking alternative sources of energy. With Nigeria already supplying France, Portugal, Spain and Belgium, it is on the radar to also supply other EU nations, particularly as the country is currently working to grow its gas reserves from 206 trillion cubic feet to 600 trillion cubic feet. However, to be in a position to be able to fully meet the EU’s demand, Nigeria needs to develop its infrastructure and increase investment. This is at the core of the various discussion and debates that will be happening at the NOG Conference & Exhibition. Dignitaries participating include H.E. Timipre Sylva Minister of Petroleum Resources, H.E. Otunba Niyi Adebayo, Minister of Industry, Trade & Investment and H.E. Mohammad Sanusi Barkindo, Secretary-General, OPEC.Industry leaders include Sen. Margery Chuba Okadigbo, Chairman-Board of Directors, NNPC, Mele Kolo Kyari, Group Managing Director, NNPC, Richard Kennedy, Chairman & Managing Director, Chevron Nigeria/Mid-Africa Business Unit & Chairman, OPTS, Mike Sangster, Managing Director & Chief Executive, TotalEnergies EP Nigeria Limited, Richard Laing, Chairman & Managing Director, ExxonMobil Affiliate Companies in Nigeria, Osagie Okunbor, Managing Director, The Shell Petroleum Development Company of Nigeria Limited & Country Chair, Shell Companies in Nigeria, Elohor Aiboni, Managing Director, Shell Nigeria’s Exploration and Production Company Limited and Philip Mshelbila, Managing Director & Chief Executive Officer, Nigeria LNG. 2022 sponsors include NNPC, ExxonMobil, Nigeria LNG, Shell, Chevron, TotalEnergies, Oando, IPPG, NUPRC, NCDMB, Prime Atlantic, DCPL, Coleman Cables, UTM Offshore, First E&P, ND Western, Samsung Heavy Industries Nigeria, Montego, Nivafer, RusselSmith, Vurin Group, MG Vowgas Group, West African Ventures, MicCom Cables, Niger Delta E&P, Eleva Group, Heritage Group, Seplat Energy, Banwo & Ighodalo. Various industry stakeholders have named NOG as one of the key events in Nigeria’s energy sector for strategic business planning and decision-making process and are looking forward to the conversations that will shape the nation’s energy agenda for the next 12 months and beyond.

Read more »

Six operators pre-qualified under Mozambique’s 6th Licensing Round

Following the evaluation of pre-qualification documents from thirteen bidders, Mozambique has pre-qualified 12 companies under its ongoing 6th Licensing Round. Only Nigerian independent Aiteo Exploration & Production did not meet the requirements for pre-qualification. Pre-qualified operators include three Chinese national oil companies (NOCs): CNOOC, Sinopec International and PetroChina International. The three international oil companies (IOCs) already present in the country, Eni, ExxonMobil and TotalEnergies, also pre-qualified as operators. Under the 6th Licensing Round, companies are able to apply for Exploration and Production Concession Contracts (EPCC) after studying data licensed by the INP under standard Master Licensing Agreements (MLA). Most work commitment programmes include a first sub-period with seismic acquisition and a minimum spending of $5m. Drilling commitments must be made only when entering the second sub-period. To support bidders, the INP has made available 2D and 3D seismic datasets for Multi-Client licensing. These surveys cover both onshore and offshore areas and consist of 22,715 sq. km of 3D seismic, 41,905 km of offshore 2D seismic and 18,735 km of onshore 2D seismic.

Read more »

Mozambique’s Balama graphite mine to rely on new hybrid solar/thermal power system

Solarcentury Africa, part of the BB Energy Group, has just reached financial close on a 11.25 MWp solar PV plant and 8.5 MW/MWh battery energy storage system for Mozambique’s Balama graphite mine. The project is financed by CrossBoundary Energy and is expected to start operating at the end of Q1 2023. The Balama mine is operated by Syrah Resources of Australia and currently relies on a 15.4 MW diesel driven power station. The new solar and battery facilities will be integrated to the existing thermal power generation plant and managed by a hybrid power control system, delivered under a 10-year build-own-operate-transfer (BOOT) arrangement. The arrangement comprises an operating lease and an operating and maintenance contract. “The hybrid power system will supply approximately 35% of the Mine’s power needs, resulting in a c. 35% reduction of diesel consumption,” Syrah Resources and BB Energy said in a statement. At the end of the 10-year contract, ownership of the project company will be transferred from CrossBoundary Energy to Syrah Resources.

Read more »

EPC contract signed for Ethiopia’s first IPP

The EPC contract for the Phase 1 (50 MW) of the Tulu Moye Geothermal Project in Oromia, Ethiopia, was signed yesterday with the consortium of Mitsubishi Corporation and SEPCOIII Electric Power construction Co. Construction is expected to start in September this year for a commissioning by December 2024. The project is led by Tulu Moye Geothermal Operations Plc (TMGO), a joint-venture between Meridiam (51%) and Reykjavik Geothermal (49%). The facility will be Ethiopia’s first Independent Power Producer (IPP) project, and a pathfinder for future geothermal developments in the country. It is expected to be set up on one of the best geothermal fields in the world, with an estimated capacity of over 1 GW. Drilling for phase 1 started in March 2020 but was suspended for several months due to travel restrictions imposed by the Covid-19 pandemic. Drilling activities were able to resume only in mid-June 2020 and the first well, GA-1, was completed in Q1 of 2021. GA-2 and GA-3 were eventually drilled in 2021, followed by GB-1 were drilling is still ongoing. Under a contract signed in 2019, the Kenya Electricity Generating Company (KenGen) is the one in charge of drilling 10 geothermal wells and 2 injection wells to accomplish the first phase of 50MW within the next two years. Full details on the Tulu Moye Geothermal Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

NOCs dominate list of bidders under Mozambique’s 6th Licensing Round

Following the completion of the pre-qualification process for Mozambique’s 6th Licensing Round, a total of 13 companies have submitted documents. Interested bidders mostly include national oil companies, including CNOOC, Sinopec International, and PetroChina International (CNPC) of China, ONGC Videsh of India, Rosneft (RN Angoche) of Russia and QatarEnergy. The IOCs that already have blocks in the country, including Eni, ExxonMobil and TotalEnergies, are also participating. The rest of the bidders include South Africa’s Sasol who already produces gas from the onshore Temane and Pande fields; Russia’s gas independent Novatek; Nigerian independent Aiteo E&P; and Discover Exploration, who operates Licenses 35, 36 and 37 in the Comoros just outboard of Mozambique’s offshore Rovuma Areas 1 and 4. Under the 6th Licensing Round, companies are able to apply for Exploration and Production Concession Contracts (EPCC) after studying data licensed by the INP under standard Master Licensing Agreements (MLA). Most work commitment programmes include a first sub-period with seismic acquisition and a minimum spending of $5m. Drilling commitments must be made only when entering the second sub-period. To support bidders, the INP has made available 2D and 3D seismic datasets for Multi-Client licensing. These surveys cover both onshore and offshore areas and consist of 22,715 sq. km of 3D seismic, 41,905 km of offshore 2D seismic and 18,735 km of onshore 2D seismic.

Read more »

Angola: Eni’s discovers at least 500m additional barrels at Ndungu field

Eni has upgraded its field estimate at Ndungu on Block 15/06 offshore Angola at 800 million to 1 billion barrels of oil equivalent in place following the successful drilling of the Ndungu-2 appraisal well. The Ndungu-1 discovery well had been drilled in 2019 with original oil in place (OIIP) of 257m barrels according to Sonangol. With Ndungu-2, Eni has potentially discovered an additional 500m to 700m barrels of oil equivalent, confirming the tremendous success of its infrastructure-led exploration strategy in the country. Ndungu-2 marks the seventh discovery of Eni on Block 15/06 in four years. The adoption of an enabling environment by the administration of João Lourenço had led to the relaunch of the exploration campaign in 2018, which resulted in discoveries at Kalimba-1 and Afoxe-1 the same year. These were followed by Agogo-1, Ndungu-1 and Agidigbo-1 in 2019, and Cuica-1 in 2021. Source: MinFin Angola Out of these, Agogo benefited from incentives by being granted marginal status under the Presidential Legislative Decree 6/18 of May 2018. It was put on stream and started producing in January 2020 as a tie-back to the N’Goma FPSO. It is now being subject to a full field development planning with a new FPSO hub in the making. Cuica was next and achieved first oil in August 2021 from the Armada Olombendo FPSO. The vessel also started receiving production from the Cabaça North field in September 2021. Ndungu-1 came next, with first oil achieved in early 2022 via an early production scheme tied-back to the N’Goma FPSO. A second producer well is now expected at Ndungu in Q4 2022, according to Eni. Full details on the exploration and development activities on Block 15/06 are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Togo becomes first in Africa to be connected to Equinao subsea cable

In collaboration with Google, Société d’Infrastructures Numériques (SIN) and CSquared, Togo became last week the first landing point of the Equiano subsea cable in Africa. President Faure Gnassingbé inaugurated it on Friday at the autonomous port of Lomé. The cable is part of Google’s $1bn plan to build African digital capacity, and will also land in Nigeria, Namibia and South Africa later this year. The landing in Nigeria is scheduled in April 2022, according to sources within Google that Hawilti spoke to. Equinao was first introduced by Google in 2019 and will ultimately run from Europe to Africa via Portugal. While Nigeria was initially set to be its first landing point, Togo made a successful case to Google since then that Equinao should have a landing point in the country. The country of 8m was already the first in West Africa to launch a 5G network in 2020. This new cable is fully funded by Google, making it its third private international cable after Dunant (USA-France) and Curie (USA-Chile), and its 14th subsea cable investment globally. It is named after Olaudah Equiano, a Nigerian-born writer and abolitionist who was enslaved as a boy. Equiano is based on space-division multiplexing (SDM) technology and will offer 20 times more bandwidth than any other cable currently serving West Africa, and result in affordable internet access for millions in the region. Research commissioned by Google expects the cable to help a country like Togo double internet speeds within three years and reduce internet prices by 14%. “We strive to be a digital hub for innovation and investment as we demonstrate our commitment to enhancing public and social services for all of our citizens. This historic moment will boost economic growth in Togo too, creating 37,000 new jobs between 2022 and 2025 and increasing economic output by an additional $351 million,” said Cina Lawson, Minister of Digital Economy and Digital Transformation of Togo.

Read more »

Meet Azule Energy, Angola’s newest and biggest upstream player

Following their announcement last year that they were in negotiations to combine their Angolan businesses, bp and Eni have officially signed an agreement to form a new 50/50 independent company in the country, Azule Energy. Azule Energy, a bp and Eni Company, combines both majors’ businesses in Angola with over 200,000 barrels of oil equivalent per day (boepd) of net production and 2 billion barrels equivalent of net resources. Azule Energy is a new and independent international energy company that will hold both companies’ stakes in 16 licenses in Angola along with their participation in Angola LNG and Eni’s stake in the Solenova solar company. Currently Eni is operator of Blocks 15/06, Cabinda North, Cabinda Centro, Block 1/14, Block 28 and soon the Natural Gas Consortium. In addition, the Italian major has a stake in the non-operated Blocks 0 (Cabinda), 3/05, 3/05A, 14, 14 K/A-IMI, 15 and in Angola LNG. On its side, bp is operator of Blocks 18 and 31 offshore Angola, and has non-operated stakes in blocks 15, 17, 20 and 29. bp also has non-operated interests in the Natural Gas Consortium and in Angola LNG. “Azule Energy will continue to develop the full potential of the country’s upstream sector, while also positioning itself to capture new opportunities from the energy transition with the growing role of gas and renewables in its portfolio,” Eni said in a statement yesterday. Two FPSO hubs in the making Two of the key assets operated by the new company are Block 15/06 (Eni) and Block 31 (bp). On Block 15/06, Azule Energy will notably be executing the full field development of Agogo. Tenders were issued by Eni in July 2021 for a project targeting a peak production of 120,000 bopd via the installation of a third FPSO unit on the block. On Block 31, it will be in charge of the development of the Palas, Astraea and Juno (PAJ) fields. In July 2019, an Executive Decree approved their status as marginal to make their development economically viable, in line with Presidential Legislative No. 6/18 of 18 May 2018. As a result, the PAJ project is expected to develop about 135 million barrels using a new leased FPSO. A critical gas player Azule Energy will also become a critical player in the development of Angola’s natural gas industry. At the end of 2019, bp and Eni had joined Chevron, TotalEnergies and Sonangol in forming the New Gas Consortium, a new joint venture that will explore and produce gas in Angola and represents the country’s first upstream natural gas partnership. Eni holds 25.6% in the joint-venture while bp Angola holds another 11.8%. The New Gas Consortium will supply gas to Angola LNG by developing several new assets, starting with the Eni-operated Quiluma and Maboqueiro fields in Block 2.

Read more »

Gabon’s first mini gold refinery to start operations this year

The Government of Gabon has signed convention agreements this week with Alpha Centauri Mining (ACM) to boost gold exploration, exploitation and refining in the country. The company is held by British and Emirati investors and entered Gabon in 2016. In September last year it produced about 100 kg of gold per month, according to its website. The agreements signed with the Government of Gabon this week covers the exploitation of gold mines in the Ndjole region, along with gold exploration in the Middle-Ogooue and Ogooue Ivindo provinces. More importantly, they also set the framework for the commissioning and operation of the country’s first gold refinery. “Alpha Cenauri Mining is building the country’s first refinery in the Gabon Special Economic Zone and we expect to start operations by mid-2022,” CEO Anand Bajla said after the signing ceremony. “We will start with a capacity of 4 tonnes per annum to enable Gabon to export refined gold,” he added. The mini modular refinery is a good first step for Gabon, who has so far struggled to fully develop its gold potential. Latest government data available shows gold output at 0.1 tonne in 2020. However, exports earnings have been on the rise and stood at FCFA 8.3bn between January and September 2021, compared with FCFA 2.7bn in 2019. To boost investments in the sector and support local content development, Gabon adopted a new Mining Code in 2019.

Read more »

VAALCO Energy’s drilling campaign successfully delivers first well offshore Gabon

VAALCO Energy has placed the Etame 8H-ST well on production at its Etame Marin offshore permit in Gabon. While the well had initial flow rates of about 5,000 barrels of oil per day (bopd), it was choked back to about 4,200 bopd for reservoir management purposes, the company said. Ongoing drilling campaign VAALCO embarked in December 2021 on a 4-well drilling campaign on the block, targeting two development and two appraisal wells at a cost of at least $117m. Its preliminary production uplift estimates from this new drilling campaign are between 7,000 and 8,000 gross of peak production from the four planned wells. After successfully drilling Etame 8H-ST, Borr Drilling has moved its rig to the nearby Avouma platform to drill the Avouma 3H-ST development well. The future of Etame Gabon’s Etame Marin permit has been continuously producing for almost two decades in the floating, production, storage and offloading (FPSO) vessel Petróleo Nautipa. A recent extension until 2028 along with repeated drilling programs are set to maintain field output at almost 20,000 bopd. Despite two decades of production that have seen over 121m barrels produced, the field is still estimated to have reserves and resources of about 113 million barrels. Since the Etame discovery in 1995, VAALCO Energy has achieved a 92% success rate on 36 wells drilled. In 2019, VAALCO also exercised an election to extend the lease contract for the FPSO Petróleo Nautipa at Etame through September 2021, with an additional one-year option to run through September 2022. Once the FPSO contract expires later this year, the Petróleo Nautipa will be replaced with a floating, storage and offloading (FSO) unit. The transition would lead to some reconfiguration on the field under which the existing platforms would handle processing activities while the FSO unit would handle storage and offloading of crude oil.

Read more »

Official: Shell discovers working petroleum system offshore Namibia

After weeks of speculation, Namibia’s national oil company NAMCOR has confirmed that Shell made a light oil discovery at the Graff-1 well on the PEL-39 license in the Orange Basin. The block is operated by Shell with a 45% interest along with QatarEnergy (45%) and NAMCOR (10%). The Graff-1 deep-water well was drilled to a total depth of 5,376 meters in water depths of approximately 2,000 meters, between December 2021 and February 2022. “The partners will conduct analysis on the well data and further exploration activity to determine the full size and recoverable resource potential,” QatarEnergy said, indicating that a second exploratory well might be on the table in the near future. “In the coming months, we will perform extensive laboratory analyses to gain a better understanding of the reservoir quality and potential flow rates achievable,” NAMCOR added in a statement. The discovery is encouraging news for TotalEnergies, who is drilling the Venus-1X well nearby, and for Eco Atlantic Oil & Gas who expects to spud the Gazania-1 well in the same basin this year but in South Africa. More on ongoing exploration activity in the Orange Basin can be found within Hawilti’s quarterly sector watch on Sub-Saharan African Exploration, available within the Hawilti+ research terminal.

Read more »

Burkina Faso: President Kabore ousted in a military coup

After Mali and Guinea, Burkina Faso is yet another West African country that witnessed a military coup over the weekend. Confirming several rumous, the army had declared yesterday that it has ousted President Kabore. Citing the deterioration of the security situation, including the rising Islamist insurgency, the army has halso suspended the constitution, dissolved the government and the national assembly, and closed Burkina Faso’s borders. The statement was signed by Lieutenant Colonel Paul-Henri Sandaogo Damiba and made in the name of the Patriotic Movement for Safeguard and Restoration, a previously unheard-of entity.

Read more »Africa50 and India’s POWERGRID join hands for Kenya’s first independent power transmission project

Pan-African infrastructure investment platform Africa50 and the Power Grid Corporation of India (POWERGRID) have signed a Joint Development Agreement (JDA) for the continued development of the Kenya Transmission Project. The 400 kV Lessos-Loosuk and 200 Kv Kisumu-Musaga transmissions lines are being developed in Western Kenya on a public-private partnership (PPP) basis. Africa50 and POWERGRID are developing, financing, constructing and operating both lines, which form Kenya’s first independent power transmission venture. The project represents Africa’s first financing of transmission lines on a PPP basis and could pave the way for additional private sector involvement in the continent’s energy infrastructure. “In this development partnership, POWERGRID, one of the world’s leading electric transmission utility companies will provide technical and operational know-how to the project, while Africa50 will bring its project development and finance expertise and will act as a bridge between the Kenyan government and private investors,” Africa50 said.

Read more »Hive Hydrogen and Linde announce $4.6bn Green Ammonia Plant in South Africa

Hive Hydrogen, Built Africa and Linde’s South African subsidiary Afrox have announced the establishment of a 780,000 ton/year Green Ammonia Plant at the Coega Special Economic Zone alongside the Port of Ngqura in South Africa. The $4.6bn project will be developed two phases and have its own dedicated power supply. The facility will use renewable energy to desalinate water, extract hydrogen and combine it with nitrogen to produce green ammonia. The water will be supplied by Cerebos, Africa’s largest salt products producer. The ammonia will then be cooled, liquefied and stored for export before being dispatched by pipeline from the storage tanks onto ships at the port of Ngqura. In doing so, the partners aim at meeting increasing global demand for ammonia, used by key industries such as agriculture, chemicals and mining but also as a maritime fuel and substitution fuel for coal. The choice of the Coega SEZ as project site also supports South Africa’s industrialization strategy around the Ngqura deep-water port. In November this year, South Africa’s state-owned Central Energy Fund (CEF) issued a request for information (Rfi) for the development of an independently managed midstream LNG hub from the port.

Read more »

UTM Offshore signs $2bn MoU with Afreximbank for Nigeria’s first FLNG project

Nigerian marine and services group UTM Offshore and the African Export-Import Bank (Afreximbank) have signed a Memorandum of Understanding (MoU) to raise $2 billion for the development of Nigeria’s first floating liquefied natural gas (FLNG) project. The MoU was signed yesterday in Abuja by Julius Rone, Group Managing Director/CEO of UTM Offshore and Dr. Benedict Okey Oramah, President and Chairman of Afreximbank. “This is a landmark project that Afreximbank takes very seriously,” Afreximbank’s president said. The agreement paves the way for additional collaboration between UTM Offshore and the Afreximbank to support a future final investment decision (FID) on UTM’s FLNG project. The company has been studying and conceptualising the development of an FLNG in Nigeria since 2020. In February 2021, it received a License to Establish (LTE) from Nigeria’s former Department of Petroleum Resources (DPR) for the installation of an FLNG unit on oil mining lease (OML) 104. The block is operated by the joint-venture of Mobil Producing Nigeria (operator, 40%) and the state-owned Nigerian National Petroleum Corp. (NNPC, 60%) and contains the producing Yoho field. Preparations for the project are now in full swing and benefit from robust global and technical expertise. The pre-Front End Engineering Design (Pre-FEED) contract was awarded to JGC Corporation of Japan in May and completed in October. KBR was appointed Owners Engineer while global energy and commodities trader Vitol has also joined the consortium as off-taker for the LNG. “The UTM Offshore FLNG will be the first such project developed by an African company on the continent. It will also significantly contribute to the Nigerian government’s agenda of reducing the flaring of associated gas across our industry. As Africa’s FLNG industry grows, we are well positioned to offer attractive project economics by developing shallow water gas reserves, while bringing significant environmental benefits to our industry as a whole.” Julius Rone, Group Managing Director/CEO, UTM Offshore The project notably involves the development and financing of a 1.2m tonnes per annum FLNG facility with a capacity to process 176 MMscfd of natural gas and condensate. The unit would target the processing of associated gas currently flared in order to cut carbon emissions and monetise additional reserves for the domestic and global markets. UTM Offshore is pioneering the development of the FLNG facility in collaboration with LNG Investment Management Services (LIMS), a subsidiary of the state-owned Nigeria National Petroleum Corporation (NNPC). Details on the UTM FLNG can be found in the “Projects” section within your Hawilti+ research terminal.

Read more »

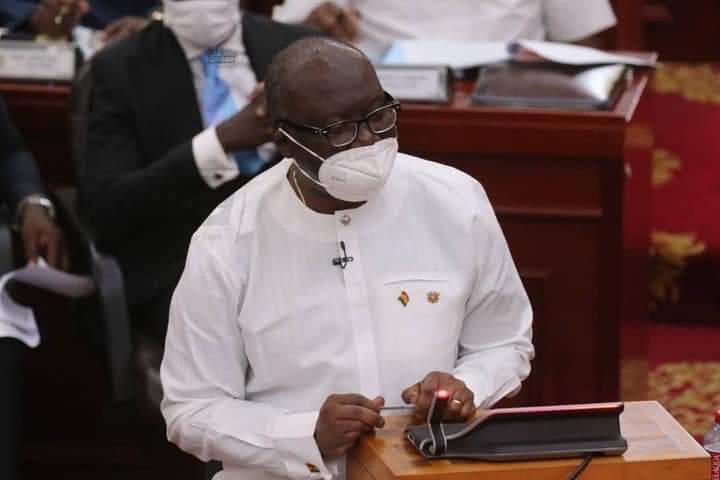

Ghana bets on higher oil revenues despite production decline over 2022-2025

Ghana made its 2022 Budget Statement this week, forecasting an overall GDP growth of +5.8% next year on the back of higher industrial and mining output and stronger commodity prices. This is slightly under the IMF’s own forecast of +6.2% for Ghana in 2022. Without Pecan, oil production will keep declining But the country is also coming to terms with its inability to boost oil & gas output in the short-term. It forecasts an oil production of 59.51m barrels next year, or a daily average of 163,044 barrels of oil per day (bopd). This contrasts with the 2021 benchmark revenue crude oil output, set at 65.86m barrels, equivalent to a daily average of 177,700 bopd. Ghana’s projections of crude oil production have actually been revised down until 2025. While its 2021 Budget Statement assumed that output would remain flat and around 60m barrels a year in the short-term, new assumptions released yesterday expects oil production to drop to 55m barrels in 2023 and 2024 and to under 52m barrels in 2025. Source: Ministry of Finance, PIAC (2016-2020 figures represent actual output) The development of the offshore Pecan field by Aker Energy is the only project that can boost output in the short-term, but first oil will not be achieved before 2024 at the earliest. Earlier this year, the Parliament of Ghana granted approval for its national oil company GNPC to acquire 37% stake in the Deepwater Tano Cape Three Points (DWTCTP) block from Aker Energy. Hopes are that the transaction could help fast-track the project that has a projected peak production of 110,000 bopd. “First Oil from the Pecan field is expected in 2024, with a ramp-up of production occurring the following year in 2025,” Ghana said in its 2022 Budget Statement. Production decline offset by higher oil prices However, stronger commodity prices will help Ghana increase its oil revenue despite lower output. Ghana now bets on a benchmark oil price of over $60/bbl for the coming years, up from previous estimates of $55. Source: Ministry of Finance As a result, and despite decreasing oil output, the country is expecting to collect over $1bn a year from the oil industry from 2022 to 2025. These projections are higher than previous estimates that set oil revenue projections at only about $900m a year until 2024. Source: Ministry of Finance For more on Ghana’s industry and the projects driving industry activity, please log into your Hawilti+ research terminal.

Read more »