Mining

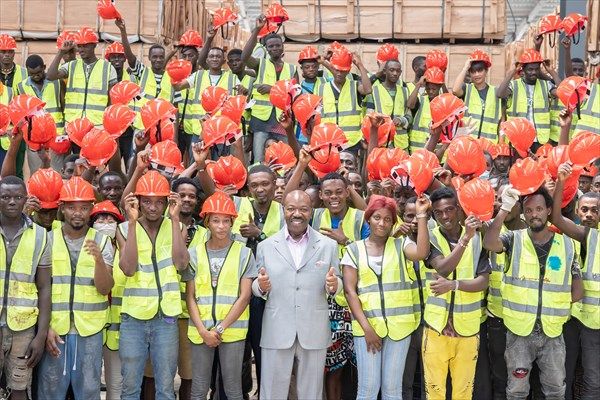

Gabon inaugurates historic gold refinery

The Gabonese Gold Refinery (ROG), the first gold processing plant in Gabon, has come on stream, as the oil producing country pushes for a more diversified economy. With a refining capacity of 7 to 10 tonnes of gold per year, the plant is a joint venture between the state-owned Equatorial Mining Company (SEM) and Alpha Centauri Mining (ACM), a company held by British and Emirati investors. Currently, total national gold production is estimated at around 2 tonnes. Located in the Special Economic Zone at Nkok in Libreville, the gold refinery is based on Italian technology, has zero emissions and 100% Acid Recovery, according to ACM. “It symbolizes the metamorphosis of our economy towards more diversification, job creation and local added value through the on-site processing of our raw materials,” President Ali Bongo Ondimba said during the commissioning of the project earlier this month, adding that Gabon plans to refine “100% of the gold produced in the country, make our country a hub for gold refining in Central Africa and allow up to a third transformation on site in particular to make jewellery in Gabon.” Last year, the Government of Gabon signed convention agreements with Alpha Centauri Mining (ACM) to boost gold exploration, exploitation and refining in the country. The company entered Gabon in 2016. The agreements set the framework for the commissioning and operation of the country’s first gold refinery. Mining for growth and development The commissioned refinery forms parts of efforts to develop Gabon’s gold potential as it seeks to expand an economy largely dependent on oil. The Central African nation is already one of the world’s top manganese producer and exporter but wants to develop additional minerals found in its soil. In a bid to attract investors and support local content development in the mining industry, Gabon adopted a new code for the sector in 2019. Earlier this year, minister for investment promotion and public-private partnerships Hugues Mbadinga Madiya echoed the government’s efforts to curb the export of raw materials as a means to improve higher value-added trade. “The general policy of the Gabon government is not to export raw materials,” Mbadinga Madiya told newsmen on the sidelines of the Africa Investments Forum & Awards in Paris in February. “The model of supplying raw materials does not create jobs.”

Read more »

Canada based exploration company launches Nigeria lithium-focused subsidiary as it secures exploration tenure

Thor Explorations Ltd, a Canada-based mineral exploration company with interests in Nigeria, Senegal and Burkina Faso, has launched a Nigerian subsidiary to explore the country’s lithium potential as Africa’s biggest economy seeks to diversify its economy beyond oil and gas. Newstar Minerals Ltd, Thor’s newly formed Nigerian subsidiary, is looking to develop its first large-scale lithium mine in the country. The company has already acquired over 600 kilometres squared of granted tenure covering two known lithium bearing pegmatite deposits and one large unexplored prospective pegmatite-rich belt. Located in Nigeria’s southwest, the tenure covers West Oyo, Kwara State and Ekiti State lithium project areas. Initial field inspection and selective sampling of key sites have returned significant lithium grades from both hard-rock spodumene and lepidolite mineralisation, the company said. It will also continue to prioritise explorations at Segilola gold mine in Osun State, also in Nigeria. “While gold remains fundamental to our growth strategy, we consider the virtually untapped lithium potential of Nigeria to be an opportunity that is too good to miss,” Chief Executive Officer at Thor Explorations Segun Lawson said in a company statement, adding the company will leverage its established in-country presence, experience and first-mover advantage. “We intend to develop both businesses (gold and lithium) without any shareholder dilution.” In 2021, Thor Explorations poured first gold from its Segilola mine as Nigeria’s first industrial gold project entered production. The company spent nearly $100 million to build the mine. Africa Finance Corp., the company’s largest shareholder, provided an $86 million debt-equity financing package. Thor said the Segilola plant produced 98,006 ounces of gold in 2022, which was its first full calendar year of commercial production. Boosting economic growth with mining Nigeria, Africa’s largest oil producer, has substantial untapped deposits of metals including gold, zinc, lead, iron ore and lithium, but nearly all extraction takes place informally on a small-scale or manual basis. As a result, crude oil sales have continued to account for more than 75% of export earnings, leaving the country vastly reliant on oil. Successive governments have pledged to significantly increase mining’s contribution to gross domestic product, which currently stands at less than 1%. In 2017, the World Bank provided around $150 million to the Nigerian government to develop the mining sector, attract investments and enhance its contribution to the economy. Since then, the mining sector has witnessed some sustained growth in its contribution to the country’s GDP, contributing 0.85% in 2022 haven grown from 0.18% in 2018. Mining made up 4% to 5% of Nigeria’s GDP in the 1960s and 1970s, before major operations shut down and crude oil became the government’s major driver of revenues. The new administration of President Bola Tinubu says he wants to boost Nigeria’s GDP by stimulating the growth of non-oil sectors, giving hopes to the revival of some key sectors, such as mining, that were underperforming.

Read more »

Africa Finance Corp. and Xcalibur Multiphysics join forces on responsible mapping of African natural resources

Africa Finance Corporation (AFC), the leading infrastructure solutions provider in Africa, and Xcalibur Multiphysics, the worldwide leader in airborne geophysics, have announced their intention to partner on mapping, developing and co-financing natural resource projects that will spur minerals and critical raw materials beneficiation in Africa. The partnership was announced at a signing ceremony today at the Mining Indaba in Cape Town, South Africa. AFC and Xcalibur, through their partnership, will prioritise projects to locate and identify AFC’s focus minerals, including precious, base and critical raw materials, comprising gold, diamonds, bauxite, manganese, copper, cobalt, graphite, lithium and rare earth elements. As a result, African countries will have access to improved geological data, which will de-risk investments in the sector, create local jobs, unlock mineral resource wealth and ultimately support a more just energy transition on the continent. Xcalibur will lead in providing the technical and mapping expertise, while AFC will lead in identifying and implementing investment and financing solutions for approved projects. Project development in seven priority countries is well advanced, extending soon to other African countries. AFC is one of the largest investors in Africa’s natural resources sector, leading transformational projects such as Nigeria’s Segilola Gold Mine, the country’s first private sector-led, commercial-scale gold project. In Sierra Leone, AFC partnered with the Ministry of Mines and Mineral Resources (MMMR) and the National Minerals Agency (NMA) on the launch of the results from a Nationwide Airborne Geophysical Survey (NAGS) to establish the full extent of the country’s wealth below ground and promote investment in its mining sector. The Corporation is also the lead investor in several precious and transition metal projects in the region, including the Karowe diamond mine in Botswana, the Kipushi copper and cobalt project in the Democratic Republic of Congo, the Franceville and Okondja manganese mining projects in Gabon and the Alufer Mining bauxite project in Guinea. These investments, amongst others, target in-country value-addition and beneficiation from Africa’s natural resources. The approach multiplies employment creation, increases export prices and government revenues, reduces trade costs and, importantly, minimises the carbon footprint associated with exporting raw materials and reimporting finished products. Sameh Shenouda, Executive Director and Chief Investment Officer, AFC “Africa has the largest reserves of the minerals and metals required for the global energy transition; the challenge is a lack of investment in mining, transportation, clean energy and processing. This is exactly what this partnership aims to address, and we look forward to working with Xcalibur to develop and finance critical projects that transform Africa’s resource wealth into economic fortune and spur economic diversification.” Xcalibur has a strong track record in executing large-scale, country-wide & regional mapping programmes and also high-resolution mapping programs, with an inventory of more than 50 million line kilometres of data acquired in Africa and worldwide. These programmes have demonstrably increased exploration activities in the host countries, leading to job creation and increased investment. Andrés Blanco, Chief Executive Officer, Xcalibur Multiphysics “Africa is exposed to climate change effects, and we believe that this alliance contributes to the green transition of the continent, combatting climate change, ensuring access to sustainable energy and protecting biodiversity and natural resources while allowing African countries and African companies to become just and relevant players on the energy transition map. We look forward to working with AFC to accelerate sustainable economic growth and build a more inclusive economy in Africa.”

Read more »

New joint-venture incorporated to unlock Simandou iron ore blocks development in Guinea

Last week, Rio Tinto announced the incorporation of the TransGuinean joint-venture (Compagnie du TransGuinéen, in French) that will develop and operate new critical rail and port infrastructure in Guinea. An International Partnership The company is a partnership between the Government of Guinea (15%), Winning Consortium Simandou (WCS, 42.5%), and Rio Tinto Simfer (42.5%). Its incorporation notably follows the signing of a Framework Agreement in March 2022 to facilitate investment decisions for the co-financing and co-development of the infrastructure required to develop the giant Simandou iron ore project. WCS is itself a consortium of Singaporean company Winning International Group (45%), Weiqiao Aluminium (part of the China Hongqiao Group, 35%) and United Mining Suppliers International (20%). On the other hand, the Simfer joint venture comprises Simfer S.A., the holder of Simandou South Blocks 3 & 4, which is owned by the Government of Guinea (15%) and Simfer Jersey Ltd (85%). In turn, Simfer Jersey Ltd is a joint venture between the Rio Tinto Group (53%) and Chalco Iron Ore Holdings (CIOH, 47%) – a Chinalco-led joint venture of leading Chinese state-owned companies. A multi-billion dollars investment programme The TransGuinean will co-develop a 650km rail corridor and ports infrastructure in the in the Forécariah prefecture to unlock reserves at the four Simandou iron ore blocks. WCS is holder of blocks 1-2 while Rio Tinto Simfer is holder of blocks 3-4. “Following the incorporation of the joint venture, the parties will now work on next steps including shareholding agreement, finalising cost estimates and funding, and securing all necessary approvals and other permits and agreements required to progress the co-development of infrastructures,” Rio Tinto said in a statement.

Read more »

Genser Energy raises $435m to expand Ghana’s midstream gas infrastructure

American energy solutions provider Genser Energy has announced the closing of a $425m funding package to support the expansion of its midstream gas business in Ghana. The company is already a provider of captive power solutions to several of Ghana’s gold mines and is currently expanding across West Africa. The 8-year, $425m funding package includes a $325m syndicated senior loan facility and a $100m mezzanine loan facility. It will be used to refinance Genser Energy’s existing debt and support three critical midstream gas projects in Ghana. Expansion of Ghana’s gas pipeline network The first one is a 100km natural gas pipeline to Kumasi, Ghana’s second largest city. In doing so, Genser Energy seeks to make piped natural gas available within Ghana’s central belt and offer an alternative to imported trucked diesel and heavy fuel oil (HFO) for industries in the region. According to Genser Energy’s records, the company is planning to build an overall gas pipeline network of 320km in Ghana to connect its power generation plants to Ghana Gas’ Prestea Regulating and Metering Station (PRMS). In November 2019, a first phase of 80km was already commissioned to provide gas to Gold Fields’ Tarkwa and Damang gold mines power stations. Additional phases notably target gas supplies to Kinross Gold Corporation’s Chirano mine, Perseus Mining’s Edikan mine, and Gold Star Resources’ Wassa mines, among others. Launch of an integrated natural gas liquids (NGLs) business The second one is a 200 MMscf/d gas conditioning plant in Prestea, southwestern Ghana, where Genser Energy intends to produce natural gas liquids (NGLs) such as propane, butane, ethane, and liquefied natural gas (LNG). All NGLs will be sold under an off-take agreement to Trafigura, who notably participated in the mezzanine loan. Trafigura is also providing additional funding to the third and last project, a NGL storage terminal at the Takoradi Port. A wide range of financiers The ability of Genser Energy to secure such a debt package is an encouraging sign for Africa where several asset owners and operators are currently raising capital for domestic midstream and downstream gas ventures. A wide and diverse range of investors participated in Genser Energy’s senior loan facility, including regional and commercial international banks, development financial institutions, and funds. These comprised the Standard Bank of South Africa, Absa Bank, Société Générale, the Mauritius Commercial Bank, Ninety One, Barak Fund SPC Ltd, and the Development Bank of Southern Africa. On the other hand, the mezzanine loan facility is provided by Trafigura, Barak Fund SPC Limited and the US Based Fund, Trilinc Global Sustainable Income Fund Master Ltd.

Read more »

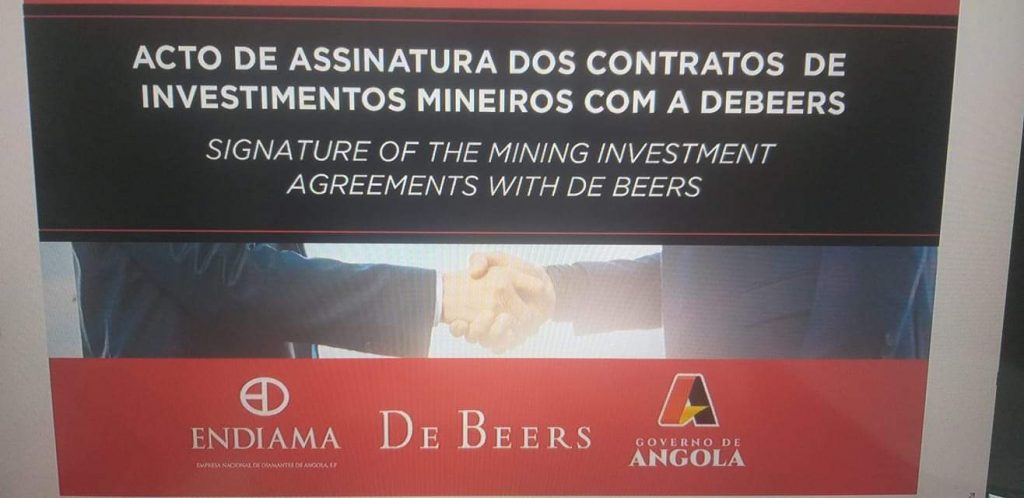

After Rio Tinto, De Beers also seals deals for diamond exploration in Angola

De Beers Group announced yesterday the signing of two Mineral Investment Contracts (MICs) with the Government of Angola for licence areas in north-eastern Angola. Both contracts formalize the award and exercise of mineral rights over a period of 35 years each, allowing De Beers Group to explore and mine diamonds in the southern African country. Each concession area will be held by a separate new joint venture company formed by De Beers Group and Endiama, Angola’s state-owned diamond company. This is another win for Angola’s diamond industry that has been the subject of substantive reforms over the past years to attract investors. In October last year, Angola’s Ministry of Mineral Resources, Petroleum & Gas and Endiama had already signed a MIC with Rio Tinto for the Chiri diamond concession in the Lunda Norte Province in northern Angola, at the border with the Democratic Republic of Congo (DRC). As Angola pursues its economic diversification strategy, its mining and minerals industry offer attractive opportunities to industrialise the country while generating jobs. Angola is already the world’s sixth largest diamond producer and diamonds represent its second biggest source of export earnings after oil and liquefied natural gas (LNG). In 2021, the country produced 9.4m carats of diamonds worth over $1.5bn, according to data from its Central Bank. The sector generated Kz. 72bn for the government, or some $175m.

Read more »

World’s leading titanium manufacturer to set up 200 MW solar plant in South Africa

Tronox Holdings, one of the world’s leading producers of high-quality titanium products, has signed a power purchase agreement (PPA) this week with South African IPP SOLA Group for 200 MW of solar power capacity. The project is expected to be commissioned by Q4 2023 and supply clean energy to Tronox’ mines and smelters in South Africa. “This 200 MW solar project is expected to provide approximately 40% of Tronox’s South African electricity needs and lower its worldwide scope 1 & 2 emissions by approximately 13%,” Tronox said in a statement. The company has set a target of aligning with a global warming scenario below 2° C and achieve net zero GHG emissions by 2050.

Read more »

South Africa’s Tharisa mine to run on solar with upcoming 40 MWp facility

TotalEren and Chariot have announced today the signing of a new Memorandum of Understanding (MoU) with South African platfinum group metals and chrome producer Tharisa Plc. The agreement paves the way to develop, finance, construct, own, operate and maintain a 40 MWp solar PV project at the Tharisa mine in South Africa’s North West Province. Following the execution of the MoU and before the project can be implemented, the parties will be negotiating a Power Purchase Agreement (PPA) for the supply of electricity on take-or-pay basis. Last November, Chariot had already signed binding key terms of a long-term joint-development partnership with Total Eren. By working together, both companies are working to jointly originate and develop wind and solar projects for mining clients in Africa. The partnership has an initial duration of three years and started on January 1st, 2022. It could then be extended for a further two years. Under the agreement, Chariot will have a right to invest between 15 to 49% into the co-development of projects. While TotalEren is a proven renewable energy independent power producer (IPP), Chariot acquired in 2021 the business of Africa Energy Management Platform (AEMP) for $2m to venture into the sector. AEMP was a renewable and hybrid energy project developer who already had a strategic partnership with Total Eren. Prior to AEMP’s acquisition by Chariot, both AEMP and TotalEren were already looking at a pipeline of 500 W of power to African mine operators.

Read more »

Tanzania issues special mining license for world’s largest unexploited nickel deposits

Following the signing of the Framework Agreement last January, the Government of Tanzania has now issued a special mining licence (SML) for a period of over 30 years for the Kabanga Nickel project, covering the full life of the project. The Kabanga Nickel Project holds the world’s largest development-ready nickel sulphide deposit and will produce Class 1 battery grade nickel, cobalt and copper. Its cradle-to-gate operation will notably rely on the hydromet technology, which is more cost efficient than smelting but can also reduce the carbon footprint and environmental impact of operations. Based on approximately 600 km of drilling, Kabanga’s previous owners, Barrick Gold Corporation and Glencore, had published a 2014 Resource Estimate (Measured, Indicated and Inferred) of 58 million tonnes of ore at an average in-situ nickel grade of 2.62%. Mineralisation of the resource is greater than 95% massive sulphide. In order the develop the project, Kabanga Nickel and the Government of Tanzania had signed last January a Framework Agreement establishing the Tembo Nickel Corporation. The operating company is now the one in charge of mining, processing and refining the Class 1 nickel with cobalt and copper co-products. Tembo is owned at 84% by Kabanga Nickel with the remaining 16% held by the Government of Tanzania. By accelerating the development of the project, Kabanga Nickel will be increasing the supply of crucial minerals in the development and manufacture of batteries used in electric vehicles. On the back of growing demand for EV batteries, global supply of nickel is forecast to grow from 2.25 million tonnes in 2020 to 5 million tonnes by 2040, according to Roskill.

Read more »

World’s second-largest mining company enters Angolan diamond mine

Last week in Lison, Angola’s Ministry of Mineral Resources, Petroleum & Gas and Angola’s national diamond company Endiama signed a mining investment contract with Rio Tinto for the Chiri diamond concession in the Lunda Norte Province in northern Angola, at the border with the Democratic Republic of Congo (DRC). The negotiations had been ongoing since late 2018 for the 108km2 concession. The contract covers a period of 35 years and provides for an initial participation of 75% by Rio Tinto in a new joint-venture with Endiama (25%) on the licence. The Angolan company could eventually increase its stake to 49%. Rio Tinto has declared that works would start immediately at the mine, with first production expected in 2024. Source: BNA Angola is the world’s sixth largest diamond producer and diamonds represent the country’s second biggest source of export earnings after oil and liquefied natural gas (LNG). The country has been increasing efforts to revive the sector and attract investments in a bid to diversify the economy, support industrialization and grow foreign exchange revenue sources.

Read more »

AVZ Minerals secures Chinese investor for major DRC lithium and tin project

AVZ Minerals has announced this morning the signing of a transaction implementation agreement (TIA) with Suzhou CATH Energy Technologies of China. Under the agreement, CATH will earn a 24% equity interest in the joint-venture set up to develop the Manono Lithium and Tin Project in the Democratic Republic of Congo (DRC). In return, CATH is to contribute $240m in cash towards the development of the project. “Proceeds from the transaction will fund a majority of the total project financing required, whilst AVZ will retain a controlling 51% interest in the Manono Project post-completion of the transaction and its position as lead developer of the Manono Project,” AVZ said in a statement this morning. In addition, the existing Offtake Agreement with Yibin Tianyi will be assigned to CATH and expanded in scope to provide offtake of SC6 for the life of the Manono Project. CATH will also enter into a long-term Primary Lithium Sulphate offtake or tolling agreement in respect of PLS produced from the PLS calcining plant. The Manono project is one of the largest upcoming mining development in the DRC, with a Roche Dure Mineral Resource of 401m tonnes grading 1.65% Li2O, 752ppm Sn, 34ppm Ta is world-class in scale and grade. It is strategically positioned as a clean and sustainable source of lithium for the global EV battery value-chain.

Read more »

Thor Explorations has poured first gold at Nigeria’s flagship gold mine

Over the weekend, Thor Explorations has poured first gold from its Segilola Gold Mine in Nigeria’s Osun State. This is a critical milestone for the project where commercial production is expected in September. Once fully commissioned, the plant will run at a processing rate of 715,000 tonnes per annum, targeting about 85,000 ounces of gold a year. The Segilola Gold Mine has been under development for a few years and will mark a critical milestone in Nigeria’s journey to further diversify away from oil. While its neighbours in West and Central Africa have all successfully developed their mining and minerals industry to support economic growth and create jobs, Nigeria’s mining sector has remained massively under-developed.

Read more »