Upstream

OPINION: The Cost of Orthodoxy

Pulling Nigeria’s ailing economy from the brink calls for a radical improvement in efficiency within its oil & gas industry, writes Ofserv CEO Dimeji Bassir who presents opportunities to cut down the cost of production within Africa’s biggest oil market. To quote Joel Barker in The Business of Paradigms “It’s so easy to say no to a new idea. After all, new ideas cause change; they disrupt the status quo. They take people out of their comfort zones and create uncertainty… Plus, it is less work to do things the way we have always done it……less work, maybe. Costly, definitely” New ideas are resisted from greasy rig floors in the Niger Delta swamps to cushy business offices and conference rooms in regulator’s offices in Abuja; each, with very prohibitive costs of inaction. Yet it’s business as usual in Nigeria’s oil industry despite current economic realities in the country, which provide the impetus for a radical transformation of its cost base. Pulling the ailing economy from the brink calls for a radical improvement in efficiency within its mainstay industry. Dwindling daily production and significantly reduced foreign exchange earnings, and foreign reserves, establishes the urgency to drive down unit cost per barrel of oil produced. Simply stated, Today’s ‘Good’ is tomorrow’s ‘Not good enough’ and what sets us apart today will be the baseline tomorrow. The future belongs to those who act with urgency and foresight. A huge, yet untapped opportunity Successful upstream operations is underpinned by the ability to balance the trio of cost-schedule- production and maximise NPV, i.e. produce the most barrels in the quickest manner possible at the cheapest mean cost across a portfolio of assets. Incremental improvement in well delivery (drilling & completion) efficiency in the US had characterised the shale oil boom which effectively began in 2007. Efficiency gains cut well costs by a third and reduced cost per barrel by 75% in the decade between 2007 and 2017. In effect, America became an oil and gas power house within this period, doubled US Shale production and tripled total daily oil output. In Nigeria, the oil and gas industry is the largest revenue contributor to the Nigerian economy but production has declined by 40% from 2010 to date. Declining oil production presents major revenue challenges and precipitates chronic macroeconomic crisis in the short to medium term. Dimeji Bassir Reducing unit production costs by driving down well delivery costs presents an untapped opportunity to increase government earnings & reduce its fiscal deficit. Being the most complex, costly and highly specialised upstream development activity which easily accounts for up to 60% of oilfield development CAPEX, drilling presents a unique opportunity to reduce the cost of oil production. For this reason, in the early eighties, drilling engineers and other personnel operating in the UK’s North Sea recognised the need to learn from each other and compare performances across their respective drilling operations. This led to the formation of the drilling performance review (DPR) in 1989, a drilling benchmarking club. Most international operators who are value-driven continue to subscribe to the DPR till this day for the inherent benefit to their global operations and enterprise’s financial performance. In general, up to 60% of drilling time goes to Non-productive time (NPT) and inefficiencies which is known in drilling parlance as invisible lost time (ILT). The cost of ILTs, being an invisible factor, to the Nigerian oil industry is in the order of billions of dollars overspent annually. Improving drilling performance therefore is an enabler to reducing cost of oil production. Lower drilling costs stimulates more drilling activities which in turn increases production and reduces unit production costs. You can’t improve what you don’t measure Drilling performance in Nigeria is laden with tremendous inefficiencies. An indicative benchmark of an average Nigerian, and similar North American well reveals significant underperformance in the Nigerian well as measured by days to drill a 10,000 feet well. A 10,000 feet well routinely delivered in 10 days in North America could take as long as 85 days in Nigeria. This disparity is surmised to be causative of the consistently high well delivery cost in Nigeria. Disproportionately long well durations delays time to market (deferred production), reduces project NPV – costly wells reduces the number of profitable opportunities – which in turn reduces rig activities and associated demand for services. By top down estimates, the industry spends circa $11.4 billion to produce 1.25 million barrels daily and approximately $6 billion in drilling wells. A 30% performance gap between the authorised expenditure (budget) and actual costs as gleaned from an analysis of Nigerian wells represents a $1.8 billion a year opportunity. The relentless pursuit of excellence in well delivery begins with establishing key indicators which must be tracked with rigour and provides indication of drilling performance and efficiency trends. An excellent drilling efficiency metric commonly tracked is the dollar spend per reservoir foot of hole. US-based oil services research firm Spears & Associates, Inc. looking at this metric in US land operations from 2006 to date showed the cost of a foot of exposed reservoir falling by 75% in over a decade when considering what was paid to the contract driller. Similarly, the directional driller cost per exposed reservoir foot fell from $45 to $35, a decrease of 25%. In addition to the reduced cost per barrel, other implications of drilling efficiency gains break down as follows: Where there is a will, there is a way Investments in the Nigerian oil and gas sector declined by 70% between 2017 and 2021 closely correlating with the contraction in production output. Nigeria could only attract $3 billion in investments (approximately 5% of the total investment into the sector in Africa) in the five years between 2017 and 2022 despite having 38% of the continent’s total hydrocarbon reserves. As the government pushes for more transfer of resource ownership to locals via organised acreage farm-outs and International Oil Company (IOC) divestments, Nigeria’s oil industry’s uncompetitiveness is certainly at its pinnacle. For the sake

Read more »

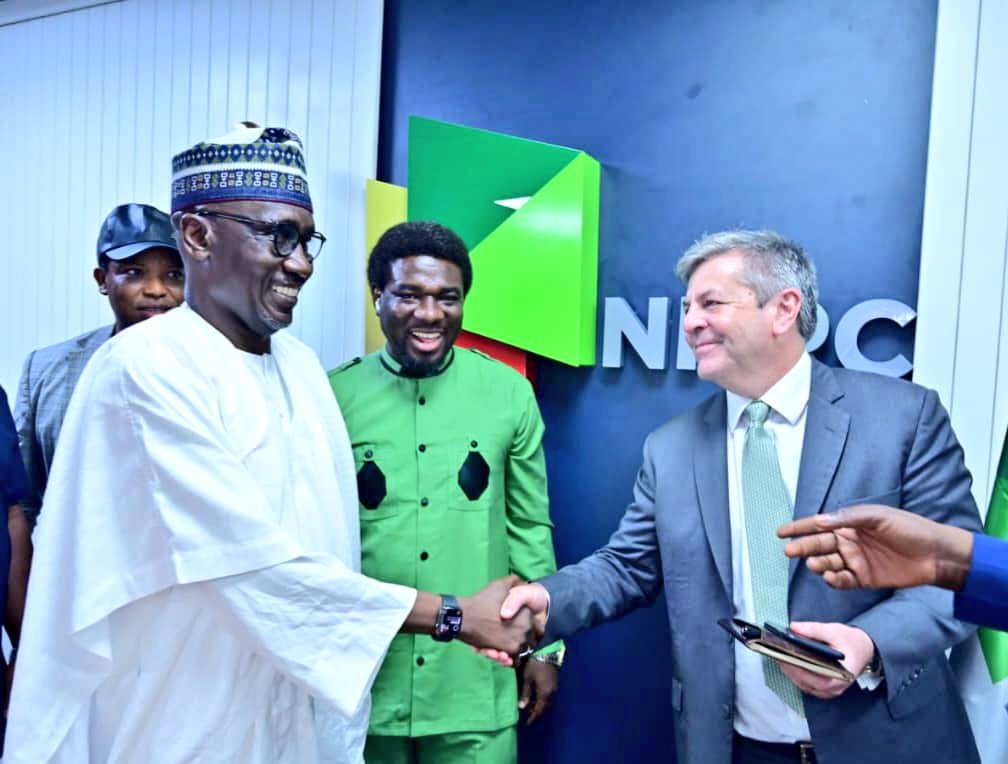

NNPC and TotalEnergies announce $550m investment in Nigeria’s Ubeta Gas Field

The Nigerian National Petroleum Corporation and TotalEnergies have announced a $550 million investment decision for the development of the Ubeta Field, a key onshore gas project expected to provide feedstock to Nigeria LNG – Africa’s biggest LNG export terminal. The project is located within OML 58, a TotalEnergies-operated onshore license that frequently suffers production disruptions due to pipeline vandalism and crude theft. The Ubeta field, discovered in 1964 and located northwest of Port Harcourt in the Niger Delta, is projected to produce about 350 million standard cubic feet (MMscf/d) of gas and 10,000 barrels of associated liquids daily. This development is expected to contribute significantly to the supply for NLNG’s Train 7. “Ubeta is the latest in a series of projects developed by TotalEnergies in Nigeria, most recently Ikike and Akpo West. I am pleased that we can launch this new gas project which has been made possible by the Government’s recent incentives for non-associated gas developments,” TotalEnergies’ Senior Vice President for Africa, Exploration & Production, Mike Sangster, said in a company statement. “Ubeta fits perfectly with our strategy of developing low-cost and low-emission projects, and will contribute to the Nigerian economy through higher NLNG exports.” At the official signing event at NNPC Towers, Group CEO Mele Kyari expressed appreciation for the Tinubu administration’s support in fostering a conducive fiscal environment that has been instrumental in reaching this significant FID. “The Presidential Executive Order is instrumental to us getting to this significant milestone, and we are now seeing the impact of the policy,” Kyari said. Slated for a 2027 start-up, the Ubeta gas condensate field in OML58 will be developed with a six-well cluster connected by pipeline to the existing Obite treatment plant. The development plan includes a 5 MW solar plant and electrification of the drilling rig to reduce carbon intensity. TotalEnergies and NNPC are also focusing on local content, with more than 90% of manhours expected to be worked locally. The Ubeta Field’s FID marks a significant step in NNPC’s ongoing efforts, supported by the executive branch, to address the challenges that have historically hindered foreign investment in Nigeria’s oil and gas industry. The project is expected to stimulate economic growth, create job opportunities, and generate substantial value for various stakeholders.

Read more »

OPINION: Charting the Course – Who Dares, Wins!

The African continent stands at a pivotal juncture in the global energy sector with its abundant oil and gas reserves offering immense potential for economic growth, writes Constantine ‘Labi Ogunbiyi. However, while the continent holds significant promise, navigating the upstream oil and gas sector in Africa comes with a plethora of risks and potential setbacks that demand careful consideration and strategic planning. This is against a backdrop of cutbacks in international capital for carbon-intensive oil and gas developments and increasing competition for the same sources of capital. Innovative financing solutions are thus required to fill the void, but can only be truly successful if tailored to specific needs and adopted and respected by all stakeholders. Nigeria, Africa’s largest oil producer, epitomizes the complexities and opportunities within the continent’s energy sector. Over the past decade, the Nigerian oil and gas industry has grappled with insecurity, asset vandalism, and community unrest, leading to a decline in investment. This coupled with the need for the sanctity of contracts and a properly structured fiscal framework has seen investment in the sector decline to about US$5 billion per annum from highs of about US$22 billion per annum in 2012. Nigeria has an abundance of unexploited discovered natural gas (as well as significant prospective gas resources), now heralded as a “clean” transition fuel amidst global energy shifts. Nigeria should seek to attract significant investment during this transition era (which has also seen crude oil prices rebound) to take full advantage of this, thus retaining the value of crude oil and gas resources to enable it to position itself for its energy transition (towards net zero) agenda. A just energy transition, the paradigm that gained impetus at the December 2023 COP28 Conference, is intended to decelerate financing fossil fuel developments while supporting those most vulnerable to the impacts of climate change when facilitating the transition to clean energy. This is not simply a tweak to existing systems; it is a fundamental transformation towards a cleaner, more sustainable future. This shift is driven by environmental concerns, the changing balance of power on the global stage, and awareness that the energy-producing nations in the Global South (which produce only a fraction of global emissions) should be given a chance to “catch up” industrially, technological advancement as consumer demands. It is estimated that the country needs about US$25 billion of annual investment in the next 10 years to achieve crude oil output of three to four million barrels per day and 3 bcf per day of gas production for domestic consumption (an ambition). A lack of available infrastructure, whether because of existing compromised infrastructure through age or sabotage or simply a lack of new investment, and competition for capital regionally, poses challenges that will need to be overcome to achieve this. Inadequate infrastructure impedes the development and operation of oil and gas projects in Africa, increases project costs, delays timelines, and heightens operational risks. The new Government has declared that it is “open for business” and will take urgent steps towards solving the fiscal, regulatory, security, and other issues discouraging investment and operations in the nation’s petroleum sector – something that is urgently required to help to push its oil and gas production to the ambitious levels being targeted. The mechanisms are in place – the Petroleum Industry Act (PIA) has done a lot to bring an enabling framework to the industry, including by allowing the Nigerian National Petroleum Corporation (NNPC) and its subsidiaries to raise capital on their own balance sheets, whether by divestitures or development partnerships on their blocks (including risk service contracts, financial and technical service agreements and the likes), crude forward sales, debt or equity capital raisings, etc. Still, there is a need to focus more on implementing the PIA in a manner that restores investors’ confidence and boosts oil and gas production, ultimately increasing jobs, the country’s earnings, and prosperity. Whilst international commodity traders have increased their activity and funding of oil production in Nigeria, they rarely support the development of appraisal and near-production assets. Access to innovative capital structures for such capital-intensive projects, involving a more risk-reward approach will be key to developing such assets, as will the deepening of regional capital markets to bolster the capital available from institutions such as the African Export-Import Bank and planned new initiatives such as the African Energy Bank. Effectively, more “home-grown” solutions will be required. As international oil companies shift focus to deep offshore and gas-rich assets, indigenous companies and smaller operators are stepping in to fill the void. However, accessing capital remains challenging. Innovative financing models, such as the contractor risk service model, offer a promising solution. This model, which involves contractors taking financial risks and receiving payment from production, incentivizes efficient asset development while mitigating risk for owners and operators. The contractor taking such risk, is effectively a co-financier of, and investor in, the development of the oil block – ensuring a service that would otherwise require immediate payment, to benefit from payment from oil and gas production (therein lies the contractor risk). The success of such models hinges on the support of all stakeholders, including operators, joint venture partners, financiers, regulatory authorities, and local communities. By aligning incentives and sharing risks, these partnerships can drive sustainable development and enhance investor returns. The recent completion of the FSO ELI Akaso infrastructure project by the Century Group (CG) (part of an alternative crude oil evacuation system (ACOES)), facilitated by the contractor risk service model, exemplifies the potential for collaboration to unlock value and foster growth. The ACOES is being developed as a result of the need to enhance production and supply security from oil blocks in the Eastern Niger Delta due to infractions and prolonged outages of the Nembe Creek Trunkline (historically one of Nigeria’s major oil transportation arteries evacuating up to 150,000 bopd of crude from the Niger Delta to the Atlantic coast for export). The CG model is “Made-in-Nigeria-for-Nigeria” but can be rolled out regionally (and globally too), in countries where access

Read more »

After its Shell acquisition, Renaissance to become pillar of Nigeria’s local content and gas monetisation strategy

Shell has announced today the sale of its onshore Nigerian subsidiary, the Shell Petroleum Development Company (SPDC), to the Renaissance Africa Energy Company comprised of ND Western, Aradel Energy (former Niger Delta E&P), First E&P, Waltersmith and Petrolin. The deal is still subject to approvals by the Nigerian government and, if completed, would represent the biggest M&A for the country’s oil & gas sector. While many will see it as yet another exit by a major IOC from the Niger Delta, the transaction is a win for Africa’s local content development. The Renaissance consortium comprises some of Nigeria’s most respected upstream companies with a demonstrated track record of redeveloping mature assets in the Niger Delta. The group already successfully came together in 2011 to incorporate ND Western and acquire SPDC’s 45% interest in OML 34. Individually, each of Renaissance’s shareholders have also demonstrated an ability to operate in Nigeria and maximise domestic value creation. Aradel Holdings has grown an integrated oil, gas and refining business around Ogbele that has continued to expand over the years. Waltersmith follows a similar pattern as operator of the producing Ibigwe marginal field and the Ibigwe modular refinery. First E&P successfully commissioned the Anyala-Madu shallow water hub in 2020 and is working with Dangote on achieving first oil at the Kalaekule Field soon. The transaction also includes continued support from Shell – operationally and financially – through the transition. This is critical to prevent past errors made during divestments in Nigeria with too little attention given to financial resources allocated to assets operations and redevelopment post completion of the deals. Last but not least, Renaissance is set to become a critical player in Nigeria’s energy transition journey as it takes over some of the country’s biggest gas upstream and midstream assets. Nigeria is currently faced with a gas supply shortage that must be addressed to meet the objectives of the Decade of Gas which seeks to grow gas penetration and develop a gas-based economy that is more sustainable and spurs industrialization. As Nigeria seeks to grow gas production, processing, and distribution, Renaissance will become a pillar of the country’s gas monetization strategy and a critical partner to the public and private sector players seeking to expand the country’s gas value-chain. In that regard, the appointment of Tony Attah, former Shell executive and Managing Director/CEO of Nigeria LNG for more than five years, to be Renaissance’s first MD/CEO is not insignificant.

Read more »

Congo-Brazzaville: Afreximbank to provide $300m for MKB II oilfields development

On September 27th, Afreximbank signed an agreement to provide a $300m facility to Trident OGX Congo for the development of the onshore Mengo-Kundji-Bindi II (MKB II) oil fields in the Republic of Congo. The reserve-based lending (RBL) facility will support the company’s capex programme to increase the country’s oil production by 30%, according to Afreximbank. Between 2018 and 2021, state-owned SNPC carried out studies to reassess the potential of its MKB II permit, where it also drilled five appraisal wells and constructed a road and platforms. “These positive results make it possible to envisage a production of over 40,000 barrels per day (bpd) at the end of the development drilling campaign in 2024,” SNPC Director General Maixent Raoul Ominga said in an interview shared with Hawilti earlier this year. In December 2021, the MKB II permit was transferred to Trident OGX Congo for 20 years to unlock additional capital and technology for its development.

Read more »

Côte d’Ivoire to sign new PSC over Block CI-705 with local upstream entity

This story was first published on the Hawilti+ Terminal on 13 September 2023. Côte d’Ivoire’s Cabinet has adopted a resolution on September 13th on the signing of a new production sharing contract (PSC) for block CI-705 with Ivory Coast Exploration (ICE) Oil & Gas. The block is located offshore Fresco and was relinquished by TotalEnergies in June 2022 after the unsuccessful drilling of the Barracuda-1X well. The block contains Albian structural closures, with structural prospects like Barracuda South yet to be tested. The award of the block to ICE is a win for Côte d’Ivoire’s local content as the company is majority-owned by Ivorian nationals. 2023 has marked a turning point for Côte d’Ivoire’s upstream sector after the commissioning of Eni’s offshore Baleine Field (phase 1) and the award of new PSCs in shallow- and deep-water to Murphy Oil and state-owned PETROCI. The government has embarked on several initiatives to boost upstream production and investment, positioning the country as a renewed hot frontier for oil & gas activity in West Africa.

Read more »

Nigeria: ExxonMobil on the hunt for two deep-water drilling rigs

ExxonMobil’s subsidiaries in Nigeria are seeking to mobilise two deep-water drilling rigs for a period of three years, with options of a further two years. Under a tender opportunity issued this week, the companies are seeking to conduct drilling, completion, testing, temporary abandonment, and workover activities in water depth ranging from 600m to 1,800m. The American major is currently divesting its shallow water portfolio in the country to focus on the development of its deep-water assets, including OML 133 (Erha FPSO), OML 138 (Usan FPSO), OML 139 and OML 154 (Owowo discovery). In recent public appearances, ExxonMobil executives in Nigeria have hinted at the progress made on several deep-water opportunities in the country, without giving any specifics. Over the past few weeks, the company’s subsidiaries have issued a total of 23 tenders to support drilling operations for three years at least, including for the provision of subsea wellhead systems and of oil country tubular goods (OCTG). The Owowo (OML 139/154) and Bosi (OML 133) developments feature amongst NNPC’s key projects this decade. The development of Owowo could include the drilling and completion of 53 producers/injectors with a subsea tie-back to the Usan FPSO. Its FEED and contracting could commence in 2024, according to NNPC. The scope for the Bosi development is yet to be announced and could rely on the existing infrastructure of Erha, located on the same block. Liam Mallon, President of ExxonMobil Upstream Company, was amongst the first executives to meet President Tinubu after he took office in May. The meeting sent encouraging sign on the major’s commitment to Nigeria and the possibility of fresh investments being announced soon. In June, the company appointed Shane Harris as its new chairman and managing director in Nigeria.

Read more »

BREAKING: British junior enters onshore Angolan blocks with Apex Atlas acquisition

Corcel Plc, an AIM-listed company with interest across battery metals and oil & gas, has acquired a 90% interest in Atlas Petroleum Exploration Worldwide Limited (Apex Atlas), which was recently awarded operated and non-operated interests in onshore oil & gas blocks in Angola. The company is not to be confused with Atlas Petroleum International, the Nigerian exploration & production company. In May 2021, Apex Atlas was awarded a 20% working interest in the KON 11 and a 25% interest in the KON 12 blocks, two licenses that have produced between 1970 and 1990. They hold strong redevelopment potential focused on the Tobias and Galinda fields. The company was also awarded a 35% interest as operator of the KON 16 exploration block. A license signature and award ceremony is scheduled to take place later this week in Angola to formalize the deal. The transaction would complete only upon the formal execution of three risk service contracts (RSC) with the Angolan government covering the KON 11, 12 and 16 Blocks. The minimum spend on KON 11 and KON 12 is of $6m, while that of KON 16 is of $3m, with a commitment to drill one well on all three blocks, according to Corcel. “The Kwanza basin has been producing for 35 years, is a well understood petroleum system and has both significant scale and upside. Corcel sees significant opportunities to increase the legacy operator estimated resources given the structural configuration of the basin and recent new structural mapping. We also see large stratigraphic and structural pre salt structures on blocks, analogous to the offshore Cameia discovery. Our initial focus will however be on quickly securing first oil and revenues through our redevelopment opportunities,” said James Parsons, Executive Chairman at Corcel.

Read more »

Nigeria: continued crude theft and workers’ strike bring production to new low

Nigeria produced 37.35 million barrels of crude oil and condensate in April this year, loosing 10 million barrels from its March production levels, according to data from NUPRC. This brought the country’s average daily oil production below the 1 million barrels of oil per day (bopd) threshold, in a country where production capacity stands at over 2 million bopd. Africa’s largest oil producer continues to be hit hard by severe crude theft from onshore assets. These used to represent almost 40% of production before COVID-19, but their share of output fell to only a fourth of the country’s daily oil and condensates volumes last year. Despite intense efforts from authorities to curb crude theft, results have been limited. “From March 2022 to March 2023, we removed 460 illegal connections on the Trans-Niger Pipeline so we could lift force majeure from our Bonny Terminal,” said Osagie Okunbor, Chairman of the Shell Companies in Nigeria, at the recently concluded Nigeria Energy Summit in Abuja. “However, we are now struggling to catch up our repair programs vis-à-vis new attempts to steal crude oil,” he confessed. So far, Shell’s Bonny Terminal has been able to export only between 2 and 3 million barrels per month in 2023, against traditional monthly volumes of 6 to 8 millions three years ago. But the biggest blow to the country’s production came from a wide strike organized by ExxonMobil workers in April 2023, forcing the American major to declare a Force Majeur at its four terminals in Nigeria. Data from NUPRC shows a loss of 4.6 million barrels at the ExxonMobil terminals between March and April 2023, including at Qua Iboe (-2.3 million barrels), Erha FPSO (-1.3 million barrels), Usan FPSO (-480,000 barrels) and Yoho FSO (-473,000 barrels). ExxonMobil was only able to resume normal operations at the end of April after successful negotiations with the workers. In its most recent report on Nigeria’s upstream industry, Hawilti forecasted a total production of some 1.57 million barrels per day in 2023. The forecast remains heavily dependent on a recovery of onshore volumes by implementing crude theft mitigation measures.

Read more »

Angola: ExxonMobil to invest $200m in Namibe Basin exploration

Some $200m is being invested into exploring Blocks 30, 44 and 45 in the frontier Namibe Basin offshore Angola, according to the country’s Ministry of Mineral Resources, Petroleum and Gas (MIREMPET). The blocks are operated by ExxonMobil (60%) under Risk Service Contracts signed at the end of 2020 with Sonangol E&P (40%) and the Agency for Petroleum, Gas and Biofuel (ANPG) for the three blocks. On Tuesday this week, the three parties signed a Memorandum of Understanding to pave the way for exploration on the blocks, during a ceremony witnessed by Minister Diamantino Pedro Azevedo. Angola expects some $200m to be invested into seismic studies and the drilling of an exploratory well on the blocks by 2024, according to MIREMPET. In case of a successful commercial discovery, some $15bn could be invested into the development of reserves in the Namibe Basin to start production by 2030. “Estimated revenue for the State from the development of a single major commercial discovery can range from $20bn to $40bn, given a conservative oil price forecast of $50-60,” MIREMPET said. ExxonMobil has mobilised the Valaris DS-9 drillship offshore Angola until July 2024, the Hawilti/Caverton Offshore Rigs Tracker shows. So far, drilling has focused on the company’s producing Block 15 where a new discovery was made at the Bavuca Sul-1 well last year.

Read more »

Chevron starts production from Lifua-A project offshore Angola

Angola’s Agency for Petroleum, Gas and Biofuel (ANPG) and Chevron’s local subsidiary CABGOC have announced the start of production from the Lifua-A project within Block 0. Chevron intends to develop the Lifua reserves via three different phases, Lifua-A, -B, and -C. Phase A relies on a stacked template structure (STS) platform with ten wells, including six production wells and four injectors. All fabrication was carried out locally in Cabinda by Algoa Cabinda Fabrication Services. “The Lifua-A platform is interconnected with the existing facilities in the Takula Area and is expected to produce a total of 6,500 barrels of oil per day from the Vermelha and Likouala reservoirs,” the ANPG said. The development of Lifua benefits from fiscal incentives granted under Angola’s marginal fields legislation. In November 2019, Executive Decree 328/18 granted marginal field status to the Lifua, 83-N, Kambala and N’Dola Sul fields in Block 0, data from Hawilti+ shows. In Angola, one of the conditions for a field to be considered marginal is that its proven oil reserves do not exceed 300 million barrels. Block 0 is located in shallow waters and is one of Angola’s most prolific assets with over 20 fields currently producing. Chevron is engaged in several brownfield development projects there, including the Sanha Lean Gas Connection (SLGC) project whose final investment decision (FID) was taken two years ago to supply gas feedstock to Angola LNG and the Soyo power plant. Out of the remaining discoveries that were granted marginal field status in 2019, N’Dola Sul is expected to be developed under a similar scheme as Lifua-A, according to Sonangol records.

Read more »

NNPC and Eroton E&P clash over operatorship of one of Nigeria’s most prolific oil and gas blocks

Nigeria’s NNPC announced on March 6th the appointment of NNPC Eighteen Operating Ltd as operator of Oil Mining Lease 18 (OML 18) onshore Nigeria by the block’s non-operating joint-venture partners. OML 18 is operated by Eroton Exploration and Production Co. (27%) while non-operating partners include NNPC (55%), OML 18 Energy Resource (Sahara Group, 16.2%) and Bilton (1.8%). Eroton was removed as operator of the joint-venture to protect the partners’ investment in OML 18, NNPC said. OML 18 has been unable to produce oil for several months due to the unavailability of the Aiteo-operated Nembe Creek Trunk Line (NCTL) that provides a connection to Shell’s Bonny oil export terminal. As a result, production has fallen from some 30,000 barrels of oil per day (bopd) a few years ago to zero for most of last year, data from NNPC shows. In comparison, Eroton E&P’s initial intention after taking operatorship of the asset in 2014 had been to increase production to 115,000 bopd of oil and 485 MMscf/d of gas. Such performance is deemed unsatisfying for an asset that covers 1,035 km2 and contains 11 discovered oil and gas fields with 714 million stock tank barrels of oil and condensate and 4.7 trillion cubic feet (Tcf) of gas reserves, according to NNPC. However, Eroton E&P is not the only to suffer from reliance on the NCTL. Data from NNPC shows that all neighboring blocks and joint-ventures who rely on that pipeline have been unable to get oil to market since April 2022. To mitigate the impact of crude theft and pipeline losses, an Alternative Crude Oil Evacuation System (ACOES) had been approved by the partners to barge oil to a floating, offloading and storage (FSO) vessel offshore Bonny. While limited barging reportedly started in June 2022, COVID-19 and delays in mooring the FSO have postponed the commissioning of the ACOES and prevented resumption of production. San Leon Energy’s Transactions The replacement of Eroton E&P as operator comes at a time when LSE-listed San Leon Energy is working to secure a controlling interest over Eroton E&P, OML 18, and the ACOES project. The company already owns 40% of Midwestern Leon Petroleum Ltd (MLPL), the entity that owns Martwestern, which itself owns 98% of Eroton E&P. In July 2021, San Leon signed Heads of Terms to reorganize MLPL and acquire the remaining 60% of the company from Midwestern Oil & Gas. Such a transaction would increase San Leon’s indirect economic interest in Eroton E&P from 39.2% to 98%. In parallel, Eroton E&P is planning to acquire Sahara Group’s 16.2% and Bilton’s 1.8% interests in OML 18, with funding from the Afreximbank. The consolidation of Eroton E&P’s interest in OML 18 is one of the conditions that must be completed for San Leon to proceed with its reorganisation of MLPL. If Eroton was to consolidate its interest in OML 18, and if San Leon was to secure a controlling interest of Eroton, its indirect economic interest in OML 18 would increase from 10.58% to 44.1%. In parallel, San Leon has also invested in the ACOES being developed for OML 18 and owns 10% equity plus a conditional further 3.323% equity in ELI Malta, the owner and operator of the ACOES project. In July 2022, a Reorganisation Agreement was signed, whose completion would increase San Leon’s interest in ELI to 50.64%. The appointment and replacement of Eroton E&P as operator of OML 18 throws uncertainty both over San Leon’s transactions but also over redevelopment plans for one of Nigeria’s biggest assets in reserves size and infrastructure capacity. Since this article was first written, Eroton E&P has categorically contested NNPC’s move. “We hereby re-iterate that Eroton remains the Operator of OML-18 in line with the provisions of the JOA and any dispute whatsoever between the parties are reserved exclusively for resolution under the Dispute Resolution clause of the JOA. The actions of the other JV partners (NNPC and Sahara) remain illegal and run contrary to the rule of law and in total breach of the terms and conditions stipulated in JOA,” the company said in a statement. This article was updated on March 14th to reflect Eroton E&P’s position and statement.

Read more »

Could 2023 be a record high for offshore drilling in Africa?

Despite a very tight offshore rig supply market, 2023 might set a new 10-year high for Africa’s offshore drilling market as several development, infill, and exploration campaigns get executed this year. According to the Offshore Rigs Tracker released this week by Hawilti and the Caverton Offshore Support Group (COSG) Plc, over 30 rigs are already confirmed to be active offshore sub-Saharan Africa this year, with more in the pipeline. Angola will continue to dominate the market like it has for a couple of years. The country has six floaters already contracted until at least 2024. Based on its pipeline of brownfield and greenfield projects, it will continue to drive deep-water drilling activity until at least 2026. All international oil companies (IOCs) have active rigs in the country, especially TotalEnergies (3), Azule Energy (2), Chevron (1), and ExxonMobil (1). They are actively pursuing infill drilling campaigns and subsea tie-back schemes on their producing FPSO units, while targeting infrastructure-led exploration opportunities. “We continue to witness an upsurge in drilling activity offshore West Africa despite the offshore rigs supply getting tight,” said Capt. Ibrahim Bello, Managing Director of Caverton Helicopters. “More drilling contracts are currently in negotiations across the region for both exploratory and development drilling, which could make 2023 one of the biggest years for offshore drilling activity on the continent since the crisis of 2014.” Nigeria’s offshore industry is also maintaining the momentum of drilling activity it saw in 2022 with at least five offshore rigs scheduled to be active in the country this year. Shell’s subsidiary SNEPCO and TotalEnergies both have floaters mobilized for most of the year on their respective deep-water blocks, OML 118 and OML 130. However, most of Nigeria’s demand is for jack-ups in shallow water, driven by key players such as Chevron, First E&P, General Hydrocarbons, and Damas E&P. After Angola and Nigeria, the Republic of Congo and Gabon are the next most active offshore drilling destinations in sub-Saharan Africa. Both countries are seeking to mitigate their production decline with additional infill drilling, development drilling, and exploratory drilling. Several campaigns are currently taking place there, including exploratory drilling by Eni in Congo and CNOOC in Gabon. Across the rest of the continent, significant development and exploratory drilling campaigns are also on the table this year, including in Senegal and Namibia. While the former is drilling to start producing oil and export LNG, the latter has all the industry’s attention as both Shell and TotalEnergies seek to confirm significant oil and gas discoveries made in the Orange Basin. The Offshore Rigs Tracker Q1 2023 can be downloaded for free here.

Read more »

Namibia: NAMCOR and QatarEnergy confirm new light oil discovery on PEL 39

The National Petroleum Corporation of Namibia (NAMCOR) has confirmed that the Jonker-1X well has discovered light oil within PEL 39 in the Orange Basin offshore Namibia. This is the third successful well in the license after the drilling of Graff-1 and La Rona-1 last year. PEL 39 comprises of Blocks 2913A and 2914B, operated by Shell along with partners Qatar Energy and NAMCOR. Shell resumed drilling with the Deepsea Bollsta in December 2022 and has the rig mobilized in Namibia until at least November 2023, Hawilti’s Offshore Rigs Tracker shows. “The Jonker-1X well was drilled to a total depth of 6,168 meters in a water depth of 2,210 meters. The acquired data is being evaluated while further appraisal is planned to determine the size and recoverable potential of the discovery,” QatarEnergy said. Shell is yet to make any official announcement on Jonker-1 or to confirm the estimated reserves it has discovered since 2022. Early industry estimates have assumed that Graff alone could hold 700 million barrels of recoverable oil and could be developed via a new FPSO and a possible FLNG solution.

Read more »

After Congo, Woodside Energy seeks to enter Namibian exploration license

Woodside Energy has entered into an exclusive Option Deed to enter into PEL 87 offshore Namibia, a deep-water block located north of recent discoveries made by TotalEnergies and Shell in the Orange Basin offshore Namibia. The License was awarded to Australian junior Pancontinental Energy in 2018. Since then, the company mapped a very large Saturn Turbidite Complex that may host several large internal hydrocarbon traps, some of which it has already mapped on 2D seismic. The deal reached with Woodside Energy provides for Woodside Energy to fund a $35m 3D seismic campaign over 5,000 km2 in addition to a cash payment of $1.5m to Pancontinental. In return, Woodside Energy has an exclusive option to become operator of PEL 87 with a 56% interest. Shall the company decide to exercise its farm-in option, it will drill the first exploration well and carry Pancontinental at 20% interest. Exploration activity is growing offshore Namibia where both Shell and TotalEnergies have rigs mobilized there for exploratory and appraisal drilling this year. Last October, Chevron entered PEL 90 just adjacent to PEL 87 and north of TotalEnergies’ Venus-1 discovery. The deal gives Woodside Energy the opportunity to grow its exploration portfolio in Africa after it entered Congo-Brazzaville in 2018. The operator is also in the process of commissioning the Sangomar Offshore Oil Project in Senegal with a projected peak production of 100,000 bopd.

Read more »

Angola: $7.8bn of contracts awarded for Agogo West Hub Project

Azule Energy has awarded several contracts worth some $7.8bn to international services companies for the development of its Agogo West Hub Integrated Project offshore Angola. The company is owned by bp and Eni. The project comprises 36 new wells producing via a 120,000 bopd FPSO vessel with a gas injection capacity of 230 MMscf/d and water injection capacity of 120,000 bpd. It will develop the Agogo and Ndungu fields, located on the West Hub of Block 15/06 where Eni already operates two FPSO units: N’Goma on the West Hub and Olombendo on the East Hub. The N’Goma FPSO will also be utilized to produce from both fields, enabling a production peak of 175,000 bpd by 2026. Agogo is significant for Angola as it marks the first major greenfield project awarded in the country since TotalEnergies’ Kaombo FPSO was commissioned on Block 32 in 2018. All market activity since then has focused on brownfield projects, including subsea tie-back schemes maximizing the use of existing FPSO units. As per the contracts signed this week, Yinson will be supplying the Agogo FPSO along with field operations & maintenance services, under a 15-year contract worth some $5.3bn. The contract includes an extension option of five years and represents Yinson’s first offshore production project in Angola. “FPSO Agogo is expected to commence operations in Q4 2025,” Yinson said in a statement. In December last year, Yinson awarded a $127m contract to WS Engineering & Fabrication, a subsidiary of Singapore’s Wah Seong Corporation, for the FPSO’s topside modules. Baker Hughes was awarded a contract to provide subsea equipment and services, including 23 standard subsea trees, 11 Aptara manifolds, StemStar5 fibre optic controls and the related system scope of supply. “A significant portion of the equipment will be manufactured, assembled and tested in Angola,” the company said in a statement. Subsea7 was awarded a contract worth between $300-500m covering the transport and installation of approximately 98 km of flexible pipes, 30 km of umbilicals, and associated subsea structures. Fabrication will take place locally at the Sonamet yard in Lobito. Aker Solutions was awarded a contract worth between $50-145m (NOK 500m-1bn) for the engineering, manufacturing and delivery of 36km of dynamic and static subsea production control umbilicals, including spares, ancillary equipment and services. Manufacturing will be done in Norway. Aker Solutions already delivered a similar order in the early 2010s for the N’Goma West Hub Development, data from the Hawilti+ Research Terminal shows. Finally, Saipem was awarded a contract for the supply, transport and installation of rigid flowlines and subsea structure; while TechnipFMC was selected for the engineering, procurement, and supply of jumpers, flowlines, risers, and all associated ancillary equipment under a contract worth $250-500m. Both companies are familiar with Block 15/06 and have already executed several contracts on the development of the West and East hubs with the FPSOs N’Goma and Olombendo, according to the contractors information on Block 15/06 provided by Hawilti+.

Read more »

Shell signs new contract for Block C2 offshore Mauritania

Shell has signed an Exploration & Production Contract (CEP) with the Ministry of Petroleum, Mines and Energy of Mauritania for offshore Block C2. The block is located just south of C10, another license already operated by Shell E&P Mauritania since 2018, and east of C8 where bp has discovered the BirAllah and Orca gas fields. The signing of the new CEP with Shell was approved by Mauritania’s Cabinet last week. The Government also approved the signing of an amendment to Block C10.

Read more »

BREAKING: Côte d’Ivoire to award seven new oil & gas blocks to Murphy Oil and PETROCI

Last Wednesday, Côte d’Ivoire’s Cabinet approved the signing of production sharing contracts (PSCs) for blocks CI-102, CI-103, CI-502, CI-531, and CI-709 with MURPHY Exploration & Production; and of blocks CI-523 and CI-525 with its national oil company PETROCI. Hawilti reported last September that both the American independent and PETROCI had expressed interest for the blocks. Independent operator Perenco was also believed to be in negotiations to acquire blocks CI-523 and CI-525. Several of these licenses hold undeveloped oil & gas discoveries that could be brought on stream relatively quickly. Murphy Oil Corporation The new portfolio of Murphy E&P, a subsidiary of Texas-headquartered Murphy Oil Corp., is particularly attractive. Blocks CI-102, CI-531, CI-103 and CI-709 form a straight column that stretches from the shallow waters offshore Abidjan all the way to deep-offshore areas where several wells have been drilled. CI-103 notably holds the Paon deep-water gas and light oil field discovered by Tullow Oil in 2012 and already appraised. In 2019, independent operator EnQuest had entered negotiations to acquire the block without reaching an agreement. Just north of Paon, Tullow Oil had also drilled the Calao-1X well in 2013, within current block CI-531. The independent had found good quality reservoir sandstone, although they were water bearing. CI-709 finally holds development potential thanks to wells previously drilled by Anadarko Petroleum in 2016 and 2017, although commercial quantities are yet to be proven. These include Pelican-1X that intersected around 21.3m of net oil pay in two separate interval, Rossignol-1X that encountered well-developed sands and roughly 4.6 m of net oil pay on water, and finally Colibri-1X that also hit hydrocarbon pay. PETROCI goes for gas On its side, PETROCI will acquire blocks CI-523 and CI-525 that hold the Ibex, Gnou, Kudu, and Eland gas fields. Both blocks are in shallow water next to the maritime border with Ghana and had previously been awarded to Taleveras and Afren and eventually to Vitol before the trader relinquished them in 2020. Interest for exploration in Côte d’Ivoire has been soaring since Italian major Eni announced a discovery at its Baleine-1X well in 2021. The discovery was appraised by the Baleine East-1X well in 2022, confirming some 2.5 bn barrels of oil and 3.3 Tcf of gas across blocks CI-101 and CI-802. In December last year, Tullow Oil had expanded its presence in the Tano Basin with the signing of a PSC for offshore exploration licence CI-803, which is adjacent to its CI-524 block where a well could be drilled in 2024. Significant prospectivity has been identified within the proven Cretaceous turbidite plays there, similar to the plays which are producing in the TEN and Jubilee Fields across the maritime border with Ghana.

Read more »

Equatorial Guinea awards three exploration blocks to international independents

Equatorial Guinea has awarded offshore exploration blocks to Panoro Energy and Africa Oil Corp. as it seeks to unlock additional reserves and reverse production decline. Earlier this month, the country appointed the former head of its national oil company, Antonio Oburu Ondo, to replace Gabriel Obiang Lima as Minister of Mines and Hydrocarbons. Infrastructure-led exploration Amongst the newly awarded blocks are Block EG-01 and Block EG-31 that are located next to producing and processing infrastructure. The shallow water Block EG-01 has been awarded to Panoro Energy (operator, 56%) with partners Kosmos Energy (24%) and national oil company GEPetrol (20%). The block is located next to the Ceiba and Okume fields, two fields operated by Trident Energy via the 160,000 bpd Sendje Ceiba FPSO. Output currently stands at some 30,000 bpd. Panoro Energy and Kosmos Energy are already partners of Trident Energy on the Ceiba and Okume complex and hold interest in the exploration Block S where a well is planned for 2024. “The partners have been awarded block EG-01 for an initial period of three years during which they will conduct subsurface studies based on existing seismic data to further define and evaluate the prospectivity of the block. Following this, the partners will have the option to enter into a further two-year period, during which they will undertake to drill one exploration well,” Panoro Energy said in a statement. On the other side, Africa Oil Corp. has been awarded shallow water Block EG-31 as operator with an 80% interest while GEPetrol holds the remaining 20%. The block is located next to the Marathon Oil Corp-operated Alba gas field and the onshore Punta Europa gas hub that houses the EG LNG export terminal. “Potential future discoveries could present low-cost, low-risk gas development opportunities targeting international LNG markets,” Africa Oil Corp. said in a statement. Rio Muni exploration Finally, Africa Oil Corp. has been awarded Block EG-18, which it had already secured during EG Ronda 2019. The award marks an evolution of the company’s acquisition strategy which had so far focused mostly on cash flowing producing assets. “In Block EG-18 the Company has identified a potentially large and highly prospective basin floor fan prospect of Cretaceous age, that is similar to those within the Company’s exploration portfolio in Namibia and South Africa,” Africa Oil Corp. added. All PSCs for the blocks are yet to be ratified by the Government and there minimum work programmes do not include drilling commitments. However, their awards to reputable E&P investors send strong signals on the appetite for upstream activity in the Gulf of Guinea.

Read more »

“At the helm of a new golden block”: TotalEnergies to spend $300m on Namibian exploration

TotalEnergies has decided to mobilise almost 50% of its global exploration budget to Namibia this year as it hopes to confirm a multi-billion barrels discovery on block 2913b within the Orange Basin. CEO Patrick Pouyanné made the announcement during the company’s 2022 Results & 2023 Objectives presentation this week. The French major will spend $300m on appraising its Venus discovery in the Orange Basin with the mobilization of two drilling rigs and the drilling of several wells. Hawilti’s Offshore Rigs Tracker shows that the Tungsten Explorer is finally on its way to Namibia where it is expected to start drilling this quarter. The drillship will start with the Venus-1A appraisal well before moving to drill new exploration wells into the adjacent Block 2912, also operated by TotalEnergies. Drilling on that second block will target the Nara-1 well and a potential Nara-1A appraisal well, which will both include drill stem tests (DSTs). The second rig, Deepsea Mira, is not expected before the middle of this year and will be mobilized for DSTs operations both at Venus-1A and Venus-1. “We want to accelerate the time to market (…) if we confirm the volumes discovered, there is room for a fast-track development,” Pouyanné added, explaining that the company could be at the helm of a new golden block that would be “a new chapter of the old business”. TotalEnergies hopes to replicate the tremendous success it has had on Block 17 offshore Angola, where it was able to start producing only five years after its initial discovery there. Block 17 is referred to as its “Golden Block” with a total of four floating, production, storage, and offloading (FPSO) vessels commissioned between 2001 and 2014.

Read more »

TotalEnergies to start Nigeria deep-water drilling campaign in February 2023

TotalEnergies is expected to start its much-anticipated infill drilling campaign offshore Nigeria in February 2023, its partner Africa Oil Corp. has said. The major has been planning a new drilling campaign on its flagship deepwater block OML 130 for some time, with an initial start scheduled for Q3 2022. The campaign will focus on infill drilling and could target up to 9 wells, including 2 exploration/appraisal ones. Exploratory drilling could notably focus on the Egina Ridge and Egina South prospects. “The rig contracted to drill the Egina infill wells is expected to commence operations in February 2023, after obtaining its final regulatory approval,” Africa Oil Corp. said in a production and operational update released today. The company is a 50% shareholder in Prime Oil & Gas, which itself holds a 16% interest in OML 130. While the rig selected is yet to be announced, Hawilti’s Offshore Drilling Tracker shows that Noble Corp.’s Gerry de Souza drillship is a likely candidate. The rig completed a drilling campaign for TotalEnergies offshore Suriname in December 2022 and arrived in West Africa at the end of last year, data from Marine Traffic shows.

Read more »

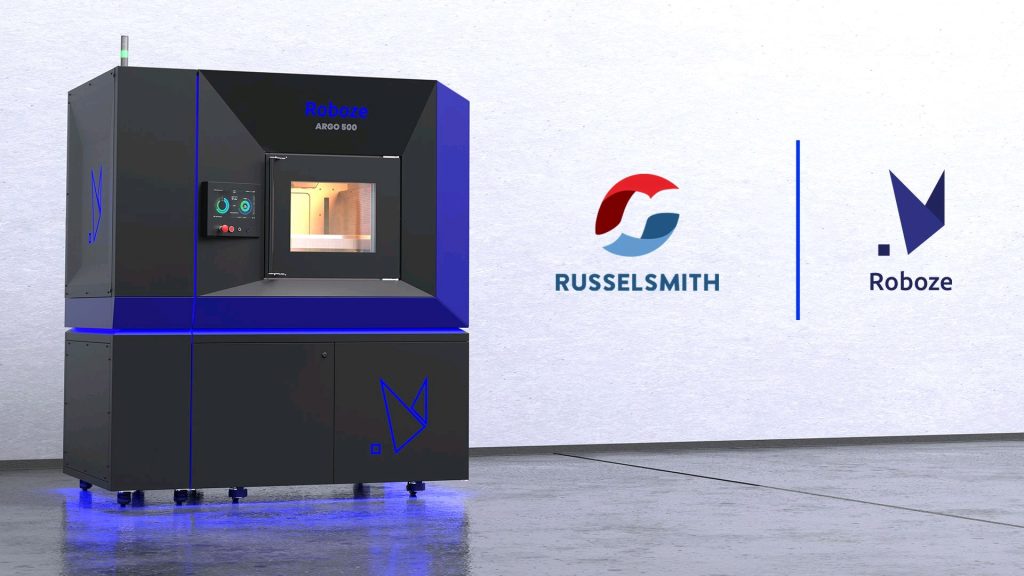

Nigeria’s RusselSmith on track to create West Africa’s first Smart Manufacturing Solutions Center

RusselSmith, one of Nigeria’s leading oil & gas maintenance and inspection solutions companies, has joined the Roboze 3D Parts Network. The Nigerian services company is now part of a network of specialized additive manufactured centres that use Roboze ARGO Production technology and are able to deliver on complex designs and difficult engineering challenges. “We are excited to introduce industrial 3D printing to the Nigerian market by joining the Roboze 3D Parts Network. This innovative just-in-time manufacturing solution allows our customers to replicate and replace hard-to-obtain OEM parts locally in a fraction of the time that it takes to source and ship them, thereby reducing costs, improving uptime and optimising their supply chain,” said Kayode Adeleke, CEO of RusselSmith. By joining the Roboze 3D Parts Network, RusselSmith wants to bring industrial 3D printing in Nigeria and set up the foundation for a digital supply chain in West Africa. The company has always been at the forefront of innovation in the Nigerian oil & gas industry, first introducing rope access technology to the market several years ago and following it up with other innovative solutions, especially in subsea services. In cooperation with Kongsberg Ferrotech of Norway, RusselSmith is already offering a unique underwater robotic pipeline repair technology that is now approved and certified by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

Read more »

Industry Catch-up: What You Might Have Missed

The oil & gas sector knows no break and has had its fair share of developments over the past two weeks. Here is what you need to know as you get back to the office. Mozambique has announced the results of its 6th Licensing Round On December 21st, Mozambique revealed the results of its 6th Licensing Round, which resulted in the award of only six blocks out of the 16 license areas that were proposed. The China National Offshore Oil Corporation (CNOOC) secured five blocks over the Save and Angoche Basins and Eni Mozambique securing one license in the Angoche Basin. None of the areas within the Zambeze Basin were awarded. “The Exploration programs proposed for the first sub-period of the Exploration Period have the potential to allow investments amounting to approximately $369.8m, foreseeing the acquisition of 31,200 Km2 of 3D seismic, opening of a minimum of four wells in deep water, and other geoscientific studies,” the National Institute of Petroleum (INP) said in a statement. Nigeria has launched a Mini Bid Round for deep-water blocks On December 21st, Nigeria announced its Mini Bid Round 2022 and put seven deep-water blocks on offer covering some 6,700 km2. A pre-bid conference is scheduled for January 16th while pre-qualification applications mut be submitted by January 31st. Under the new PIA regime, the blocks on offer are PPL-300-DO (former OPL 312); PPL-301-DO (former OPL 313); PPL-302-DO (former OPL 314); PPL-303-DO, PPL-304-DO, and PPL-305-DO (the three used to form IPL 318); and PPL-306-DO (former OPL 327). This Mini Bid Round will be a test for Nigeria’s attractiveness and competitiveness after a full overhaul of its oil & gas regulatory regime with the adoption of the PIA in 2021. Eni has selected a provider for its second FLNG unit in Congo-Brazzaville On December 22nd, Eni announced the signing of a contract with Wison Heavy Industry of China for the construction and installation of a 2.4 mtpa floating LNG unit in the Republic of Congo, offshore Pointe Noire. The unit will be the second FLNG facility of Eni in Congo since the company expects to commission this year the 0.6 mtpa Tango FLNG vessel it acquired from Exmar a few months ago. Both units will be monetizing associated gas from the Marine XII permit. Total Gabon expanded its upstream portfolio in Central Africa On December 26th, TotalEnergies EP Gabon extended its presence in Gabon with the signing of a new Exploitation & Production Sharing Contract (EPSC) over the Baudroie-Merou-Marine G5-143 permit. The 25-year agreement will run until 2047. “We remain fully committed as an energy producer in Gabon. We will maintain our investments to reduce greenhouse gas emissions by valorising associated gas and will continue to implement actions to maintain our production,” said Henri-Max Ndong-Nzue, President of TotalEnergies EP Gabon. Invictus Energy has finished drilling its first wildcat onshore Zimbabwe On January 3rd, Invictus Energy confirmed that technical and operational issues prevented a discovery at its Mukuyu-1 wildcat well onshore Zimbabwe. However, multiple potential gas bearing reservoir units were encountered and the well did prove the existence of a working hydrocarbons system. The Rig 202 is currently warm stacked on site for maintenance and upgrades and will recommence drilling operations later this year. Invictus Energy is considering an appraisal well (Mukuyu-2) or the drilling of Baobab-1. As a result, the contract with EXALO Drilling for the rig has been extended by another 12 months.

Read more »