Upstream

Nigeria: oil production reached historic low of only 1 million bopd in May 2022

Nigeria’s daily oil production averaged 1,024,371 barrels of oil last month, according to data by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC). This marks a new all-time low for sub-Saharan Africa’s largest oil producer, who should be able to produce 2 million bopd and had its OPEC quota for May set at 1.753m bopd. Who is Under-Performing? Significant losses have been reported at the onshore Shell-operated Bonny Oil Terminal. The facility serves as an export hub for several of Shell’s onshore blocks in the Niger Delta and to several independent and marginal field operators, mostly via the Trans-Niger Pipeline (TNP). Operators exporting via the Bonny terminal suffer severe pipeline losses and crude theft. Earlier this year, Hawilti was able to view one of the terminal’s oil export data sheets, confirming that pipeline losses go as high as 90% for some operators. Meanwhile, performances have been sluggish across most of the remaining oil assets. Notable month-on-month losses have been reported at ExxonMobil’s facilities, including the Qua Iboe terminal (-44.5%) and the Erha FPSO (-37%). Who is Performing? The offshore segment, including shallow water assets operated by independents and IOCs and deep-water fields operated by IOCs are the only ones providing stable volumes. Month-on-month gains have notably been reported for Neconde Energy/NPDC via the Ugo Ocha FSO (+132%), for Eni’s Abo FPSO (+57%) and for AMNI Petroleum’s Okoro FPSO (+22%). “Deep-water assets continue to perform relatively well and are expected to keep supporting production moving forward,” said Mickael Vogel, Director & Head of Research at Hawilti. “Drilling campaigns will be helpful in that regard, with Shell currently drilling 3 infill wells at Bonga on OML 118 and TotalEnergies expected to start a multi-year drilling campaign on OML 130 later this year.” Details on Nigeria’s deep-water, shallow-water, onshore and marginal field assets are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Tullow Oil and Capricorn Energy agree on all-stock merger deal

Tullow Oil and Capricorn Energy (formerly Cairn Energy) have agreed earlier this week on an all-stock merger deal worth over $800m. The combination of both companies will create one of Africa’s leading independent energy companies, and confirms the strong rise of M&A deals in Africa this year. The deal is likely to be implemented as a Court-sanctioned scheme of arrangement under which Tullow Oil would acquire all of the issued and to be issued shares of Capricorn Energy. Upon completion, Capricorn Energy shareholders would hold some 47% of the new combined group, and Tullow Oil’s shareholders the remaining 53%. While the name of the new combined company is yet to be revealed, it would sit on some 343m barrels of oil equivalent (boe) of reserves (2P) and 696m boe of resources with a production of some 96,000 boepd. The company would still be listed in London and be one of the largest Africa-focused energy independents. A Portfolio of Incremental, High-Return Investment Opportunities The new group will be present across lucrative assets in Ghana, Egypt, Gabon, and Côte d’Ivoire. Capricorn Energy notably entered Egypt in 2021 when it acquired Shell’s onshore assets in the Western Desert along with its consortium partner Cheiron. The gas-rich fields represent some 36,500 boepd of output for Capricorn Energy, with significant opportunity to deliver self-funded growth production via infill drilling and low-cost exploration. In Ghana, Tullow Oil’s success stories continues deliver returns while generating local value via the producing Jubilee and TEN fields where a drilling campaign is ongoing until 2025. New development wells are notably planned, especially at Jubilee South-East. Tullow Oil also has non-operated interests in key producing fields such as Espoir in Côte d’Ivoire or Tchatamba and Ezanga in Gabon. In 2021, the company’s working interest production averaged 59,200 boepd. Infrastructure-led exploration will be executed across these assets over the coming years, with opportunities to unlock additional reserves and maintain production decline. The wells will be reported within Hawilti’s Exploration Watch, available within the Hawilti+ Terminal. New Plays in Frontier Basins The new group could also be a key pioneer in the development of reserves in Kenya, Mauritania and Latin America notably. Tullow Oil is a partner in Project Oil Kenya, where a final investment decision (FID) is expected in 2023. The onshore project would deliver 120,000 bopd at peak and be Kenya’s first oil venture. Meanwhile, Capricorn Energy is hopeful that its C7 Block offshore Mauritania could yield success soon. The Dauphin-1 exploratory well could notably be drilled there in a couple of years.

Read more »

Sierra Leone launches 5th Petroleum Licensing Round

The Petroleum Directorate of Sierra Leone officially launched the country’s 5th Petroleum Licensing Round in London today. In total, 63,643km2 of offshore acreage is up for grab across 56 graticular blocks of some 1,360km2 each. A contract area is formed with a minimum of three graticular blocks. The Licensing Round will remain open until September 30th, 2022. It notably follows several announcements related to exploration offshore Sierra Leone earlier this month. On May 10th, Wildcat Petroleum announced it was granted non-exclusive right over 20 blocks offshore Sierra Leone where it will carry out a desktop study using geophysical and geological data. Last week, Innoson Oil & Gas also revealed the results of a third-party evaluation of its concession in the country by Ryder Scott Co, estimating up to 8.2 Tcf of gas and 234m barrels of condensate of P50 estimated un-risked gross prospective recoverable resources there. Sierra Leone has already shown oil deposits during previous exploration campaigns led by Anadarko, Repsol and Tullow Oil. These notably resulted in a few discoveries, though uncommercial ones. They include Venus B-1, Mercury-1, and Jupiter-1 by Anadarko in 2009, 2010, and 2012, and Savannah-1X by Lukoil in 2013.

Read more »New study shows 8.2 Tcf potential at Innoson’s oil & gas concession offshore Sierra Leone

Innoson Oil & Gas, part of Nigeria’s IVM Innoson Group, revealed last week the findings of a third-party evaluation conducted by Ryder Scott Co. on its concession offshore Sierra Leone. According to the American engineering and geological consultants, Innoson Oil & Gas’ blocks could contain up to 8.2 Tcf of gas and 234m barrels of condensate of P50 estimated un-risked gross prospective recoverable resources in the Sierra Leonean basin. The Nigerian company had been awarded provisional Blocks 96, 97, 114, 115, 116, 117, 133, 134 and 135 in May 2020. The blocks are in shallow water off the coast of Sierra Leone. They are notably adjacent to the Reconnaissance Permit area that the Petroleum Directorate of Sierra Leone (PDSL) granted Wildcat Petroleum earlier this month. Interest for exploration in Sierra Leone is picking up with several companies currently conducting reconnaissance operations there. The country has already shown oil deposits during previous exploration campaigns led by Anadarko, Repsol and Tullow Oil. These notably resulted in a few discoveries, though uncommercial ones. They include Venus B-1, Mercury-1, and Jupiter-1 by Anadarko in 2009, 2010, and 2012, and Savannah-1X by Lukoil in 2013. In order to assess the potential of its concession, the company notably deployed an earth remote sensing (ERS) method, reducing the need for 2D and 3D seismic and well data. “Asset evaluation, a field development plan and the setup of a data room are vigorously pursued with the immediate objective to engage a farm-in partner,” Innoson Oil & Gas explained in a statement.

Read more »

How Africa Oil Corp. made half a billion dollars from Nigeria in less than two years

Investing in Nigeria may not be for the faint-hearted, but the country continues to prove times and again that it can be a highly rewarding market. By securing an indirect interest in some of the country’s largest producing deep-water blocks in 2020, Africa Oil Corp. has shown the benefits that come with betting on Nigeria’s brownfield opportunities. In early 2020, the Canadian junior secured a 50% equity interest in Prime Oil & Gas B.V. (POGBV) for $519.5m. POGBV has an indirect 8% interest in the Chevron-operated OML 127 that contains the producing Agbami field and a 16% indirect interest in the Total-operated OML 130 that contains the producing Akpo and Egina fields. Because these represent some of Nigeria’s biggest producing assets, Africa Oil Corp.’s has relied on an average daily working interest production of 25,000 to 28,000 barrels of oil equivalent per day since 2020. Despite hedging constraining POGBV’s realized oil price to less than $60 in 2021, the company’s dividends to Africa Oil Corp. have been generous. Since January 2020, Prime has distributed eleven dividend payments totaling $500m to AOC, representing over 95% of its original equity investment. “Performance of the Company’s investment in Prime has continued to exceed expectations with strong cash flows, dividend distributions and very modest investments on the upstream assets, offshore Nigeria.” Africa Oil Corp, 13 May 2022 A Brownfield Investment Destination Nigeria offers some of the best proven reserves of oil & gas in the world, existing infrastructure and a large, established energy industry. But because of its above-ground risks, the country has repeatedly deterred foreign investors. However, deals like the one made by AOC in 2020 are proof that opportunities in the market are real. “Above-ground risks are constantly used as a pretext by foreign investors not to put their money in Nigeria. Those perceptions are often short-sighted and reveal a misunderstanding of the country’s environment. Because Nigeria is a brownfield investment destination, a successful investment strategy is one that relies on partnering with local actors who will be taking on the above-ground risks for you,” said Mickael Vogel, Hawilti’s Director & Head of Research. Last year, the country adopted the Petroleum Industry Act in a bid to bring much-needed regulatory certainty to investors. But the transition to the new regime has come with its challenges and is yet to translate into a significant increase in investments. “Recent and successful deals in Nigeria have been made by foreign companies that focus on injecting capital and bringing in technical expertise instead of seeking straightforward operatorship of the assets. In doing so, they let their Nigerian counterpart and operator navigate the country’s business environment while they focus on developing the reserves and cashing in on their investment,” added Vogel.

Read more »

Wildcat Petroleum granted non-exclusive right over 20 blocks offshore Sierra Leone

LSE-listed Wildcat Petroleum (WCAT) had announced the signing of a Reconnaissance Permit Agreement with the Petroleum Directorate of Sierra Leone (PDSL). The permit grants Wildcat Petroleum non-exclusive rights to conduct reconnaissance operations over 24,000 km2 for a period of six months. The company will notably carry out a desktop study using geophysical and geological data to identify blocks with the highest potential to yield commercially viable oil finds. “If block(s) with the potential of containing commercially viable oil discoveries are identified then WCAT intends to enter negotiations with the PDSL for a Petroleum Exploration and Production Licence(s),” Wildcat Petroleum said in a statement yesterday. The study area notably contains two uncommercial oil discoveries, Mercury and Jupiter, discovered by Anadarko Petroleum, Tullow Oil and Repsol. Based on previous exploration in the country and the presence of hydrocarbon shows in the wells drilled offshore Sierra Leone, Wildcat Petroleum believes there is a working petroleum system there. “In the period since these blocks were relinquish billions of barrels of oil resources have been discovered in the Cretaceous fans beneath the deep waters of the Guyana-Suriname Basin in South America Ð which can be linked tectonically & litho-stratigraphically with the conjugate Sierra Leone Basin,” the company added. Wildcat Petroleum was incorporated in 2020 and was admitted to the London Stock Exchange the same year. In June 2021, the company announced that it would initially focus on securing and developing a proven upstream asset in Angola, with a secondary focus on Namibia for exploration upside.

Read more »

Afentra acquires interest in producing and exploration blocks offshore Angola

Afentra has officialised its entry in Angola with the signing of Sale and Purchase Agreement (SPA) with Sonangol’s upstream subsidiary Sonangol Pesquisa e Produção. The one-year old, AIM-listed independent is acquiring from Sonangol a 20% non-operated interest in the producing Block 3/05 and a 40% non-operated interest in exploration Block 23 for up to $130m, including $80m cash upfront. The acquisition has an effective date of 20 April 2022 and follows the launch of Sonangol’s partial divestment process last year, under which Afentra was selected as preferred bidder for both blocks. Block 3/05 is located in shallow water and produced an average of 17,000 barrels of oil per day (bopd) in 2021. In 2018, it had already attracted the interest of Maurel & Prom who acquired AJOCO’s 20% interest in both Blocks 3/05 and 3/05A. Post transaction, it will remain operated by Sonangol. Block 23 is located in deep-water within the Kwanza Basin and contains the Azul oil discovery that tested at flow rates of around 3-4,000 bopd of light oil. Afentra is being joined in the block by Namibia’s national oil company NAMCOR who is taking another 40% interest in the licence. Details on Blocks 3/05 and 23 offshore Angola are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Exploration in Angola: find out about the country’s latest bidding round at Cape VIII

On April 5th, the Angolan National Oil, Gas and Biofuels Agency (ANPG) opened a tender for eight oil blocks in the Lower Congo and Kwanza offshore basins. These include Blocks 16/21, 31/21, 32/21, 33/21 and 34/21 in the Lower Congo and Blocks 7/21, 8/21 and 9/21 in the Kwanza Basin. In the presence of Minister of Mineral Resources, Petroleum and Gas, Diamantino Pedro Azevedo and Secretary of State for Oil and Gas José Barroso, the round of offshore blocks piqued the interest of several global oil majors operating in the country. Eni Angola notably submitted a bid for Block 31/21, as operator with a 50% interest, in partnership with Equinor (50%). On its side, TotalEnergies presented a bid proposal for Block 16/21, with a 100% stake. “Knowing that the basins in the bidding have been studied and the investors have been able to prove that our business environment is recommended – and that investors recognise it – and that the ANPG guarantees dialogue and continuous work with operators and with partners who trust Angola, it is something that shows us that we are on the right path and that we must commit more to boost our oil & gas sector and its contribution to the national economy,” commented Paulino Jerónimo, CEO of the ANPG. The bidding round was notably launched a month before the 8th African Petroleum Congress and Exhibition (CAPE VIII), set to take place in Luanda from May 16th-19th. The congress is sponsored by SONANGOL, TOTAL ENERGIES, EXXONMOBIL, CHEVRON, EQUINOR, TRAFIGURA, SOMOIL, SINOPEC, BFA, SNH, BRIMONT, SHEARWATER and is supported by PETAN, OGTAN, AECIPA. Headline topics include, among others, ANPG’s latest bid round, the energy transition, and opportunities and challenges under the new geopolitical paradigm shift. The congress is organized by the African Petroleum Producers Organization (APPO), the government of the Republic of Angola (for the first time), the Angolan National Oil, Gas and Biofuels Agency (ANPG) and AME Trade Ltd. The three-day event will be centered around the theme of “Energy Transition: Challenges and Opportunities in the African Oil and Gas Industry,” and assemble experts from the national, regional, and international energy and oil and gas industries to deliberate the challenges and opportunities of the energy transition and the future of the oil and gas industry in Africa. The congress will be the ideal platform for Africa’s leading oil and gas producers to confront the foregoing challenges and engender solutions to maximize its oil and gas resources. Amid the drive by developed economies towards decarbonization and net-zero policies, attending energy stakeholders will have the opportunity to reinforce the case for regional integrated supply chains and pooling resources to leverage the catalytic power of hydrocarbons in a sustainable manner. Supported by countless multinationals across the energy value chain and national oil companies, CAPE VIII will feature illuminating insight from a range of illustrious keynote speakers, who will position to influence the future landscape of energy in Africa and beyond. Confirmed Keynote speakers notably include: H.E. Diamantino Pedro Azevedo, Minister of Mineral and Petroleum Resources of Angola, President of APPO; H.E. Mahamane Sani Mahamadou Issoufou, Minister of Petroleum, Energy and Renewable Energy Republic of Niger; H.E Gabriel Obiang Lima, Minister of Industry, Mines and Energy of Equatorial Guinea; H.E. Samson Gwede Mantashe, Minister of Mineral Resources and Energy, South Africa; H.E. Dr Matthew Opoku Prempeh, Minister of Energy, Ghana; H.E. Thomas Camara, Minister of Mines, Petroleum and Energy, Ivory Coast; H.E. Didier Budimbu Ntubuanga, Minister of Hydrocarbons, Democratic Republic of Congo; H.E. Mohamed Arkab, Minister of Energy and Mines, Algeria; H.E. Bruno Jean Richard Itoua, Minister of Hydrocarbons, Congo; H.E Vincent de Paul Massassa, Minister of Petroleum, Gas and Mines, Republic of Gabon; Toufik HEKKAR, CEO of Sonatrach, Algeria; Jianqiang Zhang, President, Sinopec Angola; Dr. Omar Farouk Ibrahim, Secretary General, African Petroleum Producers Association (APPO); Ms. Cany Jobe, Director of Exploration and Production, Gambia National Petroleum Corporation; Immanuel Mulunga, Managing Director, Namcor; Edson R Dos Santosi, CEO, SOMOIL ; Dr. Ibrahim Mamane, Directeur Général, SONIDEP ; Osam Iyahen, Vice President, Oil & Gas, Africa Finance Corporation; Bráulio de Brito, Chairman, Angola O&G Service Companies Association (AECIPA); Zakaria Dosso, Managing Director, AEICORP; Matthieu Milandri, Head of Upstream Finance, Trafigura; Yann Pierre Albert Livulibutt Yangari, Independent Consultant; Dr. Babafemi Oyewole, the CEO of Energy Synergy Partners; Tim Dixon, Director and General Manager, IEA Greenhouse Gas R&D Programme. The congress will notably welcome the participation of several African national oil companies (NOCS), including Sonangol (Angola), SNH (Cameroon), SHT (Chad), PETROCI (Côte d’Ivoire), SNPC (Congo), NNPC (Nigeria), Sonatrach (Algeria), GE Petrol and Sonagas (Equatorial Guinea), and SONIDEP (Niger). In this crucial period for the development of the industry in Africa & globally, CAPE VIII presents a unique opportunity to connect with key stakeholders from Africa’s petroleum producing countries.

Read more »

NOCs dominate list of bidders under Mozambique’s 6th Licensing Round

Following the completion of the pre-qualification process for Mozambique’s 6th Licensing Round, a total of 13 companies have submitted documents. Interested bidders mostly include national oil companies, including CNOOC, Sinopec International, and PetroChina International (CNPC) of China, ONGC Videsh of India, Rosneft (RN Angoche) of Russia and QatarEnergy. The IOCs that already have blocks in the country, including Eni, ExxonMobil and TotalEnergies, are also participating. The rest of the bidders include South Africa’s Sasol who already produces gas from the onshore Temane and Pande fields; Russia’s gas independent Novatek; Nigerian independent Aiteo E&P; and Discover Exploration, who operates Licenses 35, 36 and 37 in the Comoros just outboard of Mozambique’s offshore Rovuma Areas 1 and 4. Under the 6th Licensing Round, companies are able to apply for Exploration and Production Concession Contracts (EPCC) after studying data licensed by the INP under standard Master Licensing Agreements (MLA). Most work commitment programmes include a first sub-period with seismic acquisition and a minimum spending of $5m. Drilling commitments must be made only when entering the second sub-period. To support bidders, the INP has made available 2D and 3D seismic datasets for Multi-Client licensing. These surveys cover both onshore and offshore areas and consist of 22,715 sq. km of 3D seismic, 41,905 km of offshore 2D seismic and 18,735 km of onshore 2D seismic.

Read more »

Can African oil producers help the world end reliance on Russian oil and gas?

Unlocking Africa’s oil and gas potential is now imperative against the backdrop of the war in Ukraine and the resulting crude, diesel, and gas supply crunch. This has rendered European dependence on Russian energy untenable, creating a major opportunity for Africa to position itself as a crucial option to increase the supply to the global energy markets. However, significant challenges remain for the continent’s hydrocarbon producers to suddenly ramp up their production due to infrastructure, finance, and technology deficits. Countries with major LNG resources, such as Nigeria, Angola, Libya, and Algeria, suffer from limited and underdeveloped pipeline networks, refineries, jetties, terminals, and ports. Additionally, incentivizing foreign investment is often problematized by a host of risk factors, including political instability, local insecurity issues and financial institutions shifting investments from fossil fuels to renewables. Finally, securing the latest technology to facilitate local content development has proven cost prohibitive given the reliance on foreign intellectual property and the continual brain drain of key local human capital. All the above issues will be discussed at the 8th Africa Petroleum Congress and Exhibition (CAPE VIII) taking place from 16-19 May 2022 in Luanda, Angola. The congress is organized by the African Petroleum Producers Organization (APPO), the government of the Republic of Angola (for the first time), and AME Trade Ltd. The three-day event will be centered around the theme of “Energy Transition: Challenges and Opportunities in the African Oil and Gas Industry,” and assemble experts from the national, regional, and international energy and oil and gas industries to deliberate the challenges and opportunities of the energy transition and the future of the oil and gas industry in Africa. CAPE VIII will unfold against the recession of the global pandemic that exacerbated record production declines across African hydrocarbon producing countries from 2020 to 2021. The annus horribilis was compounded by under-investment in exploration activities, leaving several of the continent’s biggest energy players struggling to cope with the post-lockdown surge in demand for hydrocarbons. Fortunately, APPO’s ambition to establish the continent as an energy hub regained significant headwind with a stellar upstream development outlook for 2022 and beyond. The congress will be the ideal platform for Africa’s leading oil and gas producers to confront the foregoing challenges and engender solutions to maximize its oil and gas resources. Amid the drive by developed economies towards decarbonization and net-zero policies, attending energy stakeholders will have the opportunity to reinforce the case for regional integrated supply chains and pooling resources to leverage the catalytic power of hydrocarbons in a sustainable manner. Supported by countless multinationals across the energy value chain and national oil companies, CAPE VIII will feature illuminating insight from a range of illustrious keynote speakers, who will mold the future landscape of energy in Africa and beyond. Keynote speakers at the conference will include: H.E. Diamantino Pedro Azevedo, Minister of Mineral and Petroleum Resources of Angola, President of APPO H.E. Mahamane Sani Mahamadou Issoufou, Minister of Petroleum, Energy and Renewable Energy Republic of Niger H.E. Samson Gwede Mantashe, Minister of Mineral Resources and Energy, South Africa H.E. Dr Matthew Opoku Prempeh, Minister of Energy, Ghana, H.E. Thomas Camara, Minister of Mines, Petroleum and Energy, Ivory Coast Dr. Omar Farouk Ibrahim, Secretary General, African Petroleum Producers Association (APPO) Ms. Cany Jobe, Director of Exploration and Production , Gambia National Petroleum Corporation Mr. Edson R Dos Santosi, CEO, SOMOIL Dr. Ibrahim Mamane, Directeur Général, SONIDEP Mr. Osam Iyahen , Vice President, Oil & Gas, Africa Finance Corporation Mr. Bráulio de Brito, Chairman, Angola O&G Service Companies Association (AECIPA) Mr. Zakaria Dosso, Managing Director, AEICORP Mr. Matthieu Milandri, Head of Upstream Finance, Trafigura Mr. Yann Pierre Albert Livulibutt Yangari, Independent Consultant Mr. Dr. Babafemi Oyewole, the CEO of Energy Synergy Partners Tim Dixon, Director and General Manager, IEA Greenhouse Gas R&D Programme Confirmed National Oil Companies at CAPE VIII include. SONANGOL, Angola SNH, Cameroon SHT, Chad Petroci, Cote d’Ivoire SNPC, Congo NNPC, Nigeria Sonagol, Angola GE Petrol, Equatorial Guinea Sonagas, Equatorial Guinea CAPE VIII is sponsored by the continent’s leading oil and gas players including: SONANGOL, TOTAL ENERGIES, EXXONMOBIL, CHEVRON, EQUINOR, TRAFIGURA, SOMOIL, BRIMONT, SHEARWATER. Hawilti is a proud Communication Partner of Cape VIII.

Read more »

Invictus Energy commits to more gas exploration onshore Zimbabwe

Geo Associates, who is about to drill in Zimbabwe what is believed to be the largest undrilled structure onshore Africa, has just committed to a second well this year. The company is a subsidiary of Australian independent Invictus Energy and holds an 80% interest in SG 4571 over the Cabora Bassa Basin in northern Zimbabwe. The area had already been explored by Mobil back in the 1990s, when the American major spent $30m acquiring surface and subsurface data, including gravity surveys and over 1,600 line kilometres of 2D seismic data. Back then, the massive 200km2 Mzarabani anticline had been identified and mapped, believed to host a conventional gas target. Last year, Polaris Natural Resources acquired 402.2km of 2D seismic over the license to support exploratory drilling by Exalo Drilling in June this year. The Mzarabani Prospect alone is estimated to contain 8.2 Tcf of gas and 250 million barrels of conventional gas / condensate (gross mean unrisked) across 5 horizons. But Geo Associates has decided to bet even higher on Cabora Bassa and has just signed a Heads of Agreement with the Sovereign Wealth Fund of Zimbabwe (SWFZ) to amalgamate SG 4571 with SWFZ’s MSC003 Cabora Bassa South Reserved Area. As a result the licence area has increased sevenfold from 100,000 ha to 709,300ha andnow covers the entire Cabora Bassa Basin in Zimbabwe. The company notably committed to increase its minimum work programme obligations for SG 4571’s second exploration period, which runs to June 2024. These include the acquisition of an additional 400km line of seismic data in the expanded area, and the drill of a second exploration well as part of the drilling campaign set to start in the middle of this year. Full details on the Cabora Bassa Gas Project onshore Zimbabwe are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

In this new oil market supercycle, African operators turn to local content for help

Economic recovery, geopolitics and the overall global energy demand and supply have impacted the price of both crude oil and natural gas in the last couple of months. A reality that has gotten genuine industry players working, especially within Africa. On the continent, oil players are ramping up activity first for their domestic markets, and of course to supply international markets that are in dire need of some respite in the face of the uncertainty and chaos caused by the Russian invasion of Ukraine. In this context, agitation and worry will not solve the problems, only strategic business decisions will. It is no news that several oil and gas asset owners in Africa are eager to get their fields to production after three to four years of stagnating performances. But while there is hydrocarbon to be produced and current prices are certainly attractive, the equation will be incomplete without the deployment of the right assets in the hands of the right team. Every day and possibly every hour, a meeting is being held across African energy capitals. In Lagos, Luanda, or Brazzaville, the focus is on investments, project execution, and asset purchase/lease. But how many of these negotiations will transition into profitable and executable ventures? This is not the time to take a chance on new market entrants, but the time to move forward with experienced and verified stakeholders who know what’s at stake and can act quickly. In Nigeria, credible intel has it that the management of West Africa Exploration & Production (WAEP) and General Hydrocarbon Limited (GHL) have formally engaged the Century Group for the development and production of their assets, all in the same week. The former has a substantial interest in OML 71/72 where lies the Kalaekule field, while the latter is the lead stakeholder in OML 120 where it is planning the redevelopment of the Oyo field. In selecting Century Group, both companies have concretely chosen to use the in-country assets of arguably the only Nigerian wholly-owned company providing FPSO solutions at the moment. The company has indeed a proven track record of safe operational framework and of over 30% cost savings even in the heart of the COVID 19 lockdown. When historic times call for urgent solutions, it turns out that local content is the most strategic, prudent, and cost-efficient decision for new hydrocarbons producers like WAEP and GHL. Over the past decade, several Nigerian energy companies have undoubtedly proven that they are energy infrastructure experts and have boosted indigenous capacity and participation. But none has really compared to the Century Group who is now well-positioned to support upcoming projects in the country. And this is just the beginning. More African names like UTM Offshore Limited or PFL Engineering Limited can now be trusted as capable partners to shape the future of the Nigerian energy industry post exit of IOCs. In the same vein, the sale of crucial energy infrastructure should be based first on the criteria of capacity to operate sustainably rather than solely on finance. Nigeria has a huge budget deficit (NGN 6.25tn, or approximately 3.39% of its GDP) and is heavily reliant on foreign debt financing. For an economy that heavily relies on oil, the current reality is a great opportunity to support recovery and help the country meet its fiscal and infrastructural obligations to the citizenry through direct earnings. Let the fields come alive and most of all, let the country’s most competent ones lead the charge.

Read more »Algeria: significant onshore oil & gas discovery by Sonatrach and Eni

On Sunday, Italian major Eni and national oil company Sonatrach have announced a new significant onshore oil and associated gas discovery in their Zemlet el Arbi concession within the HDLE prospect. This is the first of five exploratory wells planned in the Berjine North Basin in the Algerian desert. The concession is operated by their joint-venture, with Sonatrach holding 51% and Eni the remaining 49%. “Preliminary estimates of the size of the discovery are around 140 million barrels of oil in place,” Eni said in a statement. Both company have already declared that they would fast-track the field’s development for a start-up in Q3 2022. The HDLE-1 discovery is located about 15km from the Bir Rebaa North field processing facilities. The well discovered light oil in the Triassic sandstones of Tagi Formation, confirming 26 m of net pay with excellent petrophysical characteristics. Its production test delivered 7,000 barrels of oil per day (bopd) and 5 MMscfd of gas. “The discovery will be quickly appraised with the drilling of a second well, HDLE-2, in April 2022 to confirm the additional potential of the structure extending in the adjacent Sif Fatima 2 concession operated by an Eni-Sonatrach JV (50-50%),” Eni added.

Read more »

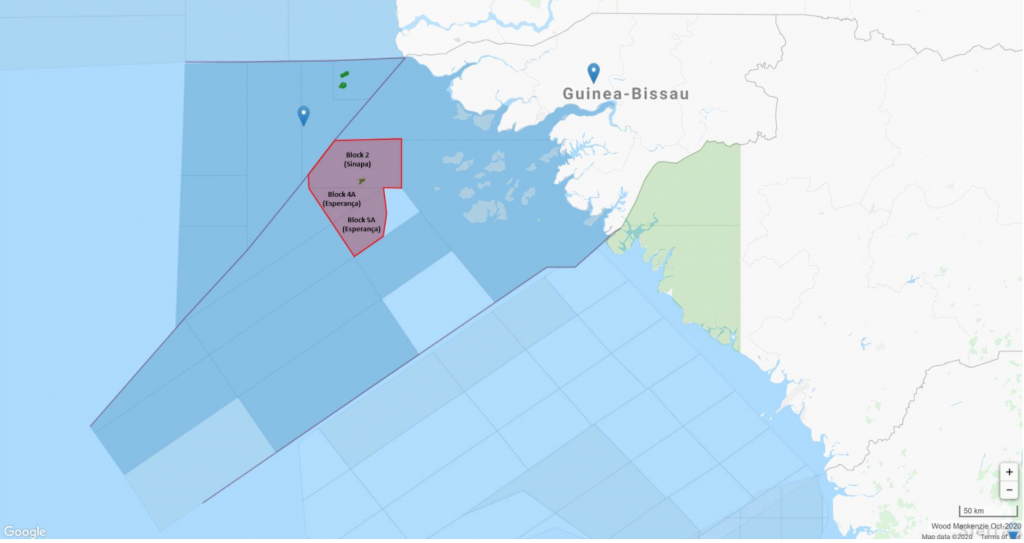

FAR Ltd to withdraw from Guinea-Bissau exploration blocks

Australian independent Far has commenced steps to withdraw from its interests in the Esperanca Blocks 4A & 5A and Sinapa Block 2 offshore Guinea Bissau, the company said today. The licenses are operated by PetroNor E&P with a 78.57% interest while FAR holds the remaining 21.43%. In October 2020, the current exploration phases for the blocks were extended for 3 years and are now valid until October 2023, with an obligation to drill an exploration well. Since 2021, PetroNor and FAR had been undertaking a full review of a potential well location for the 2023 program. The Atum Propsect is believed to be the key drill target and is mapped to contain Best Estimate Prospective Resource of 471m barrels (unrisked P50). FAR’s exit from Guinea-Bissau follows its exit from the Sangomar Offshore Oil Project offshore Senegal last year after being in default of payment. However, FAR continues to be present offshore The Gambia, where it is operator with a 50% interest of Blocks A2 & A5. While the results of its Bambo-1 well on Block A2 were unsuccessful, FAR did not throw the towel and has highgraded three of the four mapped prospects for potential drilling: Panthera in Block A2, and Jatto and Malo in Block A5. The company’s best estimate (P50) for these three prospects is of 1.5 billion barrels of prospective resource volumes.

Read more »

QatarEnergy deepens ties with Namibia

The state-owned national oil companies of Qatar and Namibia, QatarEnergy and NAMCOR E&P, have signed a Cooperation Agreement in Doha to deepen the energy cooperation between both countries. Under the agreement, QatarEnergy will support NAMCOR E&P in the development of a sustainable upstream oil and gas sector in Namibia, notably by providing training and human capital development opportunities to NAMCOR employees. Pursuant to the terms of the agreement, the two companies also agreed to work together on investment opportunities of mutual interest in Namibia’s upstream oil and gas sector. QatarEnergy is already a key investor in Namibia’s oil & gas sector. The company has a 40% non-operated interest in PEL 39 where Shell just announced the Graff-1 discovery, and a 30% non-operated interest in Block 2913b where TotalEnergies just announced the Venus-1 discovery.

Read more »

Eni achieves first oil from Ndungu offshore Angola

Eni has announced the start of production from its Ndungu early production development project on Block 15/06 offshore Angola. The field was discovered in 2019 and is now tied-back to the Ngoma FPSO and is the third startup on the block in only seven months. The project has an expected production rate of 20,000 barrels of oil per day (bopd) and will help sustain the plateau of the Ngoma FPSO, a unit able to produce up to 100,000 bopd and commissioned back in 2014. “A further exploration and delineation campaign will be performed in the first half of 2022 with the aim to assess the full potential of the overall asset of Ndungu,” Eni said. This is the second tie-back to the N’Goma FPSO following Agogo in early 2020. Eni has been leading a successful infrastructure-led exploration strategy on Block 15/06 for a couple of years and keeps successfully putting any new discovery into production in record time by using its two FPSOs on the block, N’Goma and Olombendo. Block 15/06 is operated by Eni Angola (36.84%) along with partners Sonangol E&P (36.84%) and SSI Fifteen Ltd (26.32%). In June 2021, Sonangol officially launched its divestment process under which it notably seeks to sell up to 10% of its interest in the license. A total of 36.2m barrels were exported from Block 15/06 last year according to the Ministry of Finance, representing a daily average of almost 100,000 bopd. As of December 2020, 142.2m barrels had been produced from the West Hub (N’Goma FPSO) with remaining reserves estimated at 174m barrels, while 85.7m barrels had been produced from the East Hub (Olombendo FPSO) where remaining reserves were estimated at 159.8m barrels. In parallel to its subsea tie-back projects on the license, Eni is also advancing plans for the full development of the Agogo discovery with a third production hub. Tenders were issued in July 2021 for a project targeting a peak production of 120,000 bopd via the installation of a third FPSO unit on the block. Full details on Block 15/06 offshore Angola are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

OFFICIAL: co-venturers on Block 2913b confirm Venus discovery offshore Namibia

TotalEnergies, who has a 40% operated interest in block 2913b within Petroleum Exploration Licence (PEL) 56, has confirmed that it has made a major light oil discovery at the Venus-1X well. The discovery was also officially confirmed this morning by its co-venturers Impact Oil & Gas and Namibia’s state-owned oil company NAMCOR. Venus was one of the most anticipated well in the world last year and was spudded in December 2021. Rumours have been circulating for a week now that a massive discovery has been made, with a potential find of well over 1 billion barrels of oil equivalent. While no official confirmation has been given yet on the size of the discovery, Impact Oil & Gas has announced that the find contains light oil and associated gas and constitutes a world-class discovery that exceeded pre-drill expectations. ““A comprehensive coring and logging program has been completed and will enable the preparation of appraisal operations designed to assess the commerciality of this discovery,” said Kevin McLachlan, Senior Vice President Exploration at TotalEnergies. The discovery lies in the deep-waters of the Orange Basin in southern Namibia, where Shell also announced this month an oil discovery at the Graff-1 well on PEL 39. “The Venus well was drilled to a total depth of 6,296 metres by the Maersk Voyager drillship, and encountered a high-quality, light oil-bearing sandstone reservoir of Lower Cretaceous age, with 84 metres of net oil pay,” Impact Oil & Gas said. Block 2913b is operated by TotalEnergies EP Namibia B.V (40%) along with its partners QatarEnergy (30%), Impact Oil and Gas Namibia (20%), and Namcor (10%). Details on the block are available in the Hawilti+ research terminal.

Read more »

Algeria’s national oil company renews onshore PSC in Niger

SONATRACH International (SIPEX BVI), the international subsidiary of the Algerian national oil company, has recently renewed its onshore production sharing contract (PSC) in Niger. On February 4th, it signed in Niamey the updated PSC for its Kafra Block. The initial PSC was signed in 2015 and led to the successful drilling of two exploratory wells. KFR-1, drilled in 2018, notably discovered 168m barrels of heavy crude oil (2P). A year later, KFRN-1 discovered another 400m barrels of paraffin-rich reserves (waxy oil). Following several analyses, SONATRACH mentioned that current updated liquids volumes were estimated at 100m barrels in place (2P).

Read more »

Strong production performance from Shell brings Nigerian oil production back up

Nigeria’s oil and condensate production was up +14% Month-over-Month (MoM) between December and January, latest data from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) shows. Oil production only was up about +17% and reached almost 1.4 million barrels of oil per day (bopd) at the start of the year. This is a level Nigeria had not seen since early 2021. Source: NUPRC Shell’s infrastructure was responsible for producing and handling 86% of the additional 6.2 million barrels produced in Nigeria between December and January. Notable MoM gains were registered at both oil export terminals operated by Shell, including Bonny (+68.6%) and Forcados (+62.6%). Oil output from the Forcados terminal notably reached a 2-year high last month. But performances also improved at two of the FPSOs that Shell operates in the country: Sea Eagle (+79.7%) and Bonga (+21%). Additional gains were also registered at Eni’s Brass terminal (+21.2%), TotalEnergies’ Odudu-Amenam hub (+20%) and First E&P’s FPSO Abigail-Joseph (+25%). Nigeria has struggle for the whole of 2021 to increase production because of a lack of investment and continued crude theft and vandalism on its infrastructure. In February and March, its allocated production quotas from OPEC are set at 1.701 million and 1.718 million bopd respectively.

Read more »

Official: Shell discovers working petroleum system offshore Namibia

After weeks of speculation, Namibia’s national oil company NAMCOR has confirmed that Shell made a light oil discovery at the Graff-1 well on the PEL-39 license in the Orange Basin. The block is operated by Shell with a 45% interest along with QatarEnergy (45%) and NAMCOR (10%). The Graff-1 deep-water well was drilled to a total depth of 5,376 meters in water depths of approximately 2,000 meters, between December 2021 and February 2022. “The partners will conduct analysis on the well data and further exploration activity to determine the full size and recoverable resource potential,” QatarEnergy said, indicating that a second exploratory well might be on the table in the near future. “In the coming months, we will perform extensive laboratory analyses to gain a better understanding of the reservoir quality and potential flow rates achievable,” NAMCOR added in a statement. The discovery is encouraging news for TotalEnergies, who is drilling the Venus-1X well nearby, and for Eco Atlantic Oil & Gas who expects to spud the Gazania-1 well in the same basin this year but in South Africa. More on ongoing exploration activity in the Orange Basin can be found within Hawilti’s quarterly sector watch on Sub-Saharan African Exploration, available within the Hawilti+ research terminal.

Read more »

Shell loses half of its African oil & gas output in only two years

Shell’s production of liquids and natural gas in Africa has been halved in only two years. The major closed 2021 with a liquids production of only 89,000 barrels per day (bpd) from the continent, compared with 183,000 bpd at the start of 2020. Similarly, its African production of natural gas was down to 448 MMscfd in Q4 2021 compared with 784 MMscfd in Q1 2020. Source: Shell quarterly earning results A Focus on African Offshore Only The data represents output volumes for both Nigeria and Egypt, where Shell is currently rationalizing its portfolio. In Egypt, it sold its onshore upstream assets in the Western Desert to a consortium of Cheiron Petroleum Corp. and Cairn Energy in September 2021 for $646m. Meanwhile, it also recently acquired seven new offshore concessions in the West Mediterranean, the Red Sea and the West Nile Delta. Shell’s strategy to exit onshore assets and focus on offshore projects also applies to Nigeria. The company is currently selling its 30% interest in the Shell Petroleum Development Co. joint-venture (SPDC JV). The JV still operates as many as 19 onshore and shallow-water licences, where Shell’s interest represented 60,000 barrels per day (bpd) of liquids and 484MMscfd of gas at the end of 2020. A Decreasing Pipeline of pre-FID African Projects Moving forward, Shell will be focusing only on African LNG projects or deep-water development projects with attractive economics. And their number is limited. In Nigeria, it holds a 26% interest in Nigeria LNG where the already delayed Train 7 project will be adding another 7.6 million tonnes per annum (mtpa) of liquefaction capacity to the Bonny Island LNG export terminal. Related to Train 7 is Shell’s HI Development on OML 144 where it has a 40% interest. HI is expected to produce 75,000 barrels of oil equivalent per day (boepd) and be a major supplier of feedstock to Train 7 once commissioned in the middle of this decade. Finally, Shell confirmed once again in its Q4 2021 earnings results that it continues to explore a few pre-FID options for the further development of its deep-water Bonga asset on OML 118. The PSC for the block was renewed in 2021. As a result, the major continues to study the Bonga Main Life Extension & Upgrade project with a projected peak production of 60,000 boepd and the Bonga North Tranche 1 subsea tie-back project with a projected peak production of 120,000 boepd. Both projects remain attractive because of their ability to add significant production volumes from the existing Bonga FPSO. However, the Bonga South-West/Aparo project, which plans to utilise a brand new FPSO with a capacity of 150,000 bopd, is delayed. Shell recently put the bidding process on hold for the project. While it continues to accept open bids, the major has declared it would not be proceeding with the development in the immediate future.

Read more »

TotalEnergies takes FID on $10bn of oil projects in Uganda, 16 years after first discovery

TotalEnergies, CNOOC and the Uganda National Oil Co. have taken a final investment decision (FID) today on the development of onshore oilfields around the Lake Albert in Uganda, and a massive export pipeline to Tanzania. The first discovery was made in January 2006 by Hardman Resources at the Mputa-1 well. Since then, over 1.4bn barrels of recoverable oil have been proven in the area. However, repeated tax disputes with the Government of Uganda and lack of refining and export infrastructure constantly delayed their development. The project was put back on the table only in April 2020 when authorities agreed the sale of TullowOil’s entire assets in Uganda to TotalEnergies for $575m. This sale was officially completed in November 2020, making TotalEnergies operator of most discoveries and finally paving the way for a final investment decision (FID). TotalEnergies is now operator of the Tilenga oil project, where first oil is expected in 2025 with a peak production projected at 190,000 barrels of oil per day (bopd). The Tilenga project covers six oil fields within Contract Area CA1, License Area LA-2 (North) and Exploration Area EA-1A, all located within the Albertine Graben in Western Uganda. Plans for the project include the drilling of 426 wells from 31 well pad locations, supported by a network of underground pipelines to collect oil production and transport it to a 200,000 bopd central processing facility (CPF) built within the planned Industrial Area in the Buliisa District. Once treated at the CPF, oil will be exported via the 1,443 km East African Crude Oil Pipeline (EACOP) that will terminate at an oil depot and an offshore loading terminal in Tanga, Tanzania. On its side, CNOOC is operator of the Kingfisher oil project with a projected peak output of 40,000 bopd. Advancing the project’s low-cost and low emissions, TotalEnergies was able to fast-track the FID and get it approved less than two years after it acquired its operated interest from TullowOil. “The design of the facilities incorporates several measures to limit greenhouse gas emissions well below 20 kg CO2eq/boe, including the extraction of Liquefied Petroleum Gas (LPG) for use in regional markets as a substitute for burning biomass, and the solarization of the EACOP pipeline,” the company said in a statement. In parallel, the Government of Uganda is also hoping to build a 60,000 bpd refinery on site to process its domestic crude. The Project Framework Agreement was signed with the consortium comprising YAATRA, BHGE, LionWorks, and Saipem in 2018 to develop, finance, construct and operate the greenfield oil refinery. Full details on the Tilenga Oil Project and the EACOP pipeline project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »