Upstream

Dhirubhai-1 FPSO likely contender for redeployment on Pecan field offshore Ghana

Ocean Yield’s Dhirubhai-1 FPSO, which had been contracted by Reliance Industries offshore India from September 2008 to September 2018, is the likely contender to be redeployed offshore Ghana for the development of the Deepwater Tano Cape Three Points block where lies the Pecan field. The vessel was converted in 2008 and has a oil production capacity of 60,000 barrels of oil per day (bopd). Ocean Yield is majority-owned by Aker Capital, whose company Aker Energy Ghana is the operator of the Deepwater Tano Cape Three Points block offshore Ghana. While KKR is set to take over the management of Ocean Yield from Aker Capital, Aker Energy still has an option to acquire the FPSO for its Ghanaian deep-water project. Aker Contracting FP ASA, an indirect subsidiary of Ocean Yield, and Aker Energy have notably entered into an agreement under which Aker Energy is granted an option to acquire the FPSO for $35m. However, the option is exercisable within a very particular timeframe: at the earliest 16 business days prior to settlement of KKR’s upcoming voluntary cash tender offer, and no later than 15 December 2021. Because Aker Energy had previously paid Ocean Yield $17.9m as compensation for prior options on the same FPSO and related services, Aker Energy’s total investment to purchase the FPSO will amount to $52.9m, shall the option by exercised. Discovered in the early 2010s by American independent Hess Corporation, the Pecan field is expected to be Ghana’s next major offshore oil & gas project. By the time the Aker Group acquired operatorship in 2018, Hess had already made seven discoveries, out of which all but one (Cob-1) had been declared commercial. The project has always been a priority for Ghana and targeted first oil by 2021, but suffered several delays, first because of the maritime boundary dispute between Ghana and Côte d’Ivoire, settled in 2017, then because of the Covid-19 pandemic. In March 2020, Aker Energy notably issued a notice to Yinson Holdings terminating the Letter of Intent for the FPSO’s charter, operations & maintenance contract it had initially planned to award to the Malaysian contractor. Since then, Aker Energy Ghana committed to finding a revised phased development to move the project forward, including via an alternate concept based on the utilisation of two small-sized FPSOs: one redeployed FPSO on the crest of Pecan in Phase 1 and another one in the North of Pecan to tie back additional resources in the northern part of the field in Phase 2. However, Ghanaian authorities have grown impatient and in August 2021, Minister of Energy Hon. Dr. Matthew Opoku Prempeh presented a paper to Ghana’s Parliament according to which the state-owned Ghana National Petroleum Corp (GNPC) would acquire a 37% additional interest in the Deep Water Tano/Cape Three Points (DWT/CTP) Block. The same day, Minister of Finance Hon Ken Ofori-Atta had presented a Loan Agreement between the Government of Ghana and GNPC Explorco for the grant of a loan of up to $1.65bn for the company to meet its payment obligation to acquire the shares in Aker Energy Ghana while also contributing to a Capex of $350m over the 2021-2024 period to achieve first oil from Pecan Phase 1.

Read more »

TechnipFMC sees $3bn of subsea opportunities in Africa within 24 months

TechnipFMC sees subsea opportunities across Nigeria and Angola totaling between $3bn and $5bn within the next 24 months, the company said during its Q2 2021 earnings conference call.The subsea market in the region will be heavily driven by TotalEnergies’ projects in Angola. These notably include the development of the Begonia (Block 17/06) and Cameia (Block 21) fields, but also the execution of two subsea tieback projects on producing blocks. These include Cravo, Lirio, Orquidea and Violeta (CLOV) Phase 3 on Block 17 and the ACCE project on Block 31 (an acronym for the Alho, Cominhos and Cominhos East fields). Block 17 has been subject to significant subsea activity recently, with the commissioning of Zinia 2 earlier this year and the ongoing execution of Dalia 3 and CLOV 2. Also offshore Angola, TechnipFMC expects to see contracts awarded for the development of Eni’s recent discovery on Block 15/06. Meanwhile, the integrated energy services provider sees two projects moving forward in Nigeria that could support the subsea market in the country. One is the development of the Preowei field on OML 130, operated by Total and whose field development plan has been approved since 2019. The other one is further development of the Shell-operated Bonga asset on OML 118. In May 2021, new agreements were executed for OML 118 between the NNPC and contractor parties SNEPCo (Shell), ExxonMobil, Total and NAOC (Eni).

Read more »

BW Energy’s discovery at Hibiscus North proves smaller than expected

Following the disappointing results of its Hibiscus Extension (DHIBM-2) well on the Dussafu Marin permit earlier this year, BW Energy has discovered oil at Hibiscus North via the DHBNM-1 exploration well. The well had a geological analogue to the Ruche Field, where the Gamba structure was the primary target, and had estimated potential reserves of 10 to 40 million barrels of oil. However, upon completion of drilling by the Borr Norve Jack-up, reserves found were below the lower end of that pre-drill resource estimate. Discovered reserves will add up to the overall resource estimates of the shallow water Dussafu Marin permit where production started in 2018 from the Tortue field, and could potentially support a tie-back in the future. The overall license produced an average of 10,500 barrels of oil per day (bopd) in Q2 2021 and is a critical asset to maintain Gabon’s oil & gas output. Source: BW Energy BW Energy is currently preparing to execute a third development phase on the block with the Ruche Phase 1 project, which will follows Tortue Phase 1 and Tortue Phase 2. The Ruche development targets the Hibiscus and Ruche Fields located 20km northwest of the Tortue Field via the drilling of up to six horizontal production wells connected to a fixed wellhead platform, itself tied back to the existing BW Adolo FPSO. Current production forecasts expect a production peak of 39,000 bopd in 2024 when Tortue Phase 2 and Ruche Phase 1 are completed. Details on the development of the Dussafu Marin Permit are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

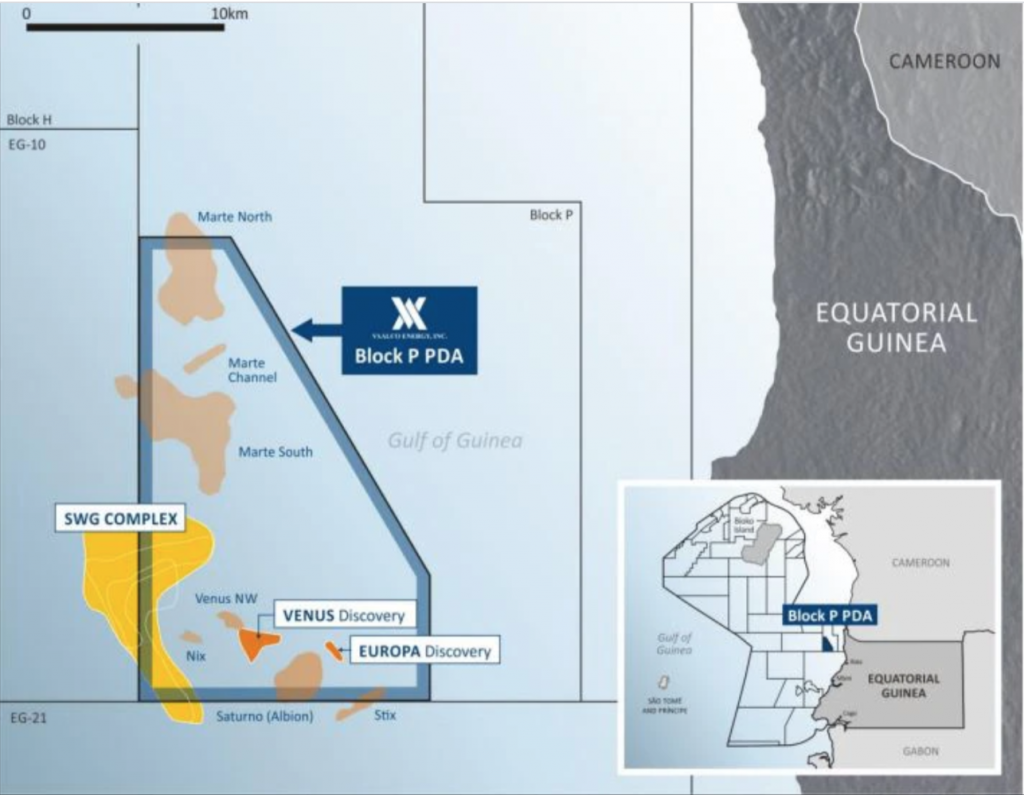

VAALCO to launch Venus development as a standalone project offshore Equatorial Guinea

VAALCO Energy has announced that it has completed the feasibility study for the development of the Venus discovery offshore Equatorial Guinea’s mainland. The discovery was made back in 2005 and is located within Block P, where VAALCO farmed in in 2012. The block’s estimated ultimate recovery (EUR) is of over 20 million barrels of oil equivalent. The company has negotiated a new amendment to the 2012 production sharing agreement and now expects to see its working interest increase to 45.9% upon approval of the Ministry of Mines and Hydrocarbons “The company is now proceeding to a field development concept and will work closely with the other joint venture owners to complete this over the coming months,” VAALCO Energy said in a statement last month. Once the development and production plan is approved, the PSC over Block P provides for a development and production period of 25 years. The announcement of a new standalone development project offshore Equatorial Guinea should be good news for a country that has struggled to reverse declining output in recent years. Equatorial Guinea currently produces about 110,000 barrels of oil per day (bopd) down from 160,000 bopd in 2016 according to OPEC data. Source: OPEC secondary sources

Read more »

Orca Energy to execute $21.4m workover programme in Tanzania

PanAfrican Energy Tanzania, the subsidiary of the Orca Energy Group that operates the wells and gas processing plant at Songo Songo in Tanzania, has signed an agreement with Exalo Drilling for the workover of three onshore wells. Activities are set to start in September 2021 on Songo Songo Island. The 2021 workover programme will notably see the wells recompleted with corrosion resistant chrome tubing while returning two wells to production and ensuring the third well continues to produce safely. Songo Songo is Tanzania’s flagship gas project and currently supplies about 60% of Tanzania’s gas, mostly used for power generation. While PanAfrican Energy operates the wells and the 110 MMscfd gas processing plant, the Songo Songo development remains owned by Songas, itself majority owned by Globeleq. Only gas produced beyond a threshold of 44.8 MMscfd can be freely marketed and sold by PanAfrican Energy. Source: Orca Energy Group The first 45 MMscfd is classified as “Protected Gas” and is owned by the Tanzania Petroleum Development Corp (TPDC) and sold under a 20-year gas agreement expiring on July 31st, 2024. This gas is used by Songas to fuel its 190 MW Ubungo gas-to-power plant but is also used for distribution to the Tanzania Portland Cement Company, and for Tanzania’s village electrification programme. Such distribution is ensured by Songas’ infrastructure which includes the 105 MMscfd, 232km pipeline to Dar es Salam and a 16km spur line to the cement plant. Beyond 44.8MMscfd, the gas is classified as “Additional Gas” and can be freely commercialized by PanAfrican Energy. The company has been steadily increasing its production and sales of Additional Gas to support additional power generation facilities in Dar es Salam, power several industries and develop a growing Compressed Natural Gas (CNG) business.

Read more »

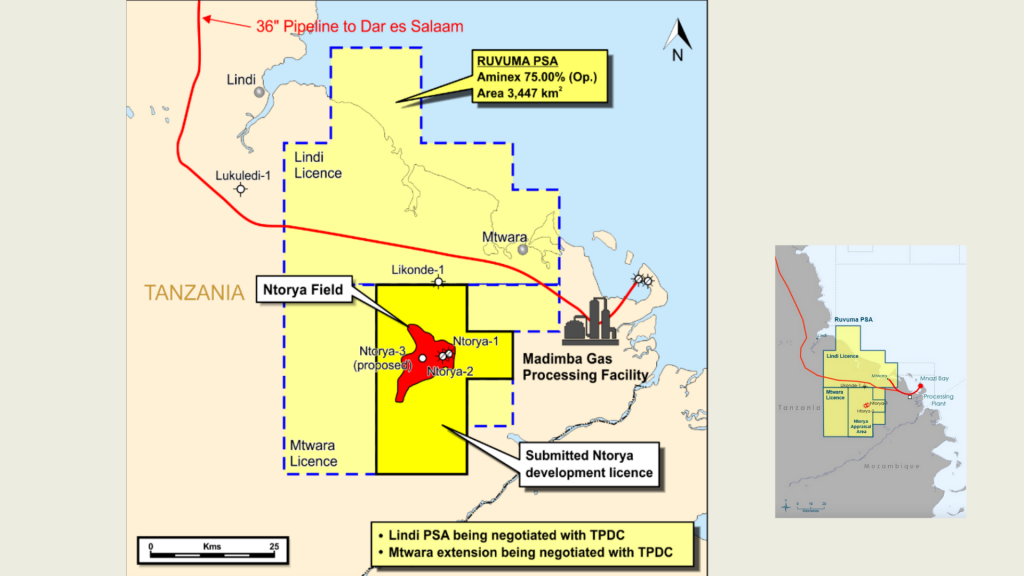

APT receives 2-year extension to meet gas exploration targets onshore Tanzania

ARA Petroleum Tanzania (APT), which took over the operatorship of the onshore Ruvuma PSA in Tanzania last year, has received a two-year extension of the license. The granting of the extension was necessary to complete key exploration activities on the block, including the acquisition of 200 km2 of 3D seismic data and the drilling of the Chikumbi-1 exploration and appraisal well (formerly known as Ntorya-3). Completion of the exploration programme will further support the conclusion of negotiations of the Gas Terms for the Ruvuma PSA and pave the way for the development of the Ntorya Gas Project. The development of the Ntorya gas accumulation has the potential to be Tanzania’s next big domestic gas project. Located in southern Tanzania where Maurel & Prom produces gas from the Mnazi Bay PSC since 2015, Ntorya used to be operated by Aminex’ subsidiary Ndovu Resources with a 75% interest before APT took over operatorship of the asset with a 50% interest last year. Aminex has since then retained a 25% interest in the license. The Ntorya accumulation is located within the onshore Ruvuma Production Sharing Agreement (PSA) signed in October 2005, which contains the Mtwara licence and the Ntorya development area, the latter being currently in negotiation. The PSA was operated by Tullow Oil until 2011 and saw the successful drilling of the Likonde-1 well in 2010, the Ntorya-1 well in 2012 and the Ntorya-2 well in 2017. Both Ntorya-1 and Ntorya-2 successfully tested gas with flow rates of 20 MMscf/d and 17 MMscf/d respectively, while Likonde-1 encountered gas shows. As a result, Ndovu applied to the Ministry of Energy for Tanzania in September 2017 for a 25-year development licence over the Ntorya area, with the application recommending the drilling of one well, the acquisition of 3D seismic over the Ntorya Field and the construction of a raw gas pipeline tied to the National Gas Gathering System at the Madimba plant, starting point of Mnazi Bay-Dar es Salam gas pipeline. In April 2020, Ndovu Resources secured a one-year extension of the Ruvuma Licence, almost three years after it applied for it. The extension did not provide enough time to complete the exploration programme, reason why new operator APT had to apply for another one which was secured a lot faster.

Read more »

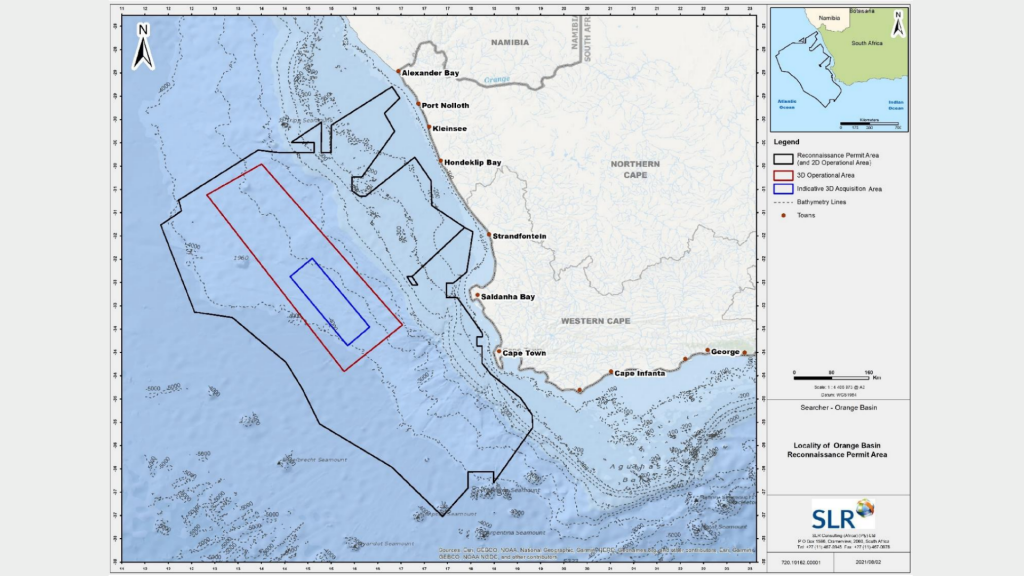

Exploration activity is heating up in the Orange Basin offshore South Africa

South Africa has been home to some of the world’s largest discoveries in recent years, with TotalEnergies opening up a new hydrocarbon’s province in the Outeniqua Basin via its Brulpadda (2019) and Luiperd (2020) discoveries. But as TotalEnergies and its partner work towards the set-up of an early production system on these discoveries, attention has turned further west to the Orange Basin. The Orange Basin covers most offshore areas from Cape Town up to the Namibian border. It notably contains the TotalEnergies-operated Block 2913b in Namibia and the Azinam-operated Block 2B in South Africa where the Venus-1 and Gazania-1 exploratory wells are expected to be spudded this year. In anticipation of increased drilling activity and potential world-class discoveries, seismic data providers Searcher and Spectrum (acquired by TGS in 2019) have been planning large seismic data acquisitions over the basin. Both companies are well-established players in the region. In November 2020, Searcher had already announced a new multi-client 2D and 3D seismic rectification project offshore South Africa, in collaboration with the Petroleum Agency of South Africa (PetroSA). Its seismic data currently stands at about 110,000 km of 2D and 15,000 km2 of 3D and covers the Outeniqua Basin and its sub-Basins: the Bredasdorp, Infanta, Pletmos, Gamtoos, Algoa and Southern Outeniqua Basins. Meanwhile, and following extensive long-offset acquisition and reprocessing programs between 2012 and 2019, Spectrum (now TGS) offers over 69,000 km of high-quality, modern 2D multi-client seismic from the Orange to the Namibe Basins. It also completed an additional 2D survey comprising approximately 3,900 km of the outboard Orange Basin in April 2019. But they have not stopped there and are about to step up their seismic data acquisition efforts significantly. They have both applied to PetroSA for Reconnaissance Permits enabling them to carry out new multi-client surveys over the Orange Basin: PetroSA acknowledged Spectrum’s application in July 2020, and Searcher’s in May 2021. Searcher’s ambition is to undertake either a 2D or a 3D seismic survey (or a combination of both) acquired back-to-back over the 2021 / 2022 Austral Summer. Its proposed 2D survey would have a total cumulative length of up to approximately 22,014 km while its proposed 3D seismic survey would cover an area of up to approximately 10,000 km2. Meanwhile, Spectrum’s application covers the undertaking of a multi-client speculative 2D seismic survey in a number of petroleum license blocks, covering an area in the order of 180,000 km2. These upcoming surveys, coupled with exploratory drilling by TotalEnergies and Azinam, are expected to confirm Southwestern Africa as one of the world’s hottest exploration frontier this decade. They would also have tremendous implications for two countries that have remained excluded from the league of global oil & gas producers and continue to rely on expensive imports to meet their energy needs.

Read more »

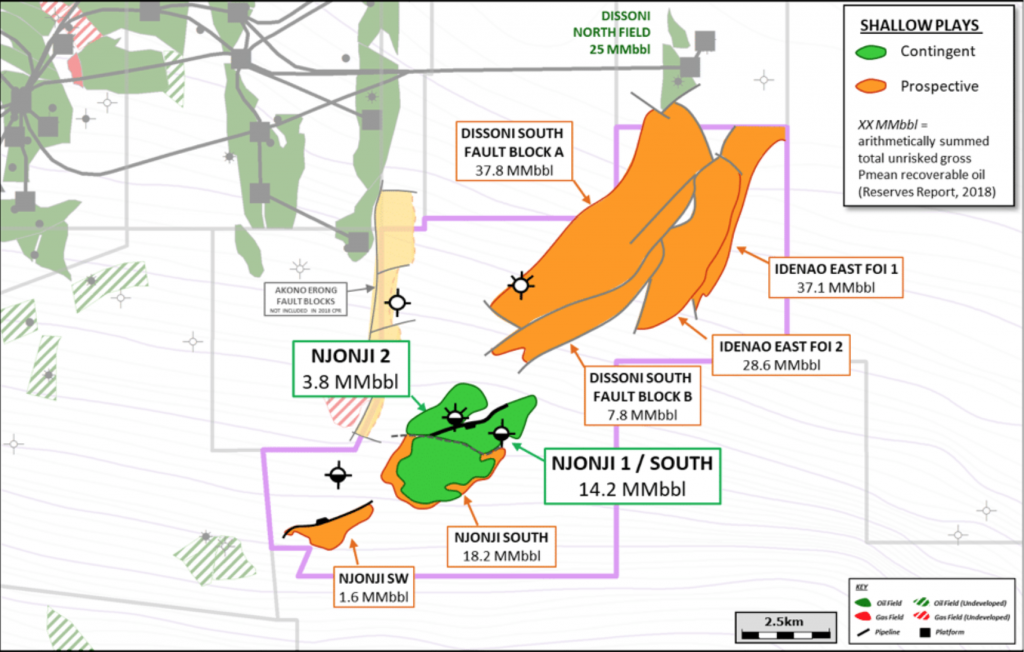

Nigerian trader farms into Thali PSC offshoreCameroun

Private Nigerian trading house Beluga Energy has signed a binding Heads of Agreement with Tower Resources Cameroon last month to acquire a 49% non-operating working interest in the Thali production sharing contract (PSC) offshore Cameroon. As operator, Tower Resources had been looking for a partner for some time in order to drill the NJOM-3 well. Consequently, the farm-out with Beluga Energy covers $15 million towards the cost of that well. With gross mean prospective resources of 111 million barrels across four identified prospects, the Thali PSC could be Cameroon’s next significant shallow water development and sees Beluga Energy entering in a drill-ready asset. Tower Resources has been operating the licence since 2015, when it acquired the block where French major Total had declared two gas discoveries: Rumpi-1 and Njonji-2 (now NJOM-2) and one oil discovery: Njonji-1 (now NJOM-1). Following a reprocessing of all available data, Tower Resouces started planning the drilling of NJOM-3 very early on. However, plans were delayed due first to the lack of site survey data, which was completed and acquired in early 2020, then by the Covid-19 pandemic. Two extensions of the initial exploration periods have provided enough time to drill and complete the well. The last exploration extension period was granted in May 2021 and runs until May 11th, 2022.

Read more »

President Buhari has signed Nigeria’s Petroleum Industry Bill into law

It took almost two decades, two historic crashes in commodity prices and two recessions for Nigeria to finally adopt its new Petroleum Industry Bill. Following its passing at both chambers of Parliament in July, the bill was officially signed into law by President Buhari today. The bill is expected to provide much-needed regulatory certainty for investors seeking to do business in Africa’s most populous nation. Nigeria has the world’s eight largest proven gas reserves and is Africa’s largest crude oil producer. However, years of under-investment have left production on a declining trend: in June of this year, Nigeria was producing only about 1.4m bopd and has not been producing over the 2m bopd threshold since 2012. A major factor to judge the efficiency and impact of the PIB will now be its ability to revive deep-water projects that have remained on the shelves for years. IOCs in Nigeria have discovered billions of barrels of oil equivalent offshore which have remained undeveloped because of market conditions and lack of a supportive regulatory framework. The passing of Nigeria’s Deep Offshore and Inland Basin Production Sharing Contract (Amendment) Act in late 2019 had only further jeopardized the economics of most of these discoveries by removing the water depth-based royalty and replacing it with a flat 10% royalty on all deep-water PSC. It had also introduced a price-based royalty adding 0 to 10% depending on the oil price. Will the PIB be able to revive the investment appetite of IOCs for those deep-water projects? Time will tell but time is also of the essence. Only the development of these discoveries has the power to significantly increase Nigeria’s output. Another crucial aspect to take into consideration is the security situation in the Niger Delta. Insecurity and vandalism there are one of the main reasons for investors shying away from Nigeria and for the exit of IOCs out of their onshore and shallow water licenses in the country. It remains until today a major factor preventing Nigeria’s hydrocarbons sector to realize its investment potential. Because host communities will not be receiving the share they asked for (2.5-3% instead of 10%), an appeasement in the Niger Delta is not certain. For the same reason, the PIB is not expected to slow down the pace of divestments by IOCs in the Niger Delta, although the same move will benefit indigenous players with cash at hand.

Read more »

OML 17 output up 40% only seven months after its acquisition by Heirs Oil & Gas

Heirs Holdings and its affiliates Transcorp announced at the start of this year a transformative acquisition of a 45% participating interest in OML 17 from the Shell Petroleum Development Co. (SPDC) joint-venture. The transaction remains one of the largest oil & gas financings in Africa with a financing component of $1.1bn. Seven months later, new operator Heirs Oil & Gas (HHOG) has already increased production by 40% and reached a production of 40,000 boepd. The information was revealed by HHOG’s new CEO, Osayande Igiehon and announced by Heirs Holdings Chairman Tony Elumelu in early August. Upon its acquisition, OML 17 had a production capacity of 27,000 barrels of oil equivalent per day (boepd) and 2P reserves of 1.2 billion barrels of oil equivalent (boe) according to Heirs Holdings’ estimates, with an additional 1 billion boe of resources for further exploration potential. The ability of a new local player to take over an onshore asset so efficiently and increase output in less than a year is an encouraging achievement as Nigeria still struggles to increase oil & gas production. Meanwhile, industry sources have confirmed to Hawilti that OML 17’s Agbada non-associated gas plant is currently in commissioning phase. The 80 MMscfd facility will be upgrading existing gas infrastructure developed by Shell during its years of operatorship.

Read more »

Good Things Come in Threes: after Angola and Ghana, Eni strikes oil in Côte d’Ivoire

Italian major Eni has announced this month a major light oil discovery (40° API) at its Baleine-1X exploration well in block CI-101 offshore Côte d’Ivoire. The company had signed the contract for the block’s license back in March 2017 and operates it with a 90% interest. This marks the third oil discovery by the company this year following Cuica in April offshore Angola and Eban in July offshore Ghana. The Baleine prospect was drilled in water depths of about 1,200m by the Saipem 10,000 drillship and reached a total depth of 3,445m. It discovered oil in two different stratigraphic levels and will now be appraised and evaluated to assess the significant upside potential of the overall structure that extends into block CI-802, another block which was just awarded to Eni back in June 2021. According to Eni, the potential of the discovery can be preliminarily estimated at between 1.5 and 2bn barrels of oil in place and between 1.8 and 2.4 trillion cubic feet (Tcf) of associated gas. “Along with the appraisal programme, Eni and Petroci Holding will also start studies for a fast-track development of the Baleine discovery,” the company said in a statement yesterday. Eni has been increasing its exploration portfolio in Côte d’Ivoire in recent years: it had been awarded Block CI-205 in 2017 and Blocks CI-501 and CI-504 in 2019. It is also struggling to maintain its share of African oil production and has been faced with decreasing output for several years. In Q2 this year, its oil & gas production from sub-Saharan Africa stood at about 293,000 boepd compared with 399,000 boepd in Q2 2019 and 386,000 boepd in Q2 2020. Source: Government of Côte d’Ivoire The opening of a new play concept in Côte d’Ivoire’s sedimentary basin is also very good news for a country where oil production has failed to meet expectations and has been dropping significantly in recent years. Crude oil production had fallen to only 20,690 barrels of oil per day (bopd) in Q1 this year, against a daily average of over 40,000 bopd back in 2016. Most of the oil produced comes from the Baobab deep-water field operated by Canadian Natural Resources (CNRL) where production started in 2005. Côte d’Ivoire remains however a strong gas producing market with good domestic off-take infrastructure from the power sector.

Read more »

African Oil Producers Have Missed on Over $29bn of Oil Revenue Since January

By and large, 2021 has been a missed opportunity for African oil producers. While the continent’s hydrocarbons sector yielded several discoveries and Nigeria finally signed its landmark Petroleum Industry Bill into law, decreasing output across the board means that African producers have not maximised benefits from the strong rebound in commodity prices. This is particularly the case with sub-Saharan Africa’s three biggest oil producers Nigeria, Angola and the Republic of Congo. Despite OPEC quotas increasing, and leaving room to ramp domestic production back up, the three countries have been unable to pump more barrels. In fact, the difference between their allocated OPEC production quotas and their actual production reached as much as 548,000 barrels per day in August this year. From January to October 2021, the three countries have missed on over $29bn worth of oil production according to Hawilti’s research and estimates. Volumes differentials between OPEC quotas and actual production increased to 30,000 bopd for Congo in August. They are even more significant for Nigeria and Angola, especially at a time when their oil prices reference is high: Nigerian and Angolan oil prices stood constantly above $70/bbl between July and September 2021. Both the Girassol Blend and Bonny Light were selling at an average of over $80/bbl in August. Source: OPEC Nigeria’s oil sector has been massively underperforming this year so far. Its oil GDP was down -12.65% in Q2 2021, its fifth consecutive negative quarter. Despite setting an oil price benchmark of $40/barrel in its 2021 budget, the country is also failing to meet its oil revenue target. Between January and May 2021, gross oil revenue stood at NGN 1,490.76 bn against a pro-rata target of over NGN 2,000 bn. Because of its inability to increase production, Nigeria is very likely to miss its yearly gross oil & gas revenue target of NGN 5,185.57 bn. Reasons abound, but chief amongst them is the lack of investment, especially from international oil companies (IOCs) in the Niger Delta, where the focus for the past decade has primarily been on divesting. Meanwhile, new local operators who have taken over critical onshore assets have been left cash strapped by the double oil price crash of 2014-2016 and 2020. Coupled with aging infrastructure, continued insecurity and repeated vandalism on pipelines, Nigeria’s oil production is simply unable to meet the needs of the hour. The declaration of Force Majeure by Shell at the Forcados oil terminal in August only aggravated the situation, with the country loosing 2.6m barrels of production between July and August 2021. Production and export figures from the country’s five IOCs-operated onshore oil terminals are the most representative of Nigeria’s current situation. While the Bonny, Brass, Qua Iboe, Forcados and Escravos terminals pumped about 165.5m barrels in H1 2020, volumes were down below 130m barrels in H1 this year according to data from the Department of Petroleum Resources (DPR). Source: Department of Petroleum Resources Hopes are that the newly signed Petroleum Industry Act will both lead to the development of undeveloped deep-water discoveries by IOCs while unlocking fresh capital into brownfield opportunities with local operators onshore and in shallow water. Hawilti’s research on M&A deals in the country’s hydrocarbons sector suggests investors are increasingly looking at brownfield investments in the region, at a time when several key local operators are looking at farm-in, technical and capital partners. Meanwhile, Angola also continues to suffer from under-investment in the past decade even though the outlook for its oil & gas sector is positive. Recent fields put into production such as Zinia 2 in May and Cuica in July have done very little to reverse production decline and the country had to revise its yearly production target down to 1,193,420 bpd this year. However, Angola had already met its oil revenue target for the year by the end of Q3, with Kz 4,200 bn already collected in the first nine months of the year against a yearly target of Kz 4,059.4 bn. The country’s short and medium-term outlook is also positive because IOCs have been extremely responsive to the bold policy moves of the Lourenço administration. Most majors operating in the country have already approved new projects, especially subsea tie-backs, infill drilling and marginal fields developments ventures. Those will be supporting production in the short-term, while three new FPSO-based production hubs are in the making by TotalEnergies, Eni and BP.

Read more »

Somoil targets 50% increase in production onshore Angola by 2024

Angolan junior Sociedade Petrolífera Angolana (SOMOIL) has contracted the FALCON 1000HP drilling rig for drilling activities at the FS and FST license onshore Angola. Operations will last about three years and will mostly focus on workover and wells repair along with the re-entry of existing wells and the drilling and completion of new wells. In order to increase production, SOMOIL is notably expected to target the Pinda reservoir and expects to reach an average daily output of 10,500 barrels of oil per day (bopd) within three years. In the first half of 2021, the FS-FST license exported 348,107 barrels (or a daily average of about 1,900 bopd), according to data from the Ministry of Finance. SOMOIL is also the operator of block 2/05, offshore, and participates in the contractor groups of blocks 3/05, 3/05th, 4/05 and 17/06.

Read more »

Maersk wins Mooring System contract on Kome-Kribi 1 FSO in Cameroon

Maersk Supply Service has just been awarded a contract by the Cameroon Oil Transportation Company (COTCO) for Phase 2 of the mooring system maintenance project on the Kome-Kribi 1 FSO (Kome-Kribi 1 Marine Terminal) offshore Douala. The marine terminal forms the last part of the 1,070km Chad-Cameroon Oil Export Pipeline that evacuates Chad’s oil to global markets. Under the project, Maersk Supply Service will replace two link arms on a yoke mooring system on the Kome-Kribi 1 Marine Termina. This notably follows Phase 1 of the project, during which Maersk Supply Service had already carried out the design, engineering, procurement and installation of a temporary redundancy system. The contract comprises of the full project management and engineering and the two-month offshore operations, which are scheduled to commence in Q4 2022. They will require an I-class Subsea Support Vessel (SSV) from the Maersk Supply Service fleet, as well as two Anchor Handling Tug Supply (AHTS) vessels, which will also be employed for station keeping of the FSO. Despite being under-utilised, the Chad-Cameroon Pipeline continues to generate revenue for the State of Cameroon with transit fees standing at FCFA 11.59bn ($21m) between January and April 2021. Details on the Chad-Cameroon Petroleum Development and Pipeline Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

BOURBON selected to support Shell’s exploration campaign in Africa

BOURBON has announced that it has been selected by Shell to provide fully integrated logistics solutions to support its upcoming deepwater offshore exploration campaigns in Namibia and Sao Tomé. Last month, Shell had selected the Valaris DS-10 drillship to drill in PEL 39 offshore Namibia and Block 6 in Sao Tomé. BOURBON’s package contract includes international freight forwarding, integrated logistics services and PSV (Platform Supply Vessel) services to support the drilling of both exploratory wells. The scope of work notably includes the international shipment and clearance of Shell’s and its subcontractors’ equipment from Houston to Walvis Bay; the management of the logistics base and associated services; and the provision of three Platform Supply Vessels: two PX105 and one P105. BOURBON will provide Integrated Logistics services through its local branch “Bourbon Logistics Namibia” with its strong and well-established local partner “Logistics Support Services” (LSS), the company explained in a statement this week.

Read more »