Energy

Malawi: Serengeti Energy completes phase 1 of Nkhotakota solar PV plant

Serengeti Energy has energized the 21 MWac Nkhotakota solar PV plant in Malawi last month, the company said last week. The energization of the facility was achieved on February 19 and paves the way to its commissioning and start of commercial operations. The project constitutes Phase 1 of the Nkhotakota solar PV plant which will ultimately reach a capacity of 38 MWac. Nkhotakota is one of many similar solar projects built in Malawi that also include JCM Power’s 60 MWac Salima and 20 MWac Golomoti facilities.

Read more »

Government of Tanzania completes negotiations with Equinor and Shell on Tanzania LNG

The Government of Tanzania has completed negotiations with Shell and Equinor, Minister of Energy January Makamba said yesterday. The completion of the negotiations enables the writing and signing of key contracts towards the $30bn Tanzania LNG project, including the Host Government Agreement (HGA). The project is expected to monetise 16 Tcf of gas discovered by Shell on Block 1 and Block 4, and 20 Tcf of gas discovered by Equinor on Block 2. Partners on the licenses include ExxonMobil, Ophir Energy, and Pavilion Energy. In June 2022, a Framework Agreement was signed between the Government of Tanzania signed, Equinor, and Shell to support negotiations. The HGA was then expected to be signed by the end of 2022 for a taking of the final investment decision (FID) in 2025. Equinor has scheduled a 3-year planning and engineering programme for the pre-FEED and FEED and expects construction to take at least 4 years after that. An independent macroeconomic study prepared last year by Stanbic Bank Tanzania and endorsed by the Ministry of Energy found that the $32.7bn, 15 million tonnes per annum (MTPA) terminal could generate fiscal proceeds of up to $6bn a year for Tanzania. Tanzania LNG is also expected to be a pathfinder in the development of sustainable LNG infrastructure in Africa with the partners reportedly exploring several low-carbon electrification options such as hydropower and solar, along with carbon capture utilization and storage (CCUS) technologies.

Read more »

Could 2023 be a record high for offshore drilling in Africa?

Despite a very tight offshore rig supply market, 2023 might set a new 10-year high for Africa’s offshore drilling market as several development, infill, and exploration campaigns get executed this year. According to the Offshore Rigs Tracker released this week by Hawilti and the Caverton Offshore Support Group (COSG) Plc, over 30 rigs are already confirmed to be active offshore sub-Saharan Africa this year, with more in the pipeline. Angola will continue to dominate the market like it has for a couple of years. The country has six floaters already contracted until at least 2024. Based on its pipeline of brownfield and greenfield projects, it will continue to drive deep-water drilling activity until at least 2026. All international oil companies (IOCs) have active rigs in the country, especially TotalEnergies (3), Azule Energy (2), Chevron (1), and ExxonMobil (1). They are actively pursuing infill drilling campaigns and subsea tie-back schemes on their producing FPSO units, while targeting infrastructure-led exploration opportunities. “We continue to witness an upsurge in drilling activity offshore West Africa despite the offshore rigs supply getting tight,” said Capt. Ibrahim Bello, Managing Director of Caverton Helicopters. “More drilling contracts are currently in negotiations across the region for both exploratory and development drilling, which could make 2023 one of the biggest years for offshore drilling activity on the continent since the crisis of 2014.” Nigeria’s offshore industry is also maintaining the momentum of drilling activity it saw in 2022 with at least five offshore rigs scheduled to be active in the country this year. Shell’s subsidiary SNEPCO and TotalEnergies both have floaters mobilized for most of the year on their respective deep-water blocks, OML 118 and OML 130. However, most of Nigeria’s demand is for jack-ups in shallow water, driven by key players such as Chevron, First E&P, General Hydrocarbons, and Damas E&P. After Angola and Nigeria, the Republic of Congo and Gabon are the next most active offshore drilling destinations in sub-Saharan Africa. Both countries are seeking to mitigate their production decline with additional infill drilling, development drilling, and exploratory drilling. Several campaigns are currently taking place there, including exploratory drilling by Eni in Congo and CNOOC in Gabon. Across the rest of the continent, significant development and exploratory drilling campaigns are also on the table this year, including in Senegal and Namibia. While the former is drilling to start producing oil and export LNG, the latter has all the industry’s attention as both Shell and TotalEnergies seek to confirm significant oil and gas discoveries made in the Orange Basin. The Offshore Rigs Tracker Q1 2023 can be downloaded for free here.

Read more »

Namibia: NAMCOR and QatarEnergy confirm new light oil discovery on PEL 39

The National Petroleum Corporation of Namibia (NAMCOR) has confirmed that the Jonker-1X well has discovered light oil within PEL 39 in the Orange Basin offshore Namibia. This is the third successful well in the license after the drilling of Graff-1 and La Rona-1 last year. PEL 39 comprises of Blocks 2913A and 2914B, operated by Shell along with partners Qatar Energy and NAMCOR. Shell resumed drilling with the Deepsea Bollsta in December 2022 and has the rig mobilized in Namibia until at least November 2023, Hawilti’s Offshore Rigs Tracker shows. “The Jonker-1X well was drilled to a total depth of 6,168 meters in a water depth of 2,210 meters. The acquired data is being evaluated while further appraisal is planned to determine the size and recoverable potential of the discovery,” QatarEnergy said. Shell is yet to make any official announcement on Jonker-1 or to confirm the estimated reserves it has discovered since 2022. Early industry estimates have assumed that Graff alone could hold 700 million barrels of recoverable oil and could be developed via a new FPSO and a possible FLNG solution.

Read more »

After Congo, Woodside Energy seeks to enter Namibian exploration license

Woodside Energy has entered into an exclusive Option Deed to enter into PEL 87 offshore Namibia, a deep-water block located north of recent discoveries made by TotalEnergies and Shell in the Orange Basin offshore Namibia. The License was awarded to Australian junior Pancontinental Energy in 2018. Since then, the company mapped a very large Saturn Turbidite Complex that may host several large internal hydrocarbon traps, some of which it has already mapped on 2D seismic. The deal reached with Woodside Energy provides for Woodside Energy to fund a $35m 3D seismic campaign over 5,000 km2 in addition to a cash payment of $1.5m to Pancontinental. In return, Woodside Energy has an exclusive option to become operator of PEL 87 with a 56% interest. Shall the company decide to exercise its farm-in option, it will drill the first exploration well and carry Pancontinental at 20% interest. Exploration activity is growing offshore Namibia where both Shell and TotalEnergies have rigs mobilized there for exploratory and appraisal drilling this year. Last October, Chevron entered PEL 90 just adjacent to PEL 87 and north of TotalEnergies’ Venus-1 discovery. The deal gives Woodside Energy the opportunity to grow its exploration portfolio in Africa after it entered Congo-Brazzaville in 2018. The operator is also in the process of commissioning the Sangomar Offshore Oil Project in Senegal with a projected peak production of 100,000 bopd.

Read more »

Angola: $7.8bn of contracts awarded for Agogo West Hub Project

Azule Energy has awarded several contracts worth some $7.8bn to international services companies for the development of its Agogo West Hub Integrated Project offshore Angola. The company is owned by bp and Eni. The project comprises 36 new wells producing via a 120,000 bopd FPSO vessel with a gas injection capacity of 230 MMscf/d and water injection capacity of 120,000 bpd. It will develop the Agogo and Ndungu fields, located on the West Hub of Block 15/06 where Eni already operates two FPSO units: N’Goma on the West Hub and Olombendo on the East Hub. The N’Goma FPSO will also be utilized to produce from both fields, enabling a production peak of 175,000 bpd by 2026. Agogo is significant for Angola as it marks the first major greenfield project awarded in the country since TotalEnergies’ Kaombo FPSO was commissioned on Block 32 in 2018. All market activity since then has focused on brownfield projects, including subsea tie-back schemes maximizing the use of existing FPSO units. As per the contracts signed this week, Yinson will be supplying the Agogo FPSO along with field operations & maintenance services, under a 15-year contract worth some $5.3bn. The contract includes an extension option of five years and represents Yinson’s first offshore production project in Angola. “FPSO Agogo is expected to commence operations in Q4 2025,” Yinson said in a statement. In December last year, Yinson awarded a $127m contract to WS Engineering & Fabrication, a subsidiary of Singapore’s Wah Seong Corporation, for the FPSO’s topside modules. Baker Hughes was awarded a contract to provide subsea equipment and services, including 23 standard subsea trees, 11 Aptara manifolds, StemStar5 fibre optic controls and the related system scope of supply. “A significant portion of the equipment will be manufactured, assembled and tested in Angola,” the company said in a statement. Subsea7 was awarded a contract worth between $300-500m covering the transport and installation of approximately 98 km of flexible pipes, 30 km of umbilicals, and associated subsea structures. Fabrication will take place locally at the Sonamet yard in Lobito. Aker Solutions was awarded a contract worth between $50-145m (NOK 500m-1bn) for the engineering, manufacturing and delivery of 36km of dynamic and static subsea production control umbilicals, including spares, ancillary equipment and services. Manufacturing will be done in Norway. Aker Solutions already delivered a similar order in the early 2010s for the N’Goma West Hub Development, data from the Hawilti+ Research Terminal shows. Finally, Saipem was awarded a contract for the supply, transport and installation of rigid flowlines and subsea structure; while TechnipFMC was selected for the engineering, procurement, and supply of jumpers, flowlines, risers, and all associated ancillary equipment under a contract worth $250-500m. Both companies are familiar with Block 15/06 and have already executed several contracts on the development of the West and East hubs with the FPSOs N’Goma and Olombendo, according to the contractors information on Block 15/06 provided by Hawilti+.

Read more »

Senegal: Ndar Energies to build a 250 MW gas-to-power plant in Saint Louis

On Wednesday, the African Export-Import Bank (Afreximbank) and Senegalese power company Ndar Energies S.A. signed a Framework Agreement for the development of a 250 MW combined cycle gas-to-power plant in Senegal. The agreement covers the financing, design, construction, and operation of the €430m facility that will be built in Saint Louis in northern Senegal, next to the border with Mauritania. Afreximbank will act as the Lead Project Developer and Mandated Lead Arranger. “The project, which possesses strong climate finance credentials, is in line with Afreximbank’s strategy to support the deployment of just energy transition solutions across Africa,” the bank said in a statement. Senegal is significantly expanding its gas-to-power capacity as domestic gas expects to become available in the coming years from offshore fields operated by bp. Earlier this month, President Macky Sall inaugurated the new 120 MW Malicounda power station which will ultimately run on gas and was co-developed by Africa50. Another 300 MW power plant has also been under construction in Cap des Biches in Dakar by West African Energy since March 2021.

Read more »

Shell signs new contract for Block C2 offshore Mauritania

Shell has signed an Exploration & Production Contract (CEP) with the Ministry of Petroleum, Mines and Energy of Mauritania for offshore Block C2. The block is located just south of C10, another license already operated by Shell E&P Mauritania since 2018, and east of C8 where bp has discovered the BirAllah and Orca gas fields. The signing of the new CEP with Shell was approved by Mauritania’s Cabinet last week. The Government also approved the signing of an amendment to Block C10.

Read more »

BREAKING: Côte d’Ivoire to award seven new oil & gas blocks to Murphy Oil and PETROCI

Last Wednesday, Côte d’Ivoire’s Cabinet approved the signing of production sharing contracts (PSCs) for blocks CI-102, CI-103, CI-502, CI-531, and CI-709 with MURPHY Exploration & Production; and of blocks CI-523 and CI-525 with its national oil company PETROCI. Hawilti reported last September that both the American independent and PETROCI had expressed interest for the blocks. Independent operator Perenco was also believed to be in negotiations to acquire blocks CI-523 and CI-525. Several of these licenses hold undeveloped oil & gas discoveries that could be brought on stream relatively quickly. Murphy Oil Corporation The new portfolio of Murphy E&P, a subsidiary of Texas-headquartered Murphy Oil Corp., is particularly attractive. Blocks CI-102, CI-531, CI-103 and CI-709 form a straight column that stretches from the shallow waters offshore Abidjan all the way to deep-offshore areas where several wells have been drilled. CI-103 notably holds the Paon deep-water gas and light oil field discovered by Tullow Oil in 2012 and already appraised. In 2019, independent operator EnQuest had entered negotiations to acquire the block without reaching an agreement. Just north of Paon, Tullow Oil had also drilled the Calao-1X well in 2013, within current block CI-531. The independent had found good quality reservoir sandstone, although they were water bearing. CI-709 finally holds development potential thanks to wells previously drilled by Anadarko Petroleum in 2016 and 2017, although commercial quantities are yet to be proven. These include Pelican-1X that intersected around 21.3m of net oil pay in two separate interval, Rossignol-1X that encountered well-developed sands and roughly 4.6 m of net oil pay on water, and finally Colibri-1X that also hit hydrocarbon pay. PETROCI goes for gas On its side, PETROCI will acquire blocks CI-523 and CI-525 that hold the Ibex, Gnou, Kudu, and Eland gas fields. Both blocks are in shallow water next to the maritime border with Ghana and had previously been awarded to Taleveras and Afren and eventually to Vitol before the trader relinquished them in 2020. Interest for exploration in Côte d’Ivoire has been soaring since Italian major Eni announced a discovery at its Baleine-1X well in 2021. The discovery was appraised by the Baleine East-1X well in 2022, confirming some 2.5 bn barrels of oil and 3.3 Tcf of gas across blocks CI-101 and CI-802. In December last year, Tullow Oil had expanded its presence in the Tano Basin with the signing of a PSC for offshore exploration licence CI-803, which is adjacent to its CI-524 block where a well could be drilled in 2024. Significant prospectivity has been identified within the proven Cretaceous turbidite plays there, similar to the plays which are producing in the TEN and Jubilee Fields across the maritime border with Ghana.

Read more »

Equatorial Guinea awards three exploration blocks to international independents

Equatorial Guinea has awarded offshore exploration blocks to Panoro Energy and Africa Oil Corp. as it seeks to unlock additional reserves and reverse production decline. Earlier this month, the country appointed the former head of its national oil company, Antonio Oburu Ondo, to replace Gabriel Obiang Lima as Minister of Mines and Hydrocarbons. Infrastructure-led exploration Amongst the newly awarded blocks are Block EG-01 and Block EG-31 that are located next to producing and processing infrastructure. The shallow water Block EG-01 has been awarded to Panoro Energy (operator, 56%) with partners Kosmos Energy (24%) and national oil company GEPetrol (20%). The block is located next to the Ceiba and Okume fields, two fields operated by Trident Energy via the 160,000 bpd Sendje Ceiba FPSO. Output currently stands at some 30,000 bpd. Panoro Energy and Kosmos Energy are already partners of Trident Energy on the Ceiba and Okume complex and hold interest in the exploration Block S where a well is planned for 2024. “The partners have been awarded block EG-01 for an initial period of three years during which they will conduct subsurface studies based on existing seismic data to further define and evaluate the prospectivity of the block. Following this, the partners will have the option to enter into a further two-year period, during which they will undertake to drill one exploration well,” Panoro Energy said in a statement. On the other side, Africa Oil Corp. has been awarded shallow water Block EG-31 as operator with an 80% interest while GEPetrol holds the remaining 20%. The block is located next to the Marathon Oil Corp-operated Alba gas field and the onshore Punta Europa gas hub that houses the EG LNG export terminal. “Potential future discoveries could present low-cost, low-risk gas development opportunities targeting international LNG markets,” Africa Oil Corp. said in a statement. Rio Muni exploration Finally, Africa Oil Corp. has been awarded Block EG-18, which it had already secured during EG Ronda 2019. The award marks an evolution of the company’s acquisition strategy which had so far focused mostly on cash flowing producing assets. “In Block EG-18 the Company has identified a potentially large and highly prospective basin floor fan prospect of Cretaceous age, that is similar to those within the Company’s exploration portfolio in Namibia and South Africa,” Africa Oil Corp. added. All PSCs for the blocks are yet to be ratified by the Government and there minimum work programmes do not include drilling commitments. However, their awards to reputable E&P investors send strong signals on the appetite for upstream activity in the Gulf of Guinea.

Read more »

Hawilti launches “Gas for Africa” report with the International Gas Union (IGU), AU-AFREC, and AFC

Hawilti released an important new study on Gas for Africa in partnership with the International Gas Union (IGU), assessing the potential for domestic gas resources to energise Africa in line with the global energy transition. The African Energy Commission (AU-AFREC) and the Africa Finance Corporation endorse the report and its findings. The study starts by analysing current energy poverty trends in Africa, a continent with the lowest electricity per capita consumption in the world and the lowest CO2 per capita emissions. It argues for a pragmatic use of natural gas reserves to support a broad industrial and economic development of Africa in a way that is sustainable and enables a just energy transition. Mickael Vogel, Director & Head of Research, Hawilti “Energy poverty in Africa often boils down to the number of people without access to electricity – 600 million, or without access to clean cooking – 970 million. Unfortunately, this assessment misses the point and can lead to responses and solutions that are ill-adapted to Africa’s development needs. As it argues for a better use of gas, the report calls for more ambitious targets around energy access so that we can both bridge Africa’s energy deficit but also support economic growth and industrialisation.” The ”Gas for Africa” report highlights several ways in which gas can have a positive impact on Africa’s socio-economic development including by switching away from coal and diesel, developing energy-intensive industries and gas-based industrialisation, displacing fuelwood and biomass in households, generating baseload electricity to integrate intermittent energies, and building gas systems that can be decarbonisable in the future with hydrogen, renewable gas, and CCUS. However, a pragmatic utilisation of Africa’s 18 Tcm of proven gas reserves – or 9% of the world’s reserves – calls for a reorientation towards domestic monetisation. Most of the gas produced in sub-Saharan Africa remains exported, with local consumption still limited because of limited infrastructure availability. Additional barriers include limited access to capital, security risks, and policy uncertaint.y To overcome these key barriers to development, a total of eight guiding principles are given as recommendations to help stakeholders and policy makers navigate the complexity of the gas industry: The full report is available for download here.

Read more »

Senegal: inauguration of the new 120 MW Malicounda power plant

President Macky Sall has inaugurated the new 120 MW Malicounda power plant on February 11th. The project is the result of a development agreement signed in 2017 between Africa50 and state utility Senelec to select a strategic sponsor to develop the facility under a Build, Own, Operate and Transfer model (BOOT). Independent power producer (IPP) Melec Power Gen, part of the Lebanese Matelec Group, was eventually selected, making Malicounda its third power station in the country following the 67.5 MW Kounoune station commissioned in 2008 and the 115 MW Tobene station commissioned in 2016. Malicounda was developed a cost of €154m and has increased Senegal’s generation capacity by 8%. Its construction started a few years ago after the setting up of a €75m (FCFA 50bn) bridge loan with the Orabank Group and a few regional partners. The senior debt was ultimately provided by the African Development Bank (AfDB), acting as the mandated lead arranger, the Arab Bank for Economic Development in Africa (BADEA), the West African Development Bank (BOAD) and the OPEC Fund for International Development (OFID). The power plant will initially consume diesel and HFO but has been designed to switch to natural gas as soon as gas becomes available from Senegal’s domestic offshore fields

Read more »

“At the helm of a new golden block”: TotalEnergies to spend $300m on Namibian exploration

TotalEnergies has decided to mobilise almost 50% of its global exploration budget to Namibia this year as it hopes to confirm a multi-billion barrels discovery on block 2913b within the Orange Basin. CEO Patrick Pouyanné made the announcement during the company’s 2022 Results & 2023 Objectives presentation this week. The French major will spend $300m on appraising its Venus discovery in the Orange Basin with the mobilization of two drilling rigs and the drilling of several wells. Hawilti’s Offshore Rigs Tracker shows that the Tungsten Explorer is finally on its way to Namibia where it is expected to start drilling this quarter. The drillship will start with the Venus-1A appraisal well before moving to drill new exploration wells into the adjacent Block 2912, also operated by TotalEnergies. Drilling on that second block will target the Nara-1 well and a potential Nara-1A appraisal well, which will both include drill stem tests (DSTs). The second rig, Deepsea Mira, is not expected before the middle of this year and will be mobilized for DSTs operations both at Venus-1A and Venus-1. “We want to accelerate the time to market (…) if we confirm the volumes discovered, there is room for a fast-track development,” Pouyanné added, explaining that the company could be at the helm of a new golden block that would be “a new chapter of the old business”. TotalEnergies hopes to replicate the tremendous success it has had on Block 17 offshore Angola, where it was able to start producing only five years after its initial discovery there. Block 17 is referred to as its “Golden Block” with a total of four floating, production, storage, and offloading (FPSO) vessels commissioned between 2001 and 2014.

Read more »

Ghana embarks on the expansion of its gas processing infrastructure

The Ghana National Gas Company (GNGC) has signed last week a project agreement for the construction of a second gas processing plant of 150 MMscf/d at Atuabo in Western Ghana. Train 2 will double gas processing capacity at Atuabo, where a first train of 150 MMscf/d was commissioned in 2015. Expansion plans have been on the table for a few years, with FEED studies completed for the second train in 2021. The initial capacity has been set at 150 MMscf/d, expandable to 350 MMscf/d in the future. The development of gas processing plants at Atuabo is part of Ghana’s Western Corridor Gas Infrastructure that transports gas produced offshore, processes it and sells it on the domestic market. The initial phase of the project cost some $1bn and was funded by China. It comprised a 58km offshore gas export pipeline from the Jubilee FPSO to the Atuabo gas plant, the construction of the first train at Atuabo, a 110km onshore pipeline transporting sales gas to the Volta River Authority’s power plant at Aboadze in Takoradi, and an LPG truck-loading gantry. The commissioning of the network in 2015 enabled TullowOil to monetise its associated gas from its Jubilee and TEN fields, thereby reducing flaring. The operator has committed to eliminate routine flaring in Ghana by 2025 while monetizing some 2 Tcf of gas reserves to meet the country’s growing gas demand. As a result, additional gas processing capacity is needed to process incremental raw gas volumes that will come from both the Jubilee and TEN fields. Details on Ghana’s gas infrastructure and the contractors involved in the expansion of the Atuabo GPP are available within your Hawilti+ research terminal – plus.hawilti.com

Read more »

Eni Congo selects Expro for onshore LNG pre-treatment facility

Expro has announced this week the signing of a 10-year Production Solutions contract with Eni Congo for an 80 MMscf/d LNG pre-treatment facility in Congo-Brazzaville. Under the agreement, Expro will design, construct, operate and maintain a fast-track the facility as part of Eni Congo’s Marine XII gas development plans that include the deployment of two floating LNG units in 2023 and 2025. Expro’s facility will be built near the Litchendjili gas plant to enable LNG production, under a 10-year contract that should generate some $300m for Expro. “The facility will link to Eni Congo’s offshore floating LNG (FLNG) operations, supporting both the local energy market and increased global demands for LNG to support secure energy supplies,” Expro said in a statement.

Read more »

UAE to inject $2bn into solar projects in Zambia

Zambia and the United Arab Emirates have signed a Memorandum of Understanding (MoU) during the Abu Dhabi Sustainability Week towards the development of 2 GW of solar energy in the Southern African state. The MoU provides for the establishment of a joint-venture between the UAE’s state-owned entity Masdar and Zambia’s state-utility ZESCO. The project seeks to diversify Zambia’s energy mix after repeated droughts have severely curtailed the country’s production of hydropower. The new joint-venture will target the installation of 2 GW of solar PV power, starting with an initial phase of 500 MW. The Government of Zambia has been committed to solar energy for several years and joined the International Finance Corporation’s Scaling Solar Initiative in 2015. The competitive auction has already resulted in the commissioning of two solar PV plants in 2019: Enel Green Power’s 34 MW Ngonya facility and Neoen’s 54.3 MW Bangweulu facility.

Read more »

South Africa: PetroSA seeks partner to reinstate full production at Mossel Bay GTL Refinery

South Africa’s PetroSA has issued a Request for Proposal (RFP) to secure a partner for the development, refurbishment, modification, upgrade, funding and/or operation of its gas-to-liquids (GTL) refinery at Mossel Bay. “PetroSA is planning to reinstate to full production level its Mossel Bay Production Assets which includes the FA Platform and GTL-Refinery (Gas Loop and Liquids Refinery) in the earliest possible time at least costs following suspension of production in 2020 due to feedstock challenges,” the company said in its RFP document consulted by Hawilti. While the 36,000 bpd refinery has not been able to produce since 2020, its outlook changed when TotalEnergies made significant gas and condensate discoveries at Brulpadda and Luiperd in 2019 and 2020, within its deep-water Block 11B/12B. Both discoveries have the potential to supply gas to the domestic market and provide the feedstock required to restart operations at PetroSA’s GTL refinery and reach full production capacity by 2027/2028. TotalEnergies and its partners are already working on an early production scheme (EPS) that would provide first gas and condensate production from the Luiperd discovery. The project would likely utilize PetroSA’s nearby infrastructure, including the FA Platform, in order to supply gas to customers in Mossel Bay. Interested parties for the development and upgrade of the Mossel Bay GTL Refinery have until February 20th to submit their applications for a turnkey solution from design to commissioning, including funding and feedstock security. PetroSA has notably expressed its interest to link the success of the projects to financial incentives, including sharing in production revenues, performance-based contracting, or equity participation.

Read more »

TotalEnergies to start Nigeria deep-water drilling campaign in February 2023

TotalEnergies is expected to start its much-anticipated infill drilling campaign offshore Nigeria in February 2023, its partner Africa Oil Corp. has said. The major has been planning a new drilling campaign on its flagship deepwater block OML 130 for some time, with an initial start scheduled for Q3 2022. The campaign will focus on infill drilling and could target up to 9 wells, including 2 exploration/appraisal ones. Exploratory drilling could notably focus on the Egina Ridge and Egina South prospects. “The rig contracted to drill the Egina infill wells is expected to commence operations in February 2023, after obtaining its final regulatory approval,” Africa Oil Corp. said in a production and operational update released today. The company is a 50% shareholder in Prime Oil & Gas, which itself holds a 16% interest in OML 130. While the rig selected is yet to be announced, Hawilti’s Offshore Drilling Tracker shows that Noble Corp.’s Gerry de Souza drillship is a likely candidate. The rig completed a drilling campaign for TotalEnergies offshore Suriname in December 2022 and arrived in West Africa at the end of last year, data from Marine Traffic shows.

Read more »

Wison starts construction of new FLNG project for Eni in Congo

Wison Offshore & Marine held yesterday its 1st Cutting Ceremony for a new floating LNG unit it is constructing for Eni in the Republic of Congo. The ceremony took place at the Nantong yard, where Wison (Nantong) Heavy Industry Co., Ltd. will be constructing the 2.4 mtpa unit. The project is expected to be commissioned in 2025 on Eni’s shallow water Marine XII Block offshore Congo-Brazzaville. It is part of Eni’s phased gas valorisation plan to develop and monetise the gas reserves on the license. Phase 1 relies on the 0.6 mtpa Tango FLNG which Eni acquired from Exmar in 2022 and where first production is expected in H2 2023 to monetise available gas from the Litchendjili et Néné-Banga fields. Once both projects are commissioned, the block will have an LNG export capacity of 3 mtpa, or 4.5 Bcm/year.

Read more »

AMEA Power on an exponential growth trajectory in Africa

AMEA Power, a Dubai-based developer, owner and operator of green energy projects, has developed a strong appetite for Africa over recent years. The company already built West Africa’s biggest solar plant, a 50 MW PV facility in Blitta, Togo. Its commissioned and under-construction solar projects total some 130 MW, spread between Morocco, Burkina Faso, Togo, and Uganda. The company has now embarked on a significant scaling up of its renewable energy capacity on the continent via new solar, wind, and hydrogen projects. Its has a pipeline of over 1 GW of solar PV projects in various stages of development in Morocco, Tunisia, Egypt, Mali, Chad, Gabon, Angola, and Djibouti. In November 2022, it also signed an MoU for a new 50 MW facility in Malawi, and announced in January 2023 the signing of a concession agreement and 25-year power purchase agreement (PPA) for a new 50 MW solar PV project in Côte d’Ivoire. Its African portfolio is also on the verge of diversification, with wind projects of some 950 MW in total being developed in Morocco, Egypt, Ethiopia, and Kenya. Last but not least, AMEA Power intends to leverage on Africa’s significant renewable energy potential to produce green hydrogen. It has currently selected Morocco, Egypt, Ethiopia, and Angola for up to 3.5 GW of green hydrogen projects that could be approved over the coming years.

Read more »

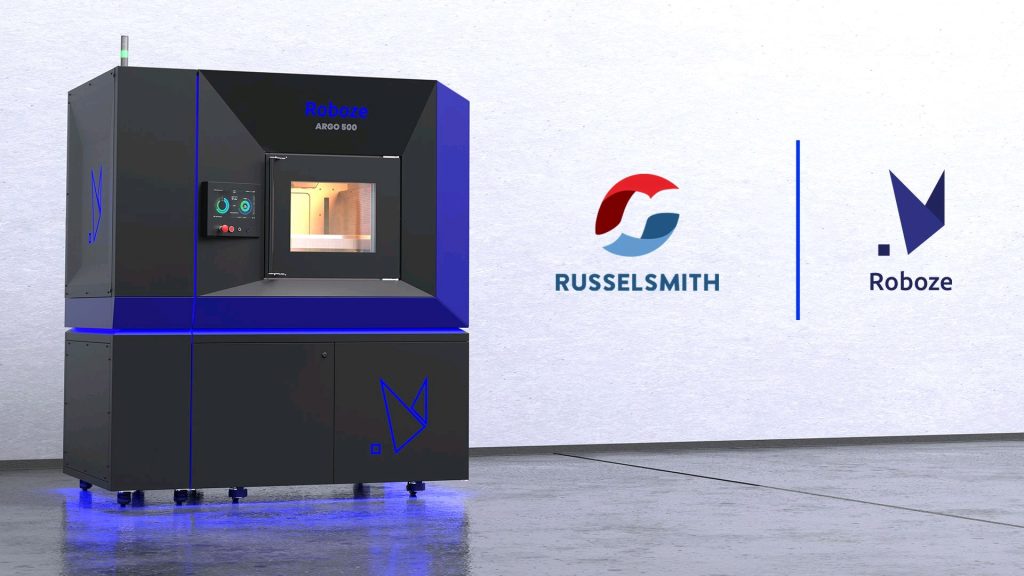

Nigeria’s RusselSmith on track to create West Africa’s first Smart Manufacturing Solutions Center

RusselSmith, one of Nigeria’s leading oil & gas maintenance and inspection solutions companies, has joined the Roboze 3D Parts Network. The Nigerian services company is now part of a network of specialized additive manufactured centres that use Roboze ARGO Production technology and are able to deliver on complex designs and difficult engineering challenges. “We are excited to introduce industrial 3D printing to the Nigerian market by joining the Roboze 3D Parts Network. This innovative just-in-time manufacturing solution allows our customers to replicate and replace hard-to-obtain OEM parts locally in a fraction of the time that it takes to source and ship them, thereby reducing costs, improving uptime and optimising their supply chain,” said Kayode Adeleke, CEO of RusselSmith. By joining the Roboze 3D Parts Network, RusselSmith wants to bring industrial 3D printing in Nigeria and set up the foundation for a digital supply chain in West Africa. The company has always been at the forefront of innovation in the Nigerian oil & gas industry, first introducing rope access technology to the market several years ago and following it up with other innovative solutions, especially in subsea services. In cooperation with Kongsberg Ferrotech of Norway, RusselSmith is already offering a unique underwater robotic pipeline repair technology that is now approved and certified by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

Read more »

Industry Catch-up: What You Might Have Missed

The oil & gas sector knows no break and has had its fair share of developments over the past two weeks. Here is what you need to know as you get back to the office. Mozambique has announced the results of its 6th Licensing Round On December 21st, Mozambique revealed the results of its 6th Licensing Round, which resulted in the award of only six blocks out of the 16 license areas that were proposed. The China National Offshore Oil Corporation (CNOOC) secured five blocks over the Save and Angoche Basins and Eni Mozambique securing one license in the Angoche Basin. None of the areas within the Zambeze Basin were awarded. “The Exploration programs proposed for the first sub-period of the Exploration Period have the potential to allow investments amounting to approximately $369.8m, foreseeing the acquisition of 31,200 Km2 of 3D seismic, opening of a minimum of four wells in deep water, and other geoscientific studies,” the National Institute of Petroleum (INP) said in a statement. Nigeria has launched a Mini Bid Round for deep-water blocks On December 21st, Nigeria announced its Mini Bid Round 2022 and put seven deep-water blocks on offer covering some 6,700 km2. A pre-bid conference is scheduled for January 16th while pre-qualification applications mut be submitted by January 31st. Under the new PIA regime, the blocks on offer are PPL-300-DO (former OPL 312); PPL-301-DO (former OPL 313); PPL-302-DO (former OPL 314); PPL-303-DO, PPL-304-DO, and PPL-305-DO (the three used to form IPL 318); and PPL-306-DO (former OPL 327). This Mini Bid Round will be a test for Nigeria’s attractiveness and competitiveness after a full overhaul of its oil & gas regulatory regime with the adoption of the PIA in 2021. Eni has selected a provider for its second FLNG unit in Congo-Brazzaville On December 22nd, Eni announced the signing of a contract with Wison Heavy Industry of China for the construction and installation of a 2.4 mtpa floating LNG unit in the Republic of Congo, offshore Pointe Noire. The unit will be the second FLNG facility of Eni in Congo since the company expects to commission this year the 0.6 mtpa Tango FLNG vessel it acquired from Exmar a few months ago. Both units will be monetizing associated gas from the Marine XII permit. Total Gabon expanded its upstream portfolio in Central Africa On December 26th, TotalEnergies EP Gabon extended its presence in Gabon with the signing of a new Exploitation & Production Sharing Contract (EPSC) over the Baudroie-Merou-Marine G5-143 permit. The 25-year agreement will run until 2047. “We remain fully committed as an energy producer in Gabon. We will maintain our investments to reduce greenhouse gas emissions by valorising associated gas and will continue to implement actions to maintain our production,” said Henri-Max Ndong-Nzue, President of TotalEnergies EP Gabon. Invictus Energy has finished drilling its first wildcat onshore Zimbabwe On January 3rd, Invictus Energy confirmed that technical and operational issues prevented a discovery at its Mukuyu-1 wildcat well onshore Zimbabwe. However, multiple potential gas bearing reservoir units were encountered and the well did prove the existence of a working hydrocarbons system. The Rig 202 is currently warm stacked on site for maintenance and upgrades and will recommence drilling operations later this year. Invictus Energy is considering an appraisal well (Mukuyu-2) or the drilling of Baobab-1. As a result, the contract with EXALO Drilling for the rig has been extended by another 12 months.

Read more »

Azule Energy continues to make progress on new Agogo hub in Angola

Azule Energy has signed an Agreement for Preliminary Activities (APA) with Yinson Azalea Production Pte Ltd to commence all preliminary activities for the provision, operation and maintenance of a FPSO asset for the Agogo Integrated West Hub Development Project offshore Angola. Agogo will be the third FPSO on Block 15/06, operated by Eni Angola (now part of Azule Energy). The field was discovered in 2019 as part of Eni Angola’s very successful infrastructure-led exploration strategy in the country. Tenders were issued by Eni in July 2021 for a project targeting a peak production of 120,000 bopd. Yinson is in charge of providing the FPSO, whose hull will be converted at the Huarun Dadong Dockyard in China. Full details on the development of Block 15/06 are available in the “Projects” section within your Hawilti+ research terminal.

Read more »