Energy

Coral-Sul FLNG ready to sail away to Mozambique’s Rovuma basin

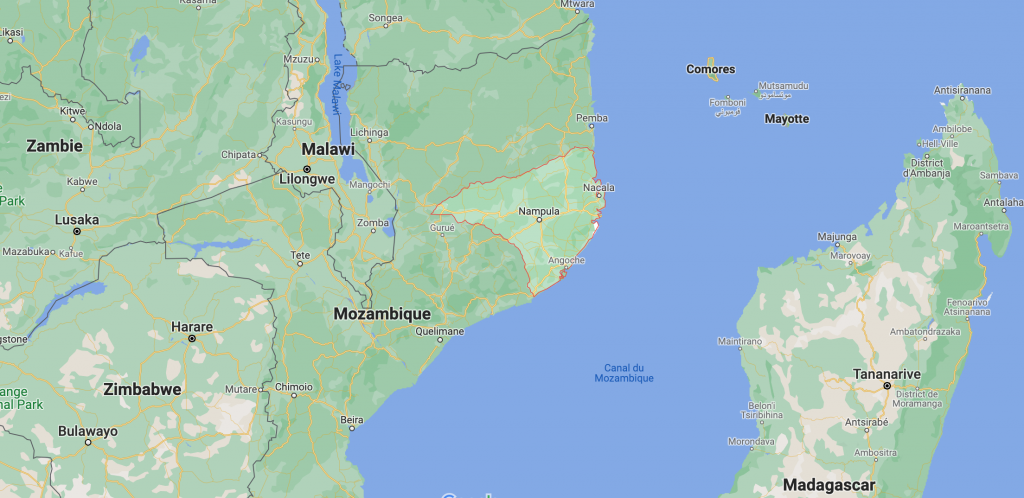

Earlier today, Eni held the naming and sail away ceremony of the Coral-Sul floating LNG (FLNG) vessel in South Korea. The event took place at the Samsung Heavy Industries shipyard in Geoje, in the presence of H.E. Filipe Jacinto Nyusi, President of the Republic of Mozambique, and H.E. Moon Jae-in, President of the Republic of Korea. The 3.4 million tonnes per annum (mtpa) FLNG forms part of the Coral South Projec and will be towed and moored at its operating site in the Rovuma basin offshore Mozambique next year. Once the FLNG facility will be in place, the installation campaign will begin, including mooring and hook-up operations at a water-depth of around 2,000 meters by means of 20 mooring lines that totally weight 9,000 tons. Production startup is then expected in the second half of 2022. Coral South Project achieved Final Investment Decision in 2017, only 36 months after the last appraisal well. FLNG fabrication and construction activities started in 2018 and were completed on cost and on time, despite the Covid-19 pandemic. The Coral Sul FLNG is 432 meters long and 66 meters wide, weighs around 220,000 tons and has the capacity to accommodate up to 350 people in its eight-story Living Quarter module. Area 4 is operated by Mozambique Rovuma Venture S.p.A. (MRV), an incorporated joint venture owned by Eni, ExxonMobil and CNPC, which holds a 70% interest in the Area 4 exploration and production concession contract. In addition to MRV, Galp, KOGAS and Empresa Nacional de Hidrocarbonetos E.P. each hold a 10% interest in Area 4. Eni is the offshore Delegated Operator and is leading the construction and operation of the floating liquefied natural gas facility on behalf of MRV.

Read more »

FAR has spudded the Bambo-1 exploratory well offshore The Gambia – What’s next?

FAR has successfully spudded the Bambo-1 exploratory well on Block A2 offshore The Gambia. The drilling campaign will take about one month and drill the well to a depth of about 3,400 metres. Bambo-1 will drill into a series of vertically staked targets with a combined estimated recoverable prospective resource of over 1 billion barrels with chance of geological success ranging from 7% to 36%. This will be FAR’s second exploratory well on the block after it drilled the Samo-1 well in 2018. Its main targeted horizons had then proved water bearing. While FAR now targets the Bambo, Soloo and Soloo Deep prospects, the Bambo one is believed to be the most prospective of the three of over 500m barrels of estimated recoverable prospective resource. Equally important, the well located is just south of Senegal’s Sangomar oil field where Woodside Energy expects to achieve first oil in 2023. FAR was previously part of the Sangomar joint-venture before it had to exit the license last year. The operator is very familiar with the environment offshore Senegal and The Gambia and expects to prove the southern extension of the Sangomar oilfield. FAR already drilled the Samo-1 well on Block A2 back in 2018 but its main targeted horizons proved water bearing. A new exploration plan was put on the table in 2019 when both blocks benefited from new licenses, still operated by FAR (50%) along with PETRONAS’ subsidiary PC Gambia (50%). Likely Development Scenario In case of a discovery, FAR has indicated that 90m barrels would be the set minimum economic field size. Its success case planning actually relies on a development of 150m barrels of oil via a 48,000 barrels of oil per day (bopd) floating, production, storage and offloading (FPSO) vessel. Three wells would then support production, gas and water injection operations. Map: FAR Ltd Details on the A2 & A5 Blocks Exploration offshore The Gambia are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

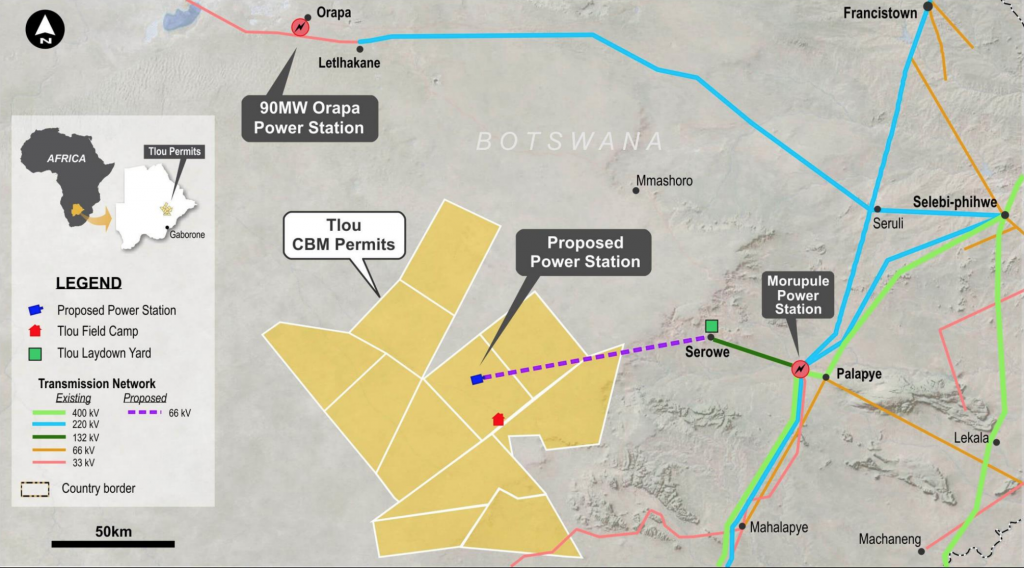

Tlou Energy to start producing green hydrogen in Botswana from 2022

While Tlou Energy continues to progress on its gas-to-power project north of Botswana’s capital Gaborone, it is now expecting to produce hydrogen and solid carbon products even before electricity. The company has been working on developing Botswana’s coal-bed methane (CBM) reserves to generate electricity since its incorporation in 2009. It is notably focusing on the development of the Lesedi project, consisting in a 10 MW gas-to-power plant and a 100km transmission line from Lesedi to Serowe. The power purchase agreement (PPA) was signed with the Botswana Power Corporation just a few weeks ago. But beyond just monetizing CBM, Tlou Energy has been working on adding solar generation capacity on site to combine large natural gas reserves with solar energy and produce green hydrogen. To execute this vision, Tlou Energy signed in August 2021 a Heads of Agreement (HOA) with Synergen Met, an Australian hydrogen developer and plasma technology company. The project is now moving full steam ahead and the prototype hydrogen production unit is currently being designed, built and tested in Brisbane before its transportation to Botswana in H1 2022, Tlou Energy said today. The use of plasma technology for hydrogen production will be a first for sub-Saharan Africa and open up additional doors for the continent to decarbonize its energy mix. Along with South Africa, Botswana is a country who continues to predominantly relies on coal to generate power for its industries and households. “Tlou Energy and Synergen Met intend to use the hydrogen produced from the prototype to generate electricity and possibly for transport fuel, initially in Tlou’s own vehicles. Solid carbon will be made available for regional consumers that require the product,” Tlou revealed today. Details on the Lesedi CBM Gas-to-Power Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Nigeria’s leading beverages manufacturer goes full on solar

Seven-Up Bottling Company, Nigeria’s manufacturer of soft drinks such as Pepsi, Mirinda, Seven Up, H2oh!, and Mountain Dew, has decided to switch to solar as a primary day-time source of energy over all its Nigerian factories. The company has signed a deal with Daystar Power to install 10.5 MW of solar power systems for five more factories in the country. Earlier this year, both companies already partnered for the design, operations and management of almost 1.5 MW of solar power systems over SBC’s bottling plants in Kaduna and Kano. The five additional factories will comprise those of Abuja, Lagos (Ikeja), Ibadan and Ilorin, all expected to be powered by solar over the next six months. By 2022, SBC will be Nigeria’s largest industrial manufacturer to use solar energy in its operations. Both companies have also announced being in discussions to roll out solar energy as the primary daytime power source for SBC’s remaining two sites in Nigeria. According to Daystar Power, the solar power systems at the factories could provide over 50% of its total daytime power consumption depending on the installation size and amount of sunshine.

Read more »

HYPHEN wins Namibia’s $9.4 bn green hydrogen project

The Government of Namibia has issued last week a notice of award to HYPHEN Hydrogen Energy, the joint-venture of Nicholas Holdings Limited and ENERTRAG South Africa (Pty) Ltd, for the development of a $9.4bn hydrogen project. It seeks to establish Namibia’s first large-scale vertically integrated green hydrogen project in the Tsau/Khaeb national park to produce 300,000 tonnes per year of hydrogen for regional and global markets, either in pure form or derivative such as green ammonia. HYPHEN’s winning bid ensures the company has the right to construct and operate the project for 40 years. Phase 1 is expected to start producing by 2026 at a cost of $4.4bn. It will include the installation of 2 GW of renewable energy generation capacity to produce green hydrogen for conversion into green ammonia The second half of the decade should see subsequent phases be developed to increase renewable energy capacity to 5 GW and commission 3 GW of electrolyser capacity. The project could create as many as 15,000 direct jobs during the four-year construction of both phases, with a further 3,000 jobs created during the operational phase, according to HYPHEN.

Read more »

South Africa issues Request for Information on new Coega LNG import hub

South Africa’s state-owned Central Energy Fund (CEF) has issued a request for information (Rfi) for the development of an independently managed midstream LNG hub in Coega, within South Africa’s Eastern Cape Province. The project is developed under a joint-development agreement (JDA) signed between three South African state-owned entities: the CEF, Transnet SOC and the Coega Development Corporation. It was first announced during the 2019 Energy Budget vote speech and forms part of South Africa’s vision to integrate gas within its energy mix and support its transition away from coal. The RfI issued last Friday covers three distinct components: a gas aggregator that would consolidate gas demand through gas purchase agreements, an EPC contractor for the construction of fixed gas infrastructure from the Ngqura Port to the gas off-takers, and the provision of a floating, storage and regasification unit (FSRU). The CEF has requested all interested parties to submit their response by December 3rd and remains opened to receiving bundled replies integrating one or more components together. It is expected that the RfI would be followed by a procurement process. Where is the Gas Demand? Coega was selected as the initial hub to materialize South Africa’s gas ambitions because of the existence of off-take infrastructure and demand centers in its surroundings, including the Coega Special Economic Zone (SEZ). Potential off-takers notably include the 340 MW Dedisa PPP that currently operates at a 12% capacity factor but could be reviewed shall gas become available. It is also around Coega where Mulilo and TotalEnergies are developing a 200 MW mid-merit plant and where Karpowership is expected to deploy a 450 MW floating power plant to be fed with gas. An additional 1,000 MW power plant is confirmed there as part of South Africa’s Integrated Resources Plan (IRP), with procurement expected to start soon. Finally, existing and future industrial users are expected to represent a gas demand of 5 PJ per annum. Offshore bunkering operations at Coega required 1 million tonnes of heavy fuel oil pre-COVID and could switch to natural gas.

Read more »

Western nations announce multi-billion dollar partnership to phase out South African coal

During the COP26 Climate Summit in Glasgow this week, the United States, Britain, France, Germany and the European Union have committed $8.5bn (£6.2bn) to help end South Africa’s reliance on coal. South Africa has become an undisputed renewable energy leader in Africa, but continues to heavily depend on burning coal to generate electricity. Coal still represents about 90% of the country’s energy mix, the highest share amongst G20 nations. Dubbed the “Just Energy Transition Partnership”, the initiative is expected to prevent up to 1.5 gigatonnes of emissions over the next 20 years. In a joint statement, the parties declared that the partnership would initially mobilise several financing mechanisms over a five-year period. These would include grants, concessional loans and investments and risk sharing instruments, including private sector funding. France has notably set its contribution at $1 bn. On its side, Germany mentioned a support for green hydrogen with a contribution of $700m from its development aid funds.

Read more »

InfraCo Africa and Helios are establishing a new $350m climate-focused investment vehicle for Africa

InfraCo Africa, part of the Private Infrastructure Development Group (PIDG) and Helios Investment Partners (Helios) have announced that they are working together to establish a pan-African investment vehicle: Climate, Energy Access and Resilience (CLEAR). The initiative was announced as part of a UK government event hosted in Glasgow on Finance Day of the UN’s COP26 Summit. CLEAR will work towards the achievement of the UN Sustainable Development Goals (SDGs) by funding climate-aligned infrastructure and growth businesses on the continent. In doing so, it will also address the growing demand from domestic and international investors for sustainable investment opportunities that can help to close the infrastructure and productivity gap in Africa. The new pan-African investment vehicle will notably leverage a robust pipeline of projects and growth businesses from both InfraCo Africa and Helios across three core themes: clean energy and the energy transition, green transportation and mobility, and sustainable growth and consumption. CLEAR expects to ultimately raise more than $350m for investment into sustainable infrastructure and businesses which will provide at least 100,000 new jobs, connect more than 1 million people to power for the first time and avoid 100m tonnes of carbon emissions. InfraCo and Helios anticipate that CLEAR will initially be established as a private vehicle but designed and capitalised with a view to listing the vehicle within 3 years of final close.

Read more »

GL Africa Energy signs agreement for a new 250 MW LNG-to-power plant in Mozambique

Janus Continental Group’s subsidiary Great Lakes Africa Energy (GL Africa Energy) has signed yesterday a Concession Agreement with Mozambique’s Energy Minister to finance, build and operate a 250 MW LNG-to-power plant in the country’s Nampula province. “The deal signals the start of a three-part phased investment. Initial phase will create 50MW capacity within 16 months. The second and third phases will add 200MW in total and will be completed within 24 months,” GL Africa Energy said in a statement shared with Hawilti. This will be GL Africa Energy’s biggest investment to date, developed under a 30-year public-private partnership with state-utility Electricidade de Moçambique (EDM) as the off-taker. Electricity generated will then supply the entire Nacala corridor in Northern Mozambique. The $400m project has been in preparations for a while and was already subject to the signing of a Memorandum of Understanding (Mou) between both parties in May 2018. This had notably followed the result of Mozambique’s Rovuma Basin domestic gas tender, the results of which were announced in January 2017. The facility will be supplied from gas coming from Mozambique’s Rovuma Basin, where Eni’s 3.4 million tonnes per annum (mtpa) Coral South FLNG is expecting to achieve first gas next year. This is also where TotalEnergies is developing a 12.88 mtpa onshore LNG export terminal, where it expects to resume works in 2022 following the declaration of Force Majeure earlier this year. While the Coral South FLNG does not have a domestic gas allocation, Mozambique LNG has 100 MMscfd allocated to the domestic market. A Growing Gas-to-Power Market Gas-to-power in Mozambique is a relatively new industry but growing rapidly. The country’s first facilities emerged from the monetizing of royalty gas from the Mozambique-Secunda Gas Pipeline that has been exporting onshore gas to South Africa since 2004. In 2015, three facilities were commissioned including the 175 MW Central Térmica de Ressano Garcia, or CTRG, currently owned by Azura Power and EDM, Gigawatt’s 100 MW Ressano García facility and Kuvaninga’s 40.29 MW gas-to-power plant. EDM’s 110 MW Maputo facility followed in 2018. More recently, Globeleq has embarked on the development of the 420 MW Central Térmica de Temane (CTT) to monetise additional gas from Temane and Pande onshore Mozambique. The project is expected to be commissioned by 2025 and has already secured funding and approvals. Meanwhile, a consortium of TotalEnergies, the Gigajoule Group and Matola Gas has embarked on a very ambitious and integrated gas-to-power project in Maputo. It notably includes the deployment of a floating, storage and regasification unit (FSRU) in the city’s harbour to import gas and support the development of the new 2,000 MW Central Térmica de Beluluane (CTB). FID is expected in 2022, with Phase 1 targeting 500 MW. Details on Mozambique’s gas-to-power projects are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

VAALCO Energy’s stock rises to historic highs after Q3 earnings and revenues surpass estimates

VAALCO Energy, the independent company operating oil & gas projects offshore Central Africa, has just reported a strong net income of $31.7m for Q3 2021. The company sold 741,000 barrels of oil this past quarter, up 15% from Q2 this year, and benefited from a realised crude oil price of $73.02/bbl. As a result, VAALCO Energy’s shares were up almost +7% today and +75% since early January. VAALCO Energy’s stock is currently trading at $3.46/share. The company is listed on the New York Stock Exchange and completed a dual listing on the London Stock Exchange in September 2019, in a bid to access additional sources of capital. Source: Yahoo Finance The company’s shares passed the $3 threshold in February this year, a level they had not reached since July 2018. They are now trading at a new 5-year high that confirms its solid performance after it doubled its net interest production this year. VAALCO Energy’s flagship asset is its Etame Marin permit offshore Gabon, where it has been producing oil since September 2002. To keep developing the fields, it recently consolidated its interests in the licence by acquiring Sasol’s 27.8% working interest, concretely doubling its total net production and reserves in the process. Source: VAALCO Energy Bringing Gabonese Operations to the Next Level VAALCO Energy is currently engaged in significant expansion of its operations at Etame offshore Gabon. Following the completion of a 3D seismic acquisition in December 2020, it is starting a new drilling campaign on the block. The 2021/2022 campaign will target at least two development wells and two appraisal wells to add anywhere between 7,000 and 8,000 bopd of additional production. The Etame 8HST, the first well of the 2021/2022 drilling program, should be spudded in early December 2021. Meanwhile, VAALCO is expected to replace the FPSO Petroleo Nautipa, whose contract expires in September 2022, by a floating, storage and offloading (FSO) unit to cut costs and maximise operations. The company is also betting on additional exploration potential around Etame and provisionally secured a 37.5% non-operated interest in blocks G12-13 and H12-13 during Gabon’s 12th Licensing Bid Round that concluded in 2021. Both blocks’ areas surround the Etame complex and are now operated by BW Energy. Achieving First Oil in Equatorial Guinea VAALCO Energy has also completed the drilling feasibility study for a standalone development of the Venus discovery on Block P offshore Equatorial Guinea and is currently proceeding to a field development concept. The project is expected to rely on a floating, storage and offloading (FSO) unit with a platform on the shelf (jack-up production unit). The PSC for Block P provides for a development and production period of 25 years from the date of approval of a development and production plan. An indicative timeline given by VAALCO in 2021 notably expects development drilling at Venus to start in October 2024 to achieved first oil in January 2025. Full details on VAALCO Energy’s operational and financial performances along with the company’s projects offshore Gabon and Equatorial Guinea are available in the “Companies” and “Projects” section within your Hawilti+ research terminal.

Read more »

Invictus Energy completes 2D seismic over Cabora Bassa onshore Zimbabwe

Invictus Energy has completed the acquisition of 839.3km of high-resolution 2D seismic data as part of its Cabora Bassa 2021 (CB21) survey onshore Zimbabwe. This significantly exceeds the company’s minimum work programme of 300km of 2D seismic data over its Special Grant 45 71 (SG 4571) license that runs to June 2024. 402.2km of data was acquired over SG 4571, where lies the Muzarabani prospect that Invictus Energy will drill next year. The remaining 437.1km of contiguous data was acquired in an existing application area. “The seismic data processing and interpretation is ongoing and once completed will enable us to identify and mature additional prospects and leads. The better imaging over the giant Muzarabani structure is very encouraging and once the interpretation of the full dataset is completed, we expect to refine the location for the basin opening Muzarabani-1 well which is scheduled to be drilled in 1H 2022,” Invictus Energy Managing Director Scott Macmillan commented. Invictus has an 80% equity stake in SG4571 via its subsidiary Geo Associates (Private) Limited. The license was granted for three years back in August 2017 and is currently in its second exploration period. Details on the Cabora Bassa Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Renergen’s shares take off after 600% increase in reserves at South Africa’s Virginia Gas Project

Renergen’s shares have been up +43.14% on the Australian Securities Exchange (ASX) and +31.27% on the Johannesburg Stock Exchange (JSE) since Friday. The most significant jump happened today with an increase of almost +30% on the ASX and +15% on the JSE after the company reported a 600% increase in its 1P helium reserves in South Africa. Source: Yahoo Finance Renergen is South Africa’s only onshore petroleum production right holder and sits over a Production Right area of 187,000 ha in the Free State around the towns of Welkom, Virginia and Theunissen. This is where its subsidiary Tetra4 is developing methane and helium reserves to produce liquefied natural gas (LNG) and helium, mostly for the domestic market at first. A 600% Jump in 1P Helium Reserves Following the recent successful drilling campaign and as part of Renergen’s ongoing assessment and development of Virginia, the company had commissioned international Reserves and Resources accreditation agency Sproule to estimate its reserves and resources of methane and helium within the Virginia Production Right area as at September 1, 2021. Sproule’s estimation resulted earlier today in an upgrade of both methane and helium reserves. 1P helium reserves have notably increased by an impressive 620% to 7.2Bcf while 1P methane reserves have increased by 427% to 215.1Bcf. As a result, 2P total gas, including methane plus helium, is now equivalent to 65 MMscfd for the remainder of the license tenor. Phase 1 is Almost Complete The development of Phase 1 at Virginia is already well underway and involves the connection of 12 existing gas wells to a new 52km gas pipeline and small-scale LNG and helium processing plant. Renergen secured all the necessary funding for this first phase and held a groundbreaking ceremony at the end of 2019. Drilling is now ongoing, along with pipeline construction and the development of the gas plant, with a commissioning expected before the end of 2021 and start of helium production in Q1 2022. Meanwhile, logistics and transport companies are expected to make a major part of future customers, and Renergen launched South Africa’s first LNG auction in July 2020 to allocate future LNG production. Strong interest for the auction confirmed the appetite of the South African market for cleaner and cheaper fuels. In August 2021, Renergen also executed its first LNG supply agreement not linked to the transport sector: the 5-year contract was inked with Consol Gloss for about 14 tons per day of LNG and will start in January 2022. It carries a price which will be linked to the floating LPG price in South Africa. Towards Phase 2 Phase 2 is expected to follow by 2024, further increasing LNG production to meet an anticipated increase in demand and provide LNG supplies across all major highways in South Africa. Key contracts for phase 2 were awarded in early 2021, including the FEED studies, and the final investment decision (FID) is expected to be taken once these are completed. Phase 2 is designed to allow Renergen to produce significantly larger quantities of LNG and liquid helium with a target of 44 MMscfd of gross gas sales made up of helium and methane. Phase 2 is expected to require a CAPEX of $800m and involve a drilling campaign of 297 wells, anticipated to build up to 44 MMscfd at full production. 65% of Phase 2’s anticipated production is already pre-sold to clients including Linde, Meser, Helium 24 and iSi. Details on the Virginia Gas Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Gabon exposes clear vision on what to do with its natural gas

Gabon is thought to hold anywhere between 3 to 5 trillion cubic feet (Tcf) of gas, although the country remains a small gas producer. To date, most of its gas has remained on the ground or flared – with only small quantities monetised domestically for power generation in Libreville and Port Gentil. But as Gabon implements an ambitious “Green Gabon” environmental policy and seeks to diversify its economy, the country wants to cut routine flaring altogether and monetise it for the benefits of its industries, households, and economy. The recent Gabon Oil, Gas & Energy Summit organized by IN-VR in Libreville last October notably exposed the alignment of most parties on the need to monetise gas instead of flaring it. A New Gas Strategy in the Making To achieve its gas ambitions, Gabon is currently working on a new Gas Master Plan with Wood Mackenzie and the World Bank’s Global Gas Flaring Reduction Partnership (GGFR). The plan will have four major ambitions: reduce gas flaring, increase energy security, expand access to affordable energy and attract investments into gas projects. Gabon’s flared gas currently emits about 2,244,500 tonnes of CO2 per year, enough to generate 500 MW of power. Natural gas also features prominently within the country’s 2021-2023 Plan to Accelerate Transformation (PAT), which includes a dedicated Gas Task Force headed by former Gabon Oil executive Yann Pierre A. Livulibutt Yangari. “Our gas strategy is targeting actions across the whole value-chain. In upstream, we want to get operators to explore for gas and stop considering it as a risk. In midstream, we want to see flared gas being monetised for the benefits of the Gabonese economy. Finally in downstream, we want to improve gas supplies especially of liquefied petroleum gas (LPG), compressed natural gas (CNG) and liquefied natural gas (LNG),” Yangari said during IN-VR’s summit. As it stands, Gabon intends to primarily monetise flared gas to generate power, manufacture urea and produce methanol. These are the major industries identified based on existing gas reserves and technology available from existing investors and operators in the country. Once these are developed, hopes are that by-products would follow, especially when it comes to LPG, CNG (Autogas) and micro-LNG. Source: DGEPF “We are working on supporting the development of a gas-based economic network to support local content development, promote technology adoption and support industrialisation,” Yangari added. While Gabon has not discovered enough gas reserves to justify the development of more significant industries like LNG for export or gas-to-liquids, the country remains hopeful. Its 12th Licensing Bid Round has resulted in the award of new exploration blocks, and upcoming drilling campaigns could result in new gas discoveries supporting further gas developments in the medium-term. To justify the investment, Gabon is putting forward its growing industrial base driving demand for both power and gas. Last September, the Gabon Power Company (GPC) notably signed a landmark Concession Agreement with Wärtsilä for the development, supply, construction, operation, and maintenance of a new 120 MW gas-to-power project in Owendo, next to the capital city of Libreville. But beyond just the power sector, Gabon wants to provide gas to its mining, forestry, agro-industry, and steel industries. In parallel, its logistics network is expanding with railways and maritime industries both positioned to be potential off-takers sooner than later. An Opportunity for Small-Scale Gas Projects Gabon’s vision relies on the monetization of gas into CNG for transport and micro-LNG for industries. A key strategy is to expand the country’s CNG network but use micro-LNG for any remote industries located over 400km from producing fields, especially mining industries. To support such expansion, the country is seeking investors across several projects such as LPG plants, LNG and CNG plants, LNG and CNG storage, onsite regasification and bi-fuel conversion. Chief amongst them is the need to secure 30,000 cubic metres of additional butane storage capacity, up from only 4 to 5,000 cubic metres now. Source: DGEPF Port Gentil features prominently within that vision as a pilot city to grow the CNG industry. It is there that Perenco already runs a private gas retail station for 40 of its own vehicles. Now, Gabon wants to grow the market by constructing public CNG stations in partnership with oil marketers and develop a new pricing structure for CNG. The aim is clear: reduce petroleum products imports while generating additional revenues from domestic gas. Perenco Takes the Lead Perenco will be a key actor of that transition to gas. The operator is the country’s sole commercial gas producer and currently supplies gas feedstock to the power stations of Port Gentil and Libreville. In fact, 100% of Port Gentil’s power relies on Perenco’s gas while 70% of Libreville’s power is generated from the operator’s gas supply. “We have invested $500m into the development of a 400km onshore and offshore gas gathering system in Gabon that supplies gas to power plants but also key industries such as Sobraga. In the process, we created 150 jobs,” Director General Adrien Broche said during the IN-VR Summit. Perenco is now increasing its investments and leveraging on its existing infrastructure to commission a 10 to 15,000 tonnes per annum (tpa) LPG plant in Batanga by 2023. Batanga is currently the cornerstone of its gas business and is equipped with enough compressors to compress gas to over 100 bars so it can be transported across the country. “The Libreville and Port Gentil power stations currently represent an off-take of about 40 MMscfd,” Broche explained. “While only half of that capacity was coming from flared gas, we are installing additional compression capacity so all feedstock supplied to power plants comes from previously flared gas. We have installed two onshore compressors this year and are now expecting additional ones for offshore operations. By mid-2022 or early 2023, all gas we send onshore for power generation will come from previously burned resources,” he added. The Need for an Industry and Policy Consensus But to furter monetise gas and create jobs, Gabon must first find a way to aggregate

Read more »

Nigeria: RainOil completes acquisition of majority stake in Eterna Plc

RainOil has completed its acquisition of 63.6% of the shares of Eterna Plc though its investment arms, Preline Ltd (60.9%) and Norsworthy Investments (2.6%). The Sale and Purchase Agreement (SPA) was executed on August 25th, 2021. The transaction had been reported in Hawilti’s Q3 M&A Watch, available within the Hawilti+ research terminal. The acquisition of Eterna will further consolidate RainOil’s market presence in Nigeria. Over the past two years, the Nigerian company has been investing heavily into its asset base which currently include three ultra-modern petroleum product storage deports in Delta, Cross River and Lagos, a 8,000 metric tonnes LPG storage facility in Lagos, over 100 retail outlets and a fleet of over 140 petroleum product tank trucks. The Nigerian downstream sector is going through significant consolidation as players seek to expand their reach and network to benefit from economies of scale in a market where PMS remains heavily subsidised and regulated. In January this year, Ardova Plc announced it was acquiring Enyo Retail & Supply, a private oil marketer with 95 retail stations in Nigeria.

Read more »

Mainstream Renewable Power big winner in South Africa’s 2.5 GW renewable energy bid round

South Africa’s Minister of Mineral Resources and Energy (DMRE), Mr. Gwede Mantashe, has announced yesterday the preferred bidders for the Renewable Energy Independent Power Producers Procurement Programme (REIPPPP) Bid Window 5. The round resulted in the selection of five consortium as preferred bidders for 25 projects totalling 2,583 MW of renewable energy. The bidders will jointly invest R50 billion in those projects, expected to reach financial close early next year and to start generating by April 2024. Out of the 2.5GW of awarded capacity, 1,608 MW will be based on onshore wind and 975 MW on solar PV. Mainstream Renewable Power alone secured 12 projects totaling 1,274 MW (824 MW of onshore wind and 450 MW of solar PV). To date, the company has been awarded over 2.1 GW of renewable energy projects under the REIPPPP and has become the largest renewable energy developer of the country by capacity. The company currently owns 100% of the projects awarded but ownership will transfer to the equity consortium upon financial close including Mainstream (25%), Globeleq (26%), Africa Rainbow Energy & Power (23.25%), H1 Holdings (23.25%) and Community Trusts (2.5%). Other preferred bidders notably include Scatec with 273 MW, a Norwegian company that entered the South African energy market back in 2010 and already commissioned several solar PV projects under previous REIPPPP windows. Scatec had also secured three solar projects totaling 150 MW during the 2 GW Risk Mitigation IPP procurement programme (RMIPPPP) earlier this year. Scatec will own 51% of the equity in the projects while its local Black Economic Empowerment partner H1 Holdings will own 46.5% and a Community Trust holding will hold the remaining 2.5%. Scatec will also be the Engineering, Procurement and Construction (EPC) provider and provide Operation & Maintenance as well as Asset Management services to the power plants. EDF Renewables secured three projects, as did Engie and Red Rocket. Finally, the joint-venture of Mulilo and Total secured one project. Mulilo Total is already progressing two projects it has been awarded under the RMIPPPP last June, with a combined capacity of almost 275 MW. Window 5 resulted in some of the cheapest bid price on record, making South Africa’s wind and solar energy very competitive against coal. From 2012 to 2015, South Africa already awarded 6.3 GW of renewable energy capacity via windows 1, 2, 3, 3.5 and 4. Thousands of jobs were created, while attracting billions on foreign direct investment. While the projects from Window 4 are just reaching commissioning stage, South Africa just closed its Risk Mitigation IPP Procurement Programme (RMIPPPP), awarding another 2 GW of projects earlier this year. Following Window 5, Window 6 is expected to be launched this year to announce the winners in May 2022, while Window 7 would be launched in 2022 to that winners are awarded in Q3 of the same year. Finally, South Africa is also planning a storage and gas-specific windows, with the former launched in November this year while the latter would see its request for proposal issued in Q1 2022.

Read more »

ExxonMobil to resume drilling offshore Angola in June 2022

ExxonMobil’s affiliate in Angola has just awarded Valaris a two-year contract for drillship VALARIS DS-9. The rig is to be reactivated and mobilized to Angola in June 2022. This marks the resumption of drilling activities for ExxonMobil in Angola following a June 2019 agreement with National Agency for Petroleum, Gas and Biofuels (ANPG) to further invest in the development of Block 15. While ExxonMobil has deployed four floating, production, storage and offloading (FPSO) units on Block 15 in 2004, 2005 and 2008, the license offers significant potential for redevelopment to tap into remaining reserves. In the first nine months of 2021, the block exported an average of 158,000 barrels of oil per day (bopd) according to data from Angola’s Ministry of Finance. To facilitate further development, the block’s 11 development areas were merged into only four in 2019. Additional investment is expected to unlock about 40,000 bopd of additional production and generate 1,000 local jobs as expansion projects get executed. ExxonMobil’s multi-year drilling program on the block is expected to involve 17 wells in phase one, followed by about 20 wells in phase 2.

Read more »

BW Energy moves to develop giant Namibian gas field first discovered in 1974

BW Energy has just signed an agreement with Aquadrill LLC to acquire the semisubmersible drilling rig “Leo” for a total consideration of $14m. Surprisingly, the rig is not to be used for the company’s flagship Gabonese nor Brazilian assets, but for the development of the Kudu gas field offshore Namibia. The acquisition of the “Leo” drilling rig follows indeed a new revised development plan for Kudu under which BW Energy plans to use a repurposed semisubmersible drilling rig as a Floating Production Unit (FPU). 1.3 Tcf of Gas Within Namibia’s Sole Production License Despite about 1.3 trillion cubic feet (Tcf) of gas discovered and its ability to transform Namibia’s energy sector and resolve the country’s energy crisis, the Kudu gas field has remained undeveloped since its first discovery by ChevronTexaco in 1974. Located 170 km off the coast of Namibia, Kudu has been subject to substantial drilling with seven appraisal wells drilled since its discovery: two by Swakor in 1987 and 1988, four by Shell in the 1990s, and one by Tullow Oil in 2007. The field has had several operators as well since it was discovered: ChevronTexaco was followed by Swakor in the 1980s then Shell in the 1990s, then Energy Africa in the 2000s before the company was acquired by Tullow Oil in 2004 which led to the issuance of Production License 001 in 2005. In the more recent past, Gazprom and national oil company NAMCOR took over the field for a short while in 2010 and 2011 (Production License 002) before operatorship was given back to Tullow Oil in 2011 (Production License 003). The British multinational finally withdrew with its Japanese partners in 2014, and BW Energy has been operator since 2017 with a firm intention to bring the project to final investment decision (FID). From the inability of parties to agree on a gas price to delays in obtaining governmental support packages and finalising costs, several factors have contributed over the years to constantly reschedule the project’s FID. BW Energy Take Over and Revives Namibia’s Gas Ambitions When BW Energy acquired the field in 2017, Kudu was estimated to contain 1C contingent resource of 755 billion standard cubic feet (Bscf), with 2C contingent resources estimated at 1.33 Tcf and 3C ones at 2.3 Tcf. The development of the field still calls for the establishment of an integrated upstream-midstream-downstream venture to produce gas via a floating production unit (FPU) before exporting it to shore to generate electricity. While initial plans envisioned a gas-to-power plant of up to 885 MW, the facility is expected to finally have half that capacity if commissioned. The latest Contingent Resources Report prepared by ERC Equipoise Ltd for BW Energy in January 2020 notably estimates gross contingent gas resources at 587 Bscf, enough to justify a 440 MW gas-to-power plant. Full details on the Kudu Gas Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Negotiations on $30 bn Tanzania LNG project to start on November 8

Tanzanian Energy Minister January Makamba has declared that negotiations would officially start on November 8 to get the Tanzania LNG project off the ground. This notably follows a meeting today in Dar es Salaam with Paul McCafferty, Equinor’s Vice President Exploration & Production International – Africa. On October 4th, Tanzanian President Samia Suhulu Hassan and Minister Makamba had also held a similar meeting, virtually, with Shell’s CEO Ben van Beurden. The development of the $30bn Tanzania LNG project in Lindi, in southern Tanzania, has been on the table for several years but talks had been suspended since the end of 2019. Last January, Equinor had even decided to write down the value of the project by $982 million, saying that its current economics did not justify keeping it on the balance sheet. But things changed when President John Magufuli died in March and his Vice President Samia Hassan took over the country’s top job. She made a direct mention of the project during her inauguration speech, giving clear signals of her intention to revive it. Since then, the Government of Tanzania has had several talks and discussions with Equinor and Shell in order to address pending issues and pave the way for the project’s development. Tanzania LNG would monetise almost 50 trillion cubic feet of gas (Tcf) discovered in offshore blocks 1, 2 and 4. Block 2 is operated by Equinor (65%) along with its partner ExxonMobil (35%) while the national oil company TPDC has the right to participate with a 10% interest. The partners have drilled a total of 15 exploration wells since 2011, resulting in nine discoveries with an estimated volume of over 20 Tcf. On the other side, Blocks 1 and 4 are operated by Shell (60%) along with Singaporean partner Pavilion Energy (20%) and Indonesian partner Medco Energi (20%). The base case development plan envisages a two-train onshore facility with a combined capacity of 10 million tonnes per annum (mtpa). On the Tanzanian side, hopes are that construction could start by mid-2023 for a commissioning by June 2028.

Read more »

TechnipFMC sees $3bn of subsea opportunities in Africa within 24 months

TechnipFMC sees subsea opportunities across Nigeria and Angola totaling between $3bn and $5bn within the next 24 months, the company said during its Q3 2021 earnings conference call. This remains in line with its previous estimate released at the end of Q2. Angola to the front The subsea market in the region will be heavily driven by TotalEnergies’ projects in Angola. These notably include the development of the Begonia (Block 17/06) and Cameia (Block 21) fields, with subsea projects values of at least $250m for both. Block 21 is notably the location of one of TotalEnergies’ future production hubs with the pre-FEED for a new floating, production, storage and offloading (FPSO) unit awarded to Yinson earlier this year. Future subsea projects by TotalEnergies in Angola also include the execution of two subsea tieback projects on producing blocks: Cravo, Lirio, Orquidea and Violeta (CLOV) Phase 3 on Block 17 and the ACCE project on Block 31 (an acronym for the Alho, Cominhos and Cominhos East fields). The latter is expected to be the biggest of the pack, with a value of $500m to $1bn. Block 17 has been subject to significant subsea activity recently, with the commissioning of Zinia 2 earlier this year and the ongoing execution of Dalia 3 and CLOV 2. Hawilti’s own research sourced from the Hawilti+ research terminal further shows that Angola will be remaining sub-Saharan Africa’s biggest subsea market in the medium-term. In July 2021, Italian major Eni notably requested expressions of interest for the Agogo full field development on Block 15/06, including the provision of an FPSO system. “Several new production hubs are in the making offshore Angola while producing blocks have received a series of incentives to develop marginal and satellite fields,” said Mickael Vogel, Head of Research at Hawilti. “Infrastructure-led exploration has also proven a very successful strategy in the country and is expected to continue, especially in Block 15/06 and Block 17.” A possible recovery in Nigeria Meanwhile, TechnipFMC sees two projects moving forward in Nigeria that could support the subsea market in the country. One is the development of the Preowei field on OML 130, operated by TotalEnergies and whose field development plan has been approved since 2019. The other one is further development of the Shell-operated Bonga asset on OML 118. In May 2021, new agreements were executed for OML 118 between the NNPC and contractor parties SNEPCo (Shell), ExxonMobil, Total and NAOC (Eni). However, a big question at the moment remains what future Bonga development project will be approved first: Bonga North or Bonga South-West/Aparo. Full details on ongoing and future projects offshore Angola and Nigeria are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

In South Africa, Renergen to become pillar of new global helium spot market

On Monday, natural gas and helium producer Renergen announced the completion of a helium forward sale agreement for 100,000 units over a period of 19 years. Each unit represents a thousand standard cubic feet (mcf) of helium at 99.999% purity and in liquid form and weights 4.7kg (37.5 litres when in liquid form). The units will be sold to Argonon Helium US Inc, a newly incorporated American helium trading company in Delaware. Argonon’s vision is to use these helium units to establish a spot market for helium. “Unlike other more transparent commodities, helium is not presently traded in the spot market and a visible price per mcf is not available. The collaboration between Renergen and Argonon is specifically designed to bring transparency of pricing into the helium market and highlight the growing global importance of helium,” Renergen said in a statement. The helium will be coming from Renergen’s Virginia Gas Project onshore South Africa. This is where Renergen’s subsidiary Tetra4 is developing the country’s first and only onshore petroleum production right to become the first liquefied natural gas (LNG) and helium producer in the country. The company already began producing small quantities of compressed natural gas (CNG) in 2016, which it supplies to the transport and logistics industry. The Virginia Gas Project is the next major phase of development, targeting the production of LNG and helium by the end 2021 by developing total proved (1P) methane reserves of 40.76 billion cubic feet (Bcf) and 1P helium reserves of 1.01 Bcf. Its Phase 1 consists in significant infrastructure expansion with a new scalable gas plant and pipeline, and a maximum production target of 74.6 million cubic feet per day (MMcfd) (about 350kg) of liquid helium and 2,700 GJ (50 tons) of LNG. Upon start of production, Renergen will become South Africa’s first distributor of LNG at filling stations through its partnership with French major TotalEnergies, and the country’s only domestic producer of helium. But the recent deal with Argonon further paves the way for the second phase of development at Virginia. With proved and probable (2P) reserves of methane estimated at 138.99Bcf and of helium estimated at 3.41 Bcf, the project has significant growth potential. As a result, Phase 2 is expected to follow by Q4 2023, further increasing LNG production to meet an anticipated increase in demand and provide LNG supplies across all major highways in South Africa. Key contracts for phase 2 were awarded in early 2021, including the FEED studies, and the final investment decision (FID) is expected to be taken once these are completed. Phase 2 is designed to allow Renergen to produce significantly larger quantities of LNG and liquid helium. Future helium’s production will be further supported by gas strikes in March 2021 at the POO7 and MDR1 wells: the former returned a helium concentration of 4.38% while the latter returned a helium concentration of 3.15%. Renergen’s recent deal with Argonon gives it potential pre-funded helium sales from Phase 2 of up to $25m and a portion of these funds would be used to accelerate Phase 2 of drilling without the need for an equity issue. Full details on the Virginia Gas Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

BW Energy starts production from Tortue Phase 2 offshore Gabon

BW Energy has announced that the hook-up of the DTM-6H and DTM-7H production wells at its Dussafu Marin Permit offshore Gabon has been completed and handover to production operations made. DTM-7H (Gamba formation) was brought online yesterday, while DTM-6H (Dentale formation) is expected online in the coming days. Both wells form part of the four additional production wells drilled as part of the Tortue Phase 2 project and tied-back to the FPSO BW Adolo. Out of these four wells, DTMH-4 and DTMH-5 had already been brought on stream in early 2020 and are producing. However, DTMH-6 and DTMH-7 formed part of a second cluster initially scheduled for completion in June 2020 but delayed because of the Covid19 pandemic. Drilling resumed only in April 2021 while gross projected investment forecast for Tortue Phase 2 had to be cut from $275m to $238m. “The Tortue Phase 2 development was completed below budget and within the revised timeframe. We look forward to the production growth following first oil from the two wells. Operationally we will now focus on stabilisation of the production and wrapping up the project activities.” Carl K. Arnet, the CEO of BW Energy Gross production averaged about 9,000 barrels of oil per day (bopd) in Q3 2021 and currently stands at 11,500 bopd. Source: BW Energy In parallel to the completion of Tortue Phase 2, BW Energy is preparing to execute a third development phase with the Ruche Phase 1 project. It targets the Hibiscus and Ruche Fields located 20km northwest of the Tortue Field via the drilling of up to six horizontal production wells connected to a fixed wellhead platform, itself tied back to the existing BW Adolo FPSO. The drilling is expected to be split into four wells in the Hibiscus Field and two wells in the Ruche Field, all targeting the Gamba reservoir. Full details on the development of the Dussafu Marin PSC are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Tanzania celebrates key milestone at 2 GW Julius Nyerere hydropower plant

Earlier today, Tanzania celebrated the readiness of the Julius Nyerere’s main dam for its first phase of reservoir impounding. The project’s water storage basin reached a depth of 95m in its mid-section, allowing for the start of water filling. The project has been under construction since 2019, with the engineering, procurement and construction executed by the Egyptian consortium of Elsewedy Electric and The Arab Contractors. The facility involves a 134m RCC gravity dam and appurtenant structures, with expected reservoir length of 100km, covering an area of about 1,350km2. Upon completion, the 2,115 MW project will be one of sub-Saharan Africa’s biggest hydroelectric facility. It is expected to be able to generate up to 6,307 GWh a year. Full details on the Julis Nyerere Hydropower Plant (Rufiji) are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Gabon on the move: what you need to know ahead of the Gabon Oil, Gas & Energy Summit in Libreville this week

Nested in the Gulf of Guinea, Gabon has built itself a reputation of environmental stewardship and sustainable development of its natural resources. The country of less than 2.5m notably hosts Africa’s largest forest elephant population and is covered at 88% by rainforest. Despite being an established offshore hydrocarbons province, Gabon is steadily diversifying away from oil. A public-private partnership with ARISE IIP resulted in the establishment of one of Africa’s most modern and efficient free zones now serving a growing industrial and mining base. The country is in fact one of the world’s top producers of manganese, of which it exported almost 4m tonnes in the first half of the year. Gabon has also successfully industrialised its wood industry to become a recognised exporter of timber: between January and June 2021, the country produced over 1 million m3 of logs. Gabon’s economy remains fairly diversified compared to that of its African neighbours. Its oil & gas sector’s contribution to the GDP stood at 37.7% in 2020 and represented 33% of government revenues last year. Oil exports also accounted for 70% of total export revenues. Maintaining the pace of investment in the country’s hydrocarbons value-chain remains a priority for the government, especially as it seeks to develop gas-based economies and use oil revenues to invest in sustainable infrastructure and the conservation of its environment. A Focus on Reversing Production Decline Gabon is member of the Organisation of Petroleum Exporting Countries (OPEC) and produced an average of 183,000 barrels of oil per day (bopd) between January and September 2021. This makes it sub-Saharan Africa’s fourth largest producer, behind Nigeria, Angola and Congo-Brazzaville and more or less at par with Ghana. Production has been in decline for several years and has stagnated in the recent past. Gabon launched its 12th Licensing Bid Round before Covid19, which it is just concluding now. The round generated relatively strong interest given market dynamics, and award letters started being issued this month with BW Energy provisionally securing two blocks along with partners Panoro Energy and VAALCO Energy. Source: DGEPF The award of new exploration acreage is much needed in order to encourage seismic acquisition and exploratory drilling and ultimately maintain production in the medium-term. Exploration has so far been a miss this year, with BW Energy’s Hibiscus Extension appraisal well (DHIBM-2) encountering water in the first half of the year, and its Hibiscus North exploration well (DHBNM-1) failing to deliver on pre-drill resource estimate in July. An Independents’ Market Gabon is an independents and national oil companies (NOCs)’ game. Shell Gabon sold all its assets in the country to Assala Energy in November 2017, and Total Gabon sold seven of its non-operated mature fields and operatorship of the Cap Lopez Oil Terminal to Perenco in July 2020. Beyond Assala Energy and Perenco, Gabon’s upstream sector is dominated by Maurel & Prom, VAALCO Energy and BW Energy along with a few NOCs such as Petronas. TotalEnergies remains the only IOC still operating upstream assets in the country. Gabon continues to offer significant opportunities for independents, both onshore and offshore. In February 2021, Panoro Energy acquired Tullow Oil’s 10% working interest in BW Energy’s Dussafu Marin Permit. A New Strategy to Monetise Domestic Gas Gabon has been working for a few years on a new strategy to monetise gas to generate additional electricity and develop new gas-based industries. The move benefits from significant political will and support and is one of the key pillars of the country’s new three-year plan over the 2021-2023 period, dubbed Plan to Accelerate the Transformation (PAT). Because Perenco represents most of the country’s operated gas production, it will play a major role in the development of Gabon’s domestic gas market. The company completed this year studies and plans for the new 10,000 metric tonnes Batanga LPG plant, where construction is expected to start before the end of the year. In July 2019, Gabon’s Ministry of Petroleum, Gas and Mines had also signed an agreement giving the Olowi Field to Perenco as its new operator. The field was developed between 2005 and 2018 by Canadian Natural Resources and is now to be redeveloped under an integrated gas project. Source: DGEPF Finally, an expanding gas industry will benefit the power sector. Gabon already runs several gas-to-power facilities and in September 2021, the Gabon Power Company (GPC) signed a landmark Concession Agreement with Wärtsilä for the development, supply, construction, operation, and maintenance of a new 120 MW gas-to-power project in Owendo, next to the capital city of Libreville. A Diversifying Energy Basket Beyond gas, Gabon is also expanding its energy sector with the development of its solar and water resources. Several hydropower plants are currently being developed, When it comes to hydroelectricity, Meridiam and the Gabon Power Company successfully reached financial close on the 35 MW Kinguélé Aval in July this year. Additional facilities include the 15 MW Dibwangui hydropower plant and the 73 MW Ngoulmendjim hydropower plants, whose power purchase agreements (PPA) were signed with Eranove in 2018. Solar energy is also making its entry into the country’s grid with the signing last August of a contract with the Turkish group Desiba Energy for the construction of a 20 MW solar power plant in Doubou, in the province of Ngounié. To find out about investment and business opportunities in Gabon, register for IN-VR’s Gabon Oil, Gas & Energy Summit hybrid conference taking place in Libreville and online between October 20th-22nd. More information at https://www.in-vr.co/gabon. All details on ongoing and future projects across Gabon’s energy sector are available within your Hawilti+ research terminal.

Read more »

Tlou Energy signs PPA with Botswana Power Corporation – takes one more step towards Lesedi gas-to-power project

Tlou Energy has signed this morning a 10 MW Power Purchase Agreement (PPA) with the Botswana Power Corporation (BPC) under which BPC will purchase up to 10 MW of power generated at the company’s Lesedi power project. The PPA is for an initial five-year term and will help Tlou Energy in reaching financial close for Phase 1 of the project, expected to cost $10m. A Pioneering Project for Botswana’s CBM Industry Tlou Energy has been working on developing Botswana’s coal-bed methane (CBM) reserves to generate electricity since its incorporation in 2009. Now listed on the AIM, ASX and BSE, the company is focusing on the development of three major project areas in Botswana: Lesedi, Mamba and Boomslang. Lesedi is a lot more advanced and is being developed as a scalable and hybrid solar and CBM gas-to-power project. It has in fact been producing gas for several years now from the Selemo project, though in small quantities. That gas has been used since 2017 to replace diesel within the generators on site. Lesedi remains an extremely attractive venture because of continued power deficit in Botswana, and continued reliance on coal-based electricity generation and imports. By burning coal and diesel, and importing significant amount of electricity from South Africa, Botswana spends on average $100m every year on securing energy for its industries and households. In contrast, Lesedi is one such project with the ability to offer a cheaper and cleaner solution from a fully local resource base. Two Phases Requiring $30m The Lesedi project is now being developed in two phases. Phase one involves the construction of the 100km transmission line from Lesedi to Serowe, which will act as the backbone for any monetisation of electricity produced from CBM at Lesedi. At a cost of $10m, it also involves the installation of transformers and generators, and the establishment of a grid connection. Initial electricity generation in phase one is proposed to be up to 2 MW. It will then be followed by phase two, at a cost of about $20m, targeting expansion from 2 MW to 10 MW and involving drilling of additional gas wells and the purchase of additional electricity generators. Any further expansion beyond 10 MW will then rely on project revenues and debt from the first two phases. Botswana’s First Carbon Neutral Baseload Power Project? In February 2021, Tlou Energy announced it was working towards the goal of being the first carbon neutral baseload power project in Botswana by further advancing land acquisition for carbon sequestration. The company’s plans to combine gas, solar and carbon sequestration at Lesedi make the project a truly unique one for Africa and could result in the supply of carbon neutral power to significant regional power consumers such as the Orapa diamond mine operated by Debswana and located north of Tlou’s gas fields. Full details on the Lesedi Hybrid CBM and Solar Power Project are available in the “Projects” section within your Hawilti+ research terminal.

Read more »