ARA Petroleum Tanzania (APT), which took over the operatorship of the onshore Ruvuma PSA in Tanzania last year, has received a two-year extension of the license. The granting of the extension was necessary to complete key exploration activities on the block, including the acquisition of 200 km2 of 3D seismic data and the drilling of the Chikumbi-1 exploration and appraisal well (formerly known as Ntorya-3). Completion of the exploration programme will further support the conclusion of negotiations of the Gas Terms for the Ruvuma PSA and pave the way for the development of the Ntorya Gas Project.

The development of the Ntorya gas accumulation has the potential to be Tanzania’s next big domestic gas project. Located in southern Tanzania where Maurel & Prom produces gas from the Mnazi Bay PSC since 2015, Ntorya used to be operated by Aminex’ subsidiary Ndovu Resources with a 75% interest before APT took over operatorship of the asset with a 50% interest last year. Aminex has since then retained a 25% interest in the license.

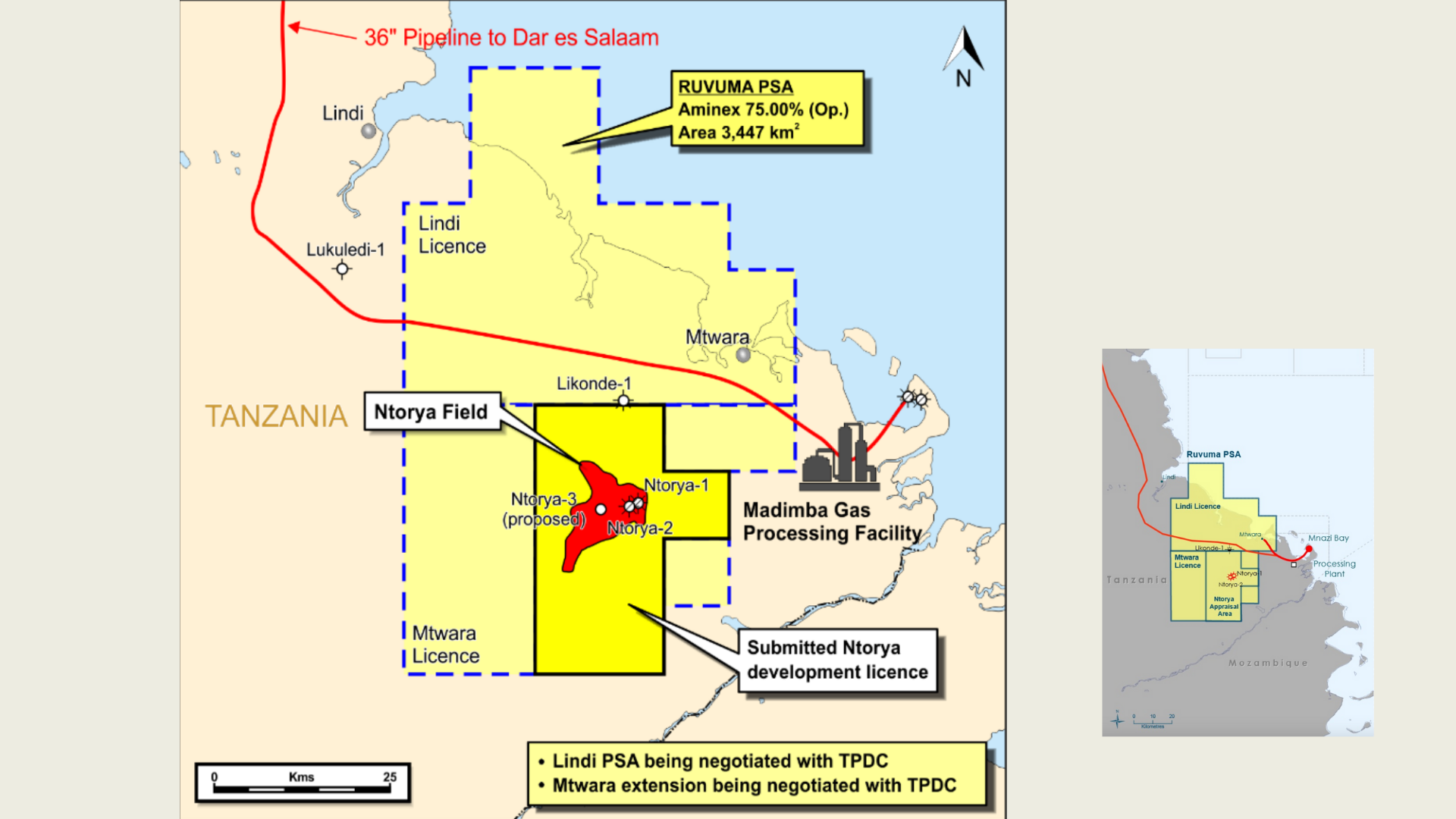

The Ntorya accumulation is located within the onshore Ruvuma Production Sharing Agreement (PSA) signed in October 2005, which contains the Mtwara licence and the Ntorya development area, the latter being currently in negotiation. The PSA was operated by Tullow Oil until 2011 and saw the successful drilling of the Likonde-1 well in 2010, the Ntorya-1 well in 2012 and the Ntorya-2 well in 2017. Both Ntorya-1 and Ntorya-2 successfully tested gas with flow rates of 20 MMscf/d and 17 MMscf/d respectively, while Likonde-1 encountered gas shows. As a result, Ndovu applied to the Ministry of Energy for Tanzania in September 2017 for a 25-year development licence over the Ntorya area, with the application recommending the drilling of one well, the acquisition of 3D seismic over the Ntorya Field and the construction of a raw gas pipeline tied to the National Gas Gathering System at the Madimba plant, starting point of Mnazi Bay-Dar es Salam gas pipeline.

In April 2020, Ndovu Resources secured a one-year extension of the Ruvuma Licence, almost three years after it applied for it. The extension did not provide enough time to complete the exploration programme, reason why new operator APT had to apply for another one which was secured a lot faster.