Energy

Afentra acquires interest in producing and exploration blocks offshore Angola

Afentra has officialised its entry in Angola with the signing of Sale and Purchase Agreement (SPA) with Sonangol’s upstream subsidiary Sonangol Pesquisa e Produção. The one-year old, AIM-listed independent is acquiring from Sonangol a 20% non-operated interest in the producing Block 3/05 and a 40% non-operated interest in exploration Block 23 for up to $130m, including $80m cash upfront. The acquisition has an effective date of 20 April 2022 and follows the launch of Sonangol’s partial divestment process last year, under which Afentra was selected as preferred bidder for both blocks. Block 3/05 is located in shallow water and produced an average of 17,000 barrels of oil per day (bopd) in 2021. In 2018, it had already attracted the interest of Maurel & Prom who acquired AJOCO’s 20% interest in both Blocks 3/05 and 3/05A. Post transaction, it will remain operated by Sonangol. Block 23 is located in deep-water within the Kwanza Basin and contains the Azul oil discovery that tested at flow rates of around 3-4,000 bopd of light oil. Afentra is being joined in the block by Namibia’s national oil company NAMCOR who is taking another 40% interest in the licence. Details on Blocks 3/05 and 23 offshore Angola are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Hawilti launches gas research programme on Nigeria

Hawilti has marked the launch of its gas research programme on Nigeria with the release of a comprehensive investment report on the country’s natural gas sector earlier this week. The 2022-2023 programme seeks to analyse the growth of Nigeria’s natural gas value-chain in light of current regional and global market dynamics. While the Nigerian government had already been pushing for a stronger adoption of gas domestically, the war in Ukraine has repositioned Nigeria as a strong potential gas supplier for the export market as well. Long-stalled projects such as Brass LNG or the Nigeria-Morocco Gas Pipeline (NMGP) could benefit from renewed interest in exporting African gas. Meanwhile, the need to secure energy for Nigerian households and industries, especially in a context of soaring diesel prices, is putting pressure on the country’s gas value-chain to provide alternative solutions such as compressed natural gas (CNG), liquefied natural gas (LNG), liquefied petroleum gas (LPG) and piped natural gas (PNG). To address those challenges, Nigeria has chosen gas as its key transition fuel and named the 2020-2030 period as “Decade of Gas” in a bid to monetize its 206 Tcf of gas reserves to drive industrialization, create jobs, and generate revenue. This is in turn generating increased interests from local and foreign investors seeking to invest in the country. While little confidence exists in the strength of Nigeria’s domestic gas value-chain, long-term industry fundamentals support a strong case for investing into the country’s gas production and infrastructure. Hawilti’s research programme is developing new data sets and perspectives into the Nigerian market, focusing on private sector-led initiatives and projects across the exploration & production and midstream segments, while highlighting the growth potential of key commodities such as LPG, LNG, and CNG. All market information generated as part of the programme is now available on the Hawilti+ research programme and to Hawilti subscribers and partners. In addition, Hawilti will be expanding its suite of quarterly sector watch on the country’s LPG and small-scale LNG industries, while releasing a new comprehensive investment report twice a year.

Read more »

Worley awarded FEED Phase II contract for Nigeria-Morocco Gas Pipeline

Worley has announced that it has been awarded a contract to provide main front-end engineering design (FEED Phase II) services for the 7,000km Nigeria-Morocco Gas Pipeline (NMGP) project. The feasibility study and FEED Phase I were previously completed by Penspen. The project is led by Morocco and Nigeria’s national oil companies, the Office National des Hydrocarbures et des Mines (ONHYM) and NNPC Ltd. If completed, it would be the longest offshore pipeline in the world. Its FEED study already received financing from the Islamic Development Bank in December 2021. The development bank had then declared that a final investment decision (FID) was targeted for 2023. The pipeline has been on the table for some time and is seen as an extension of the existing West Africa Gas Pipeline (WAGP) that was commissioned in 2011. However, WAGP has been plagued by several operational issues, including unreliable gas supplies from Nigeria and legacy debt payments from off-takers. The NMGP is expected to traverse 13 West African countries and offer African gas producers a new avenue to export their gas to neighboring countries and to Europe. Nigeria, Ghana, Côte d’Ivoire, Senegal, and Mauritania all have discovered gas reserves located offshore. Gas deliveries could be made across the pipeline route to African markets seeking to secure additional gas supplies or exported all the way up to Europe via Morocco. “The overall FEED services will be managed by Intecsea BV, our offshore engineering consultancy business in The Hague, the Netherlands. This includes the development of the project implementation framework and supervision of the engineering survey,” Worley said in a statement. Nigeria holds Africa’s largest gas reserves and is increasingly seeking to monetise it domestically and for exports. On February 16th, Minister of Petroleum Timipre Sylva was in Niger to sign the Niamey Declaration with his counterparts from Algeria and Niger. The agreement seeks to put the Trans-Sahara Gas Pipeline (TSGP) Project back on track – another gas pipeline that would allow Nigeria to export its gas to Europe via Niger and Algeria. Earlier this month, Minister Timipre Sylva also expressed interest in reviving the Brass LNG export terminal project – a 10 mtpa LNG export scheme first discussed in 2003.

Read more »

Zimbabwe’s leading cement supplier to switch to solar energy

Yesterday, PPC Zimbabwe broke ground on two solar PV plants in Bulawayo and Gwanda in southwestern Zimbabwe. The facilities will have a combined generation capacity of 30 MWac and were awarded to a consortium of the African Transmission Corporation (ATC) and Sinohydro Corporation following a competitive tender. The consortium’s project company, CentraWest, is mandated to develop, finance, construct, maintain, operate, and own the project. Construction includes the associated transmission integration infrastructure to supply PPC’s cement manufacturing operations in Coleen Bawn and Bulawayo. “To ensure reliable and quality supply of electricity to PPC Zimbabwe, a 9MW/18MWh battery energy storage system will be installed at the Gwanda site. This is one of the largest grid scale electricity storage systems to be built in Africa,” ATC Managing Director Victor Utedzi said. Construction works will generate 500 local jobs and are expected to be completed at the end of this year. ATC is steadily establishing its leadership within Zimbabwe’s solar industry. In 2019, it already developed the 2 MW Centragrid solar PV plant at Nyabira, which it is now expanding to 25 MW. Details on the project are available within the Hawilti+ research terminal.

Read more »

Tragedy hits Niger Delta as illegal bunkering site explosion kills 100

Over 100 people lost their lives last weekend at an illegal crude oil bunkering site at the Abaezi forest, in the Ohaji-Egbema Local Government Area of Nigeria’s Imo state. The illegal oil refining depot bordered Nigeria’s Rivers and Imo states and is one of many such sites operated across the Niger Delta by illegal refiners seeking to profit from the country’s oil reserves. The explosion happened as the government has intensified its crack down on pipeline vandalism and crude theft – which many use to secure the feedstock required for their illegal refining activities. These remain carried out outside any supervision, sometimes with makeshift equipment that often causes fatal accidents and heavy pollution. Several vehicles that were in a queue to buy illegal fuel were reportedly burnt by the fire outbreak that took the lives of over 100 people.

Read more »

Exploration in Angola: find out about the country’s latest bidding round at Cape VIII

On April 5th, the Angolan National Oil, Gas and Biofuels Agency (ANPG) opened a tender for eight oil blocks in the Lower Congo and Kwanza offshore basins. These include Blocks 16/21, 31/21, 32/21, 33/21 and 34/21 in the Lower Congo and Blocks 7/21, 8/21 and 9/21 in the Kwanza Basin. In the presence of Minister of Mineral Resources, Petroleum and Gas, Diamantino Pedro Azevedo and Secretary of State for Oil and Gas José Barroso, the round of offshore blocks piqued the interest of several global oil majors operating in the country. Eni Angola notably submitted a bid for Block 31/21, as operator with a 50% interest, in partnership with Equinor (50%). On its side, TotalEnergies presented a bid proposal for Block 16/21, with a 100% stake. “Knowing that the basins in the bidding have been studied and the investors have been able to prove that our business environment is recommended – and that investors recognise it – and that the ANPG guarantees dialogue and continuous work with operators and with partners who trust Angola, it is something that shows us that we are on the right path and that we must commit more to boost our oil & gas sector and its contribution to the national economy,” commented Paulino Jerónimo, CEO of the ANPG. The bidding round was notably launched a month before the 8th African Petroleum Congress and Exhibition (CAPE VIII), set to take place in Luanda from May 16th-19th. The congress is sponsored by SONANGOL, TOTAL ENERGIES, EXXONMOBIL, CHEVRON, EQUINOR, TRAFIGURA, SOMOIL, SINOPEC, BFA, SNH, BRIMONT, SHEARWATER and is supported by PETAN, OGTAN, AECIPA. Headline topics include, among others, ANPG’s latest bid round, the energy transition, and opportunities and challenges under the new geopolitical paradigm shift. The congress is organized by the African Petroleum Producers Organization (APPO), the government of the Republic of Angola (for the first time), the Angolan National Oil, Gas and Biofuels Agency (ANPG) and AME Trade Ltd. The three-day event will be centered around the theme of “Energy Transition: Challenges and Opportunities in the African Oil and Gas Industry,” and assemble experts from the national, regional, and international energy and oil and gas industries to deliberate the challenges and opportunities of the energy transition and the future of the oil and gas industry in Africa. The congress will be the ideal platform for Africa’s leading oil and gas producers to confront the foregoing challenges and engender solutions to maximize its oil and gas resources. Amid the drive by developed economies towards decarbonization and net-zero policies, attending energy stakeholders will have the opportunity to reinforce the case for regional integrated supply chains and pooling resources to leverage the catalytic power of hydrocarbons in a sustainable manner. Supported by countless multinationals across the energy value chain and national oil companies, CAPE VIII will feature illuminating insight from a range of illustrious keynote speakers, who will position to influence the future landscape of energy in Africa and beyond. Confirmed Keynote speakers notably include: H.E. Diamantino Pedro Azevedo, Minister of Mineral and Petroleum Resources of Angola, President of APPO; H.E. Mahamane Sani Mahamadou Issoufou, Minister of Petroleum, Energy and Renewable Energy Republic of Niger; H.E Gabriel Obiang Lima, Minister of Industry, Mines and Energy of Equatorial Guinea; H.E. Samson Gwede Mantashe, Minister of Mineral Resources and Energy, South Africa; H.E. Dr Matthew Opoku Prempeh, Minister of Energy, Ghana; H.E. Thomas Camara, Minister of Mines, Petroleum and Energy, Ivory Coast; H.E. Didier Budimbu Ntubuanga, Minister of Hydrocarbons, Democratic Republic of Congo; H.E. Mohamed Arkab, Minister of Energy and Mines, Algeria; H.E. Bruno Jean Richard Itoua, Minister of Hydrocarbons, Congo; H.E Vincent de Paul Massassa, Minister of Petroleum, Gas and Mines, Republic of Gabon; Toufik HEKKAR, CEO of Sonatrach, Algeria; Jianqiang Zhang, President, Sinopec Angola; Dr. Omar Farouk Ibrahim, Secretary General, African Petroleum Producers Association (APPO); Ms. Cany Jobe, Director of Exploration and Production, Gambia National Petroleum Corporation; Immanuel Mulunga, Managing Director, Namcor; Edson R Dos Santosi, CEO, SOMOIL ; Dr. Ibrahim Mamane, Directeur Général, SONIDEP ; Osam Iyahen, Vice President, Oil & Gas, Africa Finance Corporation; Bráulio de Brito, Chairman, Angola O&G Service Companies Association (AECIPA); Zakaria Dosso, Managing Director, AEICORP; Matthieu Milandri, Head of Upstream Finance, Trafigura; Yann Pierre Albert Livulibutt Yangari, Independent Consultant; Dr. Babafemi Oyewole, the CEO of Energy Synergy Partners; Tim Dixon, Director and General Manager, IEA Greenhouse Gas R&D Programme. The congress will notably welcome the participation of several African national oil companies (NOCS), including Sonangol (Angola), SNH (Cameroon), SHT (Chad), PETROCI (Côte d’Ivoire), SNPC (Congo), NNPC (Nigeria), Sonatrach (Algeria), GE Petrol and Sonagas (Equatorial Guinea), and SONIDEP (Niger). In this crucial period for the development of the industry in Africa & globally, CAPE VIII presents a unique opportunity to connect with key stakeholders from Africa’s petroleum producing countries.

Read more »

Madagascar: Ambatolampy 20 MW solar substation energized

The Ambatolampy 20MW 20/63KV solar substation, built by Malgasy contractor ENERTEC MADA, was successfully energized on April 9th. This marks a new critical milestone in the expansion of the Ambatolampy solar PV plant from 20MW to 40MW. The end of construction on the second phase of 20 MW had already been announced by AXIAN Energy’s CEO Benjamin Memmi back in February this year. The initial 20 MW facility was developed by Green Yellow, an affiliate of France’s mass-market retail Casino Group, and has been producing clean power since 2018. It remains until today the largest solar plant in the Indian Ocean. Malgasy conglomerate Axian eventually acquired 51% of the solar plant’s shares in June 2020 before embarking on an expansion to 40 MW while equipping the facility with a 5 MWh energy storage system. Full details on the Ambatolampy Solar PV Plant in Madagascar are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Mozambique inaugurates its largest solar PV plant yet

Last week, President Filipe Jacinto Nyusi of Mozambique inaugurated the 41 MWp Metoro solar PV plant, built in the northern Cabo Delgado province. The $56m facility is owned by French IPP Neoen (75%) and state utility EDM (25%) and was built by Portuguese contractor Efacec. It was financed by a $40m debt package provided by the French Development Agency and its subsidiary Proparco. It is Mozambique’s largest solar plant and notably follows the inauguration of Scatec Solar’s 40 MW Mocuba solar plant in the Zambézia Province in 2019. Central Solar Metoro’s 121,500 PV modules are able to generate up to 69 GWh a year for the Mozambican grid, ensuring the consumption of some 140,000 people.

Read more »

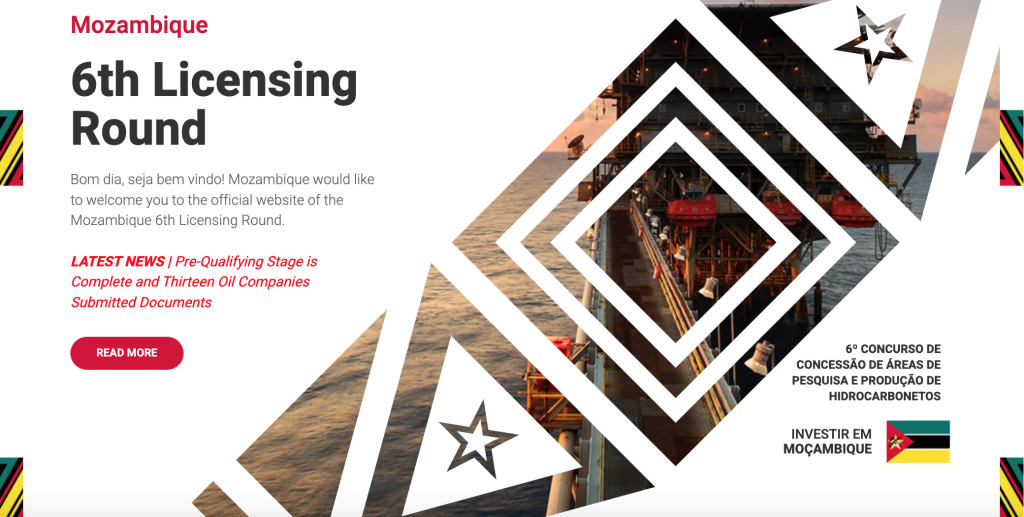

NOCs dominate list of bidders under Mozambique’s 6th Licensing Round

Following the completion of the pre-qualification process for Mozambique’s 6th Licensing Round, a total of 13 companies have submitted documents. Interested bidders mostly include national oil companies, including CNOOC, Sinopec International, and PetroChina International (CNPC) of China, ONGC Videsh of India, Rosneft (RN Angoche) of Russia and QatarEnergy. The IOCs that already have blocks in the country, including Eni, ExxonMobil and TotalEnergies, are also participating. The rest of the bidders include South Africa’s Sasol who already produces gas from the onshore Temane and Pande fields; Russia’s gas independent Novatek; Nigerian independent Aiteo E&P; and Discover Exploration, who operates Licenses 35, 36 and 37 in the Comoros just outboard of Mozambique’s offshore Rovuma Areas 1 and 4. Under the 6th Licensing Round, companies are able to apply for Exploration and Production Concession Contracts (EPCC) after studying data licensed by the INP under standard Master Licensing Agreements (MLA). Most work commitment programmes include a first sub-period with seismic acquisition and a minimum spending of $5m. Drilling commitments must be made only when entering the second sub-period. To support bidders, the INP has made available 2D and 3D seismic datasets for Multi-Client licensing. These surveys cover both onshore and offshore areas and consist of 22,715 sq. km of 3D seismic, 41,905 km of offshore 2D seismic and 18,735 km of onshore 2D seismic.

Read more »

Savannah Energy plans 250 MW wind farm in Niger

Savannah Energy, operator of some of the most prolific oil blocks in Niger, is currently planning to construct and operate the country’s first wind farm in its Tahoua Region. The project was subject to the execution of an agreement yesterday between Savannah Energy and the Ministry of Petroleum, Energy and Renewable Energies of the Republic of Niger. The wind farm will be structured as an independent power producer (IPP) and is currently in feasibility study. It is expected to be sanctioned in 2023 for a potential commissioning in 2025. Initial plans include the installation of 60 wind turbines with a total power generation capacity of up to 250 MW. The project’s timeline notably seeks to align it with the development of the West African Power Pool (WAPP) that would facilitate the exchange of electricity between West African markets via a high voltage interconnection network. Niger is scheduled to be connected to the WAPP in 2023 via a 330 kV line financed by the World Bank, the African Development Bank (AfDB), the European Union and the Agence française de Développement (AfD). Subject to the planned feasibility study confirming the ultimate scale of the project, the Tarka wind farm could produce some 600 GWh a year. Its construction could also support 500 jobs, displace carbon emissions by 400,000 tonnes of CO2/year and help reduce the cost of electricity for Nigerien households and industries.

Read more »

Can African oil producers help the world end reliance on Russian oil and gas?

Unlocking Africa’s oil and gas potential is now imperative against the backdrop of the war in Ukraine and the resulting crude, diesel, and gas supply crunch. This has rendered European dependence on Russian energy untenable, creating a major opportunity for Africa to position itself as a crucial option to increase the supply to the global energy markets. However, significant challenges remain for the continent’s hydrocarbon producers to suddenly ramp up their production due to infrastructure, finance, and technology deficits. Countries with major LNG resources, such as Nigeria, Angola, Libya, and Algeria, suffer from limited and underdeveloped pipeline networks, refineries, jetties, terminals, and ports. Additionally, incentivizing foreign investment is often problematized by a host of risk factors, including political instability, local insecurity issues and financial institutions shifting investments from fossil fuels to renewables. Finally, securing the latest technology to facilitate local content development has proven cost prohibitive given the reliance on foreign intellectual property and the continual brain drain of key local human capital. All the above issues will be discussed at the 8th Africa Petroleum Congress and Exhibition (CAPE VIII) taking place from 16-19 May 2022 in Luanda, Angola. The congress is organized by the African Petroleum Producers Organization (APPO), the government of the Republic of Angola (for the first time), and AME Trade Ltd. The three-day event will be centered around the theme of “Energy Transition: Challenges and Opportunities in the African Oil and Gas Industry,” and assemble experts from the national, regional, and international energy and oil and gas industries to deliberate the challenges and opportunities of the energy transition and the future of the oil and gas industry in Africa. CAPE VIII will unfold against the recession of the global pandemic that exacerbated record production declines across African hydrocarbon producing countries from 2020 to 2021. The annus horribilis was compounded by under-investment in exploration activities, leaving several of the continent’s biggest energy players struggling to cope with the post-lockdown surge in demand for hydrocarbons. Fortunately, APPO’s ambition to establish the continent as an energy hub regained significant headwind with a stellar upstream development outlook for 2022 and beyond. The congress will be the ideal platform for Africa’s leading oil and gas producers to confront the foregoing challenges and engender solutions to maximize its oil and gas resources. Amid the drive by developed economies towards decarbonization and net-zero policies, attending energy stakeholders will have the opportunity to reinforce the case for regional integrated supply chains and pooling resources to leverage the catalytic power of hydrocarbons in a sustainable manner. Supported by countless multinationals across the energy value chain and national oil companies, CAPE VIII will feature illuminating insight from a range of illustrious keynote speakers, who will mold the future landscape of energy in Africa and beyond. Keynote speakers at the conference will include: H.E. Diamantino Pedro Azevedo, Minister of Mineral and Petroleum Resources of Angola, President of APPO H.E. Mahamane Sani Mahamadou Issoufou, Minister of Petroleum, Energy and Renewable Energy Republic of Niger H.E. Samson Gwede Mantashe, Minister of Mineral Resources and Energy, South Africa H.E. Dr Matthew Opoku Prempeh, Minister of Energy, Ghana, H.E. Thomas Camara, Minister of Mines, Petroleum and Energy, Ivory Coast Dr. Omar Farouk Ibrahim, Secretary General, African Petroleum Producers Association (APPO) Ms. Cany Jobe, Director of Exploration and Production , Gambia National Petroleum Corporation Mr. Edson R Dos Santosi, CEO, SOMOIL Dr. Ibrahim Mamane, Directeur Général, SONIDEP Mr. Osam Iyahen , Vice President, Oil & Gas, Africa Finance Corporation Mr. Bráulio de Brito, Chairman, Angola O&G Service Companies Association (AECIPA) Mr. Zakaria Dosso, Managing Director, AEICORP Mr. Matthieu Milandri, Head of Upstream Finance, Trafigura Mr. Yann Pierre Albert Livulibutt Yangari, Independent Consultant Mr. Dr. Babafemi Oyewole, the CEO of Energy Synergy Partners Tim Dixon, Director and General Manager, IEA Greenhouse Gas R&D Programme Confirmed National Oil Companies at CAPE VIII include. SONANGOL, Angola SNH, Cameroon SHT, Chad Petroci, Cote d’Ivoire SNPC, Congo NNPC, Nigeria Sonagol, Angola GE Petrol, Equatorial Guinea Sonagas, Equatorial Guinea CAPE VIII is sponsored by the continent’s leading oil and gas players including: SONANGOL, TOTAL ENERGIES, EXXONMOBIL, CHEVRON, EQUINOR, TRAFIGURA, SOMOIL, BRIMONT, SHEARWATER. Hawilti is a proud Communication Partner of Cape VIII.

Read more »

Invictus Energy commits to more gas exploration onshore Zimbabwe

Geo Associates, who is about to drill in Zimbabwe what is believed to be the largest undrilled structure onshore Africa, has just committed to a second well this year. The company is a subsidiary of Australian independent Invictus Energy and holds an 80% interest in SG 4571 over the Cabora Bassa Basin in northern Zimbabwe. The area had already been explored by Mobil back in the 1990s, when the American major spent $30m acquiring surface and subsurface data, including gravity surveys and over 1,600 line kilometres of 2D seismic data. Back then, the massive 200km2 Mzarabani anticline had been identified and mapped, believed to host a conventional gas target. Last year, Polaris Natural Resources acquired 402.2km of 2D seismic over the license to support exploratory drilling by Exalo Drilling in June this year. The Mzarabani Prospect alone is estimated to contain 8.2 Tcf of gas and 250 million barrels of conventional gas / condensate (gross mean unrisked) across 5 horizons. But Geo Associates has decided to bet even higher on Cabora Bassa and has just signed a Heads of Agreement with the Sovereign Wealth Fund of Zimbabwe (SWFZ) to amalgamate SG 4571 with SWFZ’s MSC003 Cabora Bassa South Reserved Area. As a result the licence area has increased sevenfold from 100,000 ha to 709,300ha andnow covers the entire Cabora Bassa Basin in Zimbabwe. The company notably committed to increase its minimum work programme obligations for SG 4571’s second exploration period, which runs to June 2024. These include the acquisition of an additional 400km line of seismic data in the expanded area, and the drill of a second exploration well as part of the drilling campaign set to start in the middle of this year. Full details on the Cabora Bassa Gas Project onshore Zimbabwe are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

In this new oil market supercycle, African operators turn to local content for help

Economic recovery, geopolitics and the overall global energy demand and supply have impacted the price of both crude oil and natural gas in the last couple of months. A reality that has gotten genuine industry players working, especially within Africa. On the continent, oil players are ramping up activity first for their domestic markets, and of course to supply international markets that are in dire need of some respite in the face of the uncertainty and chaos caused by the Russian invasion of Ukraine. In this context, agitation and worry will not solve the problems, only strategic business decisions will. It is no news that several oil and gas asset owners in Africa are eager to get their fields to production after three to four years of stagnating performances. But while there is hydrocarbon to be produced and current prices are certainly attractive, the equation will be incomplete without the deployment of the right assets in the hands of the right team. Every day and possibly every hour, a meeting is being held across African energy capitals. In Lagos, Luanda, or Brazzaville, the focus is on investments, project execution, and asset purchase/lease. But how many of these negotiations will transition into profitable and executable ventures? This is not the time to take a chance on new market entrants, but the time to move forward with experienced and verified stakeholders who know what’s at stake and can act quickly. In Nigeria, credible intel has it that the management of West Africa Exploration & Production (WAEP) and General Hydrocarbon Limited (GHL) have formally engaged the Century Group for the development and production of their assets, all in the same week. The former has a substantial interest in OML 71/72 where lies the Kalaekule field, while the latter is the lead stakeholder in OML 120 where it is planning the redevelopment of the Oyo field. In selecting Century Group, both companies have concretely chosen to use the in-country assets of arguably the only Nigerian wholly-owned company providing FPSO solutions at the moment. The company has indeed a proven track record of safe operational framework and of over 30% cost savings even in the heart of the COVID 19 lockdown. When historic times call for urgent solutions, it turns out that local content is the most strategic, prudent, and cost-efficient decision for new hydrocarbons producers like WAEP and GHL. Over the past decade, several Nigerian energy companies have undoubtedly proven that they are energy infrastructure experts and have boosted indigenous capacity and participation. But none has really compared to the Century Group who is now well-positioned to support upcoming projects in the country. And this is just the beginning. More African names like UTM Offshore Limited or PFL Engineering Limited can now be trusted as capable partners to shape the future of the Nigerian energy industry post exit of IOCs. In the same vein, the sale of crucial energy infrastructure should be based first on the criteria of capacity to operate sustainably rather than solely on finance. Nigeria has a huge budget deficit (NGN 6.25tn, or approximately 3.39% of its GDP) and is heavily reliant on foreign debt financing. For an economy that heavily relies on oil, the current reality is a great opportunity to support recovery and help the country meet its fiscal and infrastructural obligations to the citizenry through direct earnings. Let the fields come alive and most of all, let the country’s most competent ones lead the charge.

Read more »

World’s leading titanium manufacturer to set up 200 MW solar plant in South Africa

Tronox Holdings, one of the world’s leading producers of high-quality titanium products, has signed a power purchase agreement (PPA) this week with South African IPP SOLA Group for 200 MW of solar power capacity. The project is expected to be commissioned by Q4 2023 and supply clean energy to Tronox’ mines and smelters in South Africa. “This 200 MW solar project is expected to provide approximately 40% of Tronox’s South African electricity needs and lower its worldwide scope 1 & 2 emissions by approximately 13%,” Tronox said in a statement. The company has set a target of aligning with a global warming scenario below 2° C and achieve net zero GHG emissions by 2050.

Read more »

World’s second largest granulated urea plant commissioned in Nigeria

Yesterday, President Muhammadu Buhari commissioned Africa’s largest granulated urea plant and the second biggest in the world in Ibeju Lekki. The Dangote Fertilizer facility has a capacity of 3 million tonnes per annum (mtpa) and is now making Nigeria self-sufficient in fertilizers, with extra capacity reserved for exports. “We have already started exporting to the USA, Brazil, India and Mexico,” Aliko Dangote said during the commissioning ceremony held at the Lekki Free Zone. The $2.5bn twin train facility processes domestic gas to produce urea and ammonia, and is located next to the 650,000 bpd Dangote refinery and petrochemicals complex, where operations are yet to start. Just this month, state-owned NNPC, the Shell Petroleum Development Co. (SPDC) JV and Dangote sealed a new Gas Supply & Aggregation Agreement (GSAA) to supply 70 MMscfd of gas from the Tunu CPF (OML 35) to Dangote Fertilizer. Another GSAA had previously been signed in December 2019 with Chevron Nigeria.

Read more »

Africa’s largest copper-gold mine to run on renewable energy

First Quantum Minerals (FQM), the company that notably operates Africa’s biggest copper mine by production in Zambia, has entered into a new partnership with Chariot and Total Eren to develop 430 MW of solar and wind power for its mining operations in Zambia. Both Chariot and Total Eren had signed last year binding key terms of a long-term joint-development partnership to jointly originate and develop wind and solar projects for mining clients in Africa. Their project in Zambia with FQM would be unique in scale for Africa and help the global mining company to decarbonize its operations as it seeks to reduce its carbon footprint by 30% by 2025. Additional renewable energy capacity would notably support operations at FQM’s flagship Kansanshi copper-gold mine new Solwezi in Northern Zambia. Since 2005, FQM has expanded its operations there and is now capable of producing 340,000 tonnes of copper and more than 120,000 ounces of gold per year.

Read more »Algeria: significant onshore oil & gas discovery by Sonatrach and Eni

On Sunday, Italian major Eni and national oil company Sonatrach have announced a new significant onshore oil and associated gas discovery in their Zemlet el Arbi concession within the HDLE prospect. This is the first of five exploratory wells planned in the Berjine North Basin in the Algerian desert. The concession is operated by their joint-venture, with Sonatrach holding 51% and Eni the remaining 49%. “Preliminary estimates of the size of the discovery are around 140 million barrels of oil in place,” Eni said in a statement. Both company have already declared that they would fast-track the field’s development for a start-up in Q3 2022. The HDLE-1 discovery is located about 15km from the Bir Rebaa North field processing facilities. The well discovered light oil in the Triassic sandstones of Tagi Formation, confirming 26 m of net pay with excellent petrophysical characteristics. Its production test delivered 7,000 barrels of oil per day (bopd) and 5 MMscfd of gas. “The discovery will be quickly appraised with the drilling of a second well, HDLE-2, in April 2022 to confirm the additional potential of the structure extending in the adjacent Sif Fatima 2 concession operated by an Eni-Sonatrach JV (50-50%),” Eni added.

Read more »

Eraskon Nigeria breaks ground on new industrial manufacturing complex

During a grand ceremony held in Yenagoa earlier today, Eraskon Nigeria has officially broken ground on its 64,000 litres per day lubricants blending plant at Gbarain in Bayelsa State. The groundbreaking was preceded by a ceremony marking the launch of the company’s new ERASKO GOLD lubricants products line. Both functions were attended by key Nigerian officials, including former President Dr. Goodluck E. Jonathan and Engr. Simbi Wabote, Executive Secretary of the Nigerian Content Development & Monitoring Board (NCDMB). Eraskon Nigeria is the company executing the project as a joint-venture between ERASKORP Nigeria and the NCDMB. The facility is expected to be commissioned in December 2022 and will help in meeting increasing domestic demand for high quality lubricants, engine oil, transmission fuels, engine coolers and specialty products such as waxes. “Nigeria consumes 800 million litres of engine oil and lubricants every year and its consumption continues to grow by 5% per annum,” said Engr. Simbi Wabote during the ceremony in Yenagoa. “Nigeria’s in-country blending capacity stands at only 150 million litres so we have a huge gap that remains met by imports,” he added. “Eraskon Nigeria’s project will result in the building of a world-class facility producing a range of high-quality lubricants for the Nigerian market,” declared Maxwell Oko, Vice Chairman and CEO at ERASKORP. “This plant is the first step in realizing our vision to build an industrial conglomerate in the Niger Delta,” he added. The lubricants blending plant is being built on 8ha of land, out of a total 50ha acquired around Shell’s Gbarain gas hub. The company envisions to further integrate its operations in the future by producing drilling and production chemicals, turbine oil and house products such as detergents and aerosols. Gbrain is increasingly emerging as a local content hub housing some of Nigeria’s newest energy infrastructure. The 12,000 barrels per day (bpd) Azikel Refinery is currently nearing completion at the same location, while Rungas expects to commission its LPG composite cylinder manufacturing unit there as well this year.

Read more »

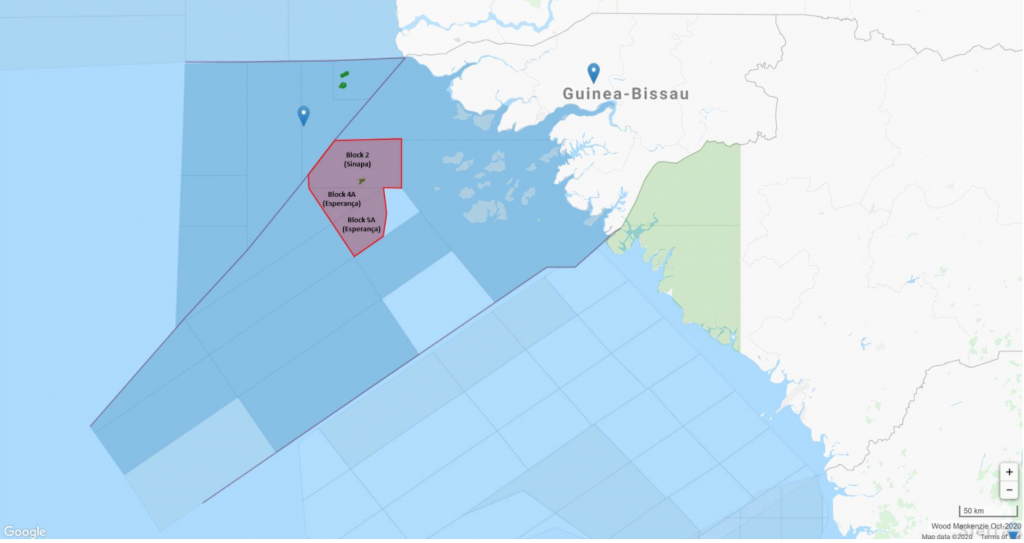

FAR Ltd to withdraw from Guinea-Bissau exploration blocks

Australian independent Far has commenced steps to withdraw from its interests in the Esperanca Blocks 4A & 5A and Sinapa Block 2 offshore Guinea Bissau, the company said today. The licenses are operated by PetroNor E&P with a 78.57% interest while FAR holds the remaining 21.43%. In October 2020, the current exploration phases for the blocks were extended for 3 years and are now valid until October 2023, with an obligation to drill an exploration well. Since 2021, PetroNor and FAR had been undertaking a full review of a potential well location for the 2023 program. The Atum Propsect is believed to be the key drill target and is mapped to contain Best Estimate Prospective Resource of 471m barrels (unrisked P50). FAR’s exit from Guinea-Bissau follows its exit from the Sangomar Offshore Oil Project offshore Senegal last year after being in default of payment. However, FAR continues to be present offshore The Gambia, where it is operator with a 50% interest of Blocks A2 & A5. While the results of its Bambo-1 well on Block A2 were unsuccessful, FAR did not throw the towel and has highgraded three of the four mapped prospects for potential drilling: Panthera in Block A2, and Jatto and Malo in Block A5. The company’s best estimate (P50) for these three prospects is of 1.5 billion barrels of prospective resource volumes.

Read more »

Nigeria’s Sahara Group strengthens governance as it drives expansion

Over the weekend, Nigerian energy and infrastructure conglomerate Sahara Group has announced new strategic appointments to support its expansion across Africa and the rest of the world. The appointments all took effect on March 1st, 2022. The head of the group’s downstream business in Nigeria, Foluso Sobanjo, was notably bumped to Head of Sahara’s downstream operations across Africa. Sahara has been increasingly expanding its investments and presence across key growing markets on the continent and currently runs operations in Nigeria, Ghana, Cote d’Ivoire, Senegal, Guinea, Cameroun, Kenya, Uganda and Tanzania. Last year, the group notably announced the expansion of its petroleum products storage capacity in Tanzania to 72m litres. Equally important, Sahara has reinforced its sustainability governance by promoting its Director of Governance and Sustainability, Pearl Uzokwe, as Director of the Sahara Foundation. Pearl Uzokwe had previously championed Sahara’s energy transition efforts and led the group’s sustainability reporting over the past few years. Finally, and in replacement of Pearl Uzokwe, Sahara has appointed Ejiro Gray as its new Director of Governance and Sustainability.

Read more »

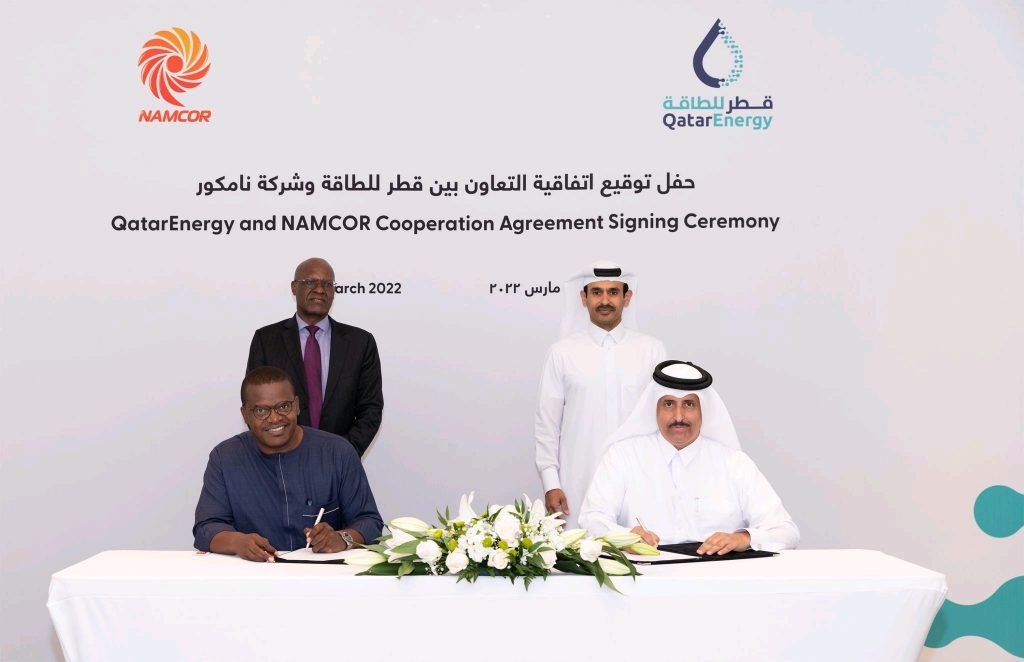

QatarEnergy deepens ties with Namibia

The state-owned national oil companies of Qatar and Namibia, QatarEnergy and NAMCOR E&P, have signed a Cooperation Agreement in Doha to deepen the energy cooperation between both countries. Under the agreement, QatarEnergy will support NAMCOR E&P in the development of a sustainable upstream oil and gas sector in Namibia, notably by providing training and human capital development opportunities to NAMCOR employees. Pursuant to the terms of the agreement, the two companies also agreed to work together on investment opportunities of mutual interest in Namibia’s upstream oil and gas sector. QatarEnergy is already a key investor in Namibia’s oil & gas sector. The company has a 40% non-operated interest in PEL 39 where Shell just announced the Graff-1 discovery, and a 30% non-operated interest in Block 2913b where TotalEnergies just announced the Venus-1 discovery.

Read more »