Energy

Perenco makes new oil find offshore Congo

Perenco has confirmed a new oil discovery within the Tchibeli North East pre-salt Vandji exploration prospect on its PNGF Sud shallow water permit in Congo-Brazzaville. “Good oil and gas shows were recorded on entry into the reservoir and a 75m oil column was interpreted on logs. A test of these zones produced at 2,000 bopd, followed by other analysis necessary to help confirm volumes,” the operator said. The company believes the new discovery could be a play opener in the pre-salt Congo, and holds a number of additional Vandji leads it could drill on the block. The block was a large shallow water permit initially awarded to Elf (now TotalEnergies) in the 1960s, which started producing in 1987. It was taken over by a partnership led by independent Perenco in January 2017 along with Hemla E&P Congo Continent Congo, Africa Oil & Gas Corporation and Petro Congo. PNGF Sud remains a mature oil asset holding significant remaining potential, with significant infrastructure in place. Nine steel jackets are currently installed and act as drilling or processing centers, supporting 67 producing wells across five fields in 2022: Tchibouela, Tchendo, Tchibeli, Litanzi and Tchibouela East. The partnership is currently executing several brownfield projects on the block to boost production, with up to six wells scheduled for 2023. Full details on the development of PNGF Sud are available in the “Projects” section within your Hawilti+ research terminal.

Read more »

Mali: official inauguration of the 140 MW Gouina hydropower plant

Mali, Guinea, Mauritania and Senegal celebrated over the weekend the inauguration of the 140 MW Gouina hydropower plant, whose units were commissioned earlier this year. The facility was built as part of a multi-project plan involving the construction of several hydroelectric stations along the Senegal River, where the hydroelectric potential is estimated at 1,200 MW. The project is owned and managed by the Organization for the Development of the Senegal River (OMVS), which received a loan of $ 110 million from the International Development Association of the World Bank several years ago for this integrated management programme for the region’s water resources. The Gouina plant is the third hydropower project of this type to be commissioned by the OMVS after the 205 MW Manantali plant in 2002 and the 60 MW Félou plant in 2013.

Read more »

AMEA Power to expand Togo’s flagship solar PV plant

AMEA Power has secured $25m in debt from the Abu Dhabi Exports Office to expand Togo’s Blitta solar PV facility. The 50 MW project, known as the Sheikh Mohammed Bin Zayed Solar Power Plant, was commissioned in June 2021 and is currently able to supply power to almost 160,000 Togolese households. Its expansion phase will add another 20 MW of solar power generation capacity and see the installation of a 4 MWh Battery Energy Storage System (BESS) to enable the supply of clean power at night. Upon completion, the 70 MW plant will be West Africa’s biggest solar PV station.

Read more »

Fourth well of the year in Orange Basin is a failure. What’s Next?

Eco (Atlantic) Oil & Gas has announced that its shallow water Gazania-1 well within Block 2B offshore South Africa did not encounter commercial hydrocarbons. The well was the fourth one to be drilled this year in the Orange Basin following Graff-1 (Shell), Venus-1 (TotalEnergies) and La Rona-1 (Shell). Gazania-1 is the only disappointing one so far. Gazania-1 was considered to be a near-term low-risk well, and its prospect’s size had best estimate prospective resources of 300 million barrels. More importantly, the well had a 60% chance of success and targeted an updip section of the already discovered A-J reservoir, along with overlapping potential reservoirs. “Gases normally associated with light oil were encountered throughout the drilling of the Gazania-1 well. This, in our view, confirms the active hydrocarbon system, proven by the A-J1 discovery well in 1988, extends to the part of the basin where the Gazania-1 well is located. Further seismic interpretation will likely lead to the definition of viable areas for trapping downdip of Gazania-1 closer to the 1988 oil discovery A-J1,” Eco Atlantic COO Colin Kinley said in a statement. But this is just the beginning for drilling in the Orange Basin, which straddles both Namibia and South Africa. In Namibia, Shell is about to resume drilling on PEL 39 where it has already discovered oil & gas earlier this year at Graff and La Rona. The Deepsea Bollsta has been contracted for the campaign set to start by the end of 2022 and last for a year. Meanwhile, TotalEnergies is expected to start appraisal drilling soon around Venus in Namibia which could be the biggest African discovery ever made. In South Africa, the French is also planning several key exploratory wells in 2023 and 2024 on Block 5/6/7 and DWOB. Meanwhile, Eco Atlantic itself will be part of another exploratory drilling campaign next year on two wells within Block 3B/4B, operated by Africa Oil Corp and where the un-risked prospective resource is estimated at over 3bn barrels of oil and liquids and over 1.3 Tcf of gas.

Read more »

Mozambique’s Coral Sul FLNG project has delivered its first cargo

Eni has announced the departure of the first LNG cargo from its Coral Sul floating LNG facility offshore Mozambique on November 13th. The Italian major is operator of the project with partners ExxonMobil, CNPC, Galp Energia, KOGAS, and national oil company ENH. The project has come on stream in line with its initial budget and schedule, despite several constraints generated by the Covid-19 pandemic. The Coral Sul FLNG unit has a capacity of 3.4 million tons per annum and is Mozambique’s first gas export project. Under an agreement signed with bp in October 2016, the British major will be the sole off-taker for the entire volumes of LNG produced by the Coral South project for a period of over twenty years. Eni revealed earlier this year that it was considering a second floating unit in the country in response of Europe’s needs to replace gas imports from Russia.

Read more »

Invictus Energy confirms working hydrocarbons system onshore Zimbabwe

Invictus Energy has reported fluorescence end elevated gas shows of up to 65 times above background levels in the Upper Angwa primary target of its Mukuy-1 well onshore Zimbabwe. The well is yet to reach total depth and has confimed a working conventional hydrocarbon system in the Cabora Bassin. “We still have several hundred metres of drilling through our primary targets with additional potential, which will be followed by a comprehensive wireline logging programme to evaluate results, with the aim of confirming the presence of moveable hydrocarbons in multiple zones,” said Scott Mcmillan, Managing Director of Invictus Energy. The company and its drilling contractor, EXALO Drilling, have encountered a few technical issues during the campaign that have slowed down drilling progress. However, a recent changeout of the downhole drilling motor has allowed operations to continue and the Exalo 202 Rig will now recommence drilling through the primary targets. What’s at Stake at Cabora Bassa? Thought to potentially be the largest undrilled structure onshore Africa, the Mukuyu pospect is subject to intense scrutiny for its potential to transform Zimbabwe’s energy landscape. The prospect is being drilled amidst favourable market conditions and a growing appetite for gas in Zimbabwe and Southern Africa. The Mukuyu Prospect alone is estimated to contain 20 Tcf of gas and 845 million barrels of conventional gas / condensate (gross mean unrisked) across 5 horizons.

Read more »

ReconAfrica’s Namibian wildcat: geological success but commercial failure

Reconnaissance Energy Africa has announced that’s its first wildcat onshore Zimbabwe, the Makandina 8-2 well, has been a geological success but failed to show commercial quantities of hydrocarbons. The well reached total depth in mid-August and confirmed the presence of a working petroleum system by encountering intervals rich with methane and hydrocarbon gas liquids such as ethane, butane, and propane. “Although geologically a successful well, economic accumulations of hydrocarbons were not encountered,” ReconAfrica said in a statement. The company is now proceeding with its plans for the second well, Wisdom 5-1, whose spudding is expected in mid-December. It is also extended its 2D seismic acquisition programme with an additional 1,500 linear km approved to be acquired between November 2022 and April 2023.

Read more »Bridport Energy makes new Board appointments ahead of inaugural LNG cargo in Nigeria

Nigerian LNG distribution company Bridport Energy has made new appointments to its Board of Directors, the company has said today. Engr. Ahmadu-Kida Musa and Mr. Auwalu A. Ilu, two experienced energy executives, have joined the company as Non-Executive Directors effective 1st October 2022. Both directors are well-known within the Nigerian oil & gas sector, where they have successfully held leadership position within international and local companies. Engr. Ahmadu-Kida Musa has over three decades of experience working in the oil & gas industry and worked on several of TotalEnergies’ onshore and offshore gas projects in Nigeria. He was until 2020 the Deputy Managing Director of TotalEnergies’ deep-water district in the country. On the other side, Mr. Ilu founded and runs one of Nigeria’s most successful LPG businesses, Ultimate Gas. He brings over 20 years of experience in the energy, maritime, and logistics industry. Bridport Energy is one of the Nigerian companies who signed a Sales & Purchase Agreement (SPA) with Nigeria LNG in 2021 to start delivering liquefied natural gas (LNG) to the domestic market. The expansion of its Board comes as the company is currently developing an LNG import, storage, and distribution terminal in Lagos where first cargo is expected within a few months.

Read more »

Angola: ExxonMobil makes new discovery on Block 15

Angola’s National Oil, Gas and Biofuels Agency (ANPG) has announced a new discovery at the Bavuca Sul-1 well on Block 15. The block is operated by ExxonMobil (36%) in partnership with Azule Energy (42%), Equinor (12%) and Sonangol E&P (10%). ExxonMobil is currently executing a redevelopment programme on the block, following a June 2019 agreement with the ANPG to boost production. The operator is expecting to increase output by 40,000 barrels of oil per day (bopd) by executing a multi-year drilling program and install new infrastructure technology to increase capacity of the existing flowlines. The Valaris DS-9 drillship was contracted for the drilling campaign, under a 2-year contract from June 2022 to June 2024. Phase one of drilling is targeting 17 wells while Phase 2 targets about 20 wells. Valaris had already announced the drilling of the exploration well at the end of September 2022, but without providing further details. “The well encountered 30 meters (98 feet) of high-quality sandstone containing hydrocarbons (…) at a water depth of 1,100 meters (3,608 feet),” the ANPG said today. Bavuca Sul-1 marks the 18th discovery on Block 15, where the Kizomba A FPSO started producing in 2004 followed by the Kizomba B FPSO in 2005. No new discovery had been made on the block since that of Bavuca in 2003.

Read more »

Angola: 12-well extension contract for the Libongos drillship

Sonadrill, the joint-venture between Seadrill and Sonangol, has secured a 12-well extension in Angola for the Libongos drillship, Seadrill announced today. The firm portion of the contract is worth $327m with commencement expected in Q4 2022 with a firm-term of approximately 25 months. The Libongos drillship was already under a multi-year contract with Eni Angola, Hawilti’s Offshore Rigs Tracker shows. The unit is reported to have been part of the company’s drilling campaign on Block 15/06, where Eni has made seven discoveries over the past four years and is executing several subsea tie-back projects on the block. Eni Angola, which now forms part of Azule Energy with bp Angola, is also progressing the full field development of Agogo on Block 15/06. Tenders were issued in July 2021 for a project targeting a peak production of 120,000 bopd via the installation of a third FPSO unit on the block. The Libongos drillship is currently heading back to Block 15/06, data from Marine Traffic shows.

Read more »

Addax Petroleum officially exits Nigeria, transfers offshore blocks to NNPC

On November 1st, Addax Petroleum Development Nigeria Ltd signed a Transfer, Settlement and Exit Agreement (TSEA) with NNPC Ltd for offshore blocks OML 123, OML 124, OML 126, and OML 137. The subsidiary of the Sinopec Group has now ceased to be the production sharing contractor on these assets, after two decades operating in Nigeria. Much sought-after assets The operator had already been criticized for its lack of investment on the blocks, leading to the revocation of its licenses in March 2021 and their award to the consortium of Kaztec Engineering and Salvic Petroleum. However, an intervention by President Buhari had seen the blocks quickly returned to Addax Petroleum a month later. Throughout the rest of 2021, rumours circulated that another Nigerian consortium involving Mars E&P, a subsidiary of the AA&R Group, along with Kaztec Engineering and Salvic Petroleum was in the race to acquire Addax Petroleum’s interest in the four OMLs. AA&R notably announced in November 2021 a $274m senior secured reserve-based lending facility from the Afreximbank to support the acquisition. However, the deal eventually fell through and did not complete. Addax’ blocks were originally awarded on a sole risk basis (100% interest) and are considered very attractive by the industry. Two of them are currently producing: OML 123 has been on production since 2006 via the Yinson-operated Adoon FPSO that develops the Antan Field, and OML 126 since 2005 via the BW Offshore-operated Sendje Berge FPSO that develops the Okwori and Nda Fields. The Adoon FPSO pumped an average of 16,400 barrels of oil per day (bopd) from January to September this year, according to NUPRC data. Its charter period expires at the end of 2022. Meanwhile, the FPSO Sendje Berge’s average output stood at under 4,500 bopd over the past few months and the vessel lease and operation contract was extended by another year until Q4 2022. On the other side, OML 137 remains undeveloped but is believed to be the most attractive asset because it holds significant gas resources that could be monetised domestically or via exports.

Read more »

Eni to start exploratory drilling offshore Congo

Borr Drilling’s Prospector 5 jackup drilling rig has reached the Central African coast where it is expected to start drilling soon for Eni Congo. In August 2022, Borr Drilling had announced the signing of a letter of intent worth $68.9m for Prospector 5 to execute a 6-well firm program expected to start in Q4 2022 with a duration of 14 months plus options. Hawilti got confirmation from Eni officials that the rig is indeed mobilized by the major offshore Congo. The campaign is expected to start with the drilling of two exploratory wells on Marine VI bis, a block operated by Eni in partnership with Congo’s national oil company, SNPC. The block holds several prospects that have been matured over the past few years, including Mbenga, Poalvou Deep, and Ikalou SW. While Eni is yet to reveal which prospect(s) will be targeted, the Prospector 5 is currently heading towards Poalvou, data from Marine Traffic shows. This will be the second rig mobilized by Eni offshore Congo, data from Hawilti’s Offshore Rigs Tracker shows. The Borr Natt rig has already been contracted by the Italian major since January 2022, under a contract set to end in January 2023, unless options are exercised. Once exploratory drilling is completed on Marine VI bis, the Prospector 5 will support development drilling on Marine XII, where Eni is developing gas reserves to start exporting LNG next year. The Prospector 5 rig will drill five development wells on Marine XII, according to SNPC. Market activity has steadily picked up in Congo over the past year, with drilling mostly focused on shallow water blocks. In its Q1 2022 Exploration Watch, Hawilti notably reported the drilling of the Lidongo Marine-1 well on Marine XI by Mercuria. According to company sources, the well successfully tested one zone and flowed oil. While the resumption of drilling is good news for Congo, a country that produces some 270,000 barrels of oil per day (bopd), more could be on the table. Last year, TotalEnergies announced it was planning to drill the Niamou prospect on Marine XX, a deep-water block it secured in February 2020. Along with its partner Woodside Energy, the French major believes that Niamou is a large attractive deep offshore prospect which could help maintain Congo’s output in the medium term. (article updated on 7 November 2022 to reflect details of the drilling campaign provided by SNPC.) More information on projects activity in the Republic of Congo is available on your Hawilti+ research terminal – plus.hawilti.com.

Read more »

Nigeria: Daewoo E&C intends to “fix” both Kaduna and Warri refineries

While in South Korea last week, President Muhammadu Buhari witnessed the signing of a letter of intent (LoI) between NNPC Ltd and Daewoo E&C for the revised strategy to fix the state-owned Kaduna Refinery in northern Nigeria. According to officials, Daewoo E&C intends to complete the Kaduna refinery rehabilitation project by signing the official contract with the NNPC by the first quarter of 2023. The Kaduna refining complex was developed in two major phases: the construction of the 110,000 bpd refinery in 1983, followed by a 30,000 tpy petrochemical unit in 1988. Various factors have severely impacted the operational efficiency of the refinery. Over the past 10 years, capacity utilization at the Kaduna Refinery has averaged only 13.87%. Future rehabilitation works the refinery site and on associated pipelines and depots are expected to bring back capacity utilization to 90% in the near future. Daewoo E&C was already selected last June for the “quick fix” project at the state-owned Warri Refinery, under a contract worth $492.3m. Both refineries were initially scheduled for full rehabilitation under a $1.484bn contract with Italian contractor Saipem, approved by the Federal Executive Council (FEC) in August 2021. However, the deal fell through and led to the restructuring of both initiatives as cheaper, “quick fix” projects executed by Daewoo E&C. Meanwhile, Italian contractor Tecnimont is busy rehabilitating the state-owned Port Harcourt Refinery under a full-fledged, $1.5bn rehabilitation scheme that started in April 2021 and will last 40 months. In early June 2022, the Italian EPC contractor reached 1 million safe manhours without LTI at the site. Details on the rehabilitation of Nigerian refineries are available in your Hawilti+ research terminal.

Read more »

TechnipFMC sees at least $4.5bn worth of subsea opportunities in sub-Saharan Africa

TechnipFMC foresees between $4.5bn and $7bn of subsea opportunities in Angola, Nigeria, and Côte d’Ivoire over the coming 24 months, according to its latest earnings presentation. Angola Angola will continue to dominate the market in terms of projects’ scope and value, as it has for the past couple of years. The implementation of an enabling environment and the granting of fiscal incentives by the Government there has translated into several new projects being approved by International Oil Companies (IOCs). Last July for instance, TotalEnergies took a final investment decision on the Begonia subsea tie-back, a 5-well development tied back to its Pazflor FPSO on Block 17. While several subsea tie-back projects have already been executed, more are in the making like the tie back of the Alho, Cominhos and Cominhos East (ACCE) fields to TotalEnergies’ Kaombo Norte FPSO on Block 32. TechnipFMC expects the subsea scope there to be worth up to $1bn. Meanwhile, new production hubs are also moving forward and will rely on the deployment of additional FPSO units. This is the case at Agogo on Azule Energy’s Block 15/06 where TechnipFMC expects the subsea scope to be worth over $1bn. On the same block, the development of additional reserves at the Cuica discovery could also support additional activity. The field was already tied-back to the Armada Olombendo FPSO in mid-2021 via an early production system (EPS) but its further development could represent up to $500m of subsea work, according to TechnipFMC. Finally, TechnipFMC expects the development of TotalEnergies’ Cameia field on Block 21 to be worth up to $500m in subsea opportunities. The development of the field benefits from fiscal incentives and will rely on a new FPSO unit. Bumi Armada is believed to have been shortlisted to provide the FPSO, with FID expected in 2024. Nigeria Despite ongoing turmoil, the Nigerian oil & gas sector is expected to rebound from 2023, after its presidential elections. TotalEnergies and Shell are both expected to approve brownfield projects there after years of hesitation. On OML 130, TotalEnergies has already restarted engineering work on its Preowei subsea tie-back project, a 70,000 bpd development that will rely on the Egina FPSO. TechnipFMC sees the subsea scope to be worth up to $1bn. Overall, OML 130 is expected to see renewed activity after the renewal of its PSC last August, with operator TotalEnergies planning a 9-well drilling campaign there that will start in a few months. Finally, Shell is expected to progress a few of its own deep-water projects on OML 118, where the production sharing contract (PSC) was renewed in May 2021. The major continues to consider three major projects on the block, including brownfield projects like Bonga North Tranche 1 (120,000 boepd at peak) and Bonga Main Life Extension & Upgrade (60,000 boepd at peak). It also has the option of developing Bonga Southwest, which would rely on a new FPSO and a unitization with the Aparo field, for a peak production of 150,000 boepd. TechnipFMC expects the subsea scope at Bonga North to be worth between $500m to $1bn, with pre-qualification documents issued by Shell in May this year. Bonga South West would be more significant as it would rely on a new FPSO, with subsea activity worth over $1bn. Côte d’Ivoire Finally, the phased development of Eni’s Baleine deep-water discovery in Côte d’Ivoire will support subsea activity in West Africa for the next couple of years. TechnipFMC notably expects the subsea scope of work to be worth up to $1bn. Phase 1, whose final investment decision (FID) was taken inearly 2022, is expected to be commissioned in 2023 with three wells producing an average of 12,000 barrels of oil per day (bopd) and 17.5 MMscfd of gas. It is expected to rely on the Firenze FPSO as a production hub: the vessel has been in Port Rashid (Dubai) since 2018 and is currently being refurbished before its redeployment offshore Côte d’Ivoire. In September 2022, Saipem already landed €1bn in contracts for the project’s initial phase, covering Engineering, Procurement, Construction and Installation (EPCI) activities of Subsea Umbilicals, Risers and Flowlines (SURF) and of an onshore gas pipeline, and the Engineering, Procurement, Construction and Commissioning activities on the refurbishment of the Firenze FPSO vessel. Details on future deep-water activity and projects in sub-Saharan Africa are available on the Hawilti+ research terminal – plus.hawilti.com.

Read more »

Shell maintains pre-FID options worth 405,000 bpd offshore Nigeria

Shell still has four major pre-FID options to develop its reserves offshore Nigeria, according to the major’s latest quarterly presentation. These represents the biggest share of the company’s pre-FID options across its global upstream portfolio. Most projects are concentrated on and around the Bonga deep-water field on OML 118, where the production sharing contract (PSC) was renewed in May 2021. Shell continues to consider three major projects on the block, including brownfield projects like Bonga North Tranche 1 (120,000 boepd at peak) and Bonga Main Life Extension & Upgrade (60,000 boepd at peak). It also has the option of developing Bonga Southwest, which would rely on a new FPSO and a unitization with the Aparo field, for a peak production of 150,000 boepd. The two brownfield projects are likely to be prioritized given their lower development costs. In May 2022, Shell notably started the tendering process for the Bonga North subsea tie-back project. The pre-qualification documents included three different packages: the topsides modification of the Bonga FPSO (design engineering, procurement, transportation, fabrication, offshore installation and commissioning); the engineering, procurement and construction of flowlines, risers, umbilicals, and installation works; and the design, manufacture, and supply of subsea equipment and provision of healthcare support. The major also continues to make progress towards the development of the shallow-water HI gas field, in partnership with Nigerian independent Sunlink Petroleum. While the development concept has not been officially confirmed, the field is expected to be a key supplier of gas to Nigeria LNG’s upcoming Train 7. Details on deep-water activity in Nigeria are available within your Hawilti+ research terminal.

Read more »

“We are still in operations!”, says Nigeria LNG

Nigeria LNG, Africa’s biggest LNG exporter, has clarified that its terminal on Bonny Island in the Niger Delta is still operating despite a force majeure issued by the company earlier this week. “The company’s plant is in operation though at limited capacity due to reduced gas supply from some of its upstream suppliers,” Nigeria LNG has declared today. The declaration of force majeure by NLNG had raised several concerns on gas supplies in and out of Nigeria. The company is Africa’s largest LNG exporter and the gas it exports represents on average 10% of Nigeria’s export revenues. It is also the biggest domestic supplier of cooking gas, a commodity that already suffers from soaring inflation. The company had earlier revealed that all its upstream gas suppliers had declared force majeure following their inability to produce gas due to ravaging floods that have already displaced millions in the Niger Delta. The shut-in of gas production has caused significant disruption of gas supply to Nigeria LNG, forcing the LNG exporter to operated at limited capacity. Nigeria LNG operates six LNG trains on Bonny Island with a capacity of 22.5 million tonnes per annum (mtpa). Most of Nigeria’s LNG is exported to Europe and Asia, with key European markets such as France, Spain, and Portugal amongst its largest buyers.

Read more »Somalia: Federal Government approves Coastline Exploration’s Production Sharing Agreements

Coastline Exploration has announced receipt of final authorization to proceed with its exploration programme in Somalia after paying a $7m signature bonus to the Somali Central Bank. The oil & gas independent had announced last February that it had signed seven Production Sharing Agreements (PSAs) for deep-water blocks offshore Somalia. “We want the first exploration well to start as soon as possible,” Somali President Hassan Sheikh Mohamud said in a statement. Based out of Houston, Coastline Exploration says it has invested over $50m in Somalia and has been engaged since 2018 on negotiating its offshore PSAs.

Read more »

VAALCO completes FSO installation and field reconfiguration offshore Gabon

VAALCO Energy delivered First Oil to the Teli floating, storage, and offloading (FSO) vessel at its Etame Field offshore Gabon on October 18, the company has revealed. The installation of the FSO had been ongoing for several months to replace the previous Petróleo Nautipa FPSO vessel operated by BW Offshore, whose contract expired in September this year. Etame is VAALCO Energy’s flagship project with a net production to the company of some 10,000 barrels of oil per day (bopd) on average. A recent extension of the production sharing contract (PSC) until 2028 paved the way for the reconfiguration of the field and a new drilling campaign. In August 2021, VAALCO Energy signed a binding letter of intent with World Carrier Offshore Services Corp. to provide and operate a FSO unit for up to eight years with additional option periods available. The agreement eventually led to the execution of a Bareboat Contract and Operating Agreement with Greece’s World Carrier Corp. to provide and operate the new Teli FSO. In doing so, VAALCO Energy expects to reduce storage and offloading costs almost 50%, lower total operating costs by approximately 17% to 20% through 2030, and increase effective capacity for storage by over 50%. In total, and once the field is reconfigured, the agreement with World Carrier is expected to lead to annual operating expense savings of around $20 to $25m over the life of the new agreement, according to VAALCO. Meanwhile the company recently extended its ongoing drilling campaign on the block from four to six wells. The Etame 8HST, Avouma 3H-ST, South Tchibala 1HB-ST, and ETBNM 2H—ST have already been drilled this year, tracking data from the Hawilti+ research terminal shows.

Read more »

Nigeria: Petralon 54 steps up engagement with Dawes Island communities

Petralon 54 Ltd has announced that it recently held a meeting with its host and impacted communities around the Dawes Island Field south of Port Harcourt in the Niger Delta. The company officially presented its Petroleum Prospecting License No. 259 (PPL 259) to the Royal Fathers and the people ahead of starting sustained commercial production later this year. “The initiative was aimed at building mutual understanding between our organisation and the Ogoloma, Okochiri and Koniju communities in Okrika Local Government Area, Rivers State,” the company said today. Petralon 54 Ltd is a subsidiary of Petralon Energy, who was awarded PPL 259 in mid-2022 by the Federal Government of Nigeria, giving it operatorship of the Dawes Island Field. The group also holds an indirect minority interest in Prime Oil & Gas, which in turns entitles it to a net reflective production of some 3,000 barrels of oil equivalent per day (boepd) from the Agbami, Akpo, and Egina deep-water fields.

Read more »

Africa’s biggest LNG exporter declares Force Majeure

A series of force majeure events have been declared by oil & gas operators in the Niger Delta, leading Nigeria LNG to declare its own force majeure on product supplies from the Bonny Island LNG terminal, the company has said today. Nigeria LNG is owned by NNPC (49%), Shell Gas B.V. (25.6%), Total Gaz Electricite Holdings France (15%), and Eni International (10.4%). The company has revealed that all its upstream gas suppliers have declared force majeure following their inability to produce gas due to ravaging floods that have already displaced millions in the Niger Delta. The shut-in of gas production has caused significant disruption of gas supply to Nigeria LNG, forcing the LNG exporter to operate at limited capacity. Nigeria LNG operates six LNG trains on Bonny Island with a capacity of 22.5 million tonnes per annum (mtpa). LNG represents on average almost 10% of Nigeria’s export earnings, data from the National Bureau of Statistics shows. In addition to supplying LNG to global markets, the company is also the biggest domestic supplier of cooking gas to the Nigerian market. Most of Nigeria’s LNG is exported to Europe and Asia, with key European markets such as France, Spain, and Portugal amongst its largest buyers.

Read more »

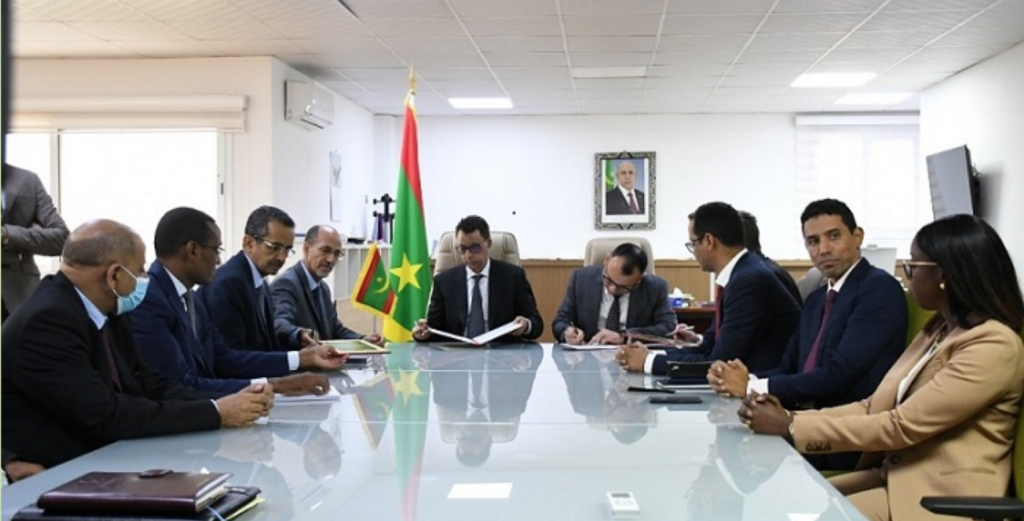

Mauritania: FID expected in 2025 on bp’s new BirAllah gas hub

bp and Kosmos Energy have signed a new Exploration & Production Sharing Contract over the BirAllah gas discovery offshore Mauritania on October 11th. A new agreement was required after the exploration period over Block C8 expired last June. The BirAllah gas field was discovered 60km north of the Greater Tortue-Ahmeyim (GTA) gas field that straddles the Mauritanian-Senegalese maritime border. Negotiations over future activity on the acreage have been ongoing for several months and were previously announced by Kosmos Energy, bp’s partner on Block C8. The new EPSC signed this week provides for 30 months of studies and planning before submitting a development plan for the field, where a final investment decision (FID) is now expected in the first half of 2025. 50 Tcf of gas have been discovered on Block C8 across the BirAllah discovery in 2015 (Marsouin-1 well) and the Orca-1 discovery of 2019. The reserves are bigger than at the GTA field, where bp and Kosmos Energy expects to start producing gas and exporting LNG next year and are already preparing the expansion of their FLNG hub to 5 mtpa. The BirAllah’s development plan is expected to further maximize local content and build on the domestic capacities developed during the development phase of GTA. The project includes an increased participation from the State of Mauritania – 29% – and will rely on the logistics capacities of the Ndiago Port, the Ministry of Petroleum, Mines, and Energy said. The project is expected to include a domestic and an export component to maximise value from the gas. Mauritania is notably trying to push for domestic gas monetization to expand its power supply, and develop gas-based industries such as petrochemicals and steel.

Read more »

Niger-Benin Pipeline is 30% complete – Presidency of Niger

The Presidency of Niger has revealed last week that the Niger-Benin Oil Export Pipeline is 30% complete, during an official inspection on October 10th by President Mohamed Bazoum. “Over 600km have already been laid across several sections,” the Presidency said. The $4bn pipeline will be 2,000km long and link Niger’s oilfields in the Agadem Basin to an export terminal at Sèmè-Kpodji in Benin. It is being built by the West African Oil Pipeline Company (WAPCO), a subsidiary of the China National Petroleum Corporation (CNPC). Upon completion, it will export up to 90,000 barrels of oil per day (bopd) from Niger. Its commissioning is expected at the end of 2023. CNPC currently produces only about 15,000 bopd from Niger to supply its 20,000 bpd SORAZ Refinery. Once the pipeline is operational, the Chinese operator intends to ramp up its production to 110,000 bopd, most of which would be exported. Spare capacity will still be available for third-party operators like Savannah Energy, operator of the R1234 PSC area onshore Niger. Details on the Niger-Benin Oil Export Pipeline and blocks activity onshore Niger are available in the “Projects” section within the Hawilti+ research terminal.

Read more »

Cape Verde planning expansion of Cabeolica wind farms

Cabeólica S.A., owner of the four wind farms on the islands of Santiago, São Vicente, Sal and Boa Vista in Cape Verde, has signed an MoU for the expansion of its facilities. The MoU targets an expansion of the Santiago facility at Monte São Filipe by 13 MW, along with the installation of 2 x 5 MW energy storage batteries on the islands of Santiago and Sal. Cabeolica was sub-Saharan Africa’s first commercial-scale wind power project upon its commissioning in 2011. It was led by the Africa Finance Corporation and co-developed with InfraCo Africa and the Finnish Fund for Industrial Cooperation. In 2021, A.P. Moller Capital acquired a 44% stake in Cabeólica S.A. from the Africa Finance Corporation through the Africa Infrastructure Fund. Cabeolica now provides 20% of the power generated in Cape Verde, displacing 15 million liters of imported diesel every year. It was recognised by the United Nations Framework Convention on Climate Change (UNFCCC) as a Clean Development Mechanism (CDM) project in 2013. “The Cabeolica Wind Farm is Cape Verde’s single highest contributor to the reduction of greenhouse gas emissions ( an average of 47,000 tons of CO2 per annum ) and this expansion will play a significant part in further reducing the country’s dependence on fossil fuels in line with its renewable energy penetration target of 30% by 2025,” the Africa Finance Corporation said.

Read more »

CrossBoundary Energy and ENGIE to spend $60m on Nigerian mini-grids

CrossBoundary Energy Access Nigeria (CBEA) and ENGIE Energy Access Nigeria have announced a new project finance agreement to build $60m worth of mini-grids in Nigeria. Undea the deal, both companies target the connection of 150,000 Nigerians to electricity. CBEA will finance the development and construction activities and own the projects, while ENGIE will provide long-term operations & maintenance (O&M) services for the mini-grids.

Read more »