Innoson Oil & Gas, part of Nigeria’s IVM Innoson Group, revealed last week the findings of a third-party evaluation conducted by Ryder Scott Co. on its concession offshore Sierra Leone.

According to the American engineering and geological consultants, Innoson Oil & Gas’ blocks could contain up to 8.2 Tcf of gas and 234m barrels of condensate of P50 estimated un-risked gross prospective recoverable resources in the Sierra Leonean basin.

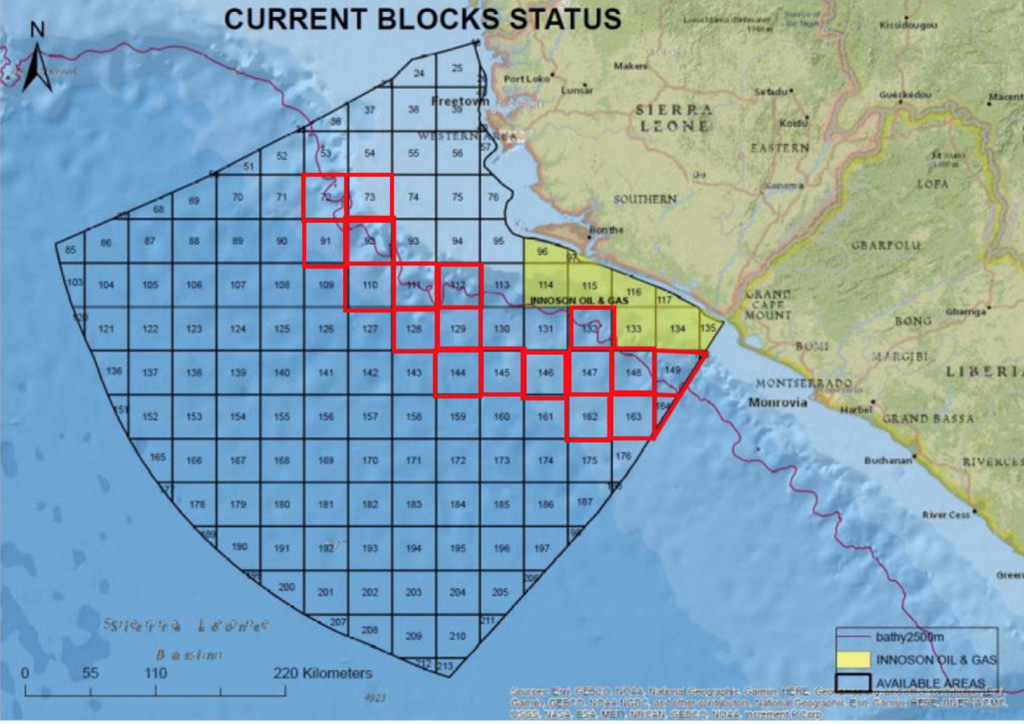

The Nigerian company had been awarded provisional Blocks 96, 97, 114, 115, 116, 117, 133, 134 and 135 in May 2020. The blocks are in shallow water off the coast of Sierra Leone. They are notably adjacent to the Reconnaissance Permit area that the Petroleum Directorate of Sierra Leone (PDSL) granted Wildcat Petroleum earlier this month.

Interest for exploration in Sierra Leone is picking up with several companies currently conducting reconnaissance operations there. The country has already shown oil deposits during previous exploration campaigns led by Anadarko, Repsol and Tullow Oil. These notably resulted in a few discoveries, though uncommercial ones. They include Venus B-1, Mercury-1, and Jupiter-1 by Anadarko in 2009, 2010, and 2012, and Savannah-1X by Lukoil in 2013.

In order to assess the potential of its concession, the company notably deployed an earth remote sensing (ERS) method, reducing the need for 2D and 3D seismic and well data.

“Asset evaluation, a field development plan and the setup of a data room are vigorously pursued with the immediate objective to engage a farm-in partner,” Innoson Oil & Gas explained in a statement.