African refineries stand as critical infrastructure within the continent’s energy landscape, serving as the essential link between raw crude oil and the diverse range of refined petroleum products that power industries, transportation, and households across the continent.

The strategic importance of refineries in Africa cannot be overstated. In addition to serving some of the fastest growing economies in the world, African refineries increasingly serve as pillars of regional energy security and trade. As demand for energy continues to rise alongside rapid urbanisation and industrialisation, their role becomes increasingly crucial in meeting both domestic consumption needs and supporting export markets.

Moreover, refineries in Africa serve as vital economic engines, generating employment opportunities, fostering technological advancement, and attracting foreign investments. They form integral parts of national and regional economies, contributing to government revenues through taxes and royalties while also enhancing energy access and infrastructure development.

However, the landscape is not without its challenges. Refinery operations often face infrastructural constraints, technological limitations, and environmental considerations that necessitate innovative solutions and strategic investments. Amidst these challenges, refineries in Africa continue to evolve, adapt, and play a fundamental role in shaping the continent’s energy future.

This programme delves into the intricacies of Africa’s refinery sector, examining their capacities and future outlook. By understanding these dynamics, stakeholders can better navigate the complexities of Africa’s energy landscape and harness its potential for sustainable development and growth.

Modular technology solutions make it possible to address several critical challenges and needs of emerging markets, especially in Africa.

![]()

Souheil Abboud

Managing Director

VFuels LLC

Africa’s consumption of petroleum products is experiencing significant growth, with the continent’s demand for oil-derived products growing at the second fastest rate in the world outside of Asia.

Increasing consumption coupled with decreasing domestic throughput necessarily means that most African markets import petroleum products. In the early 2000s, the continent’s imports of petroleum products reached the 1m barrels per day (bpd) threshold and continued growing to over 2.5m bpd by the end of 2023. Imports, mostly made of gasoline, distillates and LPG, will continue to rise over the next couple of years and up until 2026-2027 as several refineries remain off-line.

The composition of Africa’s import basket is expected to remain broadly the same, dominated by gasoline at over 50% based on latest data available by OPEC. However, the import of key commodities such as LPG is experiencing a faster growth with double digit growth witnessed in key regions such as West Africa.

Industry Trends

- Traditional refineries in West and Central Africa are in dire need of modernisation and rehabilitation and increasingly unable to meet growing domestic and regional demand,

- Modular refinery projects are on the rise across the continent, especially in West Africa,

- As demand grows, regulators are increasingly focused on implementing more stringent fuel emissions standards, calling for upgrades of most refineries,

- Several large refineries are currently planned in Nigeria and Angola but will face challenges in securing financing and feedstock,

- New refineries are increasingly positioned to serve as regional supply hub, particularly when it comes to serving landlocked markets in Western and Southern Africa.

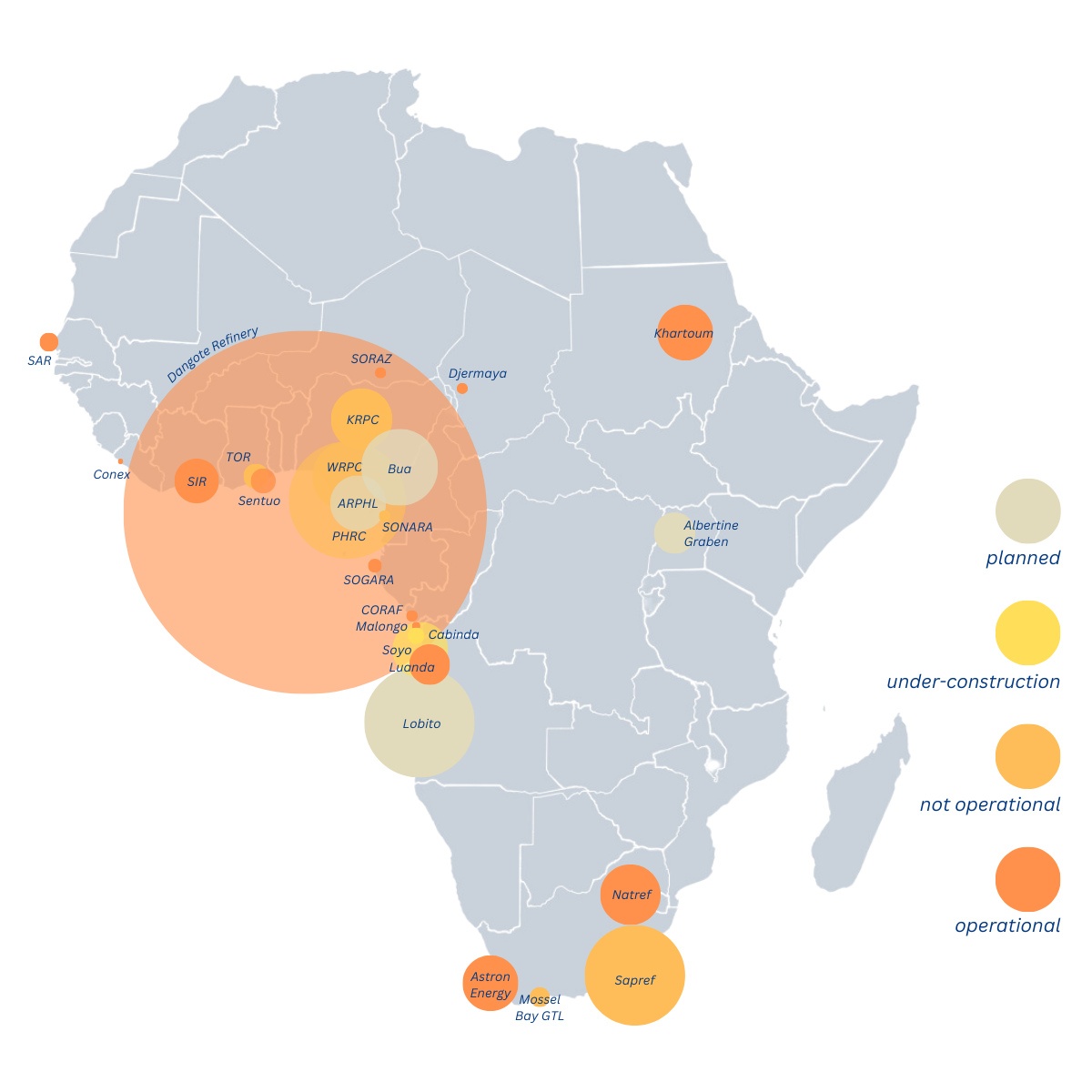

Africa’s refining industry faces significant challenges despite being rich in crude oil resources. Until the commissioning of the Dangote Refinery in Nigeria and the Sentuo Oil Refinery in Ghana over 2023-2024, Africa’s refining capacity had remained stagnant for almost two decades.

Refining hubs on the continent are currently located in North Africa (Algeria, Egypt), Nigeria and South Africa. From Cairo to Cape Town, the rest of the continent’s refineries are made of mostly aging facilities that are too old, too small, or too uneconomical to support the growing petroleum products needs of 1.3 billion Africans. These facilities are largely outdated, inefficient, and unable to meet local demand, resulting in heavy reliance on imported petroleum products. However, recent developments indicate a growing interest in upgrading and rehabilitating existing refineries, presenting substantial investment opportunities.

For now, and as the continent’s economies and populations keep growing, most sub-Saharan African refineries remain off-line. This is the case in Nigeria (PHRC, KRPC, WRPC), but also in South Africa (Engen), Ghana (TOR), Zambia (Indeni), and Cameroon (SONARA). All these facilities are in dire need of maintenance and fresh investment to rehabilitate old units, modernise infrastructure and comply with increasingly stringent emission regulations.

Nigeria, as Africa’s largest oil producer, has several ambitious refinery projects underway. The Dangote Refinery, expected to be the largest single-train refinery in the world, aims to process 650,000 barrels per day (bpd) of crude in the near future. This project not only seeks to meet Nigeria’s domestic demand but also aims to export refined products, potentially transforming the region’s refining landscape.

Across the continent, countries like Angola and South Africa are also exploring opportunities to revamp their refining capabilities. Angola’s Sonangol and its partners recently upgraded the Luanda Refinery and are commissionign soon a modular unit at Cabinda while seeking investors for large refineries at Soyo and Lobito. In South Africa, the government has proposed the refurbishment of the country’s aging refineries to boost domestic production and reduce reliance on imported fuels.

We estimate that $16bn is required to modernise and upgrade refining facilities in Africa.

Anibor Kragha

Executive Secretary

African Refiners and Distributors Association (ARDA)

New refining hubs are in the making across the Atlantic Coast

Established refining markets are focused on rehabilitating, modernising, upgrading or expanding their existing facilities to meet domestic and regional demand. This is especially the case in Senegal, Ghana, and Nigeria.

Sub-Saharan Africa’s two biggest oil producers, Nigeria and Angola, are both building large refineries that will cement their leadership over the supply of petroleum products in Africa. Both markets intend to establish regional hubs for energy trade with neighbours and landlocked countries – Nigeria with West/Central Africa and Angola with the SADC region.

Nigeria currently has the highest number of refinery projects on the continent. Security challenges and pipeline vandalism have continued to provide incentives for Nigerian operators to set up modular refineries and monetise their production onsite rather than try to export it via unreliable evacuation networks.

But so far, only 5 modular refineries have managed to reach commissioning stage. While NNPC’s refineries undergo rehabilitation, these private refineries remain the only facilities refining products in the country. However, lack of access to crude oil feedstock is preventing most of them from operating optimally – if at all.

IN THE NEWS

Africa’s refining industry on the path of recovery in 2023, shows Hawilti

22 May 2023 – EnergyConnects

Nigeria predicted to become Africa’s biggest oil refiner by 2025 — report

11 February 2023 – The North Africa Post

24 May 2023 – Edo State Government