BW Energy has been provisionally awarded two offshore exploration blocks in Gabon as part of the country’s 12th Offshore Licensing Round. The company will be operator of blocks G12-13 and H12-13 with a 37.5% interest along with VAALCO Energy (37.5%) and Panoro Energy (25%).

“The PSCs will have an exploration period totaling eight years which may be extended by a further two years. The partners have committed to drilling exploration wells on the blocks during the exploration period and intend to carry out a 3D seismic acquisition campaign on both blocks,” BW Energy said in a statement this morning.

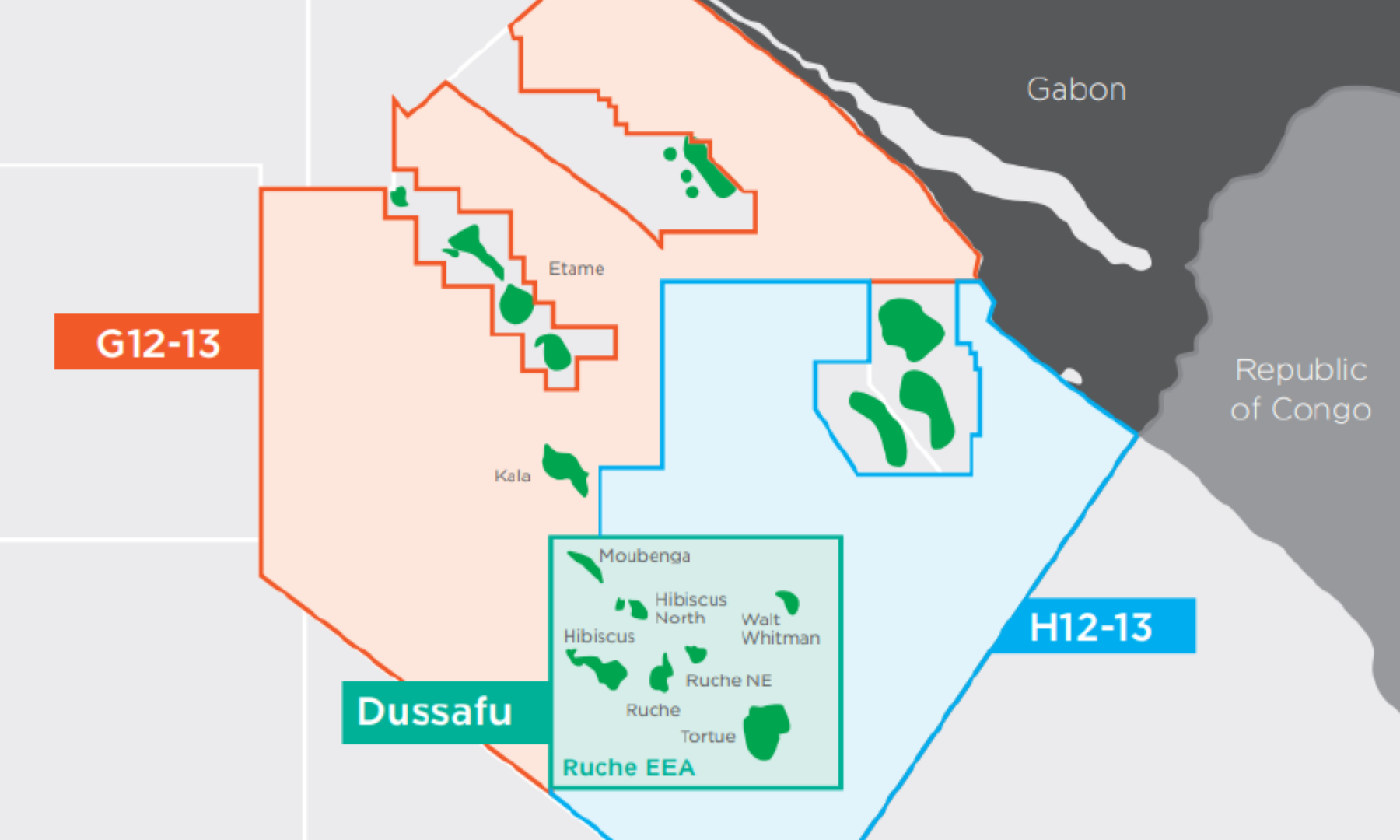

The selection of both blocks is not random for the three companies who already have a strong footprint in the Gulf of Guinea. Both PSCs are adjacent to BW Energy’s Dussafu Marin permit (operator, 73.5%) where production is expected to average 12,800 barrels of oil per day (bopd) this year and where BW Energy is planning two exploration wells per year for the coming five years.

They are also adjacent to VAALCO Energy’s Etame Marin PSC (operator, 63.6%) where production averages 20,000 bopd. VAALCO is currently preparing a drilling campaign at Etame for which it has contracted an affiliate of Borr Drilling to drill at least two development wells and two appraisal wellbores with options to drill additional wells.

Finally, Panoro Energy has been increasing its presence in the region: the company is already a non-operating partner on Dussafu Marin in Gabon where it acquired an additional 10% earlier this year along with a 14.25% in Block G in Equatorial Guinea where Trident Energy operates the Okume and Ceiba complex.

Full details on the Dussafu Marin and Etame developments in Gabon and on Block G (Okume & Ceiba) in Equatorial Guinea are available in the “Projects” section within your Hawilti+ research terminal.