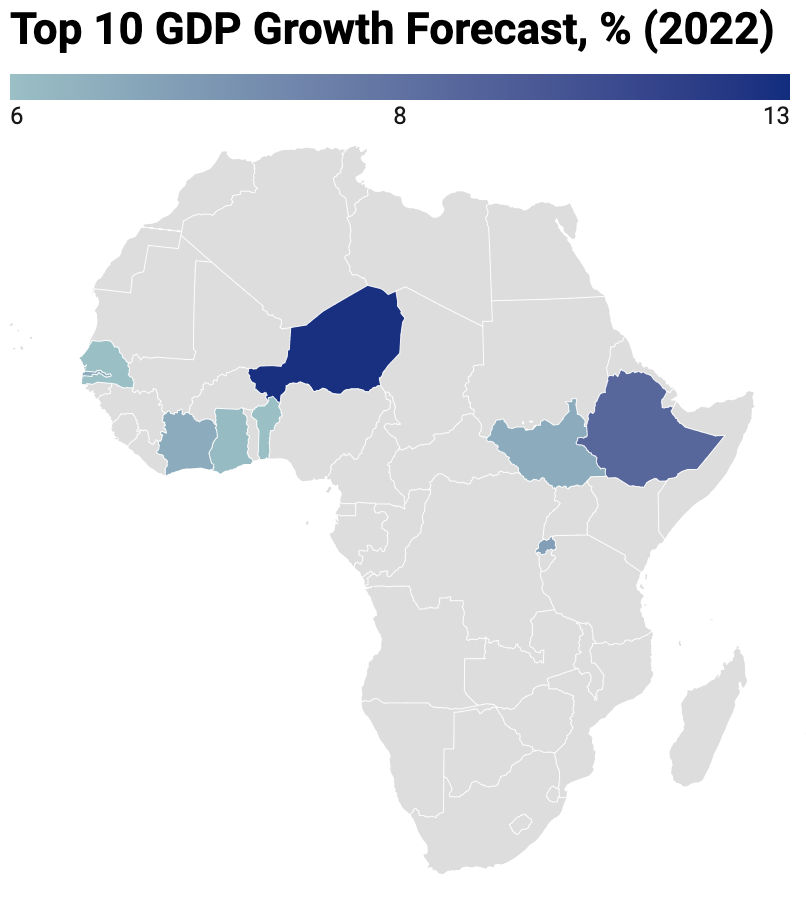

Africa will once again be home to some of the world’s fastest-growing economies next year according to the International Monetary Fund (IMF). A total of 11 countries can expect GDP growth levels of 6% or more, including eight in West Africa.

Diversified Economies

Most performing African markets have in common a relatively diversified economy, at the exception of South Sudan. Non-resource-intensive countries, such as Côte d’Ivoire, and economies with a strong mining sector such as Ghana or Mali, are expected to see robust growth in 2022, driven by a rebound in private consumption and investment as confidence strengthens and exports increase.

The fastest-growing African economies also share in common a growing and important agriculture industry. Strong agricultural growth and a faster-than expected recovery in commodity prices has in fact helped many African economies weather the economic storm induced by the COVID-19 pandemic.

Infrastructure Spending

Infrastructure spending will continue to support growth across the continent, especially in markets with big infrastructure projects such as Niger or Rwanda. Elsewhere like in Ghana and Côte d’Ivoire, economic recovery will translate into growth for the construction industry, especially as governments seek to expand basic infrastructure.

Social infrastructure is especially expected to receive a boost following the issuance of historic Eurobonds by Côte d’Ivoire and Benin in 2021, with a specific aim of investing into social and public infrastructure while financing budget deficits.

A Strong Potential for Trade

Several of the fastest-growing economies on the continent have leveraged on their geographical positions to create strong regional and intraregional trading networks. These are proving extremely useful as Africa rolls out its free-trade area and the bottlenecks created by the Covid19 pandemic ease.

Côte d’Ivoire, Ghana and Benin have all positioned themselves as gateway to the rest of West Africa and significantly invested into their ports infrastructure for instance. Efficient value-chains are notably helping to keep inflation down, with Niger, Benin, Senegal and Côte d’Ivoire recording inflation levels of only about 2%.

Overall, economic recovery hinges on countries deepening reforms that create jobs, encourage investment, and enhance competitiveness. The resurgence of the pandemic in 2021 and limited additional fiscal support will keep posing an uphill battle for policy makers as they continue to work toward stronger growth and improved livelihoods for their people.